This is a continuation of my monthly series that records what’s happening in my final stretch to early retirement. If you’re interested in previous posts, they’re here.

I’m not one to bury the lede so: We’re doing this people! Thank you so much for all of your comments on my last post about this decision. I really appreciate all of your encouragement, concerns and advice. After careful consideration it’s been decided: I’m leaving my job in September 2020.

I’m booking the month long Australia/New Zealand trip I mentioned in my last retirement update post and after that trip, I’m going to take another month to visit my college roommate in Argentina that I haven’t seen in person in almost a decade. As a result, I’m quitting my job in 10 months.

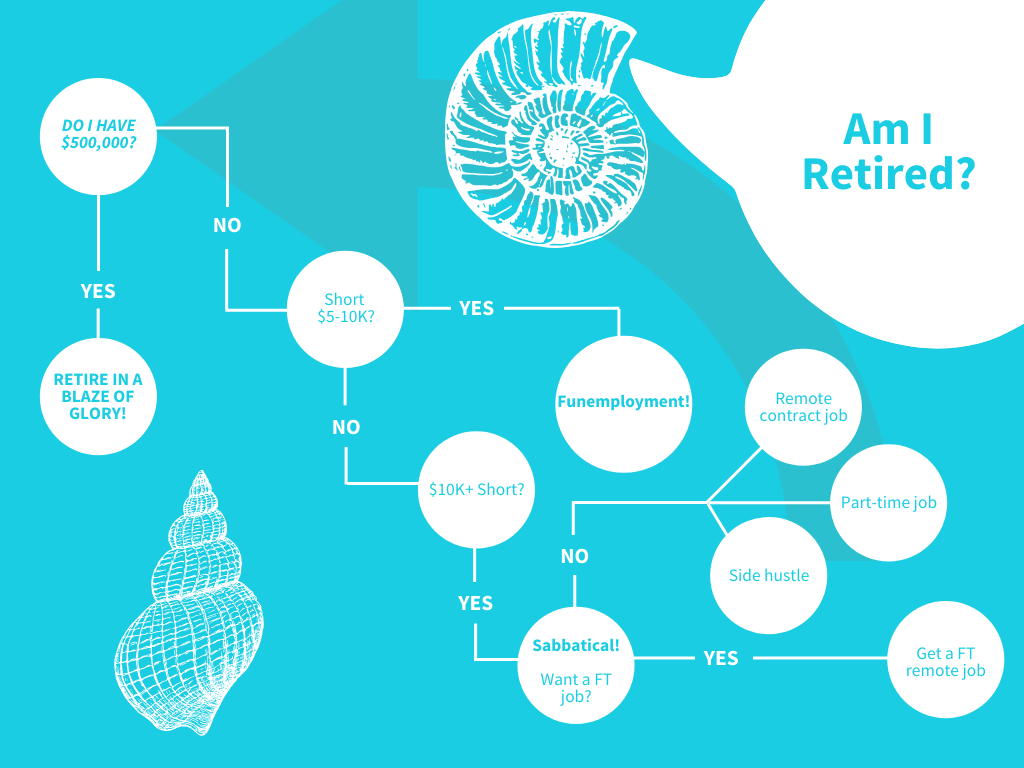

I was hoping that I would have a cut and dry plan for how this would go down, but like life, it’s turning out to not be so clear. It’s basically become a “choose your own adventure” type decision tree! Let’s get into why I made this decision and my many backup plans 🙂 .

For the numbers, I’m currently spending about $18,000 a year living in the center of a major metropolis. I added about a 10% buffer to bring that to $20,000 projected annual spending. As a general rule of thumb: 25 x annual expenses = financially independent, which is the baseline for my $500,000 goal, but as I’ve mentioned, I have a lot of backup plans built into that number to help that amount sustain me through a longer than traditional retirement.

Here’s where I currently stand:

Based on some back of the napkin math, if the market doesn’t tank in the next 10 months, I will be about $5,000 shy of my $500,000 goal. In this post, I was originally going to lay out what I would do if I missed my goal by that $5,000 or $10,000 or even $20,000, but then I realized that that kind of planning was leaving out a major player: The Market.

The stock market routinely swings up and down 1-1.5% a day, which is about $5,000-$7,500 when I’m close to my goal. I could have all these plans to make money and either no longer need it or need more the next day. So I realized that the kind of granular planning I love wouldn’t work here. I was planning these contingencies when the market shifting positively or negatively in a normal manner would make those plans obsolete very quickly.

So with all that in mind, here’s the plan: I will give my notice at work at the beginning of September 2020. My last day in the office will be September 25th. If I have $500,000 by the time I take off to FinCon 2020, that’s awesome and I can change my LinkedIn status to “Retired” and ride off into the sunset on a purple unicorn. If I do not hit that amount before my last day at work, I can instead change my LinkedIn to once again say “Funemployed” until I make up whatever gap might be there. How anticlimactic would that be eh 😉 ?

I think of myself as a weird contradiction because I am both a very cautious and randomly spontaneous person. I don’t make big decisions without a lot of thought and research, but I’m also the woman who quit her very first job without a backup plan. I berate myself for accidentally incurring an ATM fee, but happily Venmo a friend $500 on the spot after being asked if I wanted to go to a lake house for a week…but that view though 😉 #WorthIt:

So what’s changed? I was previously adamant that if I didn’t hit my number, that the first order of business would be to chat with my boss and see if he was open to me coming back after a two month sabbatical and being completely remote since we will no longer be in Seattle. I doubted he would accept that suggestion, but it was on the table as an option. Now it’s not because two things changed:

- I met a lot of you wonderful, hustling people at FinCon

- I started accidentally making some money

Finance Nerds Instilling Confidence

So basically I blame you all completely 🙂 . Seeing the awesome things people are doing online gives them an almost mystical quality, but meeting y’all in person is even more magical. I have met so many people in the last few months who are following their dreams and making it work before even hitting their financial independence number that I couldn’t help but be infected with your optimism and confidence. It also didn’t help that my 5 years retired Mom was whispering in my ear to throw caution to the wind and go for it because:

I’m Accidentally Making Money

I have previously declared that I didn’t think I needed to retire to something and that I was planning to be a complete slug in retirement and never make another dime. Well, that’s already failed. In the last 4 months, with just a few, tiny money making apps I have made over $300 without doing basically anything…that’s over 2 months of my grocery budget.

I’m not saying that I will sustain myself with the app economy after quitting my job – not at all, but seeing how easy it is in general to make money – especially without trying – was eye opening to me. That revelation combined with the wild optimism that meeting all of you instilled has made me more “Lake House Purple” than “Plan ZZZ Purple”. I am confident that I can make up any difference in my portfolio without keeping my current job. Here’s how I’m going to do it:

The Plan

May I present to you: the first decision tree I’ve ever made on a computer! (Shout out to Canva for making design so bloody easy.)

Contingency Lever 1: Make Money

Retirement

As you can see in the chart above, if I hit $500,000 I will retire in a blaze of glory and declare that FinCon 2020 is actually my retirement party 😉 .

Funemployment

If I am $5-10K short of $500,000, I will continue about my business, gallivanting around Australia, New Zealand and Argentina and at the end of all that fun, I’ll check what the market has done. If it’s swung up 1-2% then…I guess I’ll trade in my funemployed badge for a rocking chair and an AARP card.

Sabbatical

If I am more than $10K short and the market is not being kind, then I will enjoy my months off after a decade of busting my ass and then reassess my plan based on my latest net worth and my drive to do work 😉 . Based on that analysis, I can side hustle, get a fun part-time gig, grab remote contract work or (if needed) use my wild interview skills to snag another full-time remote job. Another option is a combination or rotation of side hustles, part-time and remote contract work. The world is my oyster!

Contingency Lever 2: Spend Less

We are leaving Seattle in September 2020 and our next location is TBD based on my partner’s next job and where we both want to live. If his next position is remote, we are planning to move every 3 months or so and if I’m below my target number, we will sprinkle in countries we love that have a lower cost of living, such as Mexico or Thailand. This contingency is still in the works since I don’t know our geographic future yet, but since we both want to live in several countries and explore the world, we have almost infinite options for where we can go next including many places that have a similar standard of living for a fraction of the cost.

Why So Confident?

I thought I would feel afraid to lock myself into quitting one of the best jobs I’ve ever had in a few months, but surprisingly I don’t. I have complete flexibility over my spending through geo-arbitrage and (to an extent) my income.

I’ve done a few things to get to this mental place. Just to see what’s out there, I’ve been receiving about 5 weekly emails with available marketing jobs from job sites that only deal with remote positions (contract and full-time). These jobs are not as rare as they used to be or as rare as I believed. I usually have over 30 available jobs a week in my inbox that fit my background.

I’ve also been revisiting my long list of fun and easy potential ways to make money that I mentioned in this post while also looking at the cost of living difference between expensive Seattle and cities we feel at home in, such as Puerto Vallarta, Mexico.

Conclusion

I feel good about this plan. When I quit, I may not be retired – I may be funemployed (one of my favorite things to be with a healthy emergency fund…) or I may be on a sabbatical. Either way, I’ll be taking a giant leap towards the life I want. So let’s see what the next 10 months bring. The countdown is solidified!

What do you think of my plan? Am I making incorrect assumptions or missing possible contingencies?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Your plan is awesome! I would also be the person with multiple contingencies, just to feel more secure in the decision. I can’t wait to see how it unfolds for you!

Thank you lady! I’m all about those multiple backup plans. We’ll see what happens 🙂 .

I don’t think you can plan for EVERY contingency, but it’s more about a feeling of doing what’s right for you. You will always have people giving you the pros and cons. And there are probably both, but they aren’t living YOUR life! Congrats on your decision!

Very true – I have no idea what black swans will pop up in my lifetime, but I do try to plan for the foreseeable future (even if plans can be easily de-railed). Thanks so much!

Great post! And congrats on your progress to financial independence!

You are right, the stock market swings can be really frustrating in the short term. Buy and hold, and to try to not watch CNBC/commentators is my strategy.

Thank you Nate! Great strategy – that’s my usual approach as well.

I’m not a big fan of this plan. Your net worth will fluctuate and you don’t have a lot of control over it. Why let the market dictate your decision? I’d just go with the “sabbatical option.” Then you can moderate the amount of work according to need/drive.

At FinCon, you can still tell everyone you retired. 😉 See you in Long Beach!

Thank you for the feedback good sir! The sabbatical approach of making money anyway is a good one – and possibly inevitable given my current accidental money making. Can I really tell people I’m retired if I haven’t hit my number by FinCon though? Labels are weird. Either way, see you there!

sounds like a plan. i remember age 30 pretty well and knowing i was going to leave a job. it made going to work much easier for me knowing there was an end. it wasn’t a forever end but that didn’t matter. change is good.

That’s a great point. I’ve felt that at jobs before and will analyze if I start feeling that way at this one as well. Overall I just feel better that I’m not letting the stock market basically dictate my future (e.g. if there’s a recession next year I would have to keep working despite my plans – if I hadn’t been laid off already). I’m taking control of my destiny – for better or for worse 🙂 .

Amazing how much your perspective has changed about making a little bit of money since last year 😉 But I don’t doubt that you can bring in a tiny bit to cushion that life change.

But I will ALWAYS also be sad that you’re leaving this year. Though my family room would clearly be a cheap spot to crash in the future 😉

Right?! Y’all have totally brainwashed me! And don’t be sad – we’ll just use it as inspiration to see each other a lot…which we already seem to be doing well lol!

Also I like how your family room is ‘cheap’ instead of ‘free’. Are you charging rent now or will my usual offering of booze and/or food suffice 😉 ?

Okay, okay, free. 😂😂😂

I do always appreciate snacks and/or booze though! 😉

Lol – then you will be showered in snacks and booze! Also free chef services since I did so well in your kitchen last time 😉 .

I am so stinking excited for you, and I am also squealing over your “Am I Retired?” road map. What a fun graphic. Basically just here to cheer you on. YAY, PURPLE!

Thank you so much Penny!! That’s so nice to hear. I’m trying to tamp down my excitement myself since 10 months is still a chunk of time, but I must admit I’m pumped!

Love this! What’s the worst that could happen, you go back to work?? Sounds amazing to me! Now you just gotta watch out for that senioritis kicking in next year! 😂

You make a good point 😉 ! I’ll look out for the senioritis. I haven’t actually had it since being a senior in high school and have know about or planned on quitting several jobs in the past. We shall see!

I am living vicariously through you to imagine what it feels like to have less than a year left of work. Sounds amazing.

So it sounds like your partner is going to keep working? Maybe I’m being too nosy, but I’m super curious about that dynamic. Sounds like a whole other post (or maybe there was one that happened before I arrived). I’m single and don’t have to worry about such things, but I’m really curious about the one person in a couple hits FIRE, the other person doesn’t dynamic.

Anyway, it’s always interesting to follow your progress! I’m selfishly hoping that the next stop on the journey is somewhere nearby the Midwest, so we can teach you how to say “ope” and enjoy a really low cost of living : D

I’ll definitely keep you posted – currently I just feel tired (because of the time change) and excited because of the decision. I’m going to keep these monthly updates though to document what it’s like when I get even closer now that the decision is locked in.

Yes my partner and I have separate FIRE numbers and timelines. I talked about that a little bit in the post below, but I am also curious about the dynamic haha. I’ll let you know when we get there! I currently don’t think it will be that different since we both work from home and he’s been on a sabbatical for the last 4 months. Hasn’t changed anything except he cooks and cleans more.

I’ll definitely let you know if the Midwest makes the list, but even if it doesn’t travel is part of my plans so I’m happy to hop on over. It could be part of my geo-arbitrage plan 😉 .

https://apurplelife.com/2018/08/14/half-a-million-together-and-keeping-finances-separate/

Seems like you’ve thought through all of the most likely scenarios so I don’t think you’re making a mistake. I think you’re choosing the best version of your life. And assuming ya it’s carefully considered, that’s never a mistake.

Wise words. Thank you so much! I have tried to look at it from every angle and worst case scenario. We’ll see 🙂 .

It’s not the exact same thing, but when I up and quit my job, I was surprised at how relatively easy it was to find some income-earning opportunities that I could stomach. And if I weren’t so picky/lazy, I could have easily picked up some other gig/side hustle-y things as well.

With your experience and resourcefulness, there’s no doubt you can do the same if you want or need to.

Point being, you’re absolutely making the right decision and you’re going to be totally fine. Congratulations on this big step! Also, your travel plans sound amazing.

It’s awesome to hear that from someone who has been in a similar situation. Also I imagine I will be similarly picky/lazy so we’ll see what happens 😉 . Stay tuned for too many travel pics! Thank you so much!

Sounds like a lot of thought and planning has gone into this and as youve identified – WORST case is you find a cool remote part time gig that you’d likely enjoy as you can be selective and pick something that interests you. THAT is the power of FI! Congrats on being SO CLOSE and love the geo-arbitage flexibility piece too.

How can you tell 😉 ? That worst case doesn’t sound bad at all – especially since I won’t be desperate for money ASAP. You’re right – that’s totally the power of FI. Thank you!! So close and yet so far 🙂 .

Coming from someone who was born and raised in a third world country, I really think 500K is a lot of money to retire on, especially for someone with a side gig like you. So don’t get discouraged by naysayers. But if you’re considering geo arbitrage, may I suggest the Philippines where English is widely used? My last haircut there cost me only $2, including the tip. The local beer is like 50 cents. Wish you the best.

Thank you for that added perspective! As for naysayers, I haven’t really found any yet…I’ll keep looking for them 😉 . The Philippines is on my list actually for those very same reasons (COL and widespread English). I’m loving those haircut and beer prices. Thank you for stopping by!

Yes! I’m in full support of the going for it in 10 months and figure it out after. You’ve shown you can adjust as needed, and have plenty of skills and options to make extra money if needed.

I also like the 10 months in advance announcement. I’m still a few years out, but will do something similar for both personal and professional reasons.

Congratulations – I look forward to meeting you in your newly retired form at FinCon next year!

Yay! Glad you’re onboard. As for the announcement, I’m just telling y’all that early 😉 . The job will get 2-4 weeks notice because I don’t trust them lol. I did give my boss 4 months notice before I left NYC though since we were running a 2 person company. Cool you can give your work that much notice though!

Yes – see you at FinCon! And I love the phrase “newly retired form” – like I’m going from a caterpillar to a butterfly or something!

Excited for you doesn’t even cut it my friend!!!!! I am looking forward to celebrating this at FinCon 2020 woot woot! Absolutely loving the contingencies as well as that beautiful decision tree. You got this!

Ahhhhhh thank you lady! I’m excited too – now to make my brain realize 10 months is nothing 😉 . FinCon 2020 will be a celebration indeed!

So excited for you! All your plans coming to fruition. There are only so many contingencies one can plan for – you have a good backup – your faith and confidence in your own abilities will serve you well! Would love to meet in Oz if you’re in the neighbourhood 🙂

Thank you! I’m feeling surprisingly good about it. Which city are you in again? Feel free to DM if it’s a secret 😉 . We’re finalizing our plans in the next few weeks.

That is awesome!

It is amazing how easy it can be to make a bit of extra money on the side while having fun and not being stressed. One way or the other, congrats!!!

It really is surprising – I’ve been avoiding all money making ventures until a few months ago because I thought they would be a lot of work for meager money, but I must admit I was wrong. Thank you!

Enjoy your upcoming travel. We are currently on a travel adventure planned more than a year ago and it is very hard to believe we are really in country executing our plan!

Also, I want to be the first one to say, have a GREAT retirement party in Long Beach! (Don’t pay any attention to those who happen to refer to it as “FinCon 2020” – you and I both know the truth!)

As someone who has been “early retired at 55” for over six years now, I can definitely say owning your own time (rather than a job owning you) is priceless.

I’m glad you decided not to let “Mr. Market” rule your life decisions. To be getting 30 job emails a month is amazing. Looks like there is certainly a plethora of favorable job opportunities out there for you if worse comes to worse. 😉

That’s so exciting – that sounds like a wonderful adventure and culmination of your hard work! And haha – I’ll slap a “Purple’s Retirement Party” sticker on everything that says FinCon just to make sure it’s clear 😉 .

Congratulations on 6 years of retirement! And yeah forget Mr. Market – he’s too fickle for me 🙂 . There do seem to be a lot of opportunities and I think I’ll have major flexibility since I only need to make less than a third of what I currently do to cover my expenses. To options!

I am thoroughly impressed that you are close to 500K at only 30!!(I think you’re only 30, right?).

Well Done!

Yep I’m 30. And thank you!

Congrats Purple! Have you been able to secure seats in the Apartment? Let us know if you need any advance reconnaissance on New Zealand since we are there now!

Thank you! And we’re working on the Apartments – I’m not worried though since we can just pick any day they are available. Ah the freedom of not worrying about being back at work on a certain day!

I’ll definitely let you know – thanks so much. Enjoy New Zealand!!

The 2 things I would suggest is to consider healthcare costs and such because if MR Trump gets reelected things could change for the worse on the healthcare subsidy side of things. Number 2 I would invest more of after tax funds into mid to high dividend paying stocks as to help you on the income side of things if markets crash and you can avoid selling in a down cycle.

Yep – I’ve got a plan for healthcare and assume it will stay the same or get worse. I’m using medical tourism for major expenses I can plan for (like if I discover I have a longterm disease) and overall am planning to leave the US for medical and dental needs while holding emergency coverage to help in the case I have an accident or something of that nature. I’m not planning to be on the exchange. As for high dividend stocks, I’m going to stick with my index fund portfolio with its 2% dividend and avoid selling in a downturn by spending less (through geo-arbitrage) or if necessary making some money.

FinCon 2020 will be a fitting retirement party for ya! That’s so exciting! Nothing but congratulations because as you’ve outlined, you have a pretty solid plan along with ton of contingency plans in place. Yay!

Haha yeah it will be pretty wild! Thank you so much!!

Congrats, lady! 😊

Thank you!

I think you’ll do just fine! So glad to have stumbled upon your post. What is FinCon all about? I live in Switzerland so I’m isolated from all the happenings.

Thank you! FinCon is a financial conference – people who make money from their blogs/podcasts/side hustles go to learn and network. I go to see my nerd friends 🙂 .

What are you doing about health insurance? That is the only thing that keeps me at my job. Good coverage, low cost. I have seen what one medical emergency can do to a person’t future and it scares me to death.

I completely get that. Personally because I am planning to travel globally and domestically I can’t use the regular avenues for health insurance since they are tied to one state (and do nothing internationally) so I’m getting global expat insurance to cover me for emergencies globally and then using medical tourism for any large expenses so I can plan and research what country has the best outcomes and cost. I’m definitely lucky that my nest egg only has to cover myself – if I had someone else like a spouse or a child that my healthcare had to cover I know I would be a lot more cautious.

How are you doing with the pandemic?

Did you end up moving?

Is much of your income wrapped up in the stock market these days?

Some of the market bounced back but it seems irrational, because the economy is hurting.

On the positive side for you, lots of companies are adding positions to permanently WFH, which can be wherever in the world

Hope you’re doing well!

I’m personally fine – healthy and obviously not worried about the financial implications of a job loss. 10 months hasn’t elapsed since that post 🙂 . So no not yet, but our lease is up in July and we’re leaving Seattle in September. None of my income is wrapped up in the market – do you mean like dividends? The economy may be hurting, but the stock market is not reflecting that right now. Another reason I don’t market time. It is indeed awesome to see companies realizing jobs can be done from home. It’s a potential positive for the world down the line. I hope you well too 🙂 .