Well – 2020 got real weird REAL fast. It can basically be encompassed in this humorous tweet:

People: "I want 2020 to be like the roarin' twenties!"

Earth: "Alright, infectious disease is spreading."

People: "No, not like that."

Earth: "The US stock market is tanking."

People: "Wait…"

Earth: "LMAO Bars can't be open anymore."

— Xan Halen (@synthandlasers) March 17, 2020

Of the above issues, let’s tackle the problem that directly affects my future plans: The stock market. As I’m sure you know, the stock market has been declining…or if you listen to the news “TANKING!” “CRATERING!” or “SOME OTHER DRAMATIC VERB!”

In February, the market hit a new all time high and my net worth jumped to $475,000 – only $25,000 away from my FIRE goal and that’s before adding my 2020 savings of $52,000 (Note: I’m using the S&P 500 returns when I say “the market”).

Then fear about the coronavirus swept the nation. The first US case and death actually happened in my backyard – right outside of Seattle – and rapidly spread. In case it’s helpful, here is a frequently updated map of the number of cases and deaths by country.

So then the market declined -15% in a week . Then -7% in one single day. At that point, that was the largest one day decline I had ever experienced and was shocked that I felt…fine with it. Then we went up 5% the next day. I ‘lost’ $30,000 in one day and ‘gained’ $20,000 the next. I was getting financial whiplash looking at my accounts every day (as a part of my exposure therapy regiment).

Then on March 12th, the market immediately fell -7% after opening, which triggered a trading halt for 15 minutes (which I didn’t even know was a thing…). Many more of these trading halts would happen over the next week. And finally, March 16th, the market dropped -12% in one day, which is now known as the 3rd largest daily percentage loss in our market’s history (#1 was Black Monday in 1987 and #2 was at the beginning of the Great Depression).

To add to the panic, we had also entered bear market territory, which is defined as a 20% drop from the most recent high, but also includes a second part of the definition that I don’t often hear cited: that it stays 20% below the high for 2 months or more.

The next day the market shot up 9%, which was the 11th highest one day increase in history. Cue more whiplash. The market has continued its wild, record-breaking gyrations and as of this writing is -18.59% for the year.

It’s been a wild ride, but one that shockingly hasn’t triggered my fear response. I genuinely expected my first big market drop to have an emotional affect on me, but it just…hasn’t. I guess reading 5+ years of books and blogs saying this is part of the process made it settle into my lizard brain.

So, Now What?

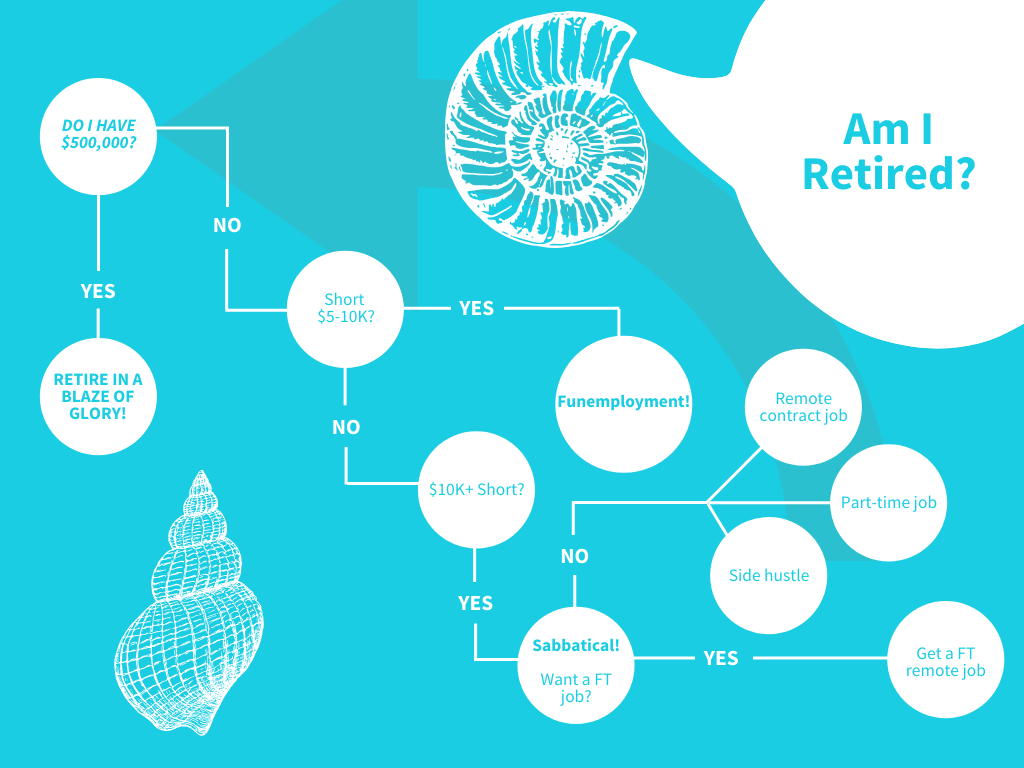

As a result of the falling market, I’ve been getting questions on Twitter and Instagram asking how my plans are changing as a result of the stock market “plunge.” So I thought I would address it here: They’re not. My plans are not changing. This is what we trained for people! And this is what the handy dandy ‘choose your own adventure’ decision tree I laid out in this article is for:

And it holds true now. Through all of this, I came to a surprising conclusion: I’m not worried about my plans and I’m (shockingly) not tempted to change my plan from quitting in September despite the changing world around us.

I already came to the conclusion that I might not hit my number when I had to decide if I was locking in my quit date last November. As the above chart shows, I acknowledged that I might not make it to $500,000 and that’s currently looking like it will be the case (not that I can tell the future 😉 ).

So why am I comfortable taking the leap when the market is dropping? Several reasons:

1. I technically hit my FIRE number and the math works

Typically a FIRE number is defined as 25 X your annual expenses. I spent $17,896 last year (while living in the center of a major metropolis, which is not the plan in retirement) and anticipate my medical plan costs to increase about $1000 in retirement, so I project spending just below $19,000 if I were to stay in the center of Seattle. Earlier this year I hit $475,000, which /25 = $19,000. My $500,000 goal was based on adding a buffer to that projection…and is also just a sexy round number 😉 , but if we’re being technical, I achieved my goal.

I’m (hopefully) looking at a 70 year retirement and no one knows the future. I’ve run my models through cFIRESim without a spending ceiling (so I can spend more in up market years) and with a spending floor of $16,000 (which is easily achieved through geo-arbitrage to countries I’m already planning to live in) and it tells me that I would have survived retiring during any 70 year period in the modern past, including 1929, the first year of the Great Depression.

2. Making extra money if necessary has always been part of the plan

I know that the future will contain other Black Swan Events that we (by definition) didn’t see coming. To combat that, in addition to spending flexibility, I’ve always been open to making money if needed after I quit my full-time job. 70 years of retirement is a LONG time and as amazing as cFireSim is, the past can’t predict the future. So even after quitting my job in September, that doesn’t necessarily mean that’s the last dollar I will ever earn.

3. I’m already accidentally making money

Last year I brought in $423.47 from apps, $400 from one freelance project and $225.58 from this blog before expenses. That’s not a lot of money, but also not something I was at all focusing on. Imagine what I could do with an extra 40-80 hours a week 😉 …

I’m also in a really unique situation because this nest egg only has to support ME – no husband, kids or pets – no mortgage or car payment. If other people had to rely on my nest egg or would be affected by my decisions I would be WAAAAAAY more conservative with this!

But instead, it’s just little old me and I am not very demanding. Despite all the madness that’s happening in the world I have been having a surprisingly nice time during self-quarantine. I don’t require a lot of money to be happy – just the people I love (even virtually to #StopTheSpread), books (free eBooks from the Library!) and sunshine (also free).

4. I’ll have 2 years of spending in cash

I’m not planning to start withdrawing money from my portfolio the second I quit my job. I was originally going to have my Year 1 money in cash so I wouldn’t need to touch my portfolio until October 2021 (or later if I’m accidentally making money). Now I’m planning to save up Retirement Year 2 in cash as well given the timeline for a coronavirus vaccine (12-18 months).

After doing that, I won’t need to touch my investments until October 2022 when the world (hopefully) looks much different than it does now. If you add the taxable dividends I should be receiving on top of that cash I won’t need to touch my portfolio until March 2023 – 3 years from now.

Further, one of my financial nerd heroes Micheal Kitces recently went through my early retiree case study on the Choose FI podcast (Episode 172) and said: “I would feel confident for her without the two years in cash….I think there actually is a little bit of a misconception out there around even what sequence risk is and what the threat actually is. The threat of sequence risk is not a crash in the first two years.” Which to be honest, I was SHOCKED to hear. He said that because of my flexibility that my numbers would work in any scenario they discussed (including the market tanking right when I retire as it is now).

5. Tomorrow is never guaranteed

The coronavirus and its higher fatality rate among older and immunocompromised people actually solidified in my mind one of the main reasons I want to quit my job ASAP: To spend more time with my Mom.

None of us are guaranteed tomorrow and I am more comfortable with quitting and seeing what happens than working one or more years ‘just in case’. Especially since my plan already included a massive amount of flexibility around spending less and most likely accidentally making some money (if all the other FIRE people who can’t seem to help making money accidentally can be believed 😉 .)

As I’ve said before, I’m not afraid to be a ‘failed’ retiree. Even with all the planning in the world, any retirement can fail given the right mix of circumstances. I’m not afraid to see if this early retirement isn’t working out after having enjoyed a few years of a sabbatical and then have to find a way to make $20,000 after tax a year to fund my lifestyle (which would be possible even if I can only get an entry level job in my field at my original starting salary from a decade ago). But I am afraid to let my life or the lives of my loved ones pass me by while I sit chained to a desk.

A Global Pandemic Caveat

So that’s the plan for now based on the information I currently have in front of me. The only thing I can see changing my mind between now and September is if the world looks the same as it does now: closed global borders and all of us still self-quarantining while the virus rages around us.

My net worth projections and my trip to Australia/New Zealand were the reason for the September quit date. If travel is still banned to those countries (and others) that postpones those plans at least a year and my partner and I have to decide what to do next with our lives.

Staying in Seattle longer is probably the smartest thing to do and if I’m still here and self-quarantined anyway, keeping my cushy work from home job for a bit wouldn’t be the worst thing in the world…it’s not like I have much else to do while stuck inside. A self-quarantined start to retirement wasn’t exactly what I had in mind 🙂 .

So unless the world is unchanged in 5 months, it’s full steam ahead. I’m quitting my full-time job in September.

MY RETIREMENT TO DO LIST

Phew! Enough of that heavy stuff. Since I’m moving forward with my plan, there are still lots of things on my to do list. Let’s use them to distract ourselves from the weird dystopian future we seem to be living in!

2020 Ongoing Monetary Goals

- Max my 401K ($19,500) – $4,434 SAVED!

- Set aside my Year 1 Retirement money in cash – $7,110 SAVED!

- Max a Roth IRA ($6,000) – REVISED

- Overall save $52,000 before I quit in September – $11,544 SAVED TOTAL!

I was originally going to invest $6,000 in a Roth IRA and $11,000 in a taxable account after gathering my Year 1 retirement money. Now, as I mentioned above, I’m instead going to keep that cash given the timeline for a coronavirus vaccine, so while I’ll still be saving about $52,000 before I quit, it will not be mostly going into the market as originally planned.

2020 Ongoing Life Goals

- Start reading books that have been sitting on my shelf forever before I donate them – IN PROGRESS

- Play PC video games – IN PROGRESS

Going through my own books have taken a backseat to reading a few library books that I finally received after being on hold. Here’s a fun snippet from one of them:

"Meditation can be difficult, especially at the beginning…If you start meditating and find yourself in a thought-free field of bliss, either you have rocketed to enlightenment or you have died."🤣 – Meditation for Fidgety Skeptics📚

— A Purple Life (@APurpleLifeBlog) March 10, 2020

I’ve been reading Meditation for Fidgety Skeptics, Come As You Are and How To Invent Everything in a race against the library eBook clock. I really do better under deadline 🙂 . My partner and I created many grand plans at the start of this year, such as walking for an hour a day, meditating daily for 15 minutes and reading a Kindle or hardback book for an hour before going to bed at 11pm. After the world turned upside down, only one of those has been consistent: meditation, and to be honest I’m shocked even one hung on 🙂 .

As for video games, that’s been going well. I got a lot more into my beloved The Sims 4 this month and went on many ridiculous adventures that are detailed in this long ass thread:

Here comes a #TheSims4 gameplay thread🎮. You've been warned. I'm starting with a outdoor and dog loving lady and am planning to make money through gathering and gardening. Let's see what happens.

— A Purple Life (@APurpleLifeBlog) February 26, 2020

My partner and I also bought The Witcher: Wild Hunt after loving the Netflix show, but quickly discovered we had differing approaches to the game and parted ways. He’s been absolutely loving it though. During that time, I also discovered that the Netflix show is actually originally based on a BOOK and that’s been added to my endless library eBook hold list 🙂 .

April To-Dos

- Start cleaning out our apartment and giving away/donating/selling items – IN PROGRESS

- Confirm if I need any additional vaccines – COMPLETE

So I jumped the gun and started this already. Oops! I dipped my toe into Facebook Marketplace for the first time and had great success selling an Amazon Fire TV Stick for $30. It sold in 1 day and I got over 10 inquiries. However, I also started trying to sell a fancy Aria Scale and have barely even gotten a nibble. I might need to switch up my cost strategy or maybe I’m too late because new years resolutions are already in the toilet and based on the current climate most likely to stay there…Either way, my Facebook Marketplace experiment was overall a success and I will be using them to shift more of our stuff as we approach nomad life.

May To-Dos

- Start buying nomad gear – IN PROGRESS

Speaking of nomad life, I have been picking up items at the recommendation of my nomad mentors and fairy godmothers All Options Considered. They gave me a list of their favorite packing cubes, daypacks and travel towels that I gobbled up. After the world calms down, I’ll round out my collection with a few more items and be ready to take on life as a nomad!

June To-Dos

- Renew my driver’s license and get the new extended version that’s required in Washington state starting later this year

- Get a Charles Schwab account for free international ATMs

- Set up Traveling Mailbox

- Buy a GoPro for my Great Barrier Reef adventures – COMPLETE

I bought my GoPro! It’s a Hero7 White and I’m loving it so far. Once self-quarantine is lifted, I’m going to try using in my friend’s pool as a test run before using it to capture my snorkel adventures throughout the Great Barrier Reef.

July To-Dos

- Get rid of basically everything I own 😬

- Cancel my WiFi service and return the modem to the store

- Transfer from Republic Wireless to Google FI

- Set up IMG global expat health insurance

August To-Dos

- Live in an AirBnB for a month!

- Decide how I’m dividing money across my bank accounts in retirement

- Sign up for an absentee ballot so I can vote online for the presidential election

September To-Dos

- Give my notice at work!

- Live in a (different) AirBnB for a month!

- Change my taxable dividends to go into my checking account instead of being reinvested

- Research the history and culture of all the places I’m traveling to this fall

- (After my last day) Transfer my 401K away from my company

Conclusion

And that’s it! I’m still chugging along with the to do list as best I can. Let’s see what the next few months hold. 25 Mondays left…

How has the last month been for you? What goals did you accomplish?

Finally, a refreshing read amidst comments and articles about FIRE being dead. Glad to hear your plans have not changed! Apart from the initial shock of a 30% drop nothing really changed from my end as well. You know what, wait. Something did change with the plans. I can’t go to Thailand anytime soon 🙁

Yay! Glad you found it refreshing. Happy to hear nothing much has changed on your end (except Thailand 🙁 ). It’s really an amazing position to be in that that’s the only real change to our lives though.

Hi Purple,

Are the 2 years of cash included in the $500,000 or in addition to that amount? So glad you shared about this – I’ve been following your blog and been very, very curious how you’ve been reacting to recent events. Great to hear you pretty much *haven’t* been reacting!

Hi Kathleen – Ideally that cash would be in addition to the $500K, but we shall see what my actual net worth will be when I quit (aka I imagine it will be less than $540K given the current state of the world/market, but then again I can’t see the future so we’ll see). Happy to sate your curiosity and I’m genuinely shocked by my lack of reaction, but happy about it 🙂 .

Purple! If you like Sims I think you will like Animal Crossing! I’ve been having so much fun playing it. Best wishes!

Oooh – looking up Animal Crossing! Thank you 🙂

I’m glad you made this the focus of this month’s post (I suppose you couldn’t ignore it!). I’ve seen a few comments floating around Facebook FI groups along the lines of ‘I wonder what this will do to A Purple Life’s plans’, but I felt sure with your cash reserves you would have no problem steaming ahead! I love your flow chart too. Fingers crossed that travel restrictions will be lifted in time for you to continue your travel plans!

Haha – well feel free to share this post if you see those questions popping up again. Thank you for believing in me 🙂 . Glad you enjoyed the flow chart! We shall see about travel restrictions – I am totally fine postponing my travels a year or two if it means people staying safe and healthy so no worries.

Glad to hear you’re going through with the original plan! Honestly, I’m not worried about you at all. The fact that you’ve thought about what you will do if it doesn’t work out speaks volumes. Plus, you’re super employable. Cheering for you!

Woah now Luxe! High praise 🙂 . Thank you so much!

Sounds good. I think you’ll do fine too. You’re flexible and can adjust.

I really hope the pandemic is under control by November. I want to go visit my parents this year. Keep at it!

Thank you Joe! Flexibility does seem to be my superpower currently 🙂 . And yes fingers crossed – I know it will have been a bit since you’ve seen them.

I was wondering about your plans in this current economic climate. Good luck and thanks for sharing!

Happy to share 🙂 and thank you!

I love how determined you are in this. Though, when I read this I think, you’re not really retiring, but rather giving yourself space to do what you want, earn how you want and live how you deserve. That’s beautiful! You have thrived up until now and will continue to!

Thank you! And aaah labels 😉 . You can call me whatever you want – I know a few people in this community are trying to rebrand ‘retirement’ to mean just that – not needing a job to live on and doing whatever you want with your time. I use that definition as well, but understand that how we currently use the word retirement doesn’t necessarily match up with that.

Looks good. You are my canary in the coal mine for “how will the $500k 2020 early retiree fare” 🙂

A small question on the change in Roth plan: why not stick the $6k in the Roth anyway and then make a qualified tax free penalty free withdrawal of that amount in 2022 if you need the $$$? You can keep it in a money market at Vanguard or BND or similar if you want to earn a bit of interest, then pull out the $6k if/when you need it. Tax savings would be small if you withdraw it within a year or two but long term tax savings are good if you leave it in there for a few decades (for example if you end up earning enough $$$ doing side hustle stuff so you don’t have to touch the cash cushion as much as projected).

Haha happy to be the canary in the coal mine. And THIS is exactly why I love sharing everything with y’all – that’s a great point! I guess the only reason I wouldn’t do that is because I would have to change my “Why I Own 100% Stocks” post 😉 . But seriously I’m going to give this some thought because you’re completely right. To my planning documents!

you’ll have 40k cash and maybe 400k invested? i think we ought not forget that’s a helluva lot of money. it really is. during this little economic setback (the physical and emotional one for world citizens is a bigger issue) i saw a drop of a big chunk of money. then i thought to myself: even if it never went back up that’s still a big chunk of money left. most of us don’t need a 5mil nest egg to live and have a good time.

Yep – that’s what will happen if the market doesn’t decrease more (or increase more 😉 ). It does indeed sound like a shitton of money lol. That’s an awesome perspective. Even if the market never gets any higher (which is basically impossible) $440K will let me live my current life for 22 years. A 2 decade sabbatical doesn’t sound bad at all 😉 .

What a strange set of circumstances to be considering going into your retirement phase, isn’t it?

I’m glad that your math still works out and I’m always impressed by how low your expenses are. I was thinking about how I’ve never been responsible *just* for my own personal spending and how that means I honestly have no clue how much or how little I need to spend in a solo scenario. It’d be fun to game that out one day, just to see.

Here’s hoping we are looking at a vastly different and improved landscape in 5 months.

Haha right?! Oh Black Swans – so unpredictable. And yeah – it definitely helps that it’s just me over here. I’m curious to see you play out that game too – keep me posted 🙂 . Fingers crossed that the world will be different, but even if it’s not I’m (surprisingly) all good over here.

I think you will be doing great Purple because you are FLEXIBLE! A lot of people come up with A plan and think they have to stick to it for THE REST of their lives. Also, you have already thought about enough contingencies that I don’t see why not getting on your early retirement journey now and keep making adjustments along the way. Worse case you can probably get back to your current life can’t you? How bad would that be? 🙂

One question though: have you tried to factor how much time you might be saving by extending yours by n months (n < 12), versus having to work on your own term (if you need to make some extra money). I would imagine that if you get a decent job today, one extra month at the office might save you multiple months of (insert what you new gig will be). As since you mentioned that time is important for you, I'm wondering if this would be something you would consider.

Thank you! I’m feeling pretty good about it – especially since my only ‘job’ will be to find a way to make it work 😉 . And yes indeed I can go back to my current life, which is pretty sweet 🙂 .

I have thought about that and currently that trade off isn’t worth it to me. This virus has drilled home even further how our health and lives are not guaranteed and lit even more of a fire under me to spend time with my loved ones before it’s too late. So it’s not currently worth it in my mind even though the monetary gains would be large. However, as I said – if I’m still stuck separate from loved ones in the fall when I was planning to quit that’s exactly what I’ll do – continue to work for a few months and sock away another year or two of spending money before riding off into the un-quarantined sunset.

I had not thought about the true risk either until I heard Kitces the other day myself. A 50% drop is zero threat to a sound withdrawal plan. The only threat is a drop that takes many years to recover. In the normal two year or less recovery you just don’t have time to pull your nest egg down enough to matter. You’ve got this!

Yeah – he always lends an awesome perspective. We all talk about drops, but not necessarily slow recoveries. And thank you! Either way I’ll keep y’all posted 😉 .

I don’t know about the statement “the normal two year or less recovery”. Big ERN has a post showing how long it took to recover from 10 bear markets, and the median time to get full recovery plus inflation is 60 months. The best 5 had a median recovery time of ~3 years, but the worst 5 took ~10.5 years.

The article is here: https://earlyretirementnow.com/2020/03/18/what-kind-of-bear-will-it-be/

To quote the article you linked 😉 I think we’re referring to this “A Bear Market with no recession at all (e.g. 1987): That’s going to recover relatively quickly in a matter of roughly 2 years.” Agreed bear markets can take longer to fully recover to its previous (inflation adjusted) high based on the economic conditions.

I see, but if the whole world shutting down for weeks doesn’t result in a recession this time around, I will be shocked.

Cool – we shall see

To address the risk of recession, is there a risk? Your money won’t be coming from actual employment. Yes a recession can tank stocks and create a long bear market, but you have a plan for that. Without fixed liabilities like mortgage, fixed rent contracts, school fees (as in children), etc, you have already fixed in the flexibility and your income plan is flexible and doesn’t depend on the batshit vagaries of employers (or a self employed business). Income from investments isn’t the same as share price, so even if that tanked for years, if you’ve invested in stuff that provides an income or reduce your expenses right down and are flexible (which you have and are), I really don’t see recession as a risk to you. More something else to be aware of and your exposure therapy should take care of it.

Yassssss!!!!! I’ve been waiting for this update, but I knew that you wouldn’t change your mind on leaving your job (like you said, this is what we trained for!). You’re a huge inspiration and such a fresh breath of air during these times! You’ve inspired me soooo much! I’m a brown girl that also doesn’t want kids or to get married, and honestly, I haven’t found many people that think the same way haha I’m now starting on my own FIRE journey, and your blog is just what I need! Will definitely be a continuous visitor 😀

Haha you knew it before I did 😉 . So happy I could bring some positivity to this weird time 🙂 . Welcome fellow child and marriage free brown girl!! That combo does seem like a rare one. Congratulations on starting your journey!!! Good luck!

You rock PURPLE!

I’m looking at leaving in June should the opportunity arise, life is just too short! So I’m keeping my mind and heart open and gathering all the data I need to make a decision that works for my family. Thanks to the FIRE community I’ve been working on this for 2 years now and I still feel like I have choices, yes even in this time of crisis.

Thanks for your inspiring posts!

Thank you so much! I agree life is too short – it’s awesome you’re doing the analysis and figuring out what’s best for you. Congratulations of being 2 years down the path! You definitely have choices 🙂 . Thank you for reading.

Im sorry if you addressed this already, but how do you have a year’s worth a dividends? I assume your portfolio is mostly in pretax account right?

My portfolio is half in pretax and half in post-tax accounts so if dividends hold steady at about 2% of a $500K portfolio I would receive $10K total, $5K from my taxable account.

I was curious: You have $368k saved up, how much of that is inaccessible until age 59 in retirement accounts? (I know there’s certain workarounds as described by Mad Fientist.)

Also: does your $17k per year annual spending depend on having a “roommate” to share rent and expenses with? What if things don’t work out with your partner, or God forbid, if something happens to him?

About half is in pretax accounts and yes I’m using the Roth IRA conversion ladder the Mad Fientist talks about to move that over. My $17K doesn’t assume having a roommate – if my partner and I break up I would get a studio apartment (I don’t like living in 1 bedrooms alone) and the ones in Seattle cost what 1/2 of a 1 bedroom does so it would be a wash.

Curious about the Airbnb plan, I saw a judge judy where some folks had done that and was intrigued how it could be a value even off season?

I don’t understand your question – can you clarify?

Hello – love your interview at ChooFI and thank you so much for sharing your journey. I am wondering, would you mind sharing some resources on how to start a blog as streamlined as yours?

Also I notice you are planning on switching to Google FI – what’s your rationale behind that? Is that cheaper than Republic Wireless?

Thank you! I don’t have any resources to share on starting a blog that looks like this really – just trial and error. I picked a free theme and that’s how it got this look. I’d suggest starting there – pick a theme you like. Google FI offers data globally and Republic Wireless does not. It’s a little more expensive as a result, but since I’ll be a nomad I want to be able to step into a country and have my phone work without having to deal with sim card annoyances like I have in the past.

This was a nice read! It gave me some hope that even such global pandemics can’t take you down if you’re planning the right way. In addition to the COVID crisis, my country (Lebanon) has been already going through a financial crisis. We’re on the verge of bankruptcy.

I graduated last summer with a computer science degree. My friend and I were planning on launching a small development company. Everything was going well at first but once the country’s situation started deteriorating we had to back down. It was the worse timing to start a company. So we now started a blog instead where we write one article a day, and hopefully it’ll get us somewhere.

This is the first time I hear about the FIRE movement, so I guess now is a good time to read more about it. Thank you for this tiny bit of hope you gave me!

Hi Bassel! I’m so happy you enjoyed it and that I could provide some hope in these wild times. I’m sorry to hear about what’s happening in your country – that’s horrible. That’s amazing you were able to recognize it wasn’t the time to start that company though and pivot to something else so quickly – that’s commendable! Definitely check out the financial independence movement – it has a lot of great principals in general. Thanks so much for stopping by and good luck!

If you are going to travel, how do you only plan for a potential $1,000 increase in health insurance costs in retirement? Even if you are purchasing domestic health plans, yearly fee rises will range from 5 to 30 percent. If you get international coverage, the base would be higher and the yearly increase similar outside of even that range, plus the premium will only increase with age.

I’ll have an international plan that also covers the US (not a domestic only plan) and I haven’t seen anywhere near 30% increases in those over the last few years. I’ve also calculated out how much I would pay at a higher age and it’s barely more. I’m also planning to spend more time abroad as I age since the people I want to spend time with in the US won’t be around anymore and that will cut out-of-pocket healthcare costs as well.

My retirement models don’t include a spending ceiling and are still successful so I can pull out more in up market years if I want and use that for future premiums.

Overall though I currently spend $18K a year living in the middle of a Seattle – I will not need to live in HCOL areas after I quit so I expect my spending will drop even further from my projected $20K that includes an 11% buffer already.

We shall see though 🙂 . I never claim to have all the answers and am happy to just share what’s happening and be a cautionary tale.