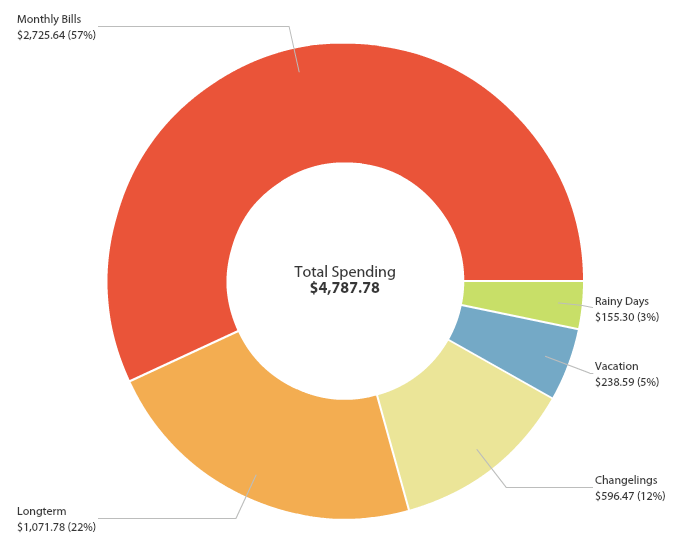

Well, somehow 2019 is 75% over and yet seems to have gone on for several years. How our brains perceive time is weird so let’s tackle something more tangible: every dollar I spent this quarter! Above is a snapshot of my Q3 spending from YNAB. Let’s get into the nitty-gritty:

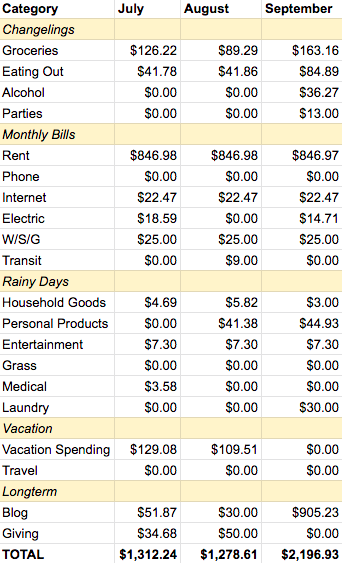

And for a month by month breakdown:

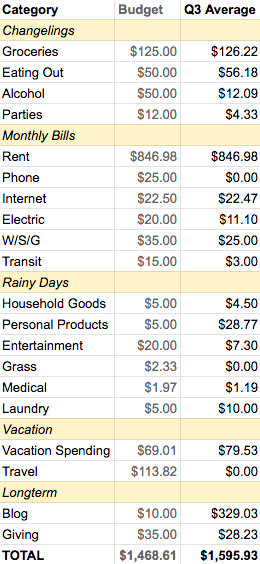

CHANGELINGS – $198.82/MONTH

I call this section “changelings” because they’re the items that change the most month to month.

Groceries – $126.22/month

Groceries were right on track this quarter! We had a lot of delicious Supper Club meals, which usually featured our awesome Sous Vide machine that we use to make easy, cheap and yummy food – if you want an intro to the magic of sous vide cooking, I’ve written about that here.

Looking through my receipts, I bought a lot of grapes (they were on supersale!) and seltzer to continue living my fancy, but frugal life. I’ve been able to maintain this level of grocery spending even while eating a lot of meat on keto. If you want to know exactly how I do it, check out a full month food breakdown here.

Eating Out – $56.18/month

Surprisingly on budget given all the eating out I did during our gorgeous summer months! This amount included some delicious Ramen, Mexican (several times), Korean BBQ, a new American restaurant near us, delivery of (not good) wings, the glory that is the southern institution of Waffle House and multiple coffees in Atlanta with a finance friend. It also included $22.50 that I sent to a finance friend to purchase a $25 Chipotle gift card – I love Chipotle so much that I’ll take discounts wherever I can get them!

Alcohol – $12.09/month

I completed my 100 Day Alcohol Free Challenge at the beginning of September, hence the very low spending. Since booze came back in my life, I have only been buying bottles of wine that I have never tried before instead of my usual “what’s the cheapest bang for my buck?” I have literally calculated that before based on the amount of alcohol, calories and price. While that might have been a frugal win, it wasn’t a life win. I want my relationship with alcohol to be about experiencing new things, not getting tipsy for the least amount of money or calories possible.

Parties – $4.33/month

This section includes items, such as snacks or a bottle of wine that I bring to parties at peoples’ houses. And it’s pretty tame! I guess with all our eating out and enjoying the sunshine, there wasn’t much time for house parties.

MONTHLY BILLS – $908.55/MONTH

Pretty self-explanatory. This section doesn’t vary a lot month to month.

Nothing exciting here. Rent, Utilities and Internet were all business as usual (I split a 1 bedroom apartment with my partner). My awesome Republic Wireless phone bill is still a sexy $0 after they introduced annual plans that allow you to get a month off your bill, so I won’t be receiving another phone bill until the spring!

The only other item of note is that I spent $9 for a total of 3 hours of parking in downtown Atlanta to meet said finance friend for coffee. Luckily I was able to offset that with some sweet Job Spotter money (and obviously it was worth it to see them)!

RAINY DAYS – $51.77/MONTH

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

Household Goods – $4.50/month

This quarter, rainy day household purchases included sexy things like soap, paper towels, compost bags and parchment paper to make my delicious FatHead Pizza:

Personal Products – $28.77/month

This included an eyeliner after my old one ran out and then another eyeliner when I discovered the first one was runny as hell (oops), as well as materials to bleach and dye my hair purple and ACT fluoride rinse to help my teeth stay awesome and cavity free. Also I’m happy to say that I’ve so far succeeded in my goal of only buying purple dye ($40 worth) with my Job Spotter payments!

Entertainment – $7.30/month

This was just my portion of our Netflix subscription that we share with a million people. Otherwise, all my film entertainment came in the form of devouring as many movies as I could during the 4 cross-country flights that happened during this quarter. Here’s one example:

Laundry – $10/month

We reupped our stash of laundry quarters at the bank. I know, we have a real rock n roll lifestyle over here…

VACATION – $79.53/MONTH

Vacation Spending – $79.53/month

We continued our monthly camping goal throughout the summer and went to a few wonderful and one not so wonderful places (see below). I also brought a finance friend into my inner circle after we ‘survived’ a weekend camping together. Overall, not a lot of money for the many trips we did to Diablo Lake, The Peninsula and Larrabee State Park:

Travel – $0/month

I didn’t buy any flights this quarter, but I did book my FinCon flight with points, which I will describe in detail along with all my 2019 points adventures in my annual travel hacking post at the end of the year. In the meantime, check out my previous ones and here’s a sneak peek of the 2019 version:

LONGTERM – $357.26/MONTH

This category is for, you guessed it, “longterm” items that come up rarely.

Blog – $329.03/month

Yep – that happened. Except for my Domain Registration and Privacy Renewals of $32.87, this spending was all for FinCon. Here’s what was included:

- FinCon 2019 Ticket: FREE thanks to a new blogger scholarship!

- FinCon 2019 Flight: FREE from points

- FinCon Hotel (Split with Roommate): $500

- FinCon Incidentals (Ubers to/from the airport, groceries and restaurants): $205.23

- My First Troll Quote T-Shirts (For me, Josh Overmyer and The Fioneers): $30

- Business Cards: $20

- FinCon 2020 Ticket: $200

Sooo basically despite all the awesome stuff I got for free, this was my most expensive trip of the year. Worth it? Yes, BUT I’m also glad I got over myself and am now open to making money on this website since I continue to rack up additional costs for this hobby 🙂 .

OVERALL

And that’s a wrap for this quarter! So far this year I’ve spent $13,902.43, which is 77.24% of my $18,727 goal. That’s perfect! Based on this trend, I’m projected to spend $18,536.57 in 2019, which is on track with my goals while living a badass life. To the rest of 2019!

How has your spending been lately? Are you on track to reach your annual goals?

Jeez, you spent so little. Nice job!

Do you have a roomate? How do you get rent to $850/m.

Great job on groceries too.

We already spent $30,500 this year. But that’s for 2 adults and 1 child so it’s not bad.

Haha thanks – I guess I technically have a roommate in that I live with my partner in a 1 bedroom 🙂 . And $30.5K is not bad for 3 people at all!

Ah, that explains it. You probably split expenses 3 ways as well. I used to have that luxury too. Still, I think I can learn a bit here. 😉

Who me? 🙂 My rent and utilities are split with my 1 partner. The amounts above reflect my portion.

That grocery spending is impressive – mine isn’t even that low, despite all my ALDI shopping! (I also mix in some farmers market trips.)

Right now internet is my big sticking point. One of the disadvantages of living in a small city – lack of competition. There is one internet company that actually works, so they charge out the wazoo and laugh when you threaten to leave to get your bill lowered. Fortunately a new player is coming to town with higher speeds and half the cost – not $22 (is that a shared about), but still much better than what I have now!

Thanks! Though I suspect I require less calories than you so that might have something to do with it 🙂 .

Yes all of those main bill numbers are split. I think I had that written out in a previous budget check in and will add it back in to avoid confusion. That’s awesome a new player is moving to town! I hope that helps lower your bill a lot.

good idea to cut your losses and get out of that campsite. sometimes you gotta recognize that having a bad time isn’t going to get you a refund.

i think we’re back where we ought to be for the rest of the year. we’re still kicking around the idea of getting on a plane this fall. it’s hard to say.

Yeah that’s the first time I’ve done something like that, but I’m a big girl – it’s time and this is part of why I’ve saved as much as I have – so I can make those kinds of decisions without money being the most serious consideration 🙂 . Sounds like a lovely rest of the year – no need to get on a plane if you’re good with where you are.

Awesome post!

Which Chase credit card do you use?

Glad you liked it! I have the Chase Sapphire Preferred 5 years and counting I believe. It’s paid for its annual fee and then some with since I used it as travel protection and always have at least 1 forced to stay overnight somewhere because of a flight problem incident a year.

I always love peeking into people’s finances. Congrats on all the money wins! And Chipotle ::drools::

Haha – glad you like it and thank you! And yumm…now I feel like I need some Chipotle tomorrow…

How is medical coverage handled within that budget? Our medical premium is almost double your entire budget at just under $3,100. We are a family of 4 in NYC but even when I break out my now adult children, it still leaves almost $2,000 per couple — and that’s on the government exchange! We’re canvassing prices in Florida where we have a condo, but I wonder if you’re under-insuring given the low numbers under “rainy day”.

Great question! My medical insurance premium is taken out of my paycheck directly and costs about $200/month. It doesn’t show up as an expense in YNAB for that reason. In my projected retirement expenses I’ve included the premiums for health insurance through quotes I’ve gotten and what I spend on medical, dental, vision in a year, which is usually around a thousand out of pocket. Check out the rainy day numbers from earlier in the year if you want an example – they were much higher and included a trip to the doctor and medicine.

These posts really inspire me. You keep it really tight (in a good way!)

I’ve been trying to be better with my budget but I still spend about $5k/mo. There’s no real reason I should be spending that much and I just need to come up with strategies to tackle my big two (eating out and groceries).

I keep re-reading your grocery post and know it’s going to help me get better.

My chipotle hack with keto: Order as sides. 1 side of chicken, 1 side of guac = less than 5 bucks.

Hahaha thank you! And oh wow $5K a month is a chunk of change 🙂 . I hope the grocery post helps you get where you want to be and SMART on the Chipotle hack. I’ve never thought of ordering as sides. I’m going to try that – THANK YOU!

That Chipotle hack is brilliant! I usually just pick up their chips & guac for $3, but I love this idea of sides!

A Purple Life: I thought I had a pretty good hold on keeping my groceries low, but you’ve got me beat! Well done!

Yeah – I’m super excited to try that hack! And it’s not a competition 🙂 , but thank you!