We’ve all heard the proclamations: You’re going to run out of money in retirement because of X. Whether it’s an underperforming market, robot automation or climate change, more often than not, these headlines in mainstream media seem to be meant to strike fear into our hearts. “Do I have enough?! Will I have enough if I work another year?? When will I have enough to be completely secure that I will never run out of money in retirement?!?”

As you might have suspected, there is no such thing as completely secure. There is no guarantee that anyone’s retirement will work out as planned or at all. There are risks involved in every decision and our job is to choose our path based on what makes the most sense to us and what allows us to sleep at night.

So I retired in 2020 with $500,000 and I’m completely comfortable quitting my job after I’ve amassed that amount. Here’s why:

SPENDING LEVERS

Overall I’m fortunate that my life preferences also happen to be choices that help keep my expenses low while I live a happy life. I think of each of these choices as levers that allow me to regulate how much I spend. Let’s dive into a few of them.

Solo Retirement

I am a solo retiree. I am lucky that no one relies on me financially or will in the future. My partner and I are never getting married, never having kids and keeping our finances completely separate.

I’m lucky that my parents have their own nest egg and have been happily retired since 2015. This $500,000 only needs to support me – not a husband, a pet or any children down the line.

Based on my spending during the last few years in the expensive cities of Seattle and NYC, I spend between $17,000 and $20,000 so a portfolio of half a million should sustain me, especially since, when retired, I will not need to live in some of the most expensive cities in the world.

‘Homeless’

I have never dreamed of owning a home. I don’t know if it’s my natural skepticism, fear of commitment or both, but I’ve always looked at owning a home (for me personally) as a chain around my ankle instead of the idyllic ‘roots’ people talk about – and this is before I even saw the numbers!

Luckily the finances behind owning a house in the expensive cities where I’ve spent my adult life, have further cemented my opinion: I never want to own a house. I heard a quote recently that made me laugh at its accuracy and cringe at its harsh truth: “Rent is the ceiling. A mortgage is the floor” meaning that rent is the most you will pay while your monthly mortgage is the minimum.

Knowing how much my rent and utilities are every month gives me comfort. Knowing that I can email my landlord when something breaks and have it fixed with no sweat off my brow or money out of my pocket, makes me feel warm inside. I know a lot of people in the financial independence community that are fantastic DIYers and mechanical thinkers. I sadly do not belong to that group.

When something is broken, I don’t want to have to call multiple contractors, figure out the cost, negotiate, schedule their visit and then pay an unknown amount afterward. At a recent happy hour, a friend lamented that she had to pay a plumber $500 earlier that day to come to her house…and they didn’t even fix the problem! I’m way too protective of my free time to give my energy and cash to a pile of bricks.

And this leads to one last reason I have never been interested in owning a home: it is (basically) immovable. My life plan involves almost constant travel and having a house sitting empty or having to manage AirBnB guests from afar is not my idea of a good time or a happy retirement.

Carfree

As I mentioned in this post, I grew up in Atlanta, GA and its lack of public transit and sidewalks (my parents are just getting them NOW) coupled with its horrendous traffic quickly put me off using cars as my main form of transportation.

When I drive through the suburbs where I grew up, I feel trapped because you literally are trapped unless you have a car – no sidewalks, no buses, no trains. The only saving grace has been the proliferation of Lyft and Uber, but using rideshares is exorbitantly expensive when crossing the widespread burbs.

So after escaping the gridlocked hell that is Atlanta’s 18 lane highways, I decided to only live places where I do not need a car to get around. This has the added perk of dropping me in locations that had sidewalks to feed my love of walking and public transit to go anywhere I want without having to fight for parking.

This decision has also has the added benefit of dropping my lifestyle costs while giving me the walking and fresh air filled life I want. I intend to keep this habit up in retirement and supplement in rural areas with car sharing services and rental cars as I do now.

But What If Large Unforeseen Expenses Pop Up?

The giant purple elephant in the room when discussing retirement for US citizens is our wildly expensive healthcare costs. This is the most often cited unforeseen expense I hear when discussing any nest egg in this country, but of course I have a plan:

Medical Tourism

Overall, if I am diagnosed with a disease that requires continuous treatment, I will move to another country with more affordable medical care (which is basically any other country…) However, if something happens to me while I’m in the US or I’m unable to travel, I carry global insurance for those worst case scenarios, such as breaking my leg or getting hit by a car. After my bills are paid I can reassess my plan and if I need to shift anything, which leads me to:

Geo-Arbitrage

In case you haven’t heard the term before, geo-arbitrage is moving somewhere where the cost of living is less. In my case I will be looking for places where I can have a similar or better quality of life for less than I spend on that life in the US. Doing this introduces the ultimate spending flexibility: less cost for the same lifestyle. There are several countries I love that are on my travel list for the first few years of retirement and fit the bill, such as Mexico, Costa Rica and Thailand.

But Does The Math Even Work?

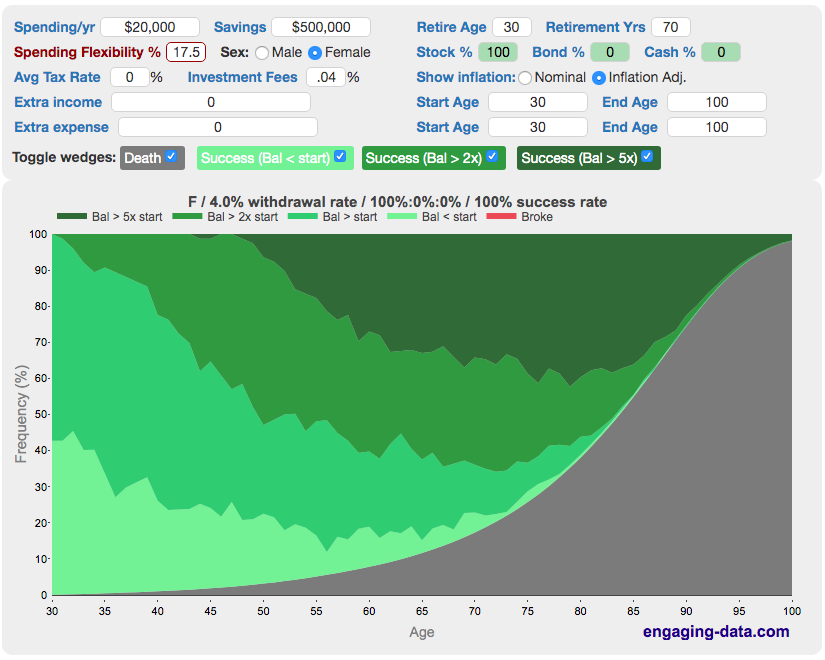

When running scenarios in cFIREsim, it shows that my $500,000 would suffice even in the worst market downturns of the last 147 years — even for a 70-year retirement. All it would take would be decreasing my spending to $16,500 during down markets, which is an easy feat for me if necessary.

The past obviously doesn’t predict the future, but even I was surprised that reducing my spending by such a small amount in a few cases could lead to such a high success rate despite everything our country has been through in the last 147 years.

Based on these calculations, I would have been safe retiring in any of the last 147 years and in many scenarios, I would have finished my 70-year retirement with a great deal more than I started with (inflation adjusted).

Oh and I forgot to mention that this calculation does not assume a spending ceiling – meaning in good years I can spend more than $20,000 if I so choose. That’s a concept I first read about in the awesome book Work Less, Live More which touts a flexible withdrawal rate of 4% of your current portfolio every year (instead of 4% of your starting amount as the Trinity Study uses). I have tweaked this idea to suit my purposes and was happily surprised at the optimistic result.

So those are my spending levers. The life I love already has some built in efficiencies and I have plans for how to combat unexpected expenses in the most vulnerable first 5-10 years of retirement, but there is another set of levers to consider.

SAVING LEVERS

Going Back To Work

Unlike a lot of traditionally aged retirees that quit because of health issues or are forced out due to their age or ability – I can easily get another job if necessary. I don’t delude myself to think it would be at the same rate, since I would have been out of the workforce for a while, or even at the same level, but it would be more than I need to live on.

If I’ve learned anything after getting 6 jobs in 7 years it’s that it is not very difficult for me to find a job – even if it’s not in my field. There are so many ways to make money and the amount I need to live on (especially if I leave the US) is fairly small. Though outside of having a failed retirement and going back to full time work, there is another possibility: that I will earn money accidentally in retirement.

“If You Earn Money You’re Not Retired!”

…Says who? Every retiree I know earns at least a little bit of money doing things they enjoy. Even my parents own a rental property. When I quit my job next year I’m looking at (hopefully) 70 years of retirement.

I never said I would never make another dime. I’m not planning on it and am not intentionally trying to (because: see my large amount of laziness), but based on other early retirees, it happens sometimes.

If it does, I wouldn’t be going after this money, but accepting it for something I enjoy doing and would happily do for free. While I am not factoring earning any more money (or collecting social security) into my plans, the possibility would of course also decrease my chance of retirement failure.

So I have several levers I can pull. In my mind I have the ultimate flexibility because adjusting my life will not interrupt anyone else’s and I enjoy the variety inherent in change.

ANALYZING RISK

After reading the above you might think I’m a little off my rocker. Yes I have Plans A, B and C, but there’s no way this will work right? I share your concerns and that is exactly the reason I read everything I can about the risks of early retirement. The likes of Our Next Life and Early Retirement Now have made me seriously think about my plan from many angles and adjust accordingly. They make great and valid points about the risks inherent in pulling this trigger and I take what they say very seriously, but I also weigh those risks against another one (queue morbid organ music): Death.

Engaging Data creates absolutely amazing data visualizations and one of them struck me right in the heart (see below). It shows the possibility of my portfolio balance being at different levels during each year of retirement and compares it to the probability of me dying during that time. That grey ‘death’ section sure is large and imposing – and I suspect this longevity data is based on white female numbers – from everything I’ve read, me being a black female decreases my long living prospects further.

To be frank, I’m not afraid to be a failed retiree. My absolute worst case scenario is that I have a bad sequence of returns in the first 5-10 years and/or large unforeseen expenses that I can’t recover from and I have to go back to work. I will have just had a relaxing, multi-year sabbatical after a decade of working my ass off. Joel from FI 180 has a great quote that perfectly encapsulates my feelings on the subject:

“My worst case scenario is everyone else’s every day scenario.”

I’m not afraid to fail, but I am afraid to spend the most active years of my life attached to a computer doing someone else’s bidding. I am afraid of running out of time with the people I love. My main objective in retirement is to spend more time with my loved ones and I can’t do that if they’re not around. Tomorrow is never guaranteed. Everything is a risk and this is the level of risk I am comfortable with.

INSTILLING CONFIDENCE

Aside from attaching myself to the level of risk I’m comfortable with, I have another reason I feel confident in my plans. I will be a 3rd generation early retiree. My Mom retired at 55 and her parents retired at 50. The world has been through so many changes during that time and they have always been able to figure it out.

In retirement my only ‘job’ will be to plot, plan and discover how to keep my retirement going. That’s it. All I need to do is solve the challenges that come at me and after watching the last two generations of my family do just that with a lot more against them – I feel confident I can do the same.

So what do you think? Am I going to fail? Am I saving too little? Let me know in the comments!

This is a guest post I wrote that originally appeared on Financial Mechanic.

Bravo, congrats on beating your goal toward early retirement by 5 years. Wish I can go back in time and be as wise as you’re so I can retire in my 30s! I am sure you will be succeeding in early retirement as you seem resourceful, gotten all your i dot and t cross, thinking through all the worse case scenario and have a plan accordingly. There’s a couple who retire on less than a mil (thinksaveretire) so you will make it on half as an individual. At least 90% of your post align with my thinking for early retirement, one huge thing that holding me back is my love for traveling, and spending money on car. I will definitely retire once I hit 500k also. One day!

Thank you! Despite how early I’m going to reach this goal I also wish I could go back in time and convince myself to listen to my partner when he brought up financial independence 2 years before I got onboard. Or that I had learned about it college. I wasted so much money 🙂 though I guess I could count that as a lesson about what I don’t want.

What about your love for traveling is holding you back? It seems like with more time in retirement travel is quick affordable if done slowly. As for the car I do feel lucky that growing up in Atlanta traffic has given me a complete distaste for owning them myself. Excited for you to retire once you hit $500K! Good luck!

I love you say “nothing is secure.”

So very true. We always want warranties and guarantees for anything and everything not even knowing if we will be here in few hours later.

I’m confident you won’t fail.

Yep – having that perspective helps me evaluate the level of risk I’m comfortable with in my life. And thank you! I’m not confident in that myself, but I’m willing to try and report back so others can learn from my successes or failures.

An enjoyable post, thanks. I followed a similar path to your plan, retiring in my 30’s on a not particularly huge pile. What pushed me over the edge was basically that quote you highlighted.

“My worst case scenario is everyone else’s every day scenario.”

I think your head is in exactly the right place. Prepare for the worst , but don’t let negativity stifle what you want to do in life. As you say, worst case – getting a day job, the horror!

You seem to share my lack of roots, with willingness to travel and no additional mouths to feed. Hopefully that will keep you in good stead as it has done for me. Enjoy!

Glad you enjoyed it and congratulations on retiring in your 30s – that’s awesome! I obviously completely agree with you 🙂 and framing it as the worst thing that can happy is that I go back to the (pretty sweet) life I have right now is really helping me let go and be willing to take that leap. We do indeed share all of those things 😉 – it’s amazing to find a kindred spirit. Thank you! Good luck to you as well!

Just a small note – if you run CFiresim with a 70 year retirement, I don’t believe that it’s telling you that you would be ok retiring any year in the past 147 years. If you put in a 70 year retirement, the latest start date for the results is ~1950 because that’s the last available 70-year window.

So it would be telling you that you would’ve been safe retiring in any year prior to 1950, not any of the last 147 years.

I think this is a pretty important distinction for planning, especially when you put in long retirement windows.

I might be wrong here, but that’s how I understand Cfiresim to work 🙂

Hi There – Fair point! I’ll edit my language to be more accurate. Though overall I still feel confident in my plan since a retirement is make or break in the first 5-10 years and doesn’t need a full 70 years to show what the success rate would be. Your point made me think though. I met the creator of cFIREsim last year and am going to try to reach out to him to confirm his intent for how this is set up. Either way, this isn’t the only retirement calculator I’ve used and feel good about my projected success rate even when doing something like a more random Monte Carlo simulation.

Hi! Recently discovered your site- Loving your blog and content. My wife and I are both 30 years old and have been getting more and more into FI and have set a goal to have saved enough to retire (and possibly move out of the US for reasons you state here re: insurance, etc) by 40 years old. You mention being comfortable to retire by 30 with $500k saved. Do you have a breakdown of what buckets those savings lie in? For instance, we have been maxing out our 401k lately and I am just wondering how you have your $500k broken down in terms of what you’ll use in your “retirement years” and what you’ll use in the gap in-between. Thanks!!

Hi! Thank you. Congratulations on your goal! My investments are about half in tax-advantage accounts and half in taxable accounts. I’m going to be pulling from the taxable account while using a Roth IRA conversion ladder to slowly move my money from my Trad IRA/401K into my Roth so I can withdraw it in 5 years without penalty. Check out Mad Fientist’s article on that if you’re interested. I have maxed my 401K since I started this journey 5 years ago, but because I was able to save at least double the max my taxable account grew as well. I hope that helps – Good luck!

I think we have a lot in common. 🤣 Hitting that FI number with as much flexibility as you have opens up so many opportunities it’s crazy. As a fellow child-free, apartment loving early retiree looking to travel the world more in the next few years, I can’t wait to see what happens!

Also, this quote is a great one: “ Rent is the ceiling. A mortgage is the floor.” We lived in a house we bought for 11 years. The mortgage was $1,400, but our annualized monthly spending just on keeping the home in working condition was $2,200. Add to that a 20% drop in value (we were naive and bought in 2006), and we would’ve been a whole lot better renting.

Thank you for confirming my suspicion 🙂 ! The amount of flexibility really is wild and I’m surprised with the options available even during something as out of left field as a pandemic. And oh no – I’m sorry about your house!

Great read! And couldn’t agree more.

There are so many opportunities and levers. My wife and I target 2024 and roughly USD 1 Mio., but I guess we could leave our day jobs much sooner. And that’s what‘s all about: having the choice and being able to focus on what really matters in life.

Cheers

So glad you enjoyed it! And that’s so exciting about 2024 (or sooner…) 🙂 . All about that choice and flexibility!

““Rent is the ceiling. A mortgage is the floor”

Heh, always thought about it the other way around. The price of your rent can explode if inflation hits while your mortgage is fixed, you know exactly how much you’ll have to pay year after year.

Your rent cannot explode – if it is going to change you get a notice about it increasing and can you move. A mortgage is the start of what you need to pay for with a house (maintenance, property tax etc) and can change often while you don’t deal with those things with a rental.

I just took the plunge 2 weeks ago into retirement & then today I found your blog. I am so happy to hear that you are loving it and the thoughts you are posting are totally mine as well. It’s great to read about your journey and not feel alone in this.

Is your plan to live off the 2 yr cash reserve while the Roth conversion is in the 1st 5 yrs? I like the idea of only spending 4% of the portfolio value instead of a set amount but do u evaluate that monthly?

Congratulations on your retirement! You’re definitely not alone 🙂 .

I’m living off the 2 year cash cushion and then my taxable account, which could sustain me for about 15 years even if the market stagnates. I don’t need to touch the Roth until after that.

If you’re talking about the 4% rule of thumb it’s based on 4% of your portfolio value when you quit (not every year – though there is a different withdrawal strategy that does something similar to that).

I’m planning to evaluate my spending annually and decide how much I want to increase it based on my own separate ‘no spending ceiling’ twist. Good luck!

Love this post.

I’ll admit I was a skeptic given ERE’s 50-part series that basically says that the 4% rule won’t cut it, but you shut me up with this post. You’re like Millennial Revolution—you covered all your bases.

The fact that this blog pulled in $4K+ last year and this amount will likely grow through the years just further bolsters your argument.

And this quote—“My worst case scenario is everyone else’s every day scenario.”—is awesome.

Thanks for this blog. You’re definitely an inspiration. All the best in your travels!

I’m so glad you love it 🙂 and that’s totally fair. I do take hardcore examination seriously, but do feel I’ve covered my personal bases. I’m also glad those facts and quotes resonated with you. I hope you’re well!

Hi! Just found your blog, it’s so hard to find early retirees with no children, no spouse/shared income/taxes, no house, and under 50, so glad I found this to follow and read, so thank you for sharing everything! Just pulled the plug after discovering fire. That death chart is very sobering!

Hi! Happy I could be of service 🙂 . Congratulations on your retirement! That chart is indeed sobering. It helps me stay focused on what’s important.

You could theoretically dump 500K into a covered call ETF like JEPI and collect around $40,000 a year in divy’s, with some small capital growth.

Maybe a bit on the riskier side to have so much in 1 fund, but just a thought.

Yeah – I’m not interested in chasing dividends and am not personally interested in a fund like that with so few companies represented (75) instead of investing in the entire market (3,000+).