After I decided that I wanted to pursue financial independence in 2015, I had a laundry list of things I needed to research and learn before retirement. However, luckily I had 10 years to figure it out 🙂 . Even though that 10 year timeline became 5 when I retired in 2020, it turned out to be plenty of time to figure out all the minutiae of HOW I would actually take this leap.

One of those tasks involved figuring out how I would access my money in retirement. I knew that I would have about half of my investments in a taxable account, which I could access at any time, but what about when that runs out? How do I access the rest of my money that’s in retirement accounts before age 59.5?

What Is A Roth IRA Conversion Ladder?

A Roth IRA Conversion Ladder is when you move money from a Traditional IRA into a Roth IRA. If you do so in small amounts and wait 5 years to touch it you can do this conversion without paying additional taxes or any penalties. This also has another benefit of slowly moving money out of a Traditional IRA, which is subject to RMDs (required minimum distributions) in your 70s. I’d like to avoid being required to take out huge sums of money that I don’t need if possible 🙂 .

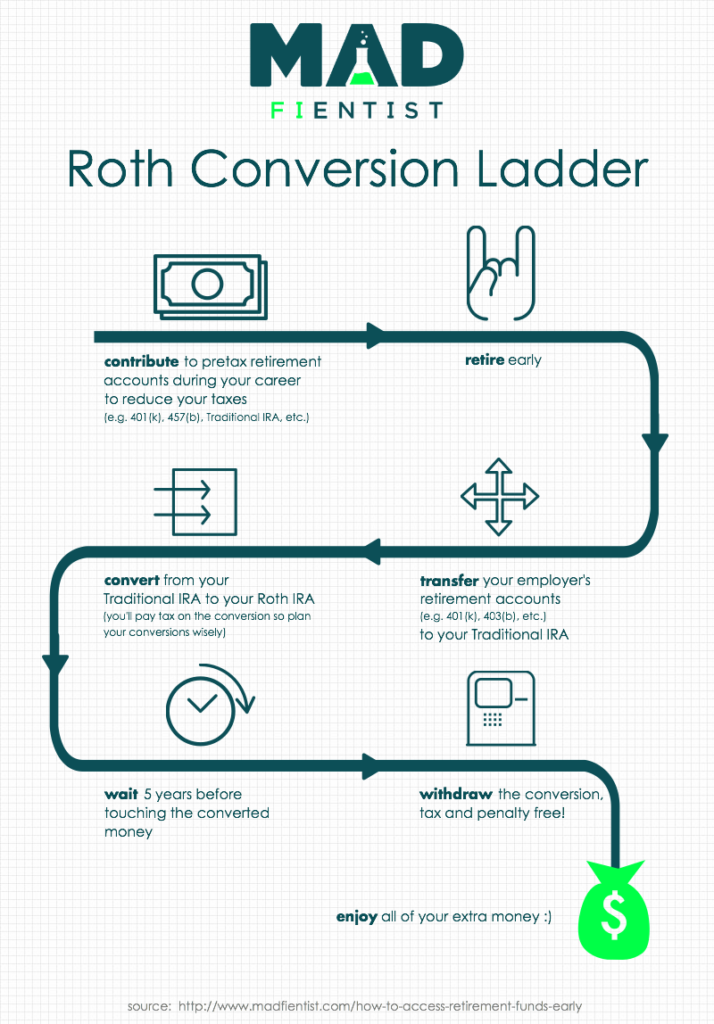

Now I cannot take credit for this idea. I learned about it from this awesome post from the Mad FIentist. He even created a sweet infographic to explain it:

So when I left my job, I followed these steps. I rolled my 401K into my Traditional IRA at Vanguard, and then prepared to move a small portion of that into a Roth IRA each year, wait 5 years to access that converted money and then enjoy it penalty free 🙂 .

However, before we release the balloons, let’s get into the nitty gritty of how I did this in 2021. It was my first time doing so and like all things in life, it was a little more complicated than beautiful infographics can make it seem 🙂 .

Calculate Taxes

Since I’m starting to convert money right after retiring, long before I need to use it (even after taking into account the 5 year waiting period), I can decide how much money to convert based on other factors. And I’ve chosen to move small enough amounts to minimize my additional taxes, if possible.

So I used this calculator that All Options Considered recommended to me to estimate how much I could convert to my Roth tax free since Roth IRA conversions are treated as income on a tax return. For me it looked like I could convert about $5,000 based on the extra income I accidentally made in 2021. So I had my number!

Convert!

Now let’s go step-by-step through how I started my Roth IRA Conversion Ladder. For the visuals, I’m using videos from this Vanguard page about Roth Conversions. I was going to figure out how to screen capture me doing these exact same things while also blocking out my financial info and then I decided to use these videos instead because it’s easier, they’re better than I could create and they already exist. Laziness for the win 🙂 .

Action 1

First, I logged into Vanguard and then selected Balances & Holdings under the My Accounts dropdown.

Action 2

Then, on the Balances & Holdings page, I found my Traditional IRA that I wanted to convert part of and selected the Convert to Roth IRA option.

Action 3

On the Convert to a Roth Brokerage IRA page, I read through all the info and confirmed that the Traditional IRA I wanted to convert was selected under Step 1: Choose an account to convert. Next, I selected “Convert part of the account in shares” instead of “Convert all of the account”.

Heads Up: The section in yellow is reminding us that for some reason, these kinds of transfers became irreversible in 2017. Previously, if you had guessed incorrectly about how much money you would make in a year and converted too much money for example, you could change it later. Now that’s not possible, so be careful with your original estimates. Personally, I undershot it by a few hundred dollars just to be safe.

Action 4

Then under Step 2: Select the holdings to convert, I entered the dollar amount I wanted to convert from my Traditional IRA to my Roth IRA (aka $5,000 in 2021).

Action 5

Next, under Step 3: Choose the Roth IRA account to convert to, I chose my Roth IRA from the dropdown menu. (Heads up that if you don’t already have a Roth IRA account, clicking that option here will take you away from this page.)

Action 6

Then I read through Step 4: Tax withholding, double checked my numbers, and acknowledged that federal and state income taxes would not be withheld from this conversion. Then I selected Continue.

Action 7

On the Review and Submit page, I reviewed my conversion details and clicked Submit to place the conversion order. Phew! I did it!!!

Confirmation!

So then it was the moment of truth: Did I do my math right? Would I owe additional taxes? Did I somehow fuck up my first Roth IRA Conversion? I’m happy to report that the answers to those questions are Yes, No and No respectively! I confirmed that I didn’t mess up by doing my 2021 taxes and letting out a breath of relief after seeing that I didn’t owe any taxes. In fact, I got $2 back – Sweet 🙂 !

Just filed my taxes for 2021 and am surprised to see that I'm getting a refund. I guess it's time to make it rain🤑🙌🏾🤣! pic.twitter.com/ak6bj57hzU

— A Purple Life (@APurpleLifeBlog) January 28, 2022

Conclusion

And that’s how I did my first Roth IRA Conversion! I now have a cool $5,000 of tax free money waiting for me in 2026 😉 . And of course, I’m going to do these conversions annually so that $5,000 will have another $5K join it in December and on and on. My Roth IRA conversion bucket will continue to grow until I need to tap into it 20 or so years into my retirement 🙂 . Anyway, I hope sharing my DIY investing successes and failures helps y’all along your journey. Next up I’m going to see if I can figure out Tax Gain Harvesting 😉 .

Have you ever done a Roth IRA Conversion?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

This post is so helpful, thank you! Are you keeping track of all of your conversions somewhere (excel sheet?) or does Vanguard keep track of that?

Can you convert funds that are currently invested (like in VTSAX)? Or can you only convert funds that are in your settlement fund (money market fund)?

I’m so glad it was helpful! And yes Vanguard keeps track in that they send you a confirmation email about it and will know about it in their system. I also have my own spreadsheet because nerds gotta nerd 🙂 .

If you’re moving money from a cash/money market fund to a Roth that’s not a conversion – it’s just investing money in a Roth IRA. Conversions come from other investment accounts, such as this one from my Trad IRA (that was indeed invested in VTSAX). Let me know if that didn’t make sense 🙂 .

Yes, that does – thank you! In the videos, Vanguard is showing funds moving from a settlement account in their traditional IRA which was confusing. But it sounds like you had VTSAX in your traditional IRA which you converted into VTSAX your Roth IRA – yes? 🙂

Yes – that’s correct. I just moved the VTSAX from one bucket to another. Now you’re making me think I should have recreated these videos to be more clear 🙂 .

This is a very helpful post! I already have an existing Roth IRA with a balance when I was contributing to it directly. Do you know how I distinguish that from the new converted funds so that I only withdraw the “aged” funds after 5 years?

I’m happy to hear that! I haven’t seen if there’s a way to tell the difference on your Vanguard dashboard, but you can check the confirmation emails Vanguard sends you. I also keep my own spreadsheet that tracks my conversion amounts just in case. Most likely when I start taking out these conversions I’ll hop on the phone with Vanguard to do it the first time to make sure I’m doing it right 🙂 .

I know in the Cost Basis report you see the details ($ and date) for your accounts – at least ETFs, not sure if it’s the same for mutual funds. You should be able to easily identify the conversions here if you follow a regular pattern (time or year or flat dollar amounts).

My accounts > Balances and holdings > Cost basis accounting

I’m not sure what you see when you go to sell the shares but I think you can specify which shares to sell first based on purchase date. People doing tax loss harvesting use this info in a similar manner. I read a post by Physician on Fire about tax loss harvesting on Vanguard that might provide more insight.

https://www.physicianonfire.com/tax-loss-harvesting-vanguard/

I have yet to do either so my knowledge is theoretical and based on my reading and internet clicking.

Thanks for this info! I went to that location within Vanguard and didn’t see a breakout of my Roth conversion. It might be in a different location for mutual funds. I’m sure there must be a way to find it though. And thank you for that PoF link!

Finding out about the Roth conversion ladder was game changing. I had the pleasure of teaching my coworker about it and just watched as the dawning happened across his face and he lit up, knowing he too, could retire early!

That’s so awesome!!!

I started doing these conversions in 2021 too and it’s a game changer. Mad Fientist has some well-thought-out posts that really helped me build confidence in retiring early.

Woohoo! That’s amazing and yeah he has some great posts 🙂 .

Can you make these convertions once you quit your job and don’t have any W2 or 1099 income?

Yes

You can make these conversions at any time. It makes sense to make them whenever you’re anticipate the tax and impact of the conversion to be lower than the tax/impact of the tax-deferred 401k/IRA withdrawal during “retirement”. This is complicated because you’re creating taxable income now, instead of taxable income later when you withdraw from your tax-deferred 401k/IRA. Taxable income impacts several other things now and once on Medicare/receiving SSI. For those in their 40s and 50s with hundreds of thousands on their tax-deferred 401ks/IRAs, there will be no escaping paying some taxes/losing APTCs, SSI, etc. It’s a guessing game to minimize the cost.

Really helpful info!

I’m also interested in how you’re drawing money while you’re waiting for these conversions to be useable. I think I remember you have a year or more in ‘cash’ (assuming not real cash but some kind of savings, lol). Did you also do anything with your taxable investments, like change to funds which pay more dividends, so you can use those to live off too? Or did you just leave it all in VTSAX, and just plan to sell off investments periodically to maintain a certain amount in ‘cash’?

I’m a few years away from hopefully retiring so just starting to think about these things!

I’m so glad it was helpful! And yep – I haven’t started withdrawing anything because I left my job with a 2 year cash cushion and I still have most of it. When I start selling shares I’ll document how I did that on the blog as well 🙂 .

Half of my investments are in a taxable account so it’s going to be a while before I need to touch these conversions. I didn’t change what I’m invested in (VTSAX), but I have changed my taxable dividends to go into my checking account while the rest are reinvested so I see that income, but I haven’t sold any shares. When I do I’ll probably sell annually. And yeah it’s great to think these things out in advance!

Good to know, thank you! Your perspective of a ‘newer’ retiree doing these things for the first time is so helpful, thanks 🙂

Go curry cracker has a tax calculator that helps for figuring out Roth conversions AND capital gains harvesting!! I’ll have to check out the one you linked

Oh cool! I just found it (link below). Thank you 🙂 .

https://www.gocurrycracker.com/federal-income-tax-calculator/

Hi Purple! Thanks again for this awesome post and writing about your early retirement journey in general. It’s such a helpful resource.

It sounds like your employer only offered a Traditional 401k, is that correct? If they had offered a Roth 401k as well, which option would you have contributed to and why? Would the Roth 401k make the ladder unnecessary?

Hi! I’m so happy it’s been helpful to you 🙂 . My employers only offered traditional 401ks and I’ve never had access to or looked at a Roth 401k in depth so I have no idea unfortunately 🙂 . Good luck!

Hi!! Newly learning anbout investing and learning how to be rich rich lmao but i have my ROTH IRA already established with fidelity. Not sure if this question has been answered already but if you already have a Roth IRA, how can you still do this? I also have a 401k that I just began at my new employer

You’ll just use this method to convert your pre-tax (think 401k and Traditional IRA) dollars to that existing Roth IRA.

Those Roth dollars are already in there growing tax-free forever, but you want to get the pre-tax dollars into Roth before they grow to huge amounts that you’ll eventually have to pay taxes on. Personally, I like to have the growth in my tax-free bucket (Roth), so I’ve converted $60k+ in the past 4 years.

Exactly that. Thank you for answering Josh!

How many years did you max out your Roth IRA contributions? I plan on RE but also realized the limitations of the Roth. I know you can withdraw the contributions at any time, but not the growth. I know it has advantages once you are retired, but what you’re going to live off has to be in taxable and rollovers.

I maxed my Roth for I think 4 years when I didn’t qualify for a Trad IRA anymore because of my salary. And yep you know what’s up. I had 50/50 of my investments in brokerage vs tax-advantaged accounts so depending on growth that’ll last for a while and after that I already have a fair bit available in my Roth.

Also I saw you emailed me to ask this as well so I’ll put that email in my “Completed” folder 🙂 .