Category: Budget Check-In

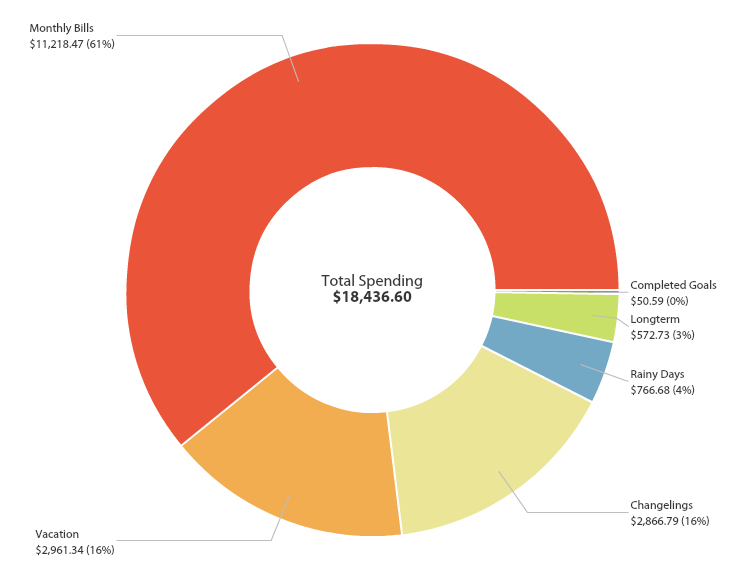

I understand that time moves faster the older you get, but HOW is the year 25% done?! I feel like it’s crawling and then look at the date and feel like it’s flying by. Fascinating. I wanted to check in on my goal to decrease my spending from $18,436.60 last year by $436.60 to a solid $18,000 this year. Let’s see how it’s going.

2017 Spending

2017 is at an end. Let’s see how I did with my goal to decrease my spending $4,491.86 from $22,491.86 last year to $18,000. Reaching this goal would prove to me that I can live on $18,000 in retirement though I’m budgeting to withdraw $20,000. The $2,000 buffer would be used for additional healthcare expenses and unexpected costs. 10% of my retirement budget would be a buffer. This safety nets make me feel like I have a warm security blanket wrapped around me. So let’s see how I did!

Q3 Budget Check-In 2017

We’re 75% done with 2017. Madness. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year. Continue reading “Q3 Budget Check-In 2017”

We’re 75% done with 2017. Madness. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year. Continue reading “Q3 Budget Check-In 2017”

H1/Q2 Budget Check-In 2017

We’re halfway done with 2017 and this year is flying by. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year. These are my averages for the first half of 2017:

We’re halfway done with 2017 and this year is flying by. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year. These are my averages for the first half of 2017:Q1 Budget Check-In 2017

Oooh maybe I should get another ledger like this.. And yes I’m that girl that always gets an itemized receipt 🙂

It’s 3 months into 2017 and we’re already 1/4 done with the year. Woah…that was fast. I wanted to check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year. Let’s see how it’s going:

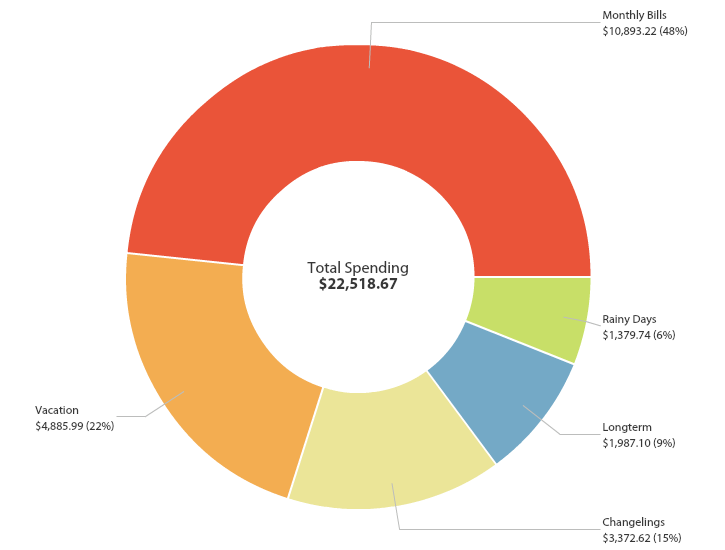

2016 Spending

Let’s look at the explosion that was my 2016 spending. Overall I spent $22,518.67 which isn’t bad (compared to the $30,000 spending of 2015) but it’s still not as low as I’d like. A few factors for this level of spending were: Continue reading “2016 Spending”

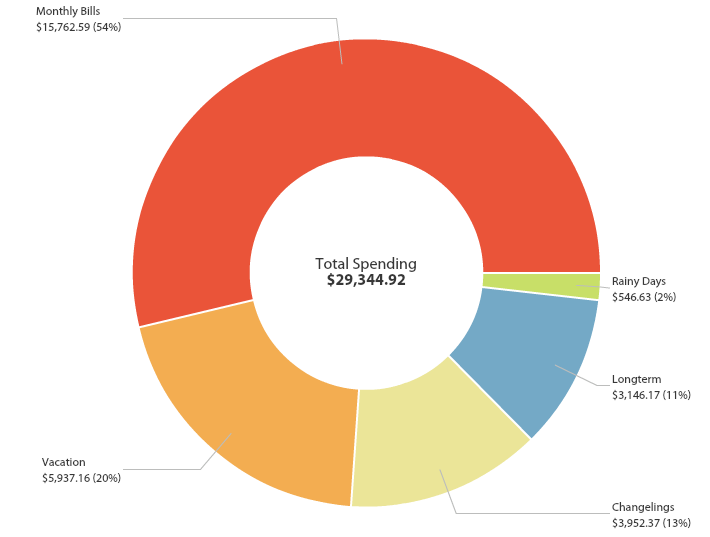

2015 Spending

Let’s look at the explosion that was my 2015 spending. Overall I spent about $30,000 which isn’t too bad since I was living the high life in NYC for half the year, but improvements can still be made. Removing the cost of our luxurious Fiji vacation and the costs of our cross country move would bring my 2015 spending to $21,840.

My 10 Year Plan

Based on my end goal of financial freedom I’ve accumulated information from various books, blogs and traditional retirement calculators to determine how much I need to save to be able to live off of indefinitely. Overall I’m basing my calculations on the updated Trinity Study from 2009 that reinforces the 4% safe withdrawal rate for investments with a 75% stock, 25% bond asset allocation even when adjusting for inflation every year. Mr. Money Mustache makes a lot of excellent points about how this study in itself even builds in a large safety margin by assuming that a person would not adjust spending to account for economic reality, such as a recession, or substitute goods to compensate for the inflation of an individual item.

Based on my end goal of financial freedom I’ve accumulated information from various books, blogs and traditional retirement calculators to determine how much I need to save to be able to live off of indefinitely. Overall I’m basing my calculations on the updated Trinity Study from 2009 that reinforces the 4% safe withdrawal rate for investments with a 75% stock, 25% bond asset allocation even when adjusting for inflation every year. Mr. Money Mustache makes a lot of excellent points about how this study in itself even builds in a large safety margin by assuming that a person would not adjust spending to account for economic reality, such as a recession, or substitute goods to compensate for the inflation of an individual item.