As an exercise I wanted to make sure that my retirement budget of $20,000 could include my current spending and items I need to add in retirement, which I’ll detail below. I’m happy to report that it’s looking really good! Let’s see what’s inside: Continue reading “Projected Retirement Budget”

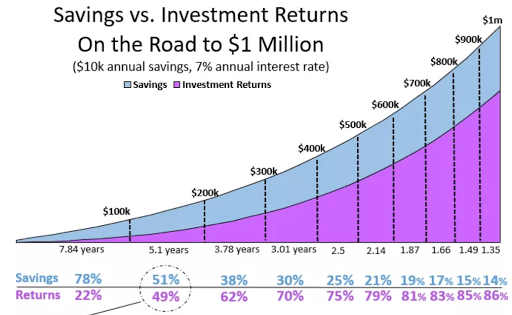

Market Noise > Contributions

This graph was made by the lovely Four Pillar Freedom.

We’ve reached the threshold. My monthly contributions to my investments are almost completely obscured by the market noise. I now add 2% of my current net worth to my investments each month and recent daily fluctuations have been more than that: Down 2.5%, Up 2% etc. I think I’ve reached what a new favorite blogger of mine Four Pillar Freedom describes as the point when the market makes a bigger impact than your contributions. Continue reading “Market Noise > Contributions”

Cashing In On Buzzwords

I need to rant for a minute. Originally when I entered the work world I thought I was simply missing something, but after 7 years I can confidently say this: People like to cash in on buzzwords. Buzzwords they use incorrectly, buzzwords they don’t understand. The people they’re selling to also don’t seem to know what they’re talking about and don’t seem to care. Continue reading “Cashing In On Buzzwords”

I need to rant for a minute. Originally when I entered the work world I thought I was simply missing something, but after 7 years I can confidently say this: People like to cash in on buzzwords. Buzzwords they use incorrectly, buzzwords they don’t understand. The people they’re selling to also don’t seem to know what they’re talking about and don’t seem to care. Continue reading “Cashing In On Buzzwords” Constant Low-Level Stress

I’ve been working for almost 7 years and I have always had a hard time pinpointing exactly why I dislike traditional work so much. After help from my partner I’ve figured out one of the reasons. The 9-to-5 work schedule was originally created in the Industrial Revolution with physical laborers in mind. 8 hours being a cog in a factory gives you another 8 hours with your family (theoretically) and another 8 hours to sleep. Perfect! Continue reading “Constant Low-Level Stress”

I’ve been working for almost 7 years and I have always had a hard time pinpointing exactly why I dislike traditional work so much. After help from my partner I’ve figured out one of the reasons. The 9-to-5 work schedule was originally created in the Industrial Revolution with physical laborers in mind. 8 hours being a cog in a factory gives you another 8 hours with your family (theoretically) and another 8 hours to sleep. Perfect! Continue reading “Constant Low-Level Stress”

Rainy Seattle Myth = Reality?

I’ve espoused before about how “Rainy Seattle” is a myth used to keep people from moving here in droves. Given how it’s the fastest growing city in the country it obviously didn’t work!

I’ve espoused before about how “Rainy Seattle” is a myth used to keep people from moving here in droves. Given how it’s the fastest growing city in the country it obviously didn’t work!

Unfortunately this year Seattle seems to be living up to the ‘myth.’ Usually rain and clouds in this city are a temporary phenomenon. Rain is usually more of a mist, so much so that Seattleites don’t use umbrellas or rain boots – there’s usually no need. If you awaken one morning and it’s cloudy more often than not by the afternoon there will be nothing but blue skies. Even during the winter there is a large amount of sun – sometimes blindingly so (our windows face west and south). Continue reading “Rainy Seattle Myth = Reality?”

A Minimum Wage Employee By My Side

I just realized that my passive income from investments (assuming an average 7% market return) has now surpassed what a minimum wage employee would make working 40 hours a week, 52 weeks a year. WOWZA! At the beginning of 2018 I had $237,000, which would generate $16,590 at 7% while a minimum wage employee would receive $15,080. That’s wild!

I have an invisible minimum wage employee working hella hard while I sleep, away from my day job, which I think is a very cool idea. I’ve touched on this phenomenon in a previous post, but she was just a teenager working part time after school then. Now she’s a full-timer. This just got serious!

Now we should probably working on raising that minimum wage (Washington did recently) so the average isn’t so low!

Watercolor & Calligraphy: New Hobbies?

One of the things I want to learn in retirement is watercolor. I was feeling down a few weeks ago and started wondering – wait, why am I waiting until retirement? I’m still in this city for another 2.5 years. That’s plenty of time to learn a skill and get rid of any utensils I’ve collected for the hobby. Continue reading “Watercolor & Calligraphy: New Hobbies?”

One of the things I want to learn in retirement is watercolor. I was feeling down a few weeks ago and started wondering – wait, why am I waiting until retirement? I’m still in this city for another 2.5 years. That’s plenty of time to learn a skill and get rid of any utensils I’ve collected for the hobby. Continue reading “Watercolor & Calligraphy: New Hobbies?”

Moving from Blogger to WordPress

I started this blog over 3 years ago to catalog my journey to early retirement. Originally I just wanted to start writing and getting my thoughts down on ‘paper’. As a result I didn’t take basically any time to decide on my platform. I typed in “free blog” into Google and (of course) Blogger, their subsidiary, was the first hit. Continue reading “Moving from Blogger to WordPress”

I started this blog over 3 years ago to catalog my journey to early retirement. Originally I just wanted to start writing and getting my thoughts down on ‘paper’. As a result I didn’t take basically any time to decide on my platform. I typed in “free blog” into Google and (of course) Blogger, their subsidiary, was the first hit. Continue reading “Moving from Blogger to WordPress”