While I was on vacation in Thailand I hit my 10,000th day of being alive. That went quickly! The market was also at an all time high and I hit $150,000 in net worth. WOAH. I expected that to happen when I got my next paycheck in March, but the rampaging market made it happen sooner. I started the year 2 months ago with $137,000 and we’re already at $150K with only 1 paycheck under my belt. I almost can’t believe it and I know it won’t last: the market will drop, maybe this month, maybe this year, maybe in a few years – I have no idea, but it will and I will see myself lose maybe half of my savings. Watching it grow in this current market and feeling that satisfaction will hopefully get me through that darker time. But in the meantime I will celebrate :). This was my first vacation where I had no job stress to think about. I even deleted my work email from my phone. I believe I am 1500 days (or less) from retirement and living life on my own terms. Bring it!

While I was on vacation in Thailand I hit my 10,000th day of being alive. That went quickly! The market was also at an all time high and I hit $150,000 in net worth. WOAH. I expected that to happen when I got my next paycheck in March, but the rampaging market made it happen sooner. I started the year 2 months ago with $137,000 and we’re already at $150K with only 1 paycheck under my belt. I almost can’t believe it and I know it won’t last: the market will drop, maybe this month, maybe this year, maybe in a few years – I have no idea, but it will and I will see myself lose maybe half of my savings. Watching it grow in this current market and feeling that satisfaction will hopefully get me through that darker time. But in the meantime I will celebrate :). This was my first vacation where I had no job stress to think about. I even deleted my work email from my phone. I believe I am 1500 days (or less) from retirement and living life on my own terms. Bring it!

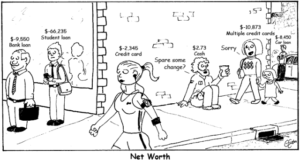

Category: Net Worth Update

2016 State of the Union

I did it again – against all odds. I started this year with the goals to:

I did it again – against all odds. I started this year with the goals to:- Max my 401K

- Max my Traditional IRA

- Increase my salary

- Overall contribute $54,000 to investments

$125,000 Net Worth

Despite not having a job for four and a half months I now have $125,000 in net worth. It seems like yesterday when I was anticipating having $100,000 in March and I already have 25% more. I’m starting to see the beauty of compound interest in just that fact. For the time I was funemployed I was making about $30,000 a year and my savings still increased a ridiculous amount. A part of it was market returns (about $10,000), but the other $15,000 was not – and I didn’t save or put any money into the market in that time. It’s just wild. I’m so excited for the next milestone. Bring it.

Despite not having a job for four and a half months I now have $125,000 in net worth. It seems like yesterday when I was anticipating having $100,000 in March and I already have 25% more. I’m starting to see the beauty of compound interest in just that fact. For the time I was funemployed I was making about $30,000 a year and my savings still increased a ridiculous amount. A part of it was market returns (about $10,000), but the other $15,000 was not – and I didn’t save or put any money into the market in that time. It’s just wild. I’m so excited for the next milestone. Bring it.

$100,000 in Assets

As of February 26, 2016 at 26 I now have $100,000 in assets. It seems like a special number and I’ve been excited for this milestone for a while. 1.5 years ago I was wandering aimlessly, spending money frivolously (I think), but not enough by American consumerist standards. I had accidentally accumulated $50,000 in assets – mostly in my 401K, which had been compounding behind the scenes.

Now I am here with $100,000 and I can’t even believe it. On to $1,000,000 :).

My Addiction: Increasing Net Worth

I am loving watching my net worth grow. I loved it before saving money was my main goal. That’s one of the reasons I love Mint.com. I can go back and see my money grow from $5,000 when I left college (from hoarding $20 bills in high school and not spending basically anything in college) to a new milestone: $60,000 as of today. Not only is this intoxicating to watch and the reason I now look forward to pay days with a childlike glee, but the mere fact that I achieved $50,000 net worth in November and have increased my net worth 20% in 3 months is insane. And so exciting. It gives me a high I can’t describe. Maybe this is what shopaholics feel right after a purchase. I have no idea, but it’s a fantastic feeling. Continue reading “My Addiction: Increasing Net Worth”

I am loving watching my net worth grow. I loved it before saving money was my main goal. That’s one of the reasons I love Mint.com. I can go back and see my money grow from $5,000 when I left college (from hoarding $20 bills in high school and not spending basically anything in college) to a new milestone: $60,000 as of today. Not only is this intoxicating to watch and the reason I now look forward to pay days with a childlike glee, but the mere fact that I achieved $50,000 net worth in November and have increased my net worth 20% in 3 months is insane. And so exciting. It gives me a high I can’t describe. Maybe this is what shopaholics feel right after a purchase. I have no idea, but it’s a fantastic feeling. Continue reading “My Addiction: Increasing Net Worth”

State of the Union: 2014

I thought it would be good to create an annual State of the Union to remember what I did each year regarding my investments and why. This was a big year – the first year I really dove in and learned how to have my money make money of its own.

I thought it would be good to create an annual State of the Union to remember what I did each year regarding my investments and why. This was a big year – the first year I really dove in and learned how to have my money make money of its own.Through my reading of the books and articles I listed in my first post I’ve gone from knowing basically nothing about the stock market and calling my parent’s mutual fund manager to ask what 401K plan to enroll in to at least an intermediate level. And with that knowledge has come a sense of calm and an understanding that flexibility and knowledge are the only kind of security.

Continue reading “State of the Union: 2014”

My 10 Year Plan

Based on my end goal of financial freedom I’ve accumulated information from various books, blogs and traditional retirement calculators to determine how much I need to save to be able to live off of indefinitely. Overall I’m basing my calculations on the updated Trinity Study from 2009 that reinforces the 4% safe withdrawal rate for investments with a 75% stock, 25% bond asset allocation even when adjusting for inflation every year. Mr. Money Mustache makes a lot of excellent points about how this study in itself even builds in a large safety margin by assuming that a person would not adjust spending to account for economic reality, such as a recession, or substitute goods to compensate for the inflation of an individual item.

Based on my end goal of financial freedom I’ve accumulated information from various books, blogs and traditional retirement calculators to determine how much I need to save to be able to live off of indefinitely. Overall I’m basing my calculations on the updated Trinity Study from 2009 that reinforces the 4% safe withdrawal rate for investments with a 75% stock, 25% bond asset allocation even when adjusting for inflation every year. Mr. Money Mustache makes a lot of excellent points about how this study in itself even builds in a large safety margin by assuming that a person would not adjust spending to account for economic reality, such as a recession, or substitute goods to compensate for the inflation of an individual item.