This year I had more than just monetary goals. They were:

This year I had more than just monetary goals. They were:

- Max my 401K ($18,000)

- Max a Roth IRA ($5,500)

- Overall invest $54,500 for a savings rate of 75%

- Have a net worth of $200,000

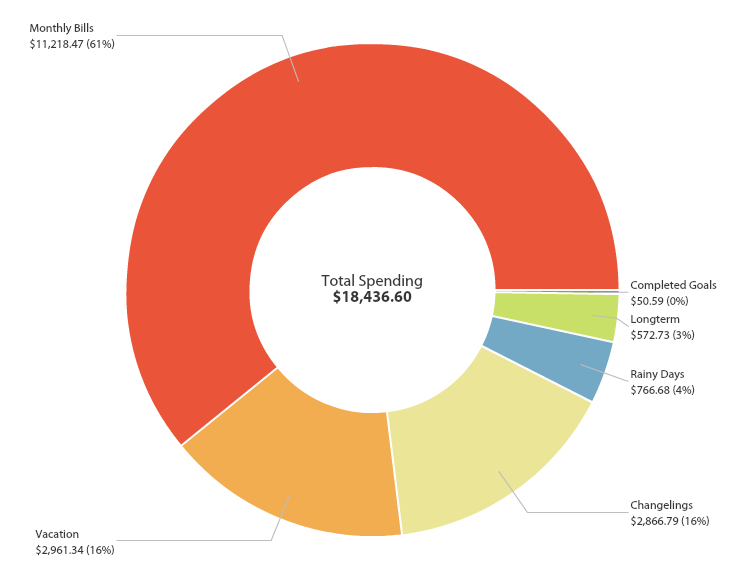

- Decrease my spending from $22,491.86 to $18,000

- Lose 28 lbs by eating low-carb/high-fat and have a normal BMI for the first time without starving myself

- Determine when I can retire based on my current salary and savings rate

We recently added a new hobby to our permanent repertoire. The stereotype of a Seattleite is a crunchy, liberal, outdoors person…and I must admit that’s pretty much accurate 🙂 . In Manhattan weekend activities included going to bars, going to bottomless mimosa brunch and complaining about your week. It was a bit of culture shock when we moved to Seattle because weekends are completely different.

We recently added a new hobby to our permanent repertoire. The stereotype of a Seattleite is a crunchy, liberal, outdoors person…and I must admit that’s pretty much accurate 🙂 . In Manhattan weekend activities included going to bars, going to bottomless mimosa brunch and complaining about your week. It was a bit of culture shock when we moved to Seattle because weekends are completely different.  I’ve been playing with the idea of owning a Kindle for over a year now. I vacillated between thinking it would be a helpful addition to my life and thinking it was too much for what it adds ($80). Currently I read on my phone or computer depending on where I am. I prefer actual books, but find them unrealistic to bring on a lot of travels. I also love the wonder of library eBooks that allow me to read anything without leaving my home (Laziness FTW?)

I’ve been playing with the idea of owning a Kindle for over a year now. I vacillated between thinking it would be a helpful addition to my life and thinking it was too much for what it adds ($80). Currently I read on my phone or computer depending on where I am. I prefer actual books, but find them unrealistic to bring on a lot of travels. I also love the wonder of library eBooks that allow me to read anything without leaving my home (Laziness FTW?)

The human brain is insane. I’m talking specifically about mine. We come to expect what’s happening now to happen forever. This is part of the irrational exuberance that creates bubbles and crashes in the stock market. It’s our nature and it’s hard to reign in. I caught my brain in the same trap recently. We recently received our Q3 bonuses. As I’ve mentioned before part of my compensation is a guaranteed target bonus that everyone receives unless they’re on a performance improvement plan. The rest of the bonus is discretionary and based on performance. I call this the “stretch bonus.”

The human brain is insane. I’m talking specifically about mine. We come to expect what’s happening now to happen forever. This is part of the irrational exuberance that creates bubbles and crashes in the stock market. It’s our nature and it’s hard to reign in. I caught my brain in the same trap recently. We recently received our Q3 bonuses. As I’ve mentioned before part of my compensation is a guaranteed target bonus that everyone receives unless they’re on a performance improvement plan. The rest of the bonus is discretionary and based on performance. I call this the “stretch bonus.”