Guess we need to start hanging out in a place like this – because stereotypes.

Guess we need to start hanging out in a place like this – because stereotypes.

My partner brought up American classes the other day and discovered something shocking: within these weird and seemingly arbitrary classifications a household income over $200,000 OR a net worth of over $200,000 is the baseline for Upper Middle Class.

…We’re Upper Middle Class?!?! Even without my partner I’m Upper Middle Class?! That’s just baffling to me. Yes I know the bias that everyone thinks they’re Middle Class whether they make $5 million or $50,000 based on a recent NY Times article, but I still didn’t consider this. I think of Upper Middle Class people as Manhattanites that own a condo and have a club membership: not mega-spenders like the stereotypes of Upper Class, but definitely very different from what I consider my simple life. Continue reading “We’re Upper Middle Class?”

I feel like I say this every time, but time is flying and money is piling up. I know this gravy train will temporarily come to an end with the next recession, but for now I am LOVING it! Seeing my money compound so fast is still crazy to me. It’s been 8 months since I hit $150,000 while in Thailand on my 10,000 day of life and here we are with 33% more. Just stupid. This has been caused by the high stock market as well as my salary being higher than I anticipated because of bonuses and investing more as a result. My goal for the end of 2017 was to have a net worth of $200,000 and we’re already there with 3 months to spare. I thought this was going to happen on my birthday in 2 days when I receive my paycheck, but instead the market has been on a rampage and I’ve reached my year end goal with 3 paychecks and approximately $22,000 left to invest this year. Just madness. We’ll see how I feel if stocks crash before the end of the year :), but for now I’m floating on a cloud. It’s time to set a new goal.

I feel like I say this every time, but time is flying and money is piling up. I know this gravy train will temporarily come to an end with the next recession, but for now I am LOVING it! Seeing my money compound so fast is still crazy to me. It’s been 8 months since I hit $150,000 while in Thailand on my 10,000 day of life and here we are with 33% more. Just stupid. This has been caused by the high stock market as well as my salary being higher than I anticipated because of bonuses and investing more as a result. My goal for the end of 2017 was to have a net worth of $200,000 and we’re already there with 3 months to spare. I thought this was going to happen on my birthday in 2 days when I receive my paycheck, but instead the market has been on a rampage and I’ve reached my year end goal with 3 paychecks and approximately $22,000 left to invest this year. Just madness. We’ll see how I feel if stocks crash before the end of the year :), but for now I’m floating on a cloud. It’s time to set a new goal. We’re 75% done with 2017. Madness. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year.

We’re 75% done with 2017. Madness. Let’s check in on my goal to decrease my spending from $22,491.86 last year by $4,491.86 to $18,000 this year.

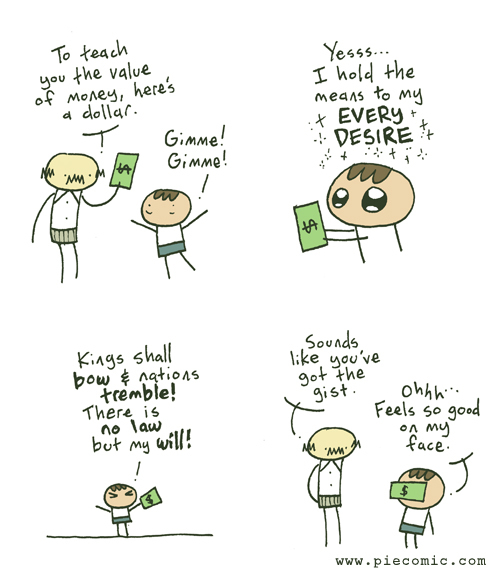

Looking back I think I’ve always been fascinated by money. I tried to negotiate prices with the tooth fairy (proof below), was a bank for my siblings (a bad one) and loved collecting foreign currency. My aunt and uncle would often bring me coins from wherever they were living at the time. I also bought fake foreign currency with the little chore money I received. I was such a normal kid 🙂 .

Looking back I think I’ve always been fascinated by money. I tried to negotiate prices with the tooth fairy (proof below), was a bank for my siblings (a bad one) and loved collecting foreign currency. My aunt and uncle would often bring me coins from wherever they were living at the time. I also bought fake foreign currency with the little chore money I received. I was such a normal kid 🙂 .

I’ve mentioned that part of my morning routine is catching up on the financial blogs that have been published since the following morning. I find which blogs I’ll read through twitter. I have a twitter list that only includes my financial bloggers and it’s very helpful to keep up not only with their blog posts, but latest news. It’s how I found out one of my favorite and most inspiring bloggers was having a meet up in Seattle and I ended up hanging out with him (and others) all night. It was amazing.

I’ve mentioned that part of my morning routine is catching up on the financial blogs that have been published since the following morning. I find which blogs I’ll read through twitter. I have a twitter list that only includes my financial bloggers and it’s very helpful to keep up not only with their blog posts, but latest news. It’s how I found out one of my favorite and most inspiring bloggers was having a meet up in Seattle and I ended up hanging out with him (and others) all night. It was amazing.