It’s that time again: Dividend Season! I look forward to it like I imagine people look forward to Christmas, but this happens 4 times a year! Let’s see how we made out this quarter. I received $881.27, which is awesome. That’s 42% more than last year! Since I started investing in 2014 I’ve received $7,380.32 in dividends – that’s almost a full month of my current salary without having to work that’s just dropped into my lap. Insanity! Let’s see if we can top that next quarter (Spoiler: I think we can 😉 ).

It’s that time again: Dividend Season! I look forward to it like I imagine people look forward to Christmas, but this happens 4 times a year! Let’s see how we made out this quarter. I received $881.27, which is awesome. That’s 42% more than last year! Since I started investing in 2014 I’ve received $7,380.32 in dividends – that’s almost a full month of my current salary without having to work that’s just dropped into my lap. Insanity! Let’s see if we can top that next quarter (Spoiler: I think we can 😉 ).

Category: Investing

Market Noise > Contributions

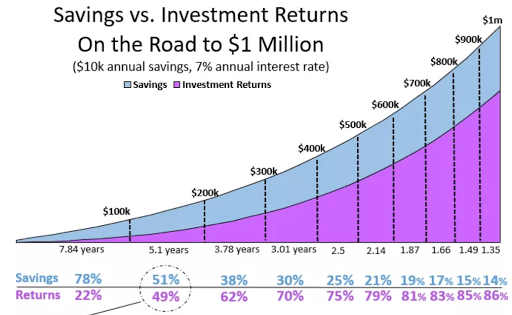

This graph was made by the lovely Four Pillar Freedom.

We’ve reached the threshold. My monthly contributions to my investments are almost completely obscured by the market noise. I now add 2% of my current net worth to my investments each month and recent daily fluctuations have been more than that: Down 2.5%, Up 2% etc. I think I’ve reached what a new favorite blogger of mine Four Pillar Freedom describes as the point when the market makes a bigger impact than your contributions. Continue reading “Market Noise > Contributions”

A Flat Market = No Problem

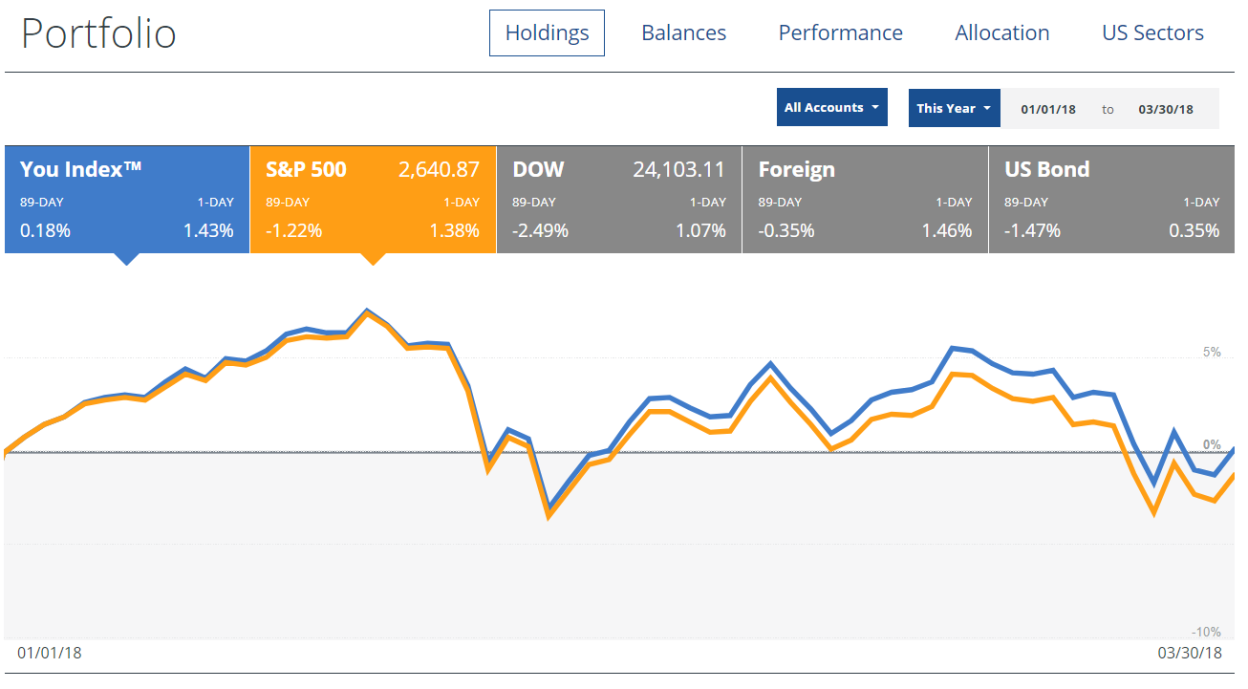

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings. Continue reading “A Flat Market = No Problem”

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings. Continue reading “A Flat Market = No Problem”

Sweet Sweet Dividends

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

So how did I make out this quarter? Like a bandit if I do say so myself! I made $787.04 from my investments. That’s a 43% increase from last year! Yes my investments have increased 56%, but that’s besides the point 🙂 . Just assuming an overall 43% increase from last year’s dividends of (even though it will be more) I’ll receive $3,916.04 in dividends in 2018. Woah. That’s like 2 weeks of salary! And I’ll receive it no matter what the market does (we’re down 1% for the year at the time I write this). An extra half a month’s salary no matter what. I like the sound of that. To next quarter!

Exposure Therapy

One of my favorite bloggers GoCurryCracker has a wonderful article on Exposure Therapy. He basically gives advice that is contrary to a lot of other finance bloggers who say ignore the stock market completely (which I would argue is a little impossible in our tech heavy, media heavy world). GoCurryCracker suggests that yes we should ignore it as in not change our plans based on it, but that we should also pay attention when it drops so we can see how we feel ‘losing’ money.

One of my favorite bloggers GoCurryCracker has a wonderful article on Exposure Therapy. He basically gives advice that is contrary to a lot of other finance bloggers who say ignore the stock market completely (which I would argue is a little impossible in our tech heavy, media heavy world). GoCurryCracker suggests that yes we should ignore it as in not change our plans based on it, but that we should also pay attention when it drops so we can see how we feel ‘losing’ money.2017 State of the Union

This year I had more than just monetary goals. They were:

This year I had more than just monetary goals. They were:

- Max my 401K ($18,000)

- Max a Roth IRA ($5,500)

- Overall invest $54,500 for a savings rate of 75%

- Have a net worth of $200,000

- Decrease my spending from $22,491.86 to $18,000

- Lose 28 lbs by eating low-carb/high-fat and have a normal BMI for the first time without starving myself

- Determine when I can retire based on my current salary and savings rate

Dividend Season

It’s that wonderful time of year again: Dividend Season! When I feel like free money is reigning down on me. It feels like my cash is just sitting in something boring like a bank account so I usually forget that it’s actually at work within 3,300+ businesses within the US and as a result those businesses pay me money every quarter for doing basically nothing. It feels like Christmas! This quarter I received $670.17 from my Vanguard account (which sadly doesn’t include my 401K or HSA), which is a 30% increase from the $514.02 I received last year and a 143% increase from the year before that ($275.23). And it will just keep increasing because of the miracle of compounding. AH! So exciting. The end of Q4 in December usually brings the largest dividend payouts of the year…on literal Christmas. I can’t wait to open my presents!

Retirement Inevitability

An article I read this morning made me realize something: early retirement is inevitable. I currently have almost a $200,000 net worth (so close!). I could stop saving now, not touch my money and let it grow. If I did that then based on historical averages I would have enough money to retire at 43 years old. That’s 12 years before my mom and 19 years before the earliest social security payout options without me adding another penny to my accounts. I could suddenly quintuple my lifestyle, live like that for the next 15 years and still retire earlier than I could have ever imagined. That’s INSANE! I might start thinking of all the money I invest from this moment as money that’s buying back my time between 32 and 43 years of age. I’m slowly rolling back the clock. I like that visual. Even if I do nothing I will get there. And fast. Let’s do this!