When I read about the paths of other financial independence seekers I’ve noticed something about myself. I’ve always been this way. When others were looking to fill their lives with things I’ve mostly always loved hoarding my money. When I was young – maybe 7 – I was even a bank to my step-siblings. I’d lend them money and collect repayments. One of them still owes me $50. With interest :). I doubt I’ll ever see it though. Such is the life of a bank of a 7 year old. Continue reading “I’m Lucky: I’ve Always Been This Way”

Category: Finance

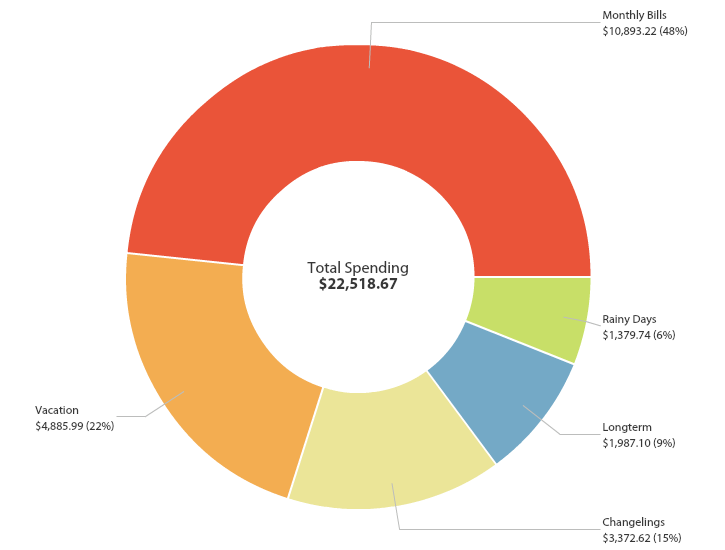

2016 Spending

Let’s look at the explosion that was my 2016 spending. Overall I spent $22,518.67 which isn’t bad (compared to the $30,000 spending of 2015) but it’s still not as low as I’d like. A few factors for this level of spending were: Continue reading “2016 Spending”

2016 State of the Union

I did it again – against all odds. I started this year with the goals to:

I did it again – against all odds. I started this year with the goals to:- Max my 401K

- Max my Traditional IRA

- Increase my salary

- Overall contribute $54,000 to investments

$125,000 Net Worth

Despite not having a job for four and a half months I now have $125,000 in net worth. It seems like yesterday when I was anticipating having $100,000 in March and I already have 25% more. I’m starting to see the beauty of compound interest in just that fact. For the time I was funemployed I was making about $30,000 a year and my savings still increased a ridiculous amount. A part of it was market returns (about $10,000), but the other $15,000 was not – and I didn’t save or put any money into the market in that time. It’s just wild. I’m so excited for the next milestone. Bring it.

Despite not having a job for four and a half months I now have $125,000 in net worth. It seems like yesterday when I was anticipating having $100,000 in March and I already have 25% more. I’m starting to see the beauty of compound interest in just that fact. For the time I was funemployed I was making about $30,000 a year and my savings still increased a ridiculous amount. A part of it was market returns (about $10,000), but the other $15,000 was not – and I didn’t save or put any money into the market in that time. It’s just wild. I’m so excited for the next milestone. Bring it.

Integrity > Money

I was laid off from my job after a little less than a year. I was strangely ecstatic about this fact. I literally called that it was going to happen and was looking for another job so I could comfortably quit when it happened. I was surprised to learn that I would also receive 1 week of severance pay…with a catch. I would have to sign a gag order and never say anything negative about Company 5, their holding company or anyone that has ever worked there or Company 5 could sue me. I asked if the agreement could be edited and the head of HR ignored me until I was able to confront her in person. I was told she could not edit the agreement. So I told her I would not be signing anything. She looked surprised. Continue reading “Integrity > Money”

I was laid off from my job after a little less than a year. I was strangely ecstatic about this fact. I literally called that it was going to happen and was looking for another job so I could comfortably quit when it happened. I was surprised to learn that I would also receive 1 week of severance pay…with a catch. I would have to sign a gag order and never say anything negative about Company 5, their holding company or anyone that has ever worked there or Company 5 could sue me. I asked if the agreement could be edited and the head of HR ignored me until I was able to confront her in person. I was told she could not edit the agreement. So I told her I would not be signing anything. She looked surprised. Continue reading “Integrity > Money”

I Refuse

I look around and see no one with the life I want. I refuse to live 45 years of my life like this. Following the instructions of a faceless company and an alarm clock. Having my company tell me when and how often I can see my family. Having a certain number of days when I do not have to be in a cubicle. Feeling stress over creating ads no one wants to see. Attending award shows created by the people who want to win the awards – a circlejerk. Pretending I care if a spam email deployed a day later than we said it would. Feeling stress that this ‘mistake’ will reflect poorly on me – even for a second. Pretending any of this matters: title, social status, perceived wealth.

I look around and see no one with the life I want. I refuse to live 45 years of my life like this. Following the instructions of a faceless company and an alarm clock. Having my company tell me when and how often I can see my family. Having a certain number of days when I do not have to be in a cubicle. Feeling stress over creating ads no one wants to see. Attending award shows created by the people who want to win the awards – a circlejerk. Pretending I care if a spam email deployed a day later than we said it would. Feeling stress that this ‘mistake’ will reflect poorly on me – even for a second. Pretending any of this matters: title, social status, perceived wealth.

I refuse for this to be my life. So I’m changing it.

$100,000 in Assets

As of February 26, 2016 at 26 I now have $100,000 in assets. It seems like a special number and I’ve been excited for this milestone for a while. 1.5 years ago I was wandering aimlessly, spending money frivolously (I think), but not enough by American consumerist standards. I had accidentally accumulated $50,000 in assets – mostly in my 401K, which had been compounding behind the scenes.

Now I am here with $100,000 and I can’t even believe it. On to $1,000,000 :).

2015 State of the Union

I fucking did it. I started this year with the goals to:

I fucking did it. I started this year with the goals to:

- Max my 401K

- Max my Traditional IRA

- Max my HSA

- Overall contribute $35,000 to investments