My recent trip to Singapore was the first vacation in years that was more than a week chilling on the beach. The last similar trip I had was exploring Europe – mostly alone – for 2.5 weeks. Usually my Mom is interested in being in a luxury bubble and not actually learning about or exploring the local area. Singapore was different and it gave me an unexpected and unique insight into my life in retirement. Continue reading “A Retirement Prequel”

My recent trip to Singapore was the first vacation in years that was more than a week chilling on the beach. The last similar trip I had was exploring Europe – mostly alone – for 2.5 weeks. Usually my Mom is interested in being in a luxury bubble and not actually learning about or exploring the local area. Singapore was different and it gave me an unexpected and unique insight into my life in retirement. Continue reading “A Retirement Prequel”

Category: Early Retirement

Early Retirement Dropped At Work

Something shocking happened at work. I was hosting an event to share recent vacation pictures with the group. Our other presenter had recently spent a month in Mexico. He even wrote a blog post for our company about how to successfully work from anywhere. He used 2 weeks of PTO to basically work half time and extend his time there. Their main goal for the trip was to look into buying a house near Puerto Vallarta. Continue reading “Early Retirement Dropped At Work”

Something shocking happened at work. I was hosting an event to share recent vacation pictures with the group. Our other presenter had recently spent a month in Mexico. He even wrote a blog post for our company about how to successfully work from anywhere. He used 2 weeks of PTO to basically work half time and extend his time there. Their main goal for the trip was to look into buying a house near Puerto Vallarta. Continue reading “Early Retirement Dropped At Work”

Locked Retirement Date: October 2, 2020

I seem to change my mind annually about my retirement date – not just when it is based on math, but if I even am locked into a date or a number. Once again I’ve changed my mind 🙂 . As I’ve mentioned, current numbers including my raise show me solidly retiring in 2020 assuming average market growth and the same amount of stretch bonus as I received last year. If I continue to receive a 4% raise each year (as my boss claimed we would) my date is at the beginning of November with 7% market returns, October with 8% and mid-August with aggressive 10% growth. Continue reading “Locked Retirement Date: October 2, 2020”

I seem to change my mind annually about my retirement date – not just when it is based on math, but if I even am locked into a date or a number. Once again I’ve changed my mind 🙂 . As I’ve mentioned, current numbers including my raise show me solidly retiring in 2020 assuming average market growth and the same amount of stretch bonus as I received last year. If I continue to receive a 4% raise each year (as my boss claimed we would) my date is at the beginning of November with 7% market returns, October with 8% and mid-August with aggressive 10% growth. Continue reading “Locked Retirement Date: October 2, 2020”

A Raise (And What It Means for Retirement)

I got a raise! And not just a cost-of-living increase of 2%, but a REAL raise of 4%! I’m assuming that’s just on my base salary so I’m going from $90,000 base to $93,600 with a guaranteed $10,000 target bonus and $600 for my cell phone. Without any stretch bonuses I’m up to $104,200! Continue reading “A Raise (And What It Means for Retirement)”

Halfway to Retirement!

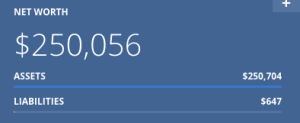

As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go!

As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go!

3 Years.

This month is an interesting milestone. 3 years ago my mother retired from 30+ years of full-time work. Work she hated. Work that kept her from spending time with me because of a long commute (that allowed my step-siblings to go to a school near their mother). Work that wasn’t very compatible with my own long commute to school downtown. Work that allowed her to retire early at 55. I can’t believe it’s been 3 years already. Continue reading “3 Years.”

This month is an interesting milestone. 3 years ago my mother retired from 30+ years of full-time work. Work she hated. Work that kept her from spending time with me because of a long commute (that allowed my step-siblings to go to a school near their mother). Work that wasn’t very compatible with my own long commute to school downtown. Work that allowed her to retire early at 55. I can’t believe it’s been 3 years already. Continue reading “3 Years.”

Retiring “To” Something

I’ve heard it over and over again: on forums and countless blog posts that it’s important to not just retire “from” your job, but to retire “to” something: something productive that will fill the ‘hole’ working leaves. I’ve been thinking about this FIRE dogma a lot and I think we should decrease its “truth” status. I honestly don’t think this is the case for me or my Mom. Continue reading “Retiring “To” Something”

I’ve heard it over and over again: on forums and countless blog posts that it’s important to not just retire “from” your job, but to retire “to” something: something productive that will fill the ‘hole’ working leaves. I’ve been thinking about this FIRE dogma a lot and I think we should decrease its “truth” status. I honestly don’t think this is the case for me or my Mom. Continue reading “Retiring “To” Something”

2017 State of the Union

This year I had more than just monetary goals. They were:

This year I had more than just monetary goals. They were:

- Max my 401K ($18,000)

- Max a Roth IRA ($5,500)

- Overall invest $54,500 for a savings rate of 75%

- Have a net worth of $200,000

- Decrease my spending from $22,491.86 to $18,000

- Lose 28 lbs by eating low-carb/high-fat and have a normal BMI for the first time without starving myself

- Determine when I can retire based on my current salary and savings rate