It’s happened y’all! I’ve worked long enough to earn 40 social security credits and have now been inducted into the club of Americans who will receive some of the money the government has been taking from my paycheck my whole career. WOOHOO!

This is an interesting and weird milestone because part of the general foundations of financial independence, such as the 4% rule of thumb, don’t actually include receiving a dime from social security as part of the plan. So getting any amount of the money I’ve given to the government for social security safekeeping, has never been a part of my calculations.

The 4% rule of thumb (I am including “of thumb” always because it’s definitely not a hard and fast rule) assumes you will live off of only the investments you have while not receiving social security or another dollar throughout your life. We can argue about how much of the current promised benefit will be available to me when I reach traditional retirement age, but it won’t be $0. Even if our government does nothing to combat the projected social security deficit, we would still be able to pay out 79% of projected benefits – that’s far from 0%.

I see receiving social security as a case of “gravy on top.” It will be apparent far before traditional retirement age if my plans to retire at 30 have succeeded or failed, but it’s good to know that if I live that long (yes I know I’m morbid 😉 ) there is an additional pot of gold waiting for me over the horizon.

How Much Will I Receive?

Assuming I receive 79% of the promised benefit and start taking it at the full retirement age of 67, I will receive $906.13/month or $10,873.56/year from social security (this calculation assumes I will never earn another dime after this year). That’s 54% of my projected retirement budget. Not too shabby.

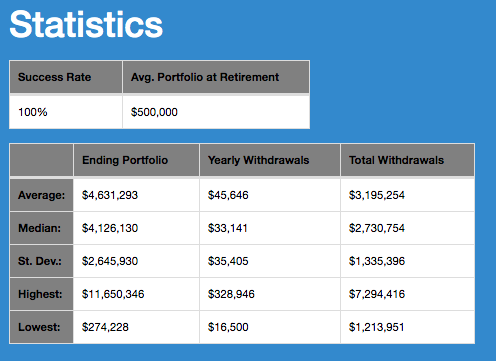

To illustrate how receiving social security would not actually change my early retirement success rate, I’ve pulled some stats from my favorite retirement calculator, cFIRESim. My parameters are:

- 70 year retirement

- $500,000 portfolio

- 0.04% expense ratio (the ER for my holding VTSAX)

- 100% stocks

- $20,000 annual variable spending that includes:

- A spending floor of $16,500 (Which is easily done without changing my standard of living through geo-arbitrage to countries I already love, such as Thailand or Costa Rica)

- No spending ceiling (AKA I can make it rain in up market years if I want to without a limit)

Here’s my success rate and ending portfolio amount if I don’t receive a dime of social security:

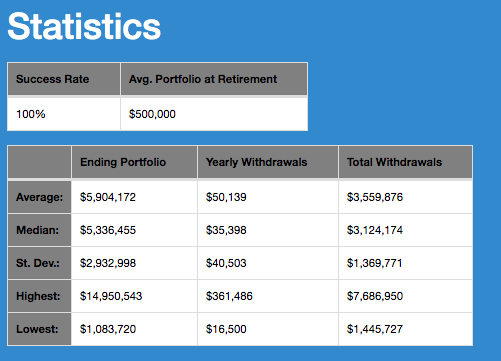

And here is my success rate with the above amount of social security:

I still have a 100% success rate based on the last 150 years of investment data with or without social security because it kicks in 30+ years after I retire. The years that would spell failure for my retirement are the first 5-10 years and after that, a windfall won’t make or break me. I would die with a larger portfolio, which is cool, but obviously I’m not around to enjoy it. So if that happens, the charities I’m leaving my dollars to can hopefully help more people, but that’s about it.

How Much Have I Made?

In the interest of full transparency, below is every dime I’ve ever made as documented by the social security administration that has allowed them to reach this projected social security amount. These numbers struck me because while my annual salary was higher than what is shown, I somehow keep forgetting that I often didn’t work the full year. I took a month or more of funemployment between each job.

My annual salary doesn’t accurately reflect what I took home. Seeing these numbers actually makes me more impressed with how much I’ve saved and how far I’ve come since starting this journey five years ago.

|

Work Year

|

Taxed Social Security Earnings

|

Taxed Medicare Earnings

|

|---|---|---|

| 2019 | Not yet recorded | Not yet recorded |

| 2018 | $104,616 | $104,616 |

| 2017 | $100,908 | $100,908 |

| 2016 | $53,100 | $53,100 |

| 2015 | $64,669 | $64,669 |

| 2014 | $62,535 | $62,535 |

| 2013 | $47,389 | $47,389 |

| 2012 | $36,750 | $36,750 |

| 2011 | $18,952 | $18,952 |

| 2010 | $0 | $0 |

| 2009 | $0 | $0 |

| 2008 | $2,880 | $2,880 |

| 2007 | $0 | $0 |

| 2006 | $0 | $0 |

| 2005 | $408 | $408 |

And that’s it! Every dime I’ve ever made from a high school receptionist to a theater intern to trying to make it on my own in Manhattan and now Seattle. Adding in what I made in 2019 ($110,034) I’ve raked in $602,241 throughout my career and despite paying more in annual federal taxes than I spend on myself, I’m approaching a $500,000 net worth. Goodness I love compound interest 🙂 .

Have you qualified for social security? Are you including receiving it in your financial projections?

UPDATE: Thanks to the below comments I’ve learned about the assumptions the SSA website makes when showing your expected benefit and changed the above amounts and stat screenshots based on what a different calculator (that allows you to customize future earnings) has shown. Thank you for helping me learn and grow y’all!

Just wanted to add that the SS administration’s calculation assumes that you will continue to work at the same salary until you retire, so your actual benefit 40 years hence may be lower. But just as welcome, I’m sure!

Interesting – I also did the calculations myself with only the years I will be working (and not assuming I have the same salary after this year) and I got a similar result.

Check out my post on how Early Retirement impacts Social Security Benefits.

https://retireby40.org/early-retirement-impact-social-security-benefit/

There is a link to a really good calculator. Check it out.

If the amount is similar, it’s definitely wrong. 🙂

Your earning will be smaller over the next 30 years. Those will drag down the average significantly. Let me know if you need help with the calculator. It’s pretty easy to use.

Ooh this calculator is much easier – thank you! I’m going to update the numbers above based on this and will read your post over my lunch break.

SS does have a calculator on their website which allows you to set future earnings to any amount you choose, including zero. I just did this.

I saw one that lets you change those variables, but only provides what your benefit would be at 62 (instead of full retirement age) – link below. Did you find a different one? https://www.ssa.gov/OACT/quickcalc/

I haven’t checked in a long time but I’m pretty sure that I must have done my 40 quarters by now since I’ve been working for 20 years nonstop now!

One of these days I will get around to playing with those numbers but they’re far less important in our plan since there may still be a lot of years between whenever we retire and SS-drawing age. *fingers crossed that that is true!*

Haha yeah I’m sure you have! I’m with you on ‘one day’ – I just did some quick calculations here, but didn’t go too deep into it since I don’t need or count on this money anyway. My fingers are crossed for you!

The amount of SS check you receive, once you file, will be decreased by the amount of your Medicare premium payments that are taken out automatically. For me (and also same for my wife) that amounts to $144 per month. So, the projected SS check for $2772 is actually reduced to $2628 per month. Same thing happens to my wife’s SS check. Instead of receiving $1307 (she is currently collecting spousal SS), her check is reduced to just $1163 per month. Just saying…. 8^)

And then there’s the (recommended) Medigap policy that covers the Medicare Part A deductible and the portion in excess of what Medicare does cover. That premium is not auto withdrawn from your SS check, so quarterly we send the Medigap folks (in my case Mutual of Omaha) an additional $314.88 per person per quarter. Got to figure that in too. 8^)

JC

Good to know – thanks. I guess it’s a good thing I don’t need this money then 😉

As someone who contributed the max amount possible to Social Security for each of the 35 years I worked my benefit and my wife’s will be a total of nearly $70,000 a year in 2020 dollars. We will not be collecting that for another 5 years but that is a pretty significant income on its own.

Damn! That’s a big chunk of change!

I think I’m just about qualified for social security. Although I’m sure it’ll be there by the time I get there, I don’t usually consider it in part of my calculations.

I feel like the more I save, the further I feel from financial independence because of lifestyle inflation. Do you have any ideas on resources for simple living and fighting off lifestyle inflation?

Yay – congrats on almost being there and glad you’re not counting it in your calculations (though it will most likely be there). Where is your lifestyle increasing? Are those increases bringing you joy? I don’t really have resources for those things because I wouldn’t really say I do either – the life I love just happens to be cheap and I am lucky in that way.

I am planning $0 in Social Security for the both of us as it is definitely the most conservative way of making sure our financial numbers work. However, I have been meaning to run what the numbers could be for us just for fun. So all of the links to SS calculators will be helpful whenever I find the time to crunch some more number!

Yep – I love that approach especially since it’s money that for me is about 40 years away and I know a lot can change in that time 🙂 . Running the numbers for fun sounds like a blast! I did just that a few years ago on a vacation. My Mom called me a nerd 😉 .