First, I just want to express how surprised and delighted I am to see that I spent $20,415 in 2021. While I did estimate that I would spend $20,000 the first few years of retirement, (after living on $18K on Seattle) and built in no spending ceiling into my plan so I can spend more than $20K down the line, all of this was based on the assumption that I would be spending about half of the year outside the US. Obviously with ‘Rona that was not the case.

We spent 2021 traveling around the United States and I wasn’t sure what to expect of my overall expenses as a result. I’ve been told that the US is an expensive place and that traveling is an expensive activity. I hear about Airbnb and flight prices rising and yet…here we are basically right on budget, despite the fact that I wasn’t checking my budget before making purchasing decisions.

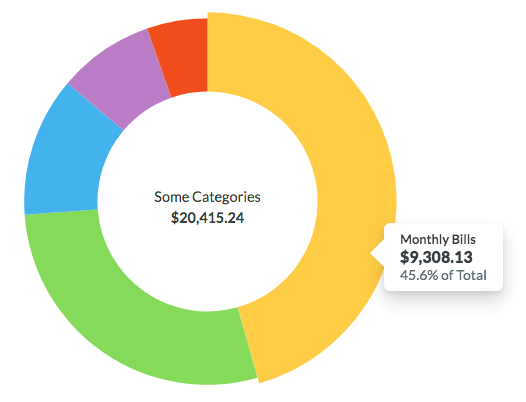

So let’s see how much I spent and get into it! Here’s every dollar I spent in 2021:

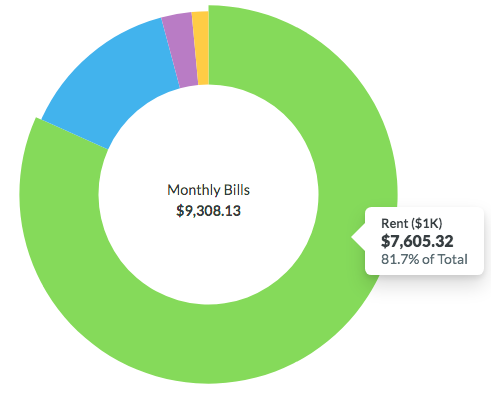

MONTHLY BILLS

45.6% Budget: $9,308.13 or $775.68/month

- Rent & Utilities: $7,605.32 or $633.77/month – This includes all our monthly living expenses, which for most of this year was Airbnb payments, which include utilities. The Airbnbs we choose are one bedrooms with a washer/dryer that’s walkable and ideally has outdoor space

- Phone*: $250.39 or $20.87/month – This is for my new Google Fi service that works globally. I switched from Republic Wireless last year and wrote about why here. Also heads up, I received $120 total in credits for y’all signing up to Google Fi and getting $20 off yourselves. Hence the asterisk*. Google’s terms top this out at max $200 received in credits and then that link will still provide y’all with the $20 off, but no credits for me so don’t worry – my bill will not be deflated forever 😉 . This is a simple referral link every Google Fi customer has so if your friends want to sign up, feel free to share your link for the same perk. Anyway, feel free to mentally add $120 to my 2021 spending to account for this if you’d like. Overall I budget $30-40/month for my phone.

- Transit: $137.25 or $11.44/month – I might eliminate this category. It used to hold all the bus tickets and Ubers I would take within a city, but since the pandemic started, I’ve just walked. The only Ubers I’ve taken have been to/from airports and train stations, which I put in my “Travel” category below along with the actual plane and train tickets. This had a lot more going on when I was working and had a monthly transit pass, but since it’s so empty, I think this is the last we’ll see of it and I’ll just put everything under “Travel.” Being a nomad has really changed these budget categories around and I’m still adapting it seems 🙂

- 2022: $1,315.17 – This is a category to hold rent and airplane costs for 2022. I wanted to keep them separate so I could understand how the life I was living vs. the next spending year looked

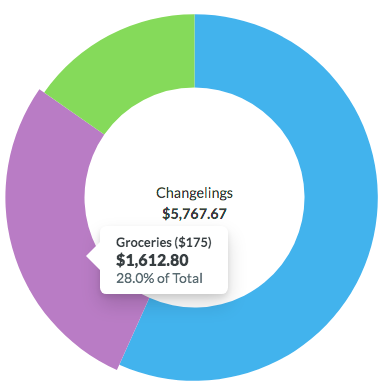

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month.

28.3% Budget: $5,767.67 or $480.64/month

- Groceries: $1,612.80 or $134.40/month – My grocery costs increased this year from the $125/month I usually spent in Seattle. This is not surprising to me since grocery costs have been increasing and because with the monthly moving we do that we’re not as efficient with our groceries as we used to be. However, that luckily hasn’t translated to more waste as I feared. If we have food left when leaving a location we give it away to others or have found food pantries that will take our food and use it for good – win/win 🙂 .

- Eating Out: $3,271.97 or $272.66/month – This amount of spending makes sense to me given that I’ve intentionally increased the amount I dine out to try the local cuisines in all the new places we’re living in! I suspected this cost would increase in retirement and I couldn’t be happier about it 🙂 .

- Alcohol: $882.90 or $73.58/month – Not bad at all – I thought this would be higher since I’m buying flights at breweries to try local brews instead of doing the more cost effective thing of buying some tipples at the grocery store, but this isn’t bad at all 🙂 .

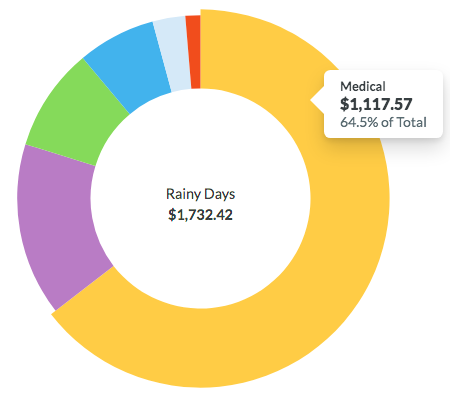

RAINY DAYS

This section is named based on a principle in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

8.5% Budget: $1,732.42 or $144.37/month

- Household Goods: $22.98 or $1.92/month – As always, this is the best part of the budget that covers things like toilet paper, sponges and items that keep a household running. Most of this stuff is already stocked in the Airbnbs we stay in so this number has plummeted from last year when I wasn’t a nomad.

- Personal Products: $264.67 or $22.06/month – This is other fun stuff like toothpaste, fluoride rinse, hair ties and hair stuff. It’s wild over here! About $100 of this was one purchase to make my hair purple for the holidays 🙂 .

- Clothing: $119.36 or $9.95/month – I finally broke my accidental multi-year clothing ban. Oh well 🙂 .

- Entertainment: $157.84 or $13.15/month – This includes our monthly Netflix subscription that we let a million people use for free, my fancy Spotify Premium subscription and movie theater tickets now that we’re finally doing that again!

- Medical: $1,117.57 or $93.13/month – This is my 6 months of health insurance coverage from World Nomads along with some doctor’s visits and medication. I talk about my retirement health insurance plan here if you’re curious.

- Grass: $50 or $4.17/month – Weed is legal in several of the states we lived in this year and as of the 2020 elections 1/3 of the US population live in places with legal weed so wooohooooo!

The purple hair is coming back y'all 💜! Also I spent so much money at @SallyBeauty that they gave me a "Mom Fuel" wine glass😬 and wedding ring wine stopper…none of this applies to me, but I like free stuff so🤷🏾♀️🤣. pic.twitter.com/D4ZtoGIOdX

— A Purple Life (@APurpleLifeBlog) December 3, 2021

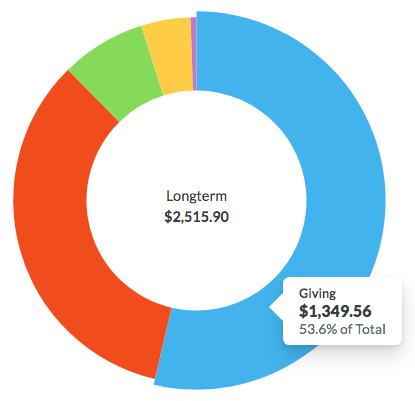

LONGTERM

12.3% Budget: $2,515.90 or $209.66/month

- Giving: $1,349.56 or $112.46/month – It’s a great year to give 🙂 . I need to keep it up.

- Subscriptions: $188.36 or $15.70/month – This includes my annual fee for the amazing Chase Sapphire Preferred Card that saves my ass on a regular basis , Patreon subscriptions, annual 1Password subscription so my shit is secure and the annual fee for my budget software YNAB

- Blog: $855.40 or $71.28/month – This includes related expenses I’m filing so I can keep track of them, such as blog hosting

- Mail: $109.59 or $9.13/month – This includes my annual Traveling Mailbox subscription so I can get my mail wherever I go and any additional costs to forward specific pieces of mail

- Electronics: $12.99 or $1.08/month – This is an awesome and well-priced phone case

After many years of knowing I should get a password manager and avoiding it, I finally signed up. I know what you're thinking🤣: pic.twitter.com/4bGiPSWA2Y

— A Purple Life (@APurpleLifeBlog) September 4, 2021

VACATION

5.3% Budget

- Travel: $1,091.12 or $90.93/month – I should probably re-name this in my budget since every day is a vacation 😉 . This includes all the planes, trains and automobiles we took around the US this year! Booking in advance seemed to play a large part in this being low, along with the fact that we can travel whenever tickets are cheaper instead of trying to fit everything into the (more expensive) weekends.

I've finished booking my flights for this year and realized…I'm flying less times annually than I did in my working years. Slow travel nomad life is wild man✈️🤷🏾♀️. pic.twitter.com/NcSQcQVabC

— A Purple Life (@APurpleLifeBlog) June 11, 2021

Days Per Type Of Lodging

When I was working, it was common to travel and visit my friends and family, but I would still be paying rent back home. However, now that we’re nomads without a home base, that’s not the case. So being a nomad unintentionally saves money in those times, despite our best efforts to pay for dinners out, groceries and even at times appliances for the people we stay with.

It usually still didn’t add up to what we would spend on rent so I thought it would be helpful to break down how many days we spent in different types of living situations this year, including visiting others and staying in my cheapest living situation to date, a tiny house in rural Georgia.

Airbnb

Number of Days: 207

Rent & Utilities Average: $940.30/month

This is the number of days we stayed in Airbnbs in 2021 and the average monthly price. At times we intentionally spent over our $2,000/month target and at times we booked cheaper places – and it looks like it evened out! Not bad – I feel like we’re experts 🙂 . If you’re curious, our criteria for a monthly Airbnb is:

- Our own space (aka no shared houses)

- 1 bedroom

- $2,000/month

- Full kitchen with microwave (and previously a dishwasher, but we’ve changed our mind about that necessity)

- Washer/dryer

- Walkable to city center and grocery store

- AC/heat

- Fast Wifi

- Ideally a free standing house with outdoor space

Georgia Tiny House

Number of Days: 64

Rent & Utilities Average: $192.33/month

We paid rent and utilities while staying in this tiny house. We also liked to often pay for takeout and even at times appliances for my partner’s family who were letting us stay on their land. Still, it was a cheap way to live for 64 days in 2021.

Staying with Friends/Family

Number of Days: 81

Rent & Utilities Average: $0*

As I mentioned, when we stay with friends and family, we like to buy takeout, groceries and sometimes (I’m seeing a pattern) appliances to help pay them back for being in their space. I put that stuff in their respective categories in my budget (eating out, groceries and giving) so they won’t show up in rent*. My partner and I have been debating if they should be (he puts them in rent), but I don’t really see it that way so they’re in separate categories. In my mind, separating it out helps me see how much we’re actually spending on Airbnb rent.

House Sitting

Number of Days: 13

Rent & Utilities Average: $0**

We housesat my partner’s parents house for about 2 weeks. In that time, I had to tend to their garden every day and it was not a small one 🙂 . I was surprised at how much time that took (and I didn’t even have to weed it)! Between that and them having a thriving garden when they returned (instead of a dead one which they usually see every summer if they leave) I think we’re even** 😉 .

2022 Housing Plan

The above breakdown of where we spent our time seems about right given that our goal in 2021 was to finally see loved ones after quarantine. We also underestimated the number of people that have extra room and asked us to just stay with them since we’re specifically coming to the area to visit them.

Staying in their space also allowed us to hang out a lot more casually and more often than if we were in an Airbnb down the street. I guess what I’m saying is #MoochFI for the win 😉 …just kidding. Next year we are planning to focus more on international locations (if it’s safe to do so) instead of being near loved ones, so I expect the numbers above that aren’t Airbnbs to plummet and my costs to increase overall 😉 . We shall see!

Me: We have to choose an Airbnb for our second month in Mexico🇲🇽. My fancy Mom requested a $3,000/month 2 bdr villa for the first month🏖️, but I assume you want to get back on budget for the second month?

Partner: Meh – let's just stay in the villa another month.

Me: DAMN – ok🤯! pic.twitter.com/1DcrBvENnD— A Purple Life (@APurpleLifeBlog) November 18, 2021

Conclusion

So there you have it, every dollar I spent this year! I aimed to spend around $20,000 (aka my retirement budget) and ended up spending $20,415.24! Without that emergency last minute Airbnb I had to find because of our COVID scare I would have almost hit $20K on the dot 😉 . 2022 currently includes a month living it up in Thailand, a month in Argentina and four months in Mexico (Merida and Puerto Vallarta specifically) and it should be interesting to see what that does to my budget. Let’s see what happens!

How was your 2021 spending? Did you reach your goals?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

I wonder how much costlier it would be if say someone single lived your exact little … Thanks for detailing everything out of course. I guess the air bnb would not be split so maybe a 30-35k lifestyle?

I’ll let y’all know if I become single in the future 🙂 . Overall I wouldn’t be choosing the same large places if it was just me, but doubling the rent cost to be safe is a fair estimate.

Just to be sure I’m reading these numbers correctly – those AirBnB costs are your half share of the one bedroom places, correct?

A solo traveler would obviously pay the full cost.

That’s correct.

Excluding a large home renovation project we did (which was not budgeted and which I consider capital improvement/investment) we’re going to come in about 4-5% below budget in our spending, which I am pleased with. Still finalizing our 2022 numbers but we think they should be similar to 2021. We are planning more travel, so if our expenses go up, I will blame it most on travel.

Did you already apply or get your Thailand entry permit? Saw they stopped applications recently.

In terms of lodging cost, do you think they would be much different if you were traveling alone? As in, would you be able to get your own place for half of what you and your partner spend combined? Or would you have to spend a little more since you couldn’t split the cost?

That’s cool! We haven’t with Thailand – we’re waiting to see about their decision in a few days. As for lodging, I would pick different places if it was just me so I think the cost would be similar, but I obviously can’t say for sure since that’s not my current lifestyle.

$940/mo in rent makes me drool lol. Complete pipe dream for me living in NYC until I relocate haha.

Was curious though, how do you keep your grocery costs so low? Maybe I just eat too much but purchasing food for 2, we spend maybe $500/mo in groceries.

This post is quite inspiring as usual — if I can have roughly $20K-$30K of expenses/yr I feel like I’m a lot closer to retirement than I had originally thought; and your numbers here really helps make the numbers concrete and grounded in reality.

Haha yeah I never could have imagined it either until I left NYC. As for groceries, they’re that low this year because I mostly dined out 🙂 . Usually I keep them low by buying in bulk for example, but that’s really possible as a nomad. I wrote a whole post about how I used to do it though – just search “Groceries” on the site and it should pop up.

And I’m so glad you enjoyed the post!

Hi,

In which category do you put books?

You are reading a lot so I guess the books represent a certain amount. Or are you renting all from libraries?

This year they were all library ebooks. I didn’t buy physical books since I can’t bring them on my nomad lifestyle.

Great summary. Thank you for sharing a realistic picture.

For my own analysis: So if you were doing airbnb only at $940×2 = $1,880 for a 1 bedroom place including utilities, that is on par with a typical rental in a major city that is not NYC, SF etc. Same with food $134+$272=$406 per person it sounds typical for a major city. (Interestingly enough these are very close to my own numbers)

Thank you! I’m glad it was helpful. And yeah if I were getting the exact same Airbnbs though I likely wouldn’t do that. I prefer smaller spaces when I’m traveling alone. I would also travel more internationally to cut costs (which I can’t do much of while my partner works in US time zones). Cool to hear these are close to your own numbers!

This is excellent! “Mom Fuel” – LOL.

I’d love to try what you are doing for a while, but it isn’t compatible with our lives right now. Maybe over a summer or something.

Haha I’m glad you enjoyed it. A summer of travel sounds lovely 🙂 .

A great example of why it’s good to remain flexible! Congrats on sticking to your budget without even trying 🙂

Exactly 😉 . And thank you!

When I first started reading your blog, I was amazed at your budget but then when I realized that it’s just a few grand less than what my wife and I spend typically in a year if you were to divide by two. If you were single, do you think you would be able to keep your budget that low? Does your partner spend typically about the same as you do? Do you even know? and I supposed you don’t even need to answer that if you (or he) doesn’t want to.

Cool. I suspect I could keep my costs at a similar level, but can’t confirm since I haven’t done it and don’t have hard numbers. My partner spends a similar amount.

Thanks for the inspiring post. I’m retired too with a decent size travel budget factored in but I could spend way less if we vacation a month a time and stay in an Airbnb. I was focused on shorter trips with expensive stays in hotels. I love the idea of a month in Merida with plenty of time to explore and chill. 😍

Thank you for reading it 🙂 . And that’s awesome either way – to each their own. Also extra cushion can be helpful. I’ll definitely keep y’all posted on our months in Merida if you’re interested!