In 2017 I spent $18,436.60, which is $4,055.26 or 18% less than last year. That’s amazing! I didn’t exactly hit my $18,000 goal, but I’m only 2.3% over and had a lot of rare or one-time expenses this year including:

– Two Far Away Weddings: $791.73 (Note: This would have been a lot more without travel hacking)

– Disney Bachelorette Party: $626.56

– Cavity Filling: $128.60

– Passport renewal $110

– Camping Equipment $100

TOTAL ONE-TIME OR RARE EXPENSES: $1,756.89

Removing those rare or one-time expenses brings me down to $16,679.71 for the year. That’s amazing! This gives me a lot of confidence in my ability to decrease my spending when needed while still living a kickass life!

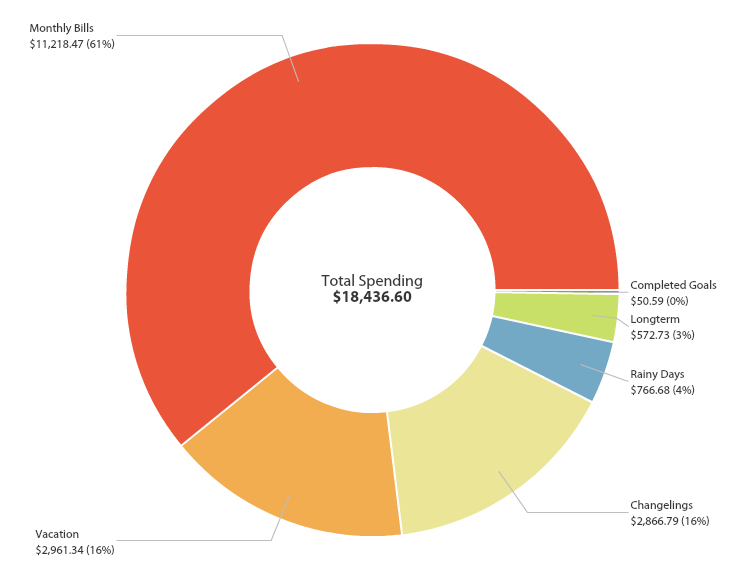

For the money voyeurs my spending broke down like this:

MONTHLY BILLS (61% Budget): $11,218.47

- $325.25 or 2.9% more than my 2016 budget because of a rent increase

- This includes rent, utilities, public transit, internet and my mobile phone

CHANGELINGS (16% Budget): $2,866.79

- Groceries $1,493.92 which is 214% more than 2016 (which I expected since I wasn’t eating breakfast and often dinners at work and cooking a lot more)

- Eating Out $622.22 which is $1,059.30 or 63% less than 2016

- Alcohol $605.51 which is $335.08 or 35% less than 2016: I’m not sure if I’ve actually drank less or if I just drank OUT less 🙂 , but I’m happy with the decrease

- Parties $145.14 ($130.85 or 47% less than 2016)

VACATION (16% Budget): $2,961.34

- Travel $1,933 ($1,245 or 39% less than 2016): I bought flights to: Boston, Atlanta x2, Albany, Singapore and Ecuador

- Vacation Spending $942.26 ($522.52 or 36% less than 2016): This includes camping gear and 4 camping trips to Blake Island, Deception Pass, Olympic National Park and Gifford Pinot National Forest as well as adventures to Vancouver, Maine/Boston, Phoenix and Disneyland

- Friends Visiting $85.86 ($156.39 or 64% less than 2016)

RAINY DAYS (4% Budget): $766.68

- Household Goods $196.22 (94% more than 2016): I became a bit more of an adult by buying a real wallet, WD-40 for our creaky doors we put up with for 2 years, ant killer spray and caulk which saved my sanity, an Ikea chair and a replacement for our sous vide that fell over as well as replacements for broken items like my partner’s French Press and a Pyrex. We were clumsy this year!

- Personal Products $92.93 ($58.90 or 38% less than 2016): $60 of this was my first haircut in many many years. Without that I would have spent $32.93, which is 78% less than last year. That’s amazing

- Clothing $31.97 ($6.32 or 16% less than 2016): I bought a few light tops for Singapore and $10 flip flops after mine broke. I also gave away 5 large trash bags of clothes. Downsizing! Also getting rid of things that definitely don’t fit now that I’m smaller. Never going back!

- Entertainment $236.15 (6% more than 2016): I went a little wild this year with $40 tickets to see the Terracotta Warriors, renting kayaks around Seattle, seeing more $6 movie matinees, discovering my new favorite movie theater (it has a bar in it = uh oh) and renting from Redbox. Worth it!

- Medical $17.65 ($389.65 or 96% less than 2016): This covers some sugar free cough drops and expensive dandruff shampoo (it turns out cutting my hair was the answer to solving my random dandruff, not fancy shampoos)

- Dental $168.26 ($182.53 or 52% less than 2016): This includes a cavity filling and electric toothbrush

- Laundry $3.50

- Grass $20: You know what this is 🙂 . Weed is legal in Washington State.

LONGTERM (3% Budget): $572.73

- Giving $248.23 ($164.26 or 40% less than 2016)

- Electronics $129.50 ($911.72 or 88% less than 2016): Includes a new phone, a portable charger for camping and long flights, new in-ear headphones, and a replacement cord and cushions for my Bose QC 15 headphones

- Taxes $100 ($125 or 55% less than 2016): This is my passport renewal

- Credit Card Fees $95 ($37 or 28% less than 2016): The annual fee for my Chase Sapphire Preferred, which once again paid for itself after I missed my train connection because of flight delays and had to spend the night in Boston unexpectedly, spending $250. Definitely worth it.

I’m surprised with how relatively little I spent for everything I experienced this year. For 2018 let’s see if I can get my spending down officially to $18,000. Onward!

I’m loving reading your blog so far, it is awesome! Very impressive and cool how you have been building up all these posts for a couple years. I figure you probably mention this somewhere else that I haven’t read yet but do you have to pay anything at all for medical or dental insurance? Also how are you thinking about paying for it once you retire? On a side note, I’m a born and raised Atlanta person too and you are 100% right about getting a car right at 16. I want to move somewhere where I don’t need a car anymore.

Hi fellow Atlantian! Thank you! I was actually thinking about how to show that information a few days ago. I do pay a little for medical and dental insurance, but it is taken right out of my paycheck and doesn’t make it into my current numbers as a result. I’m going to change that in my next quarterly review. I usually use screenshots from my YNAB to show spending, but those costs medical and dental insurance costs aren’t reflected in it (since they’re taken pre-tax) so I’ll need to get creative with how to show that. After retirement I’m planning to use World Nomads for medical insurance in the initial years (since I’ll be traveling the world) and geo-arbitrage if I need anymore serious dental work (which I doubt because I’ve had several dental surgeries and a few rounds of braces already…but I’m ready for more if necessary!) If you’re looking to move somewhere without a car I’ve lived several places without them and can point you in a good direction.