Similar to finance, before I started my path to financial independence, taxes baffled me. And when something baffled me – I didn’t want to do it 🙂 . I had classic “If I’m not naturally good at it, what’s the point?” syndrome. Continue reading “Credit Karma Tax Review: A Free & Awesome Filing Service”

Category: Taxes

The Month Of Birds: Early Retirement Month 5 (February 2021)

Another month of early retirement down and another intro where I express disbelief that time is flying so fast 🙂 . 2021 also seems to be going by faster than 2020, but maybe that’s because I’m used to pandemic quarantine life now…or maybe I’m just inviting the gods to prove me wrong in March – Please no 🙂 ! Anyway, fingers crossed this March is lightyears better than the last one. In the meantime, let’s get into what I got up to last month.

Continue reading “The Month Of Birds: Early Retirement Month 5 (February 2021)”

6 Months To Retirement: This Is Starting To Feel Real

Reality is setting in y’all. I feel similar to how I did right before we moved across the country without a house, job or knowing basically anyone on this side of the country. I had made the decision and I knew it was the right one, but it was still terrifying. I was leaving the best job I’d ever had behind, along with the best apartment I’d ever had and all the friends I’d made in my adult life. I was petrified. Continue reading “6 Months To Retirement: This Is Starting To Feel Real”

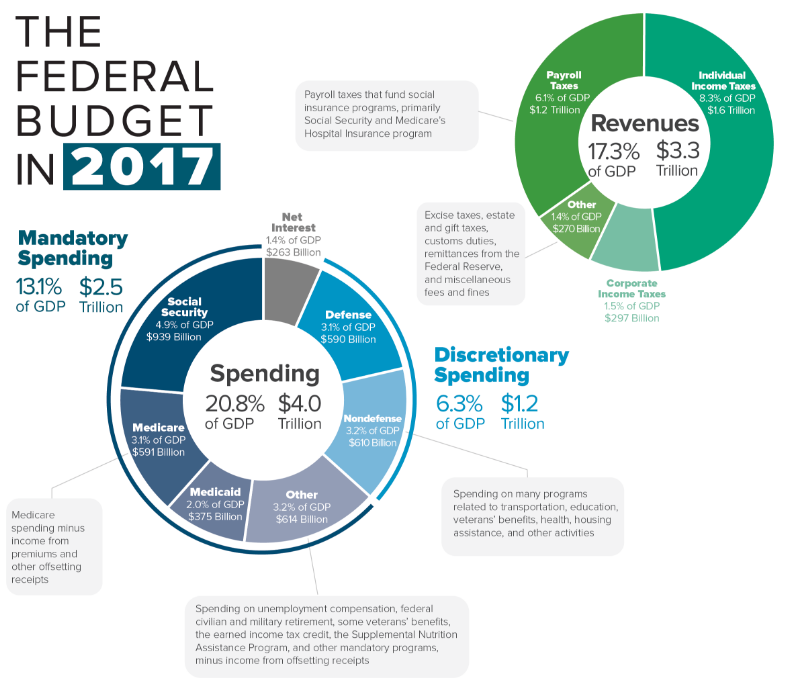

I Pay More In Taxes Than I Spend Annually

I love reframing how I view the world. A tax reform bill passed near the end of last year so taxes have been in the public eye for a bit now. Though I don’t agree with exactly how my tax dollars are spent I do not mind paying taxes. Every time I’m on a public road or see one of our public transit lines expand I think about how my money helped build that for myself and the community. This feeling is heightened when I learned that a 4 lane highway costs over $1 million PER MILE to build. Wowza. That’s a lot of cheddar. Continue reading “I Pay More In Taxes Than I Spend Annually”

2016 Taxes Conquered!

“I AM A GOLDEN GOD!!!” That’s what I kept screaming after I did my taxes, unassisted, for the first time tonight. It also happened to be me and my partner’s anniversary – the perfect time to run some numbers :). Despite how annoying and seemingly redundant our tax forms are I was so excited that I was able to do it on my own! Continue reading “2016 Taxes Conquered!”

401K vs. NYC Taxes

Taxes: Investment Accounts

2014 Taxes: Surprise!