I just realized that my passive income from investments (assuming an average 7% market return) has now surpassed what a minimum wage employee would make working 40 hours a week, 52 weeks a year. WOWZA! At the beginning of 2018 I had $237,000, which would generate $16,590 at 7% while a minimum wage employee would receive $15,080. That’s wild!

I have an invisible minimum wage employee working hella hard while I sleep, away from my day job, which I think is a very cool idea. I’ve touched on this phenomenon in a previous post, but she was just a teenager working part time after school then. Now she’s a full-timer. This just got serious!

Now we should probably working on raising that minimum wage (Washington did recently) so the average isn’t so low!

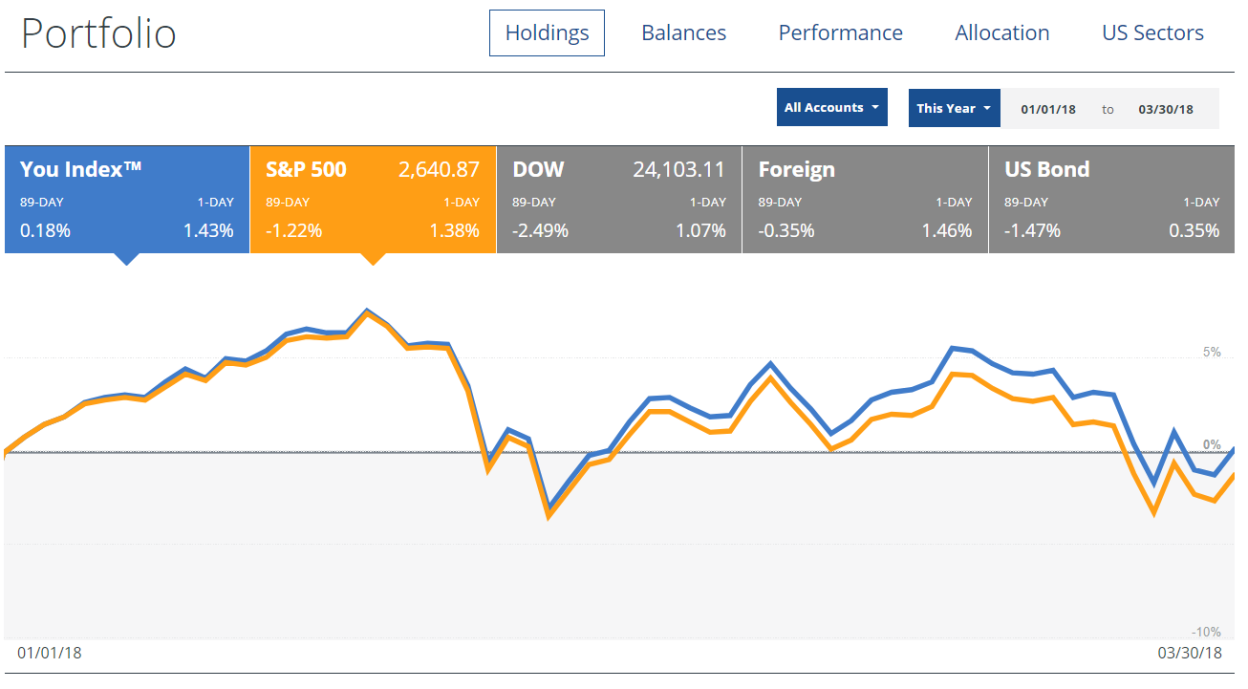

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.  It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

One of my favorite bloggers GoCurryCracker has a wonderful article on

One of my favorite bloggers GoCurryCracker has a wonderful article on  Well that happened. Apparently I now have a 800 credit score according to Equifax (not that I trust them at all – so many breaches. Goodness people). Nevertheless it’s fun to see and hilarious since I’m such a credit card churner. An 800 credit score with an average credit card age of less than 2 years 🙂 . It’s possible. To 850!

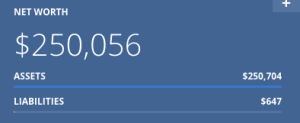

Well that happened. Apparently I now have a 800 credit score according to Equifax (not that I trust them at all – so many breaches. Goodness people). Nevertheless it’s fun to see and hilarious since I’m such a credit card churner. An 800 credit score with an average credit card age of less than 2 years 🙂 . It’s possible. To 850! As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go!

As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go! It’s about 30 days before my trip to Singapore: my first time in the country. I’m visiting because I was invited by a Seattle friend of mine (and former colleague) who grew up there. We’ll be staying in her Mom’s apartment in its many empty rooms. Luckily I’ve met her mother and got along with her well. It should be a fairly frugal trip all things considered.

It’s about 30 days before my trip to Singapore: my first time in the country. I’m visiting because I was invited by a Seattle friend of mine (and former colleague) who grew up there. We’ll be staying in her Mom’s apartment in its many empty rooms. Luckily I’ve met her mother and got along with her well. It should be a fairly frugal trip all things considered.