Unfortunately this year Seattle seems to be living up to the ‘myth.’ Usually rain and clouds in this city are a temporary phenomenon. Rain is usually more of a mist, so much so that Seattleites don’t use umbrellas or rain boots – there’s usually no need. If you awaken one morning and it’s cloudy more often than not by the afternoon there will be nothing but blue skies. Even during the winter there is a large amount of sun – sometimes blindingly so (our windows face west and south). Continue reading “Rainy Seattle Myth = Reality?”

One of the things I want to learn in retirement is watercolor. I was feeling down a few weeks ago and started wondering – wait, why am I waiting until retirement? I’m still in this city for another 2.5 years. That’s plenty of time to learn a skill and get rid of any utensils I’ve collected for the hobby.

One of the things I want to learn in retirement is watercolor. I was feeling down a few weeks ago and started wondering – wait, why am I waiting until retirement? I’m still in this city for another 2.5 years. That’s plenty of time to learn a skill and get rid of any utensils I’ve collected for the hobby.  I started this blog over 3 years ago to catalog my journey to early retirement. Originally I just wanted to start writing and getting my thoughts down on ‘paper’. As a result I didn’t take basically any time to decide on my platform. I typed in “free blog” into Google and (of course) Blogger, their subsidiary, was the first hit.

I started this blog over 3 years ago to catalog my journey to early retirement. Originally I just wanted to start writing and getting my thoughts down on ‘paper’. As a result I didn’t take basically any time to decide on my platform. I typed in “free blog” into Google and (of course) Blogger, their subsidiary, was the first hit.  Something shocking happened at work. I was hosting an event to share recent vacation pictures with the group. Our other presenter had recently spent a month in Mexico. He even wrote a blog post for our company about how to successfully work from anywhere. He used 2 weeks of PTO to basically work half time and extend his time there. Their main goal for the trip was to look into buying a house near Puerto Vallarta.

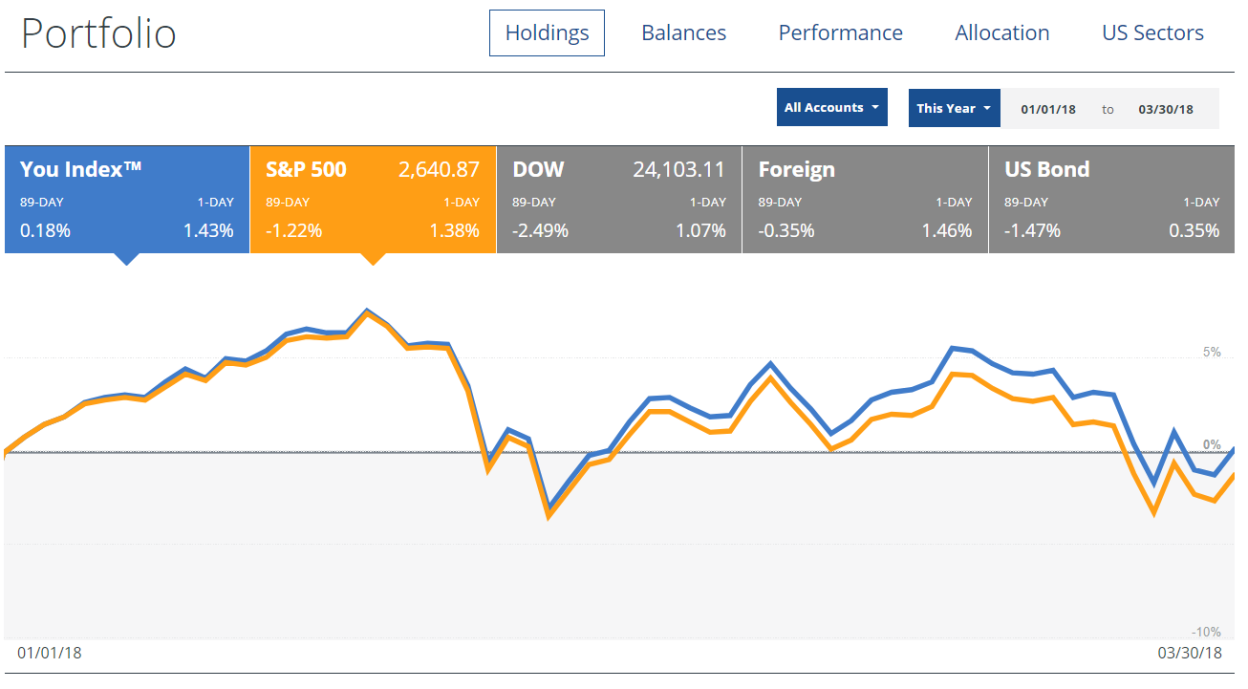

Something shocking happened at work. I was hosting an event to share recent vacation pictures with the group. Our other presenter had recently spent a month in Mexico. He even wrote a blog post for our company about how to successfully work from anywhere. He used 2 weeks of PTO to basically work half time and extend his time there. Their main goal for the trip was to look into buying a house near Puerto Vallarta.  The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings.  It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.