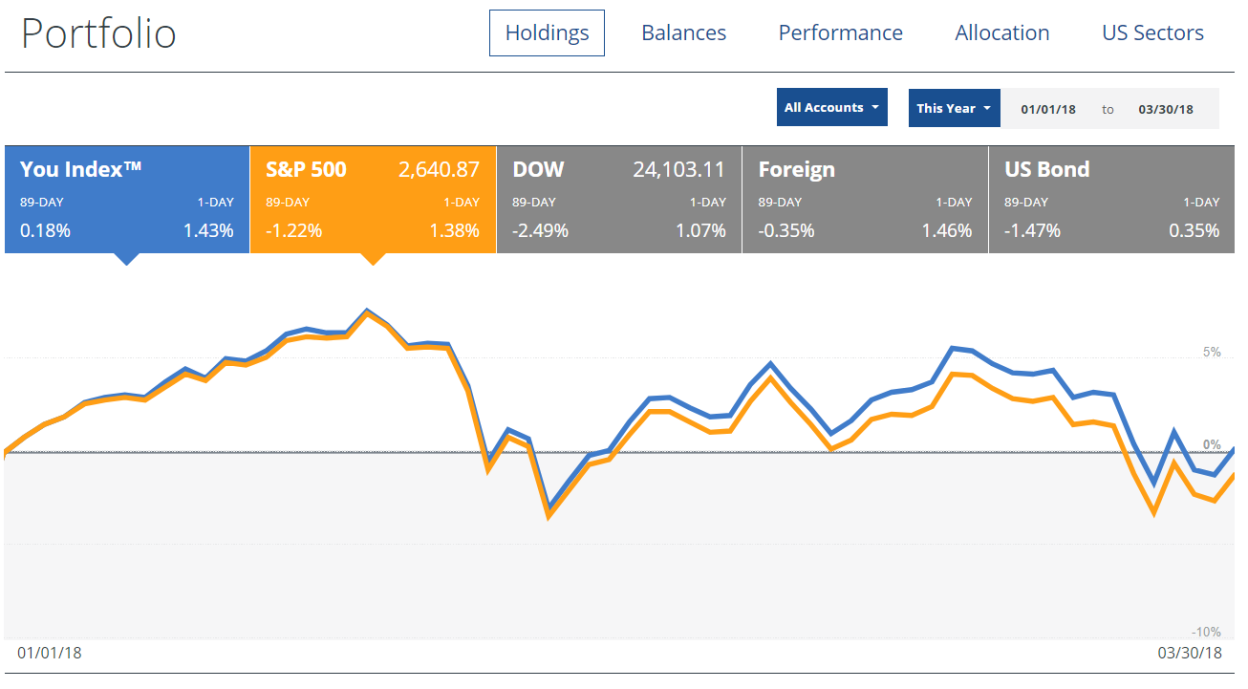

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.

To level set that many years of no growth has never happened in history, but it’s an interesting thought I wanted to explore. I was shocked with what I found. If the market remains stagnant until I retire it will only add ONE YEAR to my timeline. I would retire at the end of 2021 instead of 2020. That’s crazy! I thought the market and compounding would make this have a much larger effect, but the math doesn’t lie. This experiment made me very excited because retirement is literally an inevitability – even with something as crazy as a multi-year stagnant market. This is happening people!