This is a continuation of my monthly series that records what’s happening in my final stretch to early retirement. If you’re interested in previous posts, they’re here.

The time has come: IT’S DECISION TIME. I need to decide if next month I will book my month long trip to New Zealand and Australia for October 2020. My Mom and I are working on her goal of experiencing palaces in the sky by using travel hacking to book the Etihad First Class Apartments for our flight from Down Under. Check it out:

We need to lock it down as soon as the apartments become available, which is 11 months in advance. There are only 9 Apartments total on each plane so to get 2 of them next to each other requires advanced planning.

My goal for retirement is to have $500,000 so let’s get into the numbers to see how things are looking and decide if I should book this travel, which would essentially lock me into quitting my job right before FinCon, in September 2020.

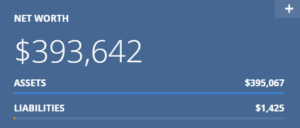

My Net Worth

It’s been a wild last two years in the stock market. I ended 2018 with my portfolio down about 4% and this year it’s up 19%. My net worth at the time of this writing is $393,642. My projection for the end of this year was $370,000 and we’re well above that because of the market tailwind.

VERDICT: Good!

My Projected Savings

I should be getting a raise at the end of this month and that brings my projected salary for this year to about $110,000. Subtracting taxes and my annual spending of around $18,000 I should be able to save an additional $26,138 this year and $53,106 next year before quitting. My current net worth + those savings bring me to $472,886 before my flight takes off to FinCon 2020. Not bad, but not quite the $500,000 I’m looking for. So let’s analyze the final piece – the stock market!

VERDICT: Good!

The Market

We are currently in the longest bull market in history. Talking heads have been saying “this is the top” for the last 5 years at least. This year the 2-year and 10-year Treasury yield curve inverted briefly, which in the past has been an ok indicator of an upcoming recession about a year after the inversion, but there are several other factors involved in predicting a recession and not all of them are saying the end is nigh! So is a recession coming? Yes. When? I have no idea. Is it coming in the next 11 months? Who knows!

The future of the market doesn’t currently look dire, so in the vein of careful optimism let’s assume that the stock market returns its average of 7% after inflation next year. If that’s the case then when I’m 75% through with the year (and I quit) I’ll assume the market will be up 5.25%, which would bring my total nest egg to $494,924. So close!

VERDICT: Not bad…

Should I Pull The Trigger?

These are the facts and projections I have to make this decision. If the world works as projected (does it ever?) I will just barely miss my goal retirement number before quitting. So it’s decision time.

I’ve mentioned before that I thought I was a candidate for One More Year Syndrome. Now that I’m in the final stretch of my financial independence journey I have completely changed my tune and have what Susan at FI Ideas coined “One Less Year Syndrome.” I want to quit so badly, but I want to be financially prepared to do so. So I need your help! Let’s make sure my desire to quit isn’t clouding my judgement too badly 😉 . What do you think I should do?

Should I book this trip and lock myself into quitting in 11 months? Have you ever locked yourself into a decision this far in advance?

So close $6000 away from your target will not change the final situation substantially. The only question I’d ask is whether you feel ready to be able to react and make concessions, compromises to compensate if the market takes a turn. If you are ready and feel confident to be able to adapt – then go for it!

You’re right 🙂 – that’s a 1 day, 1% market swing right there. I am completely flexible with my spending (no house, kids, cars, pets etc) and willing to make money in other ways after quitting if needed. I’m feeling pretty confident surprisingly – I would have been straight up terrified a few years ago. Thank you!

I think you should do it for sure. You’re obviously smart and resourceful enough to earn money from a passion project if you choose to, and you likely will. I’m now making almost $1,000 a month from my graphic arts business and it’s paying most of my mortgage. I also love it and don’t consider it work. I’m sure you’ll find something similar.

But I get your hesitation about “locking in”, I’m generally not comfortable with that either because things always change.

Aww shucks thank you! You might be right about earning some money – I’ve started doing it unintentionally the last few months, which gives me some confidence in what I could do if I actually tried 🙂 . That’s amazing that your designs are bringing in that much!! I’m with you on the hesitation – plans do always change and I just need to decide what the current plan is until the next change happens.

I’m on the fence about what you should do, but those first class apartments are enticing! I hope I fly in something like that with travel points someday! Can’t wait to hear what you decide. 🙂

Yeah that apartment is calling me 😉 …I’m sure you can travel hack your way into it! And me too haha – I’ll lay out my decision (whatever that may be) in my next monthly retirement countdown post. Stay tuned!

Unless something drastic throws your numbers off, I would keep on your track. Your NW projections can easily sway +/- 5% in a week, so I wouldn’t sweat it. On a related note, have you talked about drawdown strategy anywhere? Ie, are you planning to start withdrawing from your accounts on day 1 of retirement? If that could be delayed in any way, then it makes the decision even easier.

You make good points 🙂 . I mentioned my drawdown strategy briefly in the below post and in detail in a podcast episode that hasn’t been released yet (I’ll let you know when it is 😉 ). I am not planning to withdraw from my accounts until a year post-retirement. I’ll have my Retirement Year 1 expenses in cash in a high yield savings account before I quit so no selling of assets will have to happen for at least a year (or more if I accidentally make some money…).

https://apurplelife.com/2018/07/31/my-retirement-strategy/

Yep, definitely go for it!

You never know how things turn out. Yes, things can work out differently, but there are always other ways to make money. And there will always be risks. Life is full of risks!

But if you need money, you can always monetize the blog more or find something else you love to do and monetize that. There are always options!

Ohhh and that trip sounds extremely awesome!

You’re completely right. Everything is a risk and I definitely don’t know the future 🙂 . I love your optimism! And yesss that trip is tempting me something fierce 😉 . Thank you for stopping by!

I say do it. Pull the plug girl! Maybe work on monetizing the blog or another blog so you have a little extra income incase you need it. Or a youtube video documenting your travels and adventures post retirement and make extra money from the ads. Just a thought and btw -keep killing it 🎉

Eeek if the side hustle queen says I should do it – I’ve gotta listen 😉 ! All great ideas – I’ve never thought about making videos. That could be fun!! Thank you so much!

Book it girl. Worst case you ask for some time off for a few months and go back to finish working in December, if possible. From reading the MMM forums cohort threads, people manage to be offered great perks from their employers, such as a small sabbatical leave, when comes the time for them to resign.

Worst case scenario, you do a couple of contracts in 2021 to Coast your way to that FI number. I’m sure there is some creative way for you to find alternative plan if your number is lower than you would like after that amazing trip with mama Purple! I have no worries you have the ability to carefully craft another plan if need be.

You’re so smart 😉 . You’re completely right – there isn’t really a downside and if I’m willing to quit anyway I hold the power there (for a long break, contract work etc). If nothing else I am confident that I can come up with a plan when things inevitably change – thank you for the vote of confidence lady!

Book the trip. It’s clearly important to you. As the date approaches, ask your employer for an extended vacation or unpaid leave. If they say no, just resign. If they say yes, return to work after your trip. You can’t lose.

If you need a 6-month gig next year to bring up your net worth, then take a contract somewhere.

👍😀

Genius! Sounds like you just wrote next month’s retirement update post and put an entire plan together for me 😉 I appreciate it!

i would ask myself a couple of questions to decide? if i wait and miss out on the sky apartment part but quit and take the trip would that missing piece ruin my life? it’s like getting a nice red bike when you’re 5 years old when you really wanted blue. you got a bike/retirement!

if i ever went back to paid employment would that ruin my life/dreams? seems to me that 400-500k is a lot of money. i know i quit jobs with a helluva lot less to go mess around at age 30. of course i fully knew i would have to go back to work at some point so that part is different. i think i had 4-5k when i went to new orleans with no job lined up. part of it depends on your drawdown strategy and asset allocation i suppose. i’ll be watching to see what you decide.

Haha it wouldn’t ruin my life, but since we picked going to Australia/New Zealand specifically so my Mom could fly in that plane something big would be missing yes 🙂 .

And no going back to work would not ruin my life or dreams 🙂 . I like your thought process of going through this stuff. I quit my first job with $5K too and it worked out fine…having almost 100x that amount and thinking of it that way is making me feel more confident about the quitting decision. Uh oh 😉

You neglected to consider the massive sums from JobSpotter 😉 That’ll put you over the top!

I say pull that ripcord!

HAHA you’re so right! $60 in 3 months without trying so far – imagine if I was as amazing as Michelle and job spotted intentionally lol! Thank you for the kind words as always Josh.

I read that as “internationally” and TBH it works both ways for Michelle! 😂

Don’t forget that sweet #TAB money too, Beast!

Haha yep that totally works too. And you’re right: $26/month on top of the job spotter money for my Accountability Beast ways – next stop: 1 MILLION 😉 !

That cabin looks amazing! How many points do you need for that? A million? 😀

I have no idea what you should do. If it was me, I’d book it. I really need to keep working, I’d use 3 weeks of vacation and call in sick for that last week. A month long vacation, right?

Haha not a million – Sydney to JFK with a stop in Abu Dhabi is currently 274,395 per person (it keeps going up…another reason we don’t want to keep waiting to do this)…BUT if you’re cool ending in Abu Dhabi it’s only half that 😉 .

Yes the current plan is to be Down Under for 1 month, but I’m playing around with then hopping to Argentina for a month after that to see my college roommate…

I’ll also have no vacation days left at that point and get no sick days (I feel like that should be illegal, but ok…) So basically it would be a ‘I’m leaving for 1-2 months without pay and if you say no I’m quitting’ 🙂 …knowing my company they’d show me the door immediately, but maybe I’m being a pessimist…

You need to start thinking about a severance package now. Don’t just quit. Avoid walking away with nothing. PM if you need more info.

Thanks Joe – my industry doesn’t give severance unfortunately.

Adding to the chorus: do it! If you are not comfortable with the total number, you can do some contract work . I understand the hesitation, though.

You’re totally right – I’ve actually been getting daily emails with remote contract and full-time marketing positions just to get a feel for what’s out there and there’s A LOT. Even if I want to do something less stressful I could find a part-time job as a library receptionist or something (as a random example). Quitting one job isn’t the end of the world. Thank you for stopping by!

Yes! Yes! Yes! I did a similar thing before setting myself on FIRE on May 2018. I had my countdown app and everything. I felt l happy everyday I saw myself getting closer to my FIRE date. When I started worrying a bit, I reminded myself that the enemy of a very good plan is a perfect plan. So far, it has been great! You will do great too!!

“Before setting myself on FIRE” – I laughed out loud at that so thank you 🙂 . And congrats on FIREing!!! You’re completely right – nothing is perfect. I’m so happy it’s been a great decision for you!! Thank you for stopping by!

Hey, if you really need to, you can always come live in our shed. 🙂 Book it!

Lolol – sweet! How much is the rent? #ShedFI

Agh I am conflicted about this one! Of course you will get a lot of encouragement from this community to do it– and we all want you to do it and succeed!

However, you analyzed a fairly optimistic situation, and I’m concerned that even in your optimistic situation you are not quite at your goal. In a market downturn, you would be vulnerable to early sequence of returns risk.

As you mentioned and others have said, you are smart and creative and could likely find ways to make money if you needed to, so this trip could be more of a sabbatical if worst came to worst.

Personally, I would want a liiiittle more padding before jumping ship, since finding work in a recession would be more difficult, and I wouldn’t want to spend the first couple years of retirement in mild worry.

I know if anyone could make it happen, you can! Just have some backup plans ready.

Okay, these were my thoughts too… you just summarized them a lot better. Haha.

Maybe, you could push for a higher raise next month to offset some?

Sadly a higher raise isn’t happening – I already make more than most of the people a promotion above me and it’s taken almost 2 years of hounding to even get this little raise ugh. Thanks so much for the push back lady – I really do appreciate it. Want to make sure I have all my bases covered!

I debated including my million backup plans and contingencies in this post – it seems like I should have 🙂 . If I don’t hit my number I’m not ‘retiring’ – I’ll just be funemployed for a bit 🙂 and then make money elsewhere. The ways in which I do that (a different remote FT job, contract, part-time, side hustle) would be based on how far I am from my goal.

My current $500K goal already includes a 10% buffer within it so I’m cool with that combined with my ability to move anywhere with a lower cost of living at the drop of a hat (Take me back to Mexico ASAP please…) and make money in any of the ways above if needed. If a recession was the cause of me needing to adjust I’d go with the moving/spending less plan instead of finding work since that would be more difficult.

Thank you for looking out for me lady and get excited to read about too many backup plans in my post next month 🙂 !

Do it. I think you would be able to figure it out if something were to change in the coming years. You are incredibly resourceful like that. 😉

Aww thank you for the vote of confidence lady! I’m starting to believe the same…

Since you are bright bright and driven, you will certainly apply yourself in an engaged way post FI. This is bound to result in some money making because $ is the currency of engagement in our society. Hence I think you will likely be fine to commit to the palace if you want to. The stock market is hugely volatile in a one year timeframe. It could hugely change your number situation in one year but tends to of course smooth out with time. My experience has been that even in this my first full year not working, I have generated a fair amount of unexpected cash

Oh my – compliments will get you everywhere 😉 ! I’m starting to think making a little money in retirement might indeed be inevitable…Awesome to hear you generated unexpected cash your first full year. Completely agree with the volatility of the market – I feel a little silly trying to make this decision given all the unknowns, but that’s kind of life right 🙂 ?

Depends on how willing you’ve decided to be on side hustling to pad things out 😉 I know you’ve said in the past you’re not interested in that, but everything I’ve seen from you in this past year makes me think you might not hate low key side hustles for a while, especially if it gets you out of the 9-5.

If you’re still set on never needing to make another penny again, I’d push the date.

I’m with Angela on this one. If you’re open to a little side hustle should the market move sideways or down on you between now and then it would help. If not, you might just hand in there one more year. OR you can “take a year off” and figure out if you are retiring, going part time or going back FT. Thing is you can do any of the above and still be successful. Your call.

Good points Alison – I am indeed open! “Taking a year off” is an option I hadn’t really considered…HMM! All awesome options – thank you for opening my eyes to the additional possibilities 🙂 .

Yeeeeeah my tune on side hustling has done a 180 – Y’all tricked me! I’m now making a little money from this blog/apps/patreon without even trying – I can’t imagine what would happen if I actually put effort behind making a little money outside the 9-to-5 😉 .

Hmmmmmm, conservative me would scream don’t quit, you are not there yet but I also have seen a lot of changes I the last few years and a lot of them have not been good. If it was me, I would book the trip. If I didn’t get to my goal or didn’t have enough time off, based on your skill set am sure you can find another job to get you to your number when you get back.

I have learnt over the years, people are capable of many things and can be very resourceful if they need to be or want it badly enough.

Either way I am sure you will figure it out. We never regret things we did but the chances we never took.

“We never regret things we did but the chances we never took” – you’re so right. I’ve been thinking of this ‘locking myself in’ as trying to project if I’ll be ready to retire when really it’s just saying goodbye to my current job…it sounds a lot less scary that way 🙂 . The changes I’ve observed in my company have also not been good. Thank you for stopping by!

Purple –

Don’t know how long you’ve been with your current company, but have you thought of engineering your layoff a la FS rather than simply resigning? It could give you just the extra tailwind you need to make your goal number, and more. Along with training your replacement, you could include your month off as part of your transition plan. 😉

As FS says, “It’s better to get laid off than quit.” 🙂

Oh, and make a video and/or blog about your entire “apartment in the sky” / Australia travel experience. Australia has been on and off our travel to do list simply because of the LONG flight there and back. But perhaps we could handle it if we were in one of those sweet air apartments. I always plan out our travels about 18 months in advance anyway …

Hey There – I’ve been here 3 years and they don’t even give sick days let alone severance pay (from engineering a layoff). People are fired without warning here all the time and I have to fight tooth and nail for even tiny raises. I like the idea though! And wish it was something I could make happen.

I’ll definitely have a blog post if not also a video of the Etihad experience! And I’m planning to get a GoPro (or similar device) to record all the snorkeling adventures we will have so I can promise that will happen!

And yeah because of these sweet first class set ups I’m EXCITED for long plane rides. In fact we picked our route to be the longest possible on the way back LOL! Such a weird mindset shift. And YES on planning that far in advance – I love it and am so happy to meet a similar planner. My Mom was just texting me about 2022 plans…

Your mom sounds like my kind of gal! 😉

If you have no/few contingency plans to make up the shortfall, then I would keep working.

But, if as others have said, you’re willing to go back to full time work or if side hustling / contract work is an option that is viable for you (in terms of opportunity and interest), then I’d go for it.

In addition to the optimistic scenario you presented here, you should run some worst case scenarios, at least for yourself, and decide if you can live with those. 30 is *super* young to never again work for money, so even if you had to ultimately go back to work after a year to 35 or even 40, you’d still be way, way, way ahead of what the vast majority of people can do.

I’ve got a lot of contingency plans – I’ll explore that once I make up my mind and post about that next month. Going back to work or making money in other ways is something I’m completely open to – even after I hit my number and retire. I’m pulling the cord so early that flexibility is key even after my goal is reached. And yep – my worst case scenario is just what I’m doing right now, which isn’t too bad at all 🙂 .

I love to encourage risks as much as possible, but I’m a little nervous about this! Could you do a smaller trip and then do this big one when you for sure hit your goal? Either that or try to hedge with side hustle money, as others said.

I’m glad you said that – I’m interested in that nervous feeling so I can try to combat it with contingency plans! As for the trip, we can’t delay it for 2 reasons: 1) These seats keep increasing in the number of points required and will soon be too ridiculous for even us to contemplate 🙂 2) My Mom’s reason for going on this trip is the flight, but mine is to see the Great Barrier Reef before it’s gone and it’s dying more every day…We’ve been planning this for a few years now. Anyway, I’m totally open to side hustle money or even contract work, which is fairly available in our industry to make sure I hit my goal even without a full-time job. Thank you for stopping by lady!

I’m so with you on prioritizing the natural wonders. When we went to NZ the Franz Josef glacier had massively receded already.

You’ll figure this out, I know it 🙂

Oh no – that’s so sad! And thank you lady 😉

I think the question for you to answer is how comfortable are you with your financial contingency if you don’t hit $500k or the market starts it’s decline. If you are comfortable with that scenario, then book the trip. If you are not comfortable, then wait a bit longer.

How often are the apartments available using points? Might that influence your decision a bit if you can’t get the time frame you want?

I am comfortable with that scenario 🙂 and I’ve been scribbling on pieces of paper the reasons why (which I’ll share in the follow up post to this one next month).

The apartments are available every day so that doesn’t really restrict us. We’re completely flexible with our timing to fly back in October/November next year and are planning backwards based on getting the seats we want.

Go for it! You don’t know how long you’re going to have with your mom. I bet you’ll make at least a decent chunk from the blog.

Side note: I’m trying to figure out the points game after years of doing it with coach. Can you do a quick explanation of how you’d book the etihad apartment with points? I saw the above number of 275k points. Would those be american points? Which credit cards would you target? Do you think you’ll ever run out of sign up bonuses?

You’re right about my Mom – my morbid brain keeps coming back to that. As for the blog, I very much doubt it, but that would be some nice icing on top 🙂 .

Sure, but we shouldn’t start with Etihad as an example because that’s advanced level 😉 . See this instagram post (https://www.instagram.com/p/B3PY-26nMvo/) for a normal example. I got a Delta credit card when they were having a 50K sign up bonus for their card with no annual fee the first year, hit the spending minimum, paid off the card in full every month and then cancelled it after about 8 months, then used those points (which were Delta Skymiles) to book on their website – you just toggle between Points/Cash on the main page when searching for a flight. I target credit cards that offer the kind of points I need for the flight I want (e.g. Delta Skymiles in this case). For more examples check out my annual travel hacking posts that show what flights I got and for what kind of points: https://apurplelife.com/category/travel/travel-hacking/

I don’t think I’ll run out of sign up bonuses because new cards and new rules are coming out all the time though the game is getting harder lately with airlines making some flights a better deal to buy with cash instead of using points or just making using points more difficult.

Thank you! I know it’s a little morbid but it’s just reality. You don’t know what life will bring you and why not live your best moments now.

Okay so I’m trying to go to Europe on business class. I’ve got 175k ultimate rewards points. Looks like united I could do 140k round trip. It’s kind of tough to find business award availability.

It’s so easy with economy but I want to experience fancy! I want a lie down seat! I read through the posts but I couldn’t find the actual finding availability once you have the points. Any other tips?

You’re totally right. As for booking United Biz Class to Europe, check this out: https://thepointsguy.com/guide/united-polaris-to-europe-this-summer/ . The Points Guy is an amazing resource with screenshots of booking any possible award flight. That site has been my go-to for years. Feel free to browse their pages and let me know if you have any other specific questions!

A rare trip serves as a great opportunity to shift plans. After all, money is earned to live. You won’t regret picking up a part-time job later if need be, but you’ll likely regret passing the chance to spend quality time with family on a unique trip! Go with your gut feeling, which I sense is to go for the trip! 🙂

You’re correct on my gut feeling 😉 . Thank you for the perspective! I’ve been all into the numbers and possible future projections, but you’re right – time is precious and money is just a tool.

Do it!!

Worse comes to worse, you get a few months off, then work freelance/part time for another year or so to give your investments a bit more time to grow (and maybe even throw a bit more money in, since your expenses are so low). Either way, you get a break from the daily grind.

You make good points! I don’t like labels personally, but thinking about this as “quitting A job” instead of “the end of work FOREVER” is helping me be more comfortable with locking myself into this change. Even if I was “retiring” – according the all the retirees I know that’s not the end of making money necessarily.

If you’re willin bro make money in other ways (as you said in another comment) then I say go for it. As someone else pointed out, &6k isn’t that much in the grand scheme of things so go and enjoy your vacation/retirement!

Haha vacation/retirement – I love it! Yep I’m willing to make more money and $6K does not seem like a lot in hindsight. The market went up yesterday and closed that gap in my calculation actually 🙂

I’m strongly in the “do it” camp! My reason is, and I think someone else alluded to it (didn’t see above, so either missed it or on Twitter), I would decouple this trip from quitting work. I don’t see the trip as “requiring” going all-in on the retirement plan.

My thought is – just book the thing, and then at the appropriate time (3 m out) judge based on your position/market activity. If you’re further away from $500k than desired, talk to your employer and frame it as “I’d love to stay but this once-in-a-lifetime trip came up” (“The Shire is calling, and I must go”). They might be on-board with it! Then work the extra 6-12 m and then pull the trigger.

If they can’t accommodate a 4-6 w leave, tender your resignation and hop to a new job upon returning home. Given the stinginess in raises, you could end up with a nice bump. And if the economy is in recession at that time, plan C could be some gig work, etc.

Anyway – I think all this is within your contingency planning…but that’s where my mind went with it all! 🙂

More generally – the trip sounds amazing. It’s been a place my partner and I have been thinking about too!

Haha – Team “Do It”! I love it. You’re totally right it’s not a black and white situation and like life seems to be complicated 🙂 . Thank you for making my plan for me 😉 . I think I could get a large jump from hopping jobs if needed and it might just be nice to do something different after a sabbatical. The world is my oyster!

And ooh yes you should totally go – I haven’t been yet 🙂 , but everyone keeps telling me how gorgeous The Shire is 😉 . Thanks so much for stopping by!

You’re target always let’s me know I am spending too much money! lol! This is the first time I’ve ever heard of these planes. I am very interested in travel to Australia and New Zealand! Can’t wait to follow along!

Haha personal finance is personal – you’re just spending differently 😉 . And yeah those planes are completely wild. I’ll be sure to gather some Australia/New Zealand tips to share!

Hello,

I think you should do it, BUT your number is very tight already. You think you are OK now, but what if you have more expenses in a few years for health or other reasons? Also, there are a lot of uncertainties in the US right now… many of them could make the market go down quite a bit. Sequence of return risk…

I would therefore try to get unpaid leave, if that doesn’t work I would leave but would take a new job for an extra year or two after you come back and see how it goes.

On another note, where was that picture on top of your post taken? it looks beautiful!

Good luck in any case!

I talk about those contingencies in this article if you’re interested: https://apurplelife.com/why-im-comfortable-retiring-with-500000/. Basically my calculations work without a spending ceiling so I can spend more in good years if I need/want to.

For medical I’m planning to use medical tourism to my advantage and in general use geo-arbitrage to have the same standard of living for less if needed. I like the unpaid leave idea and am planning to make more money if I don’t hit my number or the market tanks or I lose my job or something else unforeseen happens.

I took that in Puerto Vallarta, Mexico last week! Great town. And thank you!

I just came across your blog about 40 minutes ago. We are trying to reach our FIRE goal in the next few years. Reading all of this is getting me so excited for you and myself too! What a great job, congratulations on your achievement! There’s a saying in my first language that goes something like “Work is not a wolf, it won’t take off running away into the woods.” The biggest asset you have in your net worth is your youth with all the talents you’ve got. Don’t worry about it, it will work out, go for it!

Well then HELLO and Welcome! That’s so exciting – good luck! I’ll be following along on your blog (also when I opened it I freaked out thinking your wife had purple hair too 🙂 !)

Thank you! I like that saying a lot – my Mom says something similar, but less awesomely phrased “Money is everywhere.” I appreciate you saying that – I’m seriously tempted to just go for it 😉 .

Thank you for the shout out. I’m late to chime in because I too have been out traveling, doing the 5 Utah parks in the trailer and enjoying the freedom of RE life.

My last, and probably final post, is about why you’ve always gotta have an exit strategy. There are a lot of reasons to say “hell yeah” to this trip, and there will always be reasons to be afraid. The work world is rapidly changing, and you are a capable, savvy adventurous person who truly will figure it all out. This may not turn out to be “retirement”, whatever that is 🙂 If it turns out to be a mini-retirement, I believe you’ll be fine, because you’ve gotten where you are from job hopping and negotiating higher pay.

“Twenty years from now you will be more disappointed by the things you didn’t do than by the ones you did. So throw off the bowlines, Sail away from the safe harbor. Catch the trade winds in your sails.” — Mark Twain

That sounds wonderful – I’m glad you’re enjoying that RE life! Thank you for the vote of confidence. And oh no that was your final post? I’ll miss your blog, but completely understand – you’re busy enjoying life 🙂 .

You’re so right – even if this doesn’t turn out to be ‘retirement’ (oh labels…) it’ll be something 😉 . Amazing quote – thanks so much for stopping by!

Well, that worked out a bit differently to expected.

To the commentor above who said ‘what’s the worse that can happen?’ – probably not what they were thinking.

You can go once all this is over and NZ and Oz open up again.