When I first heard of tax-advantaged investment accounts, they sounded too good to be true. My thoughts included, “What do you mean I can put money into a Traditional IRA without paying taxes on it first?” and, “What do you mean I can take money out of a Roth IRA without paying taxes on the backend?” This class of investments sounded like some kind of dark magic.

But then I heard of an HSA (Health Savings Account) and discovered it’s the rainbow unicorn of tax-advantaged accounts because HSAs are triple tax advantaged. That means you don’t pay taxes when you put money into it, you don’t pay taxes when you invest it and you don’t pay taxes when you take money out. Sweet!

I first heard of this triple tax-advantaged aspect of HSAs from this article by the Mad FIentist and I immediately wanted to get my hands on one.

WHAT IS AN HSA?

An HSA is basically a savings account for health expenses. It can only be used for health-related expenses and it has contribution limits that are set by the IRS. In 2020, the limit for the amount you could contribute to an HSA in that year was $3,550 for an individual and $7,100 for families.

Your contributions are 100% tax deductible up to these limits. Also HSAs are owned by individuals (instead of your employer) and are similar to 401Ks and IRAs in that they can be transferred to other financial institutions regardless of where you originally open one.

Here’s the exciting part though: Unlike an FSA (Flexible Spending Account) that might be offered by your employer, you don’t have to use an HSA within a certain timeframe. In addition, you can invest the money within it and use it to cover healthcare expenses at any time – even years after the procedure occurred, as long as you keep the receipt 🙂 .

Because of all these features – if you don’t need the money in your HSA to cover immediate healthcare expenses, an HSA can just serve as an additional and completely tax-advantaged investment account that helps you rocket towards your financial goals.

WHY USE AN HSA?

HSAs are awesome because they provide:

- Triple tax-advantages: Back up taxman because this is all legal and you never get a cut of my HSA money!

- Delayed distributions: There is no time limit to when you have to spend your HSA – just keep your receipts and at any time you can withdraw that amount, even years later. Personally, I just take pictures of my receipts and save them to my Google Drive for safe keeping

- Investment capabilities: While you wait for the opportune moment to withdraw from your HSA (or if you’re like me and not planning to spend that money on health expenses and are keeping it as an additional investment account), you can invest that money and watch it grow

HOW TO GET AN HSA

So this is where there’s a slight fly in the ointment. To qualify for an HSA you:

- Must be enrolled in a (HDHP) High-Deductible Health Plan

- Must be under the age of 65

- Can’t have other supplemental health insurance coverage

- Can’t be claimed as a dependent on someone else’s tax return

- Can’t be enrolled in Medicare (Part A, Part B) or Medicaid

Tackling the first requirement: You have to have a HDHP (High-Deductible Health Plan) to qualify for HSA. Most employees in the US have health insurance through their employer, so if your employer doesn’t offer an HDHP, you’re out of luck for now unless you change employers, they change their plan offerings, or you get a HDHP without them.

I wasn’t able to get a HDHP for 2 years after I learned about it because my employer didn’t offer a high-deductible plan. Then I changed jobs after moving across the country from NYC to Seattle and I was able to open my first one. I was super pumped! Now to clarify, it’s the contributions that can’t happen if you don’t have a HDHP. You can keep your HSA open and invested no matter what your healthcare situation is. So if you’re looking to rollover an existing HSA or open a new one, the next step is to choose a provider.

WHY I CHOSE LIVELY

I kept my HSA with my old provider for years because every time I looked into rolling it over to another company, it seemed like too much of a hassle. However, the constant monthly fees they were grabbing from me made me wince every time I saw those deductions in my account.

My previous provider was Payflex and in addition to those monthly fees, they also had minimum cash balance requirements. So $1,000 of my $3,550 HSA couldn’t be invested and had to stay in cash at all times. Obviously that’s a significant percentage of the money I wanted to invest, so that wasn’t ideal. I also had several customer services issues with my previous provider and found their overall set up to be clunky and not very transparent.

Enter Lively. I put out the call on social media and saw others were doing the same. We wanted to crowdsource the best HSA provider based on people’s actual experiences – and Lively kept popping up.

Lovin' Lively. No fees. TD Ameritrade (who they partner with) has no fees on ETFs as well.

— Andy Hill (@AndyHillMKM) January 17, 2020

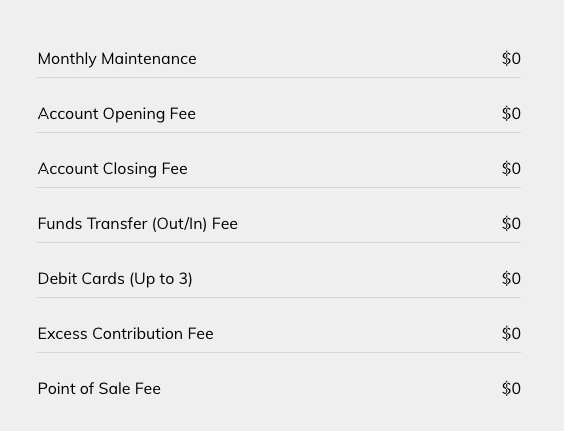

After I kept seeing recommendations for Lively from people I trust within the personal finance community, I decided to do some digging myself – and I really liked what I found 🙂 . It turns out that Lively has no fees, a modern infrastructure and is known for excellent customer service (which I later confirmed is accurate 🙂 ). Here’s an example of the fees many HSA providers have that Lively does not:

This company was highly recommended to me by several of my finance friends. As a result, I switched over to Lively at the beginning of 2020 and it was a seamless process with outstanding customer service. If you have an existing HSA or qualify to contribute to a new one, I cannot recommend Lively enough. I love working with them.

HOW TO SIGN UP FOR A LIVELY HSA

Opening an account is straightforward. Here are the steps I took:

- Open a Lively account and fill in your basic information

- If you have a current HSA, they’ll ask if you want to roll it over

- Your account will then be finalized in 1-2 business days (unless there’s a delay on the previous provider or bank’s end)

- Login and start investing!

One thing I loved about this process is how Lively held my hand every step of the way (yes, I’m clingy like that 😉 – especially when it comes to my money). They send secure messages when every step of your sign up and transfer is complete so it doesn’t just feel like you’re floating in ether, like I did with other companies in the past. With their gentle guidance and a few annoying delays from Payflex that made me even happier I was leaving them, I was up and running in no time 🙂 .

However, please note that the above experience involves me rolling an existing HSA from a different provider over to Lively. My cousin’s husband recently opened a Lively account (at my recommendation) and was instead trying to deposit money directly from Chase Bank and it took longer than the 1-2 business days mentioned above.

He contacted Lively about the delay and they told him it was a delay on the bank’s end, but I just wanted to give that heads up in case you’re looking to invest directly from a cash account instead of through an HSA rollover and your timeline is a little longer as a result. Fortunately, he was able to get everything resolved and is happy with Lively’s service.

HOW TO INVEST YOUR LIVELY HSA

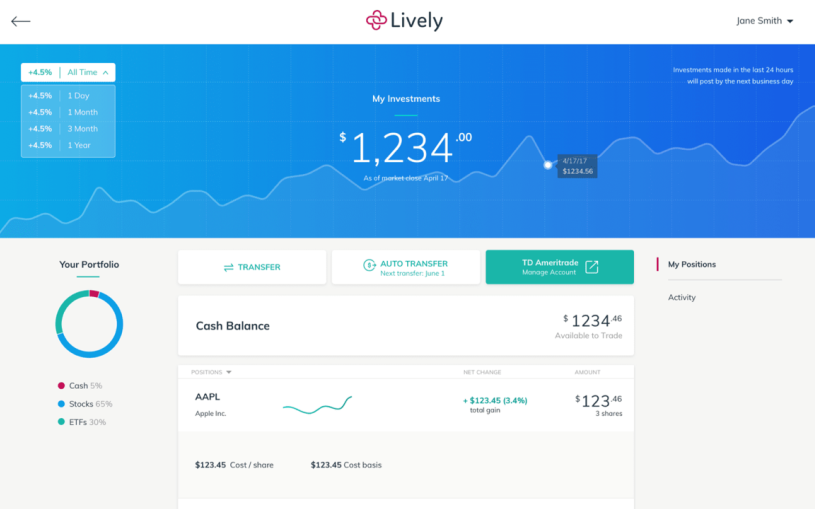

Lively has 2 ways to invest your HSA:

- Through a financial advisor, which is an “HSA Guided Portfolio” through a company called Devenir

- DIY or as they call it a “Self-Directed Brokerage Account” through TD Ameritrade

As a DIY investor myself who does not trust financial advisors that aren’t hourly because they have a conflict of interest (and if they’re not a fiduciary are not legally obligated to put your interests first), I obviously chose the DIY “Self-Directed Brokerage Account” option.

Here are the details on the Self-Directed Brokerage Account option. It includes:

- No minimum investment requirement

- $0 commissions for online trading of most US stocks

- Access to a variety of investment options, such as stocks, bonds, CDs, over 550 commission-free ETFs and more than 13,000 mutual funds

However, please note that these investments are through TD Ameritrade so you will be directed to open an account with them and make any investments through their website. Also note that because I’m fancy like that, I only wanted to invest in my beloved VTSAX (Vanguard Total Stock Market Index Fund) even though there are many similar options with TD.

To do so, I had to pay a $25 fee per transaction (worth it 😉 ) and like the silly goose I am, I didn’t realize that I should factor that in when I was saying how much I wanted to invest. I said “all money” instead of “all money – $25” so the transaction on the TD website came back as rejected. I reached out to Lively and TD and they clarified what I was doing wrong so I could invest in my bougie index fund without issue 🙂 . Since that mishap of my own making, it’s been smooth sailing.

CONCLUSION

There are many things I value in a company, but my top three are: (1) Customer Service, (2) Price and (3) Ease Of Use. In that order. I had heard wonderful things about Lively’s customer service, but I don’t believe anything until I see it 🙂 . However, I’m happy to report that all the good things I heard about them have proven to be true over the last year.

They are responsive, clear and available when I need them. In addition, their website is very user-friendly and easy to use and as I mentioned before, their prices can’t be beat (you can’t pay less than $0 😉 ).

So that concludes my HSA saga! I’ve finally found a company that I am happy with after a year of using their service. I hope this Lively review can help answer some questions you have if you’re looking for a no fee HSA option with awesome customer service.

Do you have an HSA? If so, what providers have you used and what was your experience with them?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

I’ve been meaning to do this since July ….thanks for the reminder! Not sure if your link gives you any kickback but you got one person to sign up…this is after searching Nerdwallet and others for best HSA. Lively was the champ for that. Thanks again!

Woohoo – happy to help! It took me a while to gather the energy to switch as well 😉 . And yeah this one in an affiliate link – they give $10 per sign up if they approve it though I think they’re giving $20 for the holidays so thank you! When I buy some thai takeout with it after the payout in like 4 months I’ll toast you and your new HSA! Also that’s awesome to hear Lively ranks highly on those websites – I think it’s the recommendation for Morningstar as well so it’s not just me that loves them 🙂 .

With your current health insurance, are you able to contribute to an HSA? I’ve often wondered how an HSA can be paired with health insurance after leaving work.

My current plan is an HDHP so I should be able to. I’m not planning on it, but cool to have the option!

A quick note – Unless your spouse is the beneficiary of your HSA, it is fully taxable as a lump-sum distribution to your heir(s). This may encourage you to actually withdraw from your HSA for medical expenses as they arise.

Good to know – I’m not getting married or having children and am planning to cash out the HSA with the medical receipts I’m hoarding before my death to make it nice and easy to distribute any money I have left.

I love my HSA. I’ve been maxing it out since I was 22 so I’ve saved a good chunk since that time. I put everything into the total stock market index fund too. Do you have any tips on how to keep track of the receipts? I admit I’ve been kind of bad about that!

That’s awesome! For receipts I just automatically save them to my Google Drive if they’re digital and take a picture and upload it if it’s printed. I hope you can wrangle those up!

Ooh we have the opportunity to try an HSA for the first time this year. While I hate change, I do love the chance to try out a new tax advantaged investment account. I was wondering where we’d take our account if I decided that it was a terrible decision though so I appreciate the review!

That’s exciting! And haha – yeah I’m not good with change myself 🙂 . Glad you appreciated it!

So if Lively isn’t charging any fees, how do they make money on these accounts???

No idea 🙂 . I imagine it’s similar to how banks that don’t charge fees (like Ally) make money. If you find out specifics feel free to share.

I suppose Lively seems like a great deal in comparison to the high fees and requirements on the former employer’s HSA. But paying $25 *per transaction* to invest her funds in VTSAX is ridiculous.

I opened my HSA with Fidelity, because Vanguard doesn’t offer them. No fees to open, no minimums, no monthly fees, nothing. My HSA is invested in FZROX, which is the functional equivalent of VTSAX, but with 0% in fees. (VTSAX fees are a minuscule 0.04%). Fidelity isn’t making a penny from me, but I guess it’s a loss leader for them.

If you’re going to stick with Lively, I hope you’re making just one transaction per year of the annual max to minimize that per transaction fee.

Hi, Purple. Thought it would be helpful to update details on this one. With Lively’s move from partnering with TD Ameritrade to Charles Schwab, it has changed the fee structure. To keep a $0 fee to transfer funds to the brokerage account, you must either maintain a balance of $3,000 in your Lively account or pay $24/year. My partner has a low balance, so we are starting to shop around to see what other options there may be. Will check out Fidelity per @Tobi’s comment.

Thanks so much for bringing this new fee to my attention! I have more than that in my account so I haven’t experienced that fee before. Let me know what you think about Fidelity! If things keep changing over here I might need to move as well 🙂 .

Additional info for those who have legacy Lively HSA accounts. I reached out to Lively to ask whether (and when) nI would be charged a fee as I have less than $3,000 cash in my Lively HSA (FYI, my balance is sitting at less than $1), and all of my funds were in my HSA investment account. They were quick to reply (kudos to customer service) and explained that if my account remains in its current status, I will not be charged a fee. However, any *new* HSA contributions in 2024 would not be able to be transferred to the investment account unless I either maintained a $3,000 balance in Lively or paid $24/year.

Thank you for sharing! I’m glad their customer service responded quickly. That’s an interesting and important clarification.

I just wanted to offer a different opinion experience than what it appears most are saying. I like many others searched the web and Lively seemed to be a great option. I chose to proceed with setting up my HSA account with them and it has been a complete disaster! After completing all the steps and connecting them to my bank account, nothing happened! After reaching out to them they said I needed to provide other forms of identity to finalize the set up. After weeks of zero communication I emailed them again and was told their security team decided I couldn’t have an account and they couldn’t provide any further information! Yes, it was that simple, not more elegant or reasonable, very simple and ridiculous and sounded like it came from a high school student. After calling and speaking to a representative and a manager, it still remained the same. Their secret security team that no one in the company has access to is the final word and are unreachable! Completely unreasonable and unprofessional in every aspect! I wish I had never attempted to set up an account through Lively.

Oh no! I’m so sorry you had that experience.