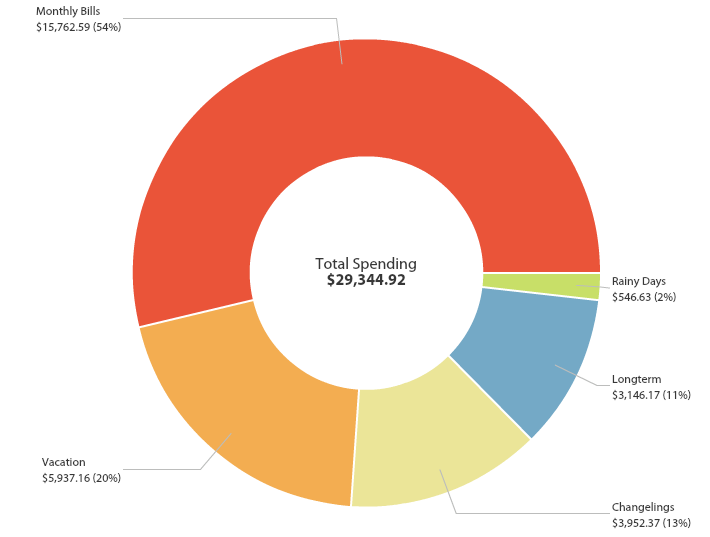

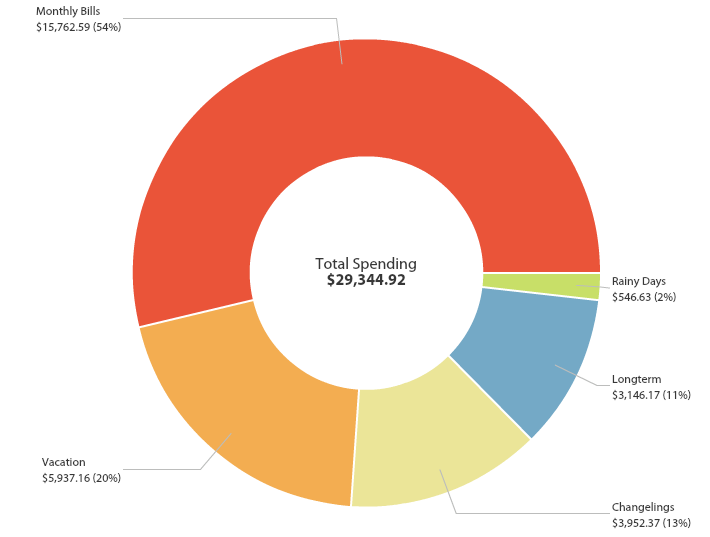

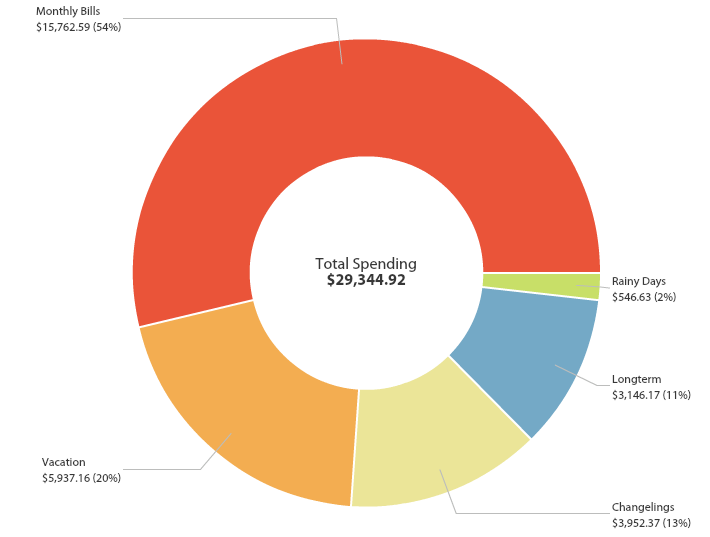

2015 Spending

Something strange has happened. I was reading through my previous posts to see to help reminisce about the year and what I’ve accomplished and I read my post about “Frugality and Weight Management” and how it seemed they went hand in hand. I started laughing while reading it because I felt so differently now. Continue reading “Frugality and Weight Management Part II”

Something strange has happened. I was reading through my previous posts to see to help reminisce about the year and what I’ve accomplished and I read my post about “Frugality and Weight Management” and how it seemed they went hand in hand. I started laughing while reading it because I felt so differently now. Continue reading “Frugality and Weight Management Part II”

It’s been a while. A little over two months since I’ve last written. It’s been a wild ride. I am now sitting in an office completing my fifth week of work with the best client and team I’ve ever had. We are almost fully moved into our apartment. All that is left is putting paintings on the wall.

It’s been a while. A little over two months since I’ve last written. It’s been a wild ride. I am now sitting in an office completing my fifth week of work with the best client and team I’ve ever had. We are almost fully moved into our apartment. All that is left is putting paintings on the wall.

Continue reading “Transition Complete: NYC to Seattle”

As you know, I have now maxed my 401K in six months of living in NYC to decrease my large state and city tax bill before we move. But I’ve been wondering how much money in state and city taxes I have saved by maxing this before I leave and how much of federal taxes have I saved by simply maxing this account. Continue reading “401K vs. NYC Taxes”

As you know, I have now maxed my 401K in six months of living in NYC to decrease my large state and city tax bill before we move. But I’ve been wondering how much money in state and city taxes I have saved by maxing this before I leave and how much of federal taxes have I saved by simply maxing this account. Continue reading “401K vs. NYC Taxes”

I now have more money saved than my current annual salary. In essence, I have someone that is as qualified and driven as me working for me full time. I now essentially have another Purple running around working even harder than I am to make money. Over time this money-made Purple will far outpace my ability to make money. And I couldn’t be more proud of her. I think of LinkedIn as a digital resume that is constantly knocking on doors asking who wants to hire me. And now I have a monetary twin who is constantly working to make me richer. Continue reading “Dividends & My More Successful Twin”

I now have more money saved than my current annual salary. In essence, I have someone that is as qualified and driven as me working for me full time. I now essentially have another Purple running around working even harder than I am to make money. Over time this money-made Purple will far outpace my ability to make money. And I couldn’t be more proud of her. I think of LinkedIn as a digital resume that is constantly knocking on doors asking who wants to hire me. And now I have a monetary twin who is constantly working to make me richer. Continue reading “Dividends & My More Successful Twin”

As of right now, June 1st, I have saved the same amount that I did in all of 2014. I was shocked when I realized this earlier today because I feel as if nothing is different. I haven’t deprived myself of anything. We still order delivery, have fancy drinks and give as freely as we did last year. I am just as happy if not happier. I mostly can’t figure out where we used to spend so much money that I could save $20,000 in 5 months when last year it took me 12. Yes saving wasn’t a major goal of mine and I did not have the wise guidance of Mr. Money Mustache, Go Curry Cracker and Root of Good’s blogs, but besides changing my cell phone carrier this month (which this month is more expensive than AT&T because of the upfront costs) I haven’t consciously changed anything about my life. If anything I thought spending was increasing as a result of the impending move. I will need to do a more in-depth analysis of Mint.com to see what has changed and where I used to spend more money, but right now I am shocked and ecstatic.

As of right now, June 1st, I have saved the same amount that I did in all of 2014. I was shocked when I realized this earlier today because I feel as if nothing is different. I haven’t deprived myself of anything. We still order delivery, have fancy drinks and give as freely as we did last year. I am just as happy if not happier. I mostly can’t figure out where we used to spend so much money that I could save $20,000 in 5 months when last year it took me 12. Yes saving wasn’t a major goal of mine and I did not have the wise guidance of Mr. Money Mustache, Go Curry Cracker and Root of Good’s blogs, but besides changing my cell phone carrier this month (which this month is more expensive than AT&T because of the upfront costs) I haven’t consciously changed anything about my life. If anything I thought spending was increasing as a result of the impending move. I will need to do a more in-depth analysis of Mint.com to see what has changed and where I used to spend more money, but right now I am shocked and ecstatic.

I thought maxing my 401K in 6 months when I’ve never maxed it in 12 would be difficult, but it hasn’t been. With the exception of some unanticipated giving this month I haven’t even had to reallocate funds from anything else to make sure I reach my goal. And it’s currently in sight. By the end of this month I will have maxed my 401K for 2015 and saved about $1,500 that would have originally gone to New York state and city taxes. I’ll post a full analysis of that in a later post, but overall I’m just shocked with how easy this has been. It makes me even more hopeful for the future and my long term goals.

There is about a month left on my 401K challenge and things are heating up. In a recent post I explained how I would be moving to Republic Wireless from AT&T and paying an early termination fee as well as buying a new phone. I’m currently unable to sell my iPhone unlocked because the jailbreaking community is waiting for Apple to release its latest iOS update (8.4). I paid about $300 for my new Android phone and will pay about $250 for the early termination fee while sitting on about $600 worth of iPhone potential. These unexpected expenses are making things a little tight.

There is about a month left on my 401K challenge and things are heating up. In a recent post I explained how I would be moving to Republic Wireless from AT&T and paying an early termination fee as well as buying a new phone. I’m currently unable to sell my iPhone unlocked because the jailbreaking community is waiting for Apple to release its latest iOS update (8.4). I paid about $300 for my new Android phone and will pay about $250 for the early termination fee while sitting on about $600 worth of iPhone potential. These unexpected expenses are making things a little tight.

And I did not help myself by increasing my 401K contribution from 55% of my salary to 60% – my paycheck this week was hilariously small. I should have enough money to pay rent on the day rent is due. Hopefully I will not have to dip into my funemployment money before then. I’m confident this will work out fine though. I’m leaving on vacation today and two days after I return my next paycheck comes in. Getting paid to vacation is the best. Let’s feel that burn and finish strong!

I’m half way through my “Maxing 401K in 6 Months” Challenge and I must admit I haven’t felt a difference. Despite my paychecks being half what they used to be I haven’t felt stressed or stretched. Saving in the current month for the next month’s rent has become routine. And the thrill I get seeing my 401K amount increase $1,500 every 2 weeks is something I can’t even describe. I’ve already saved $10,000 in my 401K and $11,000 overall this year and it’s the beginning of April. That’s 27.5% of my $40,000 savings a year goal which would double how much I saved last year.

I’m half way through my “Maxing 401K in 6 Months” Challenge and I must admit I haven’t felt a difference. Despite my paychecks being half what they used to be I haven’t felt stressed or stretched. Saving in the current month for the next month’s rent has become routine. And the thrill I get seeing my 401K amount increase $1,500 every 2 weeks is something I can’t even describe. I’ve already saved $10,000 in my 401K and $11,000 overall this year and it’s the beginning of April. That’s 27.5% of my $40,000 savings a year goal which would double how much I saved last year.