Let’s start with all the caveats! Just like everything I do in my life, this is not a recommendation. I’m just trying stuff out and seeing what works. I am not an expert or a guru, I’m just a 30 year old going through life. This is how I’ve set up my investment portfolio, but I’m not saying this is right for everyone. It’s called personal finance for a reason.

Alrighty – now that the disclaimers are done, let’s dig into it! When I finally decided to listen to my partner and look into this whole “financial independence thing” (after 2 years of him bothering me…) I read everything I could on the subject. I devoured finance books and blogs.

After several months of data gathering, I felt that I understood the subject matter enough to decide how I wanted to structure my own investment portfolio. Before I started reading, I didn’t really understand what a stock WAS y’all!

But after those first few months of reading, I understood enough to realize that my 401(k) was in sub-par funds (that my parents’ financial advisor suggested…) and felt comfortable enough to stray a little from the beaten path (like that’s rare for me 😉 ). I moved my 401(k) to low cost stock index funds and then decided to make a plan for my investing future.

After careful consideration and financial calculations, I decided to own 100% US Stocks. I have received a fair number of questions on the reasoning behind this decision with the main concerns including:

But What About Bonds?

Bonds are a stabilizing force in a portfolio that helps smooth the wild ride of the stock market. The flip side of that is that bonds are a drag on your portfolio. While greater stability can help people sleep at night, holding bonds also decreases the overall return of your portfolio, which first clicked for me when I read this post by Go Curry Cracker about why he’s on the path to 100% stocks.

Longevity

Hopefully I am looking at a 70 year retirement, and because of that long time frame, I am of course concerned about running out of money. Having 100% stocks helps me fight against the challenges of living that long on my portfolio.

In Go Curry Cracker’s post he lays out the possible terminal values of a portfolio and finds that the difference in terminal value between a portfolio of 100% stocks compared to 70% stocks for a 60 year retirement is FOUR TIMES more. Having 30% bonds instead of 0% leaves you with 1/4 of the money at the end of a long retirement.

That’s a lot of dough to leave on the table just to play down stock market gyrations. And to be honest, I’m not very concerned about experiencing stock market volatility because of:

Lifestyle Flexibility

My lifestyle is completely flexible. I have absolutely no roots or anything keeping me in one location (no house, no car, no kids, no pets). Geo-arbitrage is part of my retirement plan both so I can see the world and experience other places, and because it allows me to scale my costs up and down as needed without decreasing my standard of living. I can also look into earning a little money if needed. I will use decreased spending and (if necessary) increased income instead of bonds to help smooth my ride. So that’s why I don’t own bonds, but what about my weird stock allocation?

But What About International Stocks?

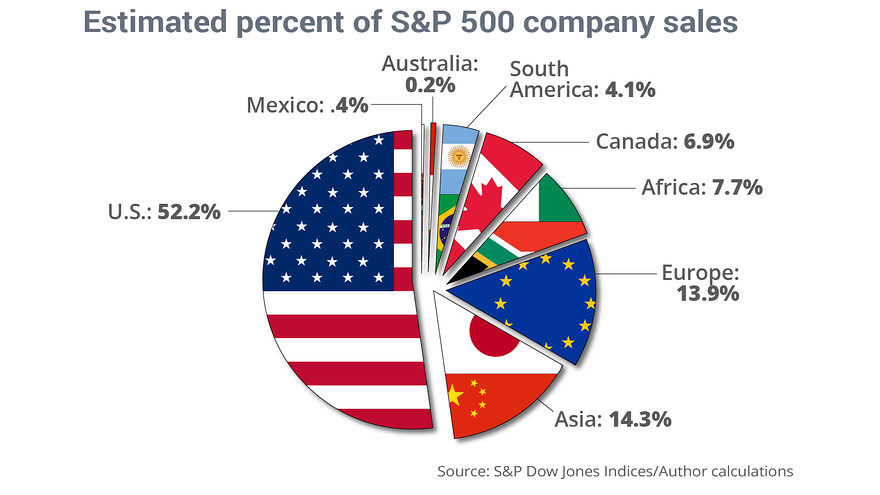

I never realized this truth before I read this post by the Godfather of FI, JL Collins, but US stock index funds, such as the VTSAX that I own, actually include a fair bit of international exposure. To show this, Collins references the below chart that explains how much of the sales of the US companies in the S&P 500 (which make up 75% of VTSAX) come from overseas.

I was shocked to see that the amount from other countries is almost half! In addition to where the sales come from, Collins makes some great points about the additional risks that come along with investing in international funds, such as currency risk, accounting risk and the higher expense ratio. Read the full article if you’re curious about those details.

It also just so happens that the US makes up 15% of global GDP. The US is not a small player on the stage. I am aware of home country bias and am not investing this way because I think the US is perfect or because I happen to live here. It just so happens that I’ve weighed the pros and cons and think I’ll be just fine without. I already have a fair bit of international exposure built in. If the US’s percent share of global GDP or the percentage of US company sales from other countries decreases significantly, I’ll reassess my plan.

Simplicity

“Simple is good. Simple is easier. Simple is more profitable.” – The Simple Path To Wealth by JL Collins

I’m a self-proclaimed lazy person and I’m always looking for efficiencies in my life. In addition to all the reasons above, another reason I do not hold bonds or international stocks is simply because it’s more complicated without a lot of upside based on my specific situation. Rebalancing a portfolio, even with the complexities of tax-advantaged and taxable accounts isn’t THAT complicated, but it is one more thing that I don’t need to do. Instead, I can just let it ride.

Conclusion

I try to carefully evaluate all the big decisions in my life to make sure my decision is the best one for me – and my portfolio is no different. 100% US Stocks sounds like the best option for me at the moment, but I can’t promise I’ll never change my mind 😉 . Life is about learning and adapting based on new knowledge, but for now I’m riding the wildly bucking unicorn that is 100% US stocks.

What do you think about my reasons for holding 100% US Stocks? What’s your portfolio made of?

you know what’s under the hood of the smidlap misguided portfolio. 15% cash, 15% preferred shares, 48% individual stocks, 22% index funds. we put it out there for public consumption and ridicule but really don’t care how anyone feels about it. there was one blogger who thought that was too much cash. he doesn’t matter to us. he’s just a blogger.

the key thing you wrote here is that you didn’t carve the strategy into a stone tablet and sign a pledge in blood. you can always change your mind in that and many other things.

Indeed I do! Glad you aren’t letting random people on the internet sway you from what makes the most sense to you 😉 . Also this had me cracking up: “you didn’t carve the strategy into a stone tablet and sign a pledge in blood.” Yep – I can’t promise I won’t change my mind about…well literally anything 🙂 .

This is such a great topic! I learned so much from your post and the links you provided. Here I thought I was in 100% US stocks just because I’m lazy, but now I can justify by laziness.

I’ve been toying with moving to bonds, but we’re not planning on retiring anytime soon, and as you said – they are a drag on your portfolio. Vanguard keeps suggesting it almost every time I log in though.

Honored to ride the bucky unicorn with you. However, I should add – we have accounts through work that we have less of a say in, so that’s my risk management plan for now.

Hahaha – glad I could spread some knowledge and help justify your laziness 😉 . That’s interesting Vanguard suggests it – they’ve never done that to me… Welcome to the bucking unicorn! Happy to share. And I assume you mean that your work forces you into bonds? Either – way that’s an interesting risk management plan 🙂 .

I was 100% in US stocks when I was 30.

Now that I’m older and more conservative, I have more bond, international, and real estate.

I think 100% stock is a great option when you’re young.

That’s cool! I am indeed young 🙂 . We’ll see if my feelings change as I get older. Thanks so much for stopping by!

How much cash are you keeping on hand for when you pull the ER trigger to smooth sequence of returns?

I’ll have a year of expenses in cash when I pull the trigger so I don’t have to withdraw anything for a year (or longer if I accidentally make some money). I don’t want to hold more than a year in cash since cash is an even worse drag than bonds. As for sequence of returns, my main plan there is to decrease expenses by moving somewhere else for a while. If I can decrease from $18K to $16.5K in a downturn I would have been fine in any previous retirement year.

What taxes, fees, etc (if any) do you anticipate as you w/d your funds to live off of every year?

I’m planning to stay under the 15% tax bracket for capital gains so I don’t pay additional tax on that money, but if I make money and am pushed out of that I’ll pay the tax out of the extra money earned. The only fees are my 0.04% expense ratio that’s already taken out automatically.

Love that expense ratio!

Thanks for sharing, I have most of my 401k in Vangaurd index funds too.

I must admit that I love it too 🙂 . And that’s awesome your company offers Vanguard funds in the 401(k)! I hear that’s rare.

I do the same strategy. Since I graduated in 2013 I’ve done purely the us total stock market.

I have no intentions of changing! Just ride the ups and downs.

That’s super cool! I don’t think I’ve met someone with that allocation before. Let’s do this!

I’m on team 100% US stocks too! I had some bonds thrown it because I “should” but realized the exact same things you described. High five and rock n roll! <3

Woohoo! Our small club is growing by the minute – Welcome 🙂 . Rock n roll indeed!

It’s great you are thinking critically about your asset allocation and plan to continue to do so. Your thought process is backed up by some very sound advice.

I think being really aggressive when you are young and have a potentially long retirement horizon is the way to go. That is… As long as you are sure you can ride out a severe market downturn without pulling out. Just make sure recency bias isn’t skewing your thought process. We have had quite a bull run since 2008.

I had a 90/10 stock to bond allocation for years. I’ve recently went 75/25. I am FIREing next year and decided to be a bit more conservative.

I thought long and hard about how much I was willing to lose if the market dropped… Say… 50%. The conclusion I came to is that half of 3/4 of the portfolio would still enable me to live a slow travel lifestyle worry free.

None of us are right or wrong here because noone can predict how the market will perform. The best you can do is to be truly honest with yourself about your risk tolerance.

Great post. Keep up the good work.

Great points – I have a few reasons I believe I will be able to ride through a severe downturn without selling, but I obviously can’t confirm that until it happens 😉 .

I have 2 main reasons I think I’ll be able to stick it out: 1) My parents pulled out a large sum in 2000 and 2008 and obviously seriously regret it. If I was starting to have similar thoughts they have offered to talk me through it so I avoid their mistakes.

2) Since I started investing heavily 5 years ago I routinely visualize opening my account and seeing 50% or less of it in there. As I’ve increased my net worth I have seen my portfolio drop $1K, $5K and now $10K or more in a day and I make myself look at it and think “That $10K was 1/2 a year of expenses – How does this feel?” So far I haven’t felt anything surprisingly, but will continue that exposure therapy and visualization until it’s needed. Also reminding myself that I have the same number of stocks as yesterday – they’re just worth less if I wanted to sell them all right now, which I should never do anyway.

Congratulations on your impending FIRE date! I love that you thought about how much you were willing to see your portfolio drop and edited your allocation accordingly. I completely agree with you – no one knows the future, but being honest with what you can handle is key. There’s a reason my parents close their ears when I mention how the market’s doing 😉 . Thank you for stopping by!

I doubled majored in finance and accounting. One top of that, I’ve completed one of the most rigorous financial exam series in the world (6,000+ pages for the 3 CFA exams). I’ve also personally invested in bonds, commodities, stocks, and options for over 10 years.

With all that said, I’m also going up to 100% stocks (after the next market crash/correction). With a long time horizon (10+ years) it’s more risky not to own stocks. At the start of this article you say you’re not an expert… but it looks like you have an solid strategy in place 🙂

Interesting – thank you for the vote of confidence and for stopping by!

Also jumped on the 100% US stock bandwagon after reading A Simple Path the Wealth. I don’t think I’ll ride this allocation out through retirement, though, but only time will tell. Cant wait to see where your geo-arbitrage takes you

Oh really?? What part of the book made you want to go that route? And what allocation are you thinking for retirement? I also can’t wait to see where it takes me 😉 . Lots of variables are in the air right now, which is not preferred by my plan-loving heart 🙂 so we shall see.

I agree with just about everything here! GCC and A Simple Path yo Wealth we’re very persuasive 🙂 While I don’t own 100% US stocks (I still have like 15% international as my parents advised me early on to diversify into that and I haven’t wanted to sell since it’s been in a funk the past two years) all my current investments go towards US! I also have like 6-7% bonds but waiting for a market dip to move that over 🙂 maybe one day I’ll be 100% US stocks!

Haha they make good points. Sounds like you’re well diversified over there. I’ll be curious to see what you decide to do when international stocks increase and the market overall drops. Keep me posted!

Laziness can be strategic! 🙂

I was willing to go 100% stocks for a while but I like to mix things up for balance so swung away from that.

Hahaha – I love it! And super cool – mixing things up is usually my bag, but not in this case 🙂 . Thank you for sharing.

I switched to 70/30 upon retirement. One of the main factors for me holding 30% bonds is that the Trinity Study had more failures at 100/0 than it did at 75/25. I certainly understand that 100% stocks has greater upside, but it’s the downside that I’m guarding against. Especially with where we are in the business cycle, as a recent retiree w/ zero income, I don’t think I could stomach a 50% portfolio drop. With 30% bonds, a 50% stock market drop means my portfolio only loses about 1/3 of it’s value. While I’d rather not see that either, that seems easier to deal with.

Totally makes sense – do what you can stomach! I’m not worried about the downside for me personally since my entire life/spending amount is flexible. My projections include me decreasing my spending to $16.5K in the worst down markets, which gave me a 100% success rate (based on historical data) with 100% stocks for a 70 year retirement.

“I can’t promise I won’t change my mind about…well literally anything 🙂 .”

Well, I hope on this one thing you don’t. 🙂

You’ve set yourself on a great path, but it only works if you stay the course over the decades.

If you can hold firm through this current storm, there is not much the market can throw at you that will rattle your nerves.

Would be a shame if after earning those stripes you let boredom, novelty or some other siren song lead you onto the rocks. 🙂

Great post, and thanks for the links!

Hi Jim! Thank you so much for stopping by. Good advice as always – I just included that line because my partner loves to remind me of all the things I’ve changed my mind about in recent years: that I wouldn’t have a public blog – oops, that I wouldn’t go on podcasts – oops, that I don’t need a sous vide machine…the list is long, but luckily doesn’t include anything to do with my asset allocation.

The current market turmoil has shockingly had no effect on my emotions. I won’t be changing anything as a result of it. I’m here for the long haul and I completely credit your wonderful book and amazing stock series for getting me to this point. So thank you so much 🙂 . And it made my day you liked my post!

I’m JL Collins all the way. I just found out about FIRE last November and I just started. I plan to retire in 10 years. I’ll be 45 then. I’m 100% stock until close to retire, I’ll change it. Im following the “Simple Path of Wealth” like a bible. Thank you for sharing your article and story on podcast. I enjoy it very much. And thank for sharing the Job Spotter. 🙂

That’s awesome! Welcome and congratulations on your timeline! So happy you enjoyed the podacst and Job Spotter! Thank you for stopping by.

Hi – great post and thanks for sharing your thoughts with the world to create discussion! I arrived at this blog because I am looking very hard for compelling reasons WHY I should EVER allocate to bonds (even in old age retirement). Yes, I understand volatility can occur, even if sustained, but assuming you don’t let emotions get you, the math and historical evidence seems to suggest that stocks will always come out on top if one can weather storms.

I think I read somewhere above that you might change your allocation in later years, but even then, why? Even if the market loses 30% for some period of time, you will still be withdrawing a very small % from a large pot, so who cares?

I feel like bonds are a hedge in case any of us have some unforeseen mega expense – but how many of those do we really have in life?

Anyways… thanks again!

Welcome! I haven’t found a reason that compels me besides emotional ones – mathematically all stocks seem like the way to go. As for me mentioning I might have bonds in the future – that’s simply because I never say never 🙂 and if my retirement goes well I could take some money off the table to fund large medical expenses if I see them coming on the horizon. Good luck!

Thanks – that totally makes sense and seems to align with the most common justification I can find – emotional shock absorber.

Love it. Great explanation! I have a similar thought process in that I don’t really like cash or bonds. I would call myself 100% stocks except I do have an investment property, and my superannuation (Aussie version of a 401K) is held in a default mixture (even when I select ‘ highly aggressive’ it still has some cash and bonds ugh). I totally agree though, the volatility is worth it for the returns over the long term. I am starting to see my snowball really gather momentum now, recently ticked over $1M net worth and starting to see regular dividend payments of over $1000 per month, as well as some returns from my business that matches the dividends. So I have reached my ‘lean fire’ or ‘single fire’ but continue to fly, earn and invest towards ‘fat fire’ or ‘family fire’ as I call it where my expenses will be a little higher. Predominantly though, this is all in index funds. I am concentrated in australian stocks (high dividends) but also buying more US stocks.

Glad to know it makes sense and congratulations on $1M – that’s so exciting!! And woah on dividends and business returns on top of that – you’re a beast!

Do you use a roth or just a generic brokerage account? Confused about taxes, etc. and want to avoid penalties for withdrawing at an early age

I use both actually 🙂 . A regular brokerage account will allow you to access all of the money in it at any time, but a Roth IRA does let you withdraw your regular contributions if needed. It took me a while to read up on all of this stuff and figure out what plan was best for me. I’d suggest JLCollinsNH.com’s Stock Series for that or the book Simple Path to Wealth if you prefer that format. Good luck!

Hi there! Love your website and your content. I’m following a similar path and I even thought to myself, wow I think people would benefit from following my progress… but after a Google search, you are already doing that! Big fan of what you’re doing though.

Quick question: You mention having a company 401k… what did you do with these funds at retirement? With the massive tax hits, I’m stuck feeling like my 401k is worthless to me until I’m 55 unless I want to pay an early deduction fee. Any input would be greatly appreciated.

Hi Bryan! There’s always space for more people to share their stories so if that’s something you’re interested in – go for it! When I retired I rolled those into a Traditional IRA and am starting to do a Roth IRA Conversion ladder to access them without fees before 59.5. Mad FIentist has a great article about that if you’re interested. Good luck!

Your responses are brimming with emotional intelligence and I love how you role model “take space, make space” to honor your own decisions AND what journey others may be on!

Thank you so much for your kind words! That’s exactly what I’m going for 🙂 .

I was 100% stock funds for over 25 years until I retired at 63 (2013). From everything I have read and experienced, I believe a touch of Bonds of 5-10% would improve your bottom line at retirement. Check it out, run the numbers.

I enjoyed reading this *so much*! It inspired me to add a couple questions to the list for my financial advisor meeting next week, to investigate if he’s fiduciary and what “fee only” is, and most importantly to let go of “making the right decision” and focus on “designing the right decision FOR ME.”

I’m so happy to hear that! “Fee only” means they charge a flat fee for their time and are not like most free advisors that instead get commissions based on the investments they sell to you, which obviously incentives them to give advice that’s best for their wallet, not yours. However, they’re not allowed to put their needs before yours if they are a fiduciary. Absolutely figure out what the right decision is for your specific situation. Good luck!