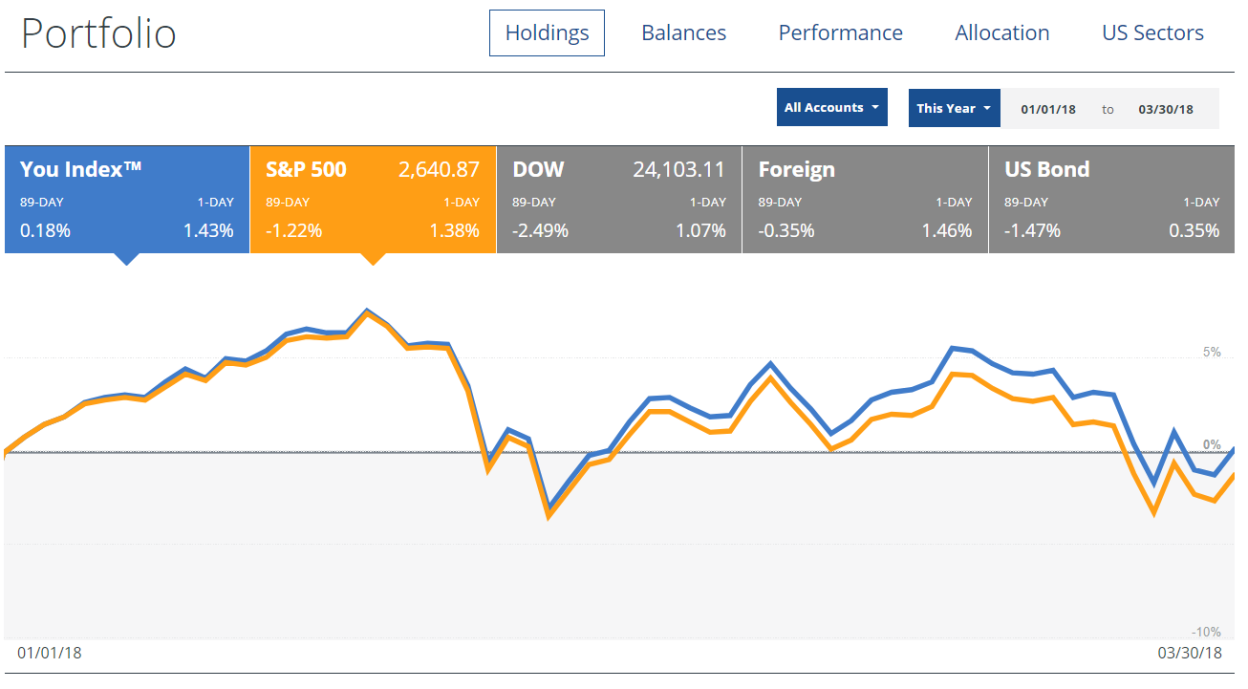

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings. Continue reading “A Flat Market = No Problem”

The end of Q1 2018 has me at about 0% market gains for the year (while the S&P 500 is down -1.22%). This inspired me to do a thought experiment. What if the highly improbable happened and the market remains stagnant at a 0% gain until I retire? How long would that add to my working career? My initial thought was several years since the average of 7% would add $17,850 to my current portfolio so my savings for the year would be made of approximately 20% gains and 80% savings. Continue reading “A Flat Market = No Problem”

Sweet Sweet Dividends

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

It’s the end of Q1, which means it’s once again DIVIDEND SEASON! I look forward to it every 3 months because even though I know this is a distribution from the 3,000+ businesses I partially own it still feels like it’s free money that’s dropped into my account.

So how did I make out this quarter? Like a bandit if I do say so myself! I made $787.04 from my investments. That’s a 43% increase from last year! Yes my investments have increased 56%, but that’s besides the point 🙂 . Just assuming an overall 43% increase from last year’s dividends of (even though it will be more) I’ll receive $3,916.04 in dividends in 2018. Woah. That’s like 2 weeks of salary! And I’ll receive it no matter what the market does (we’re down 1% for the year at the time I write this). An extra half a month’s salary no matter what. I like the sound of that. To next quarter!

Q1 Budget Check-In 2018

Singapore: A Travel Blog

SINGAPORE

SINGAPOREWelcome to Disneyland! Jk – it’s Singapore. And it’s basically a grown up Disneyland. I had no expectations when visiting Singapore, but was quickly blown away. I also realized that this is the first vacation I’ve taken in a few years that was not based on luxury and beach relaxation. Instead I was being a real explorer again! So I’ve decided to start a new series that catalogs tips I learned during my travels and how much it cost. Continue reading “Singapore: A Travel Blog”

Locked Retirement Date: October 2, 2020

I seem to change my mind annually about my retirement date – not just when it is based on math, but if I even am locked into a date or a number. Once again I’ve changed my mind 🙂 . As I’ve mentioned, current numbers including my raise show me solidly retiring in 2020 assuming average market growth and the same amount of stretch bonus as I received last year. If I continue to receive a 4% raise each year (as my boss claimed we would) my date is at the beginning of November with 7% market returns, October with 8% and mid-August with aggressive 10% growth. Continue reading “Locked Retirement Date: October 2, 2020”

I seem to change my mind annually about my retirement date – not just when it is based on math, but if I even am locked into a date or a number. Once again I’ve changed my mind 🙂 . As I’ve mentioned, current numbers including my raise show me solidly retiring in 2020 assuming average market growth and the same amount of stretch bonus as I received last year. If I continue to receive a 4% raise each year (as my boss claimed we would) my date is at the beginning of November with 7% market returns, October with 8% and mid-August with aggressive 10% growth. Continue reading “Locked Retirement Date: October 2, 2020”

The Crypto Craze

It’s times like these that I am so glad I started this blog. It will be very interesting to look back on this post years from now and see how things turned out with the latest rage: Cryptocurrency. I first heard about Cryptocurrency when Bitcoin started getting press when I was still at Company 2 in 2012 and since then it has slowly grown in media attention and been joined by a host of new coins, some too ridiculous to believe (e.g. Garlic Coin anyone?) Continue reading “The Crypto Craze”

It’s times like these that I am so glad I started this blog. It will be very interesting to look back on this post years from now and see how things turned out with the latest rage: Cryptocurrency. I first heard about Cryptocurrency when Bitcoin started getting press when I was still at Company 2 in 2012 and since then it has slowly grown in media attention and been joined by a host of new coins, some too ridiculous to believe (e.g. Garlic Coin anyone?) Continue reading “The Crypto Craze”

2 Weeks Off Keto

I originally started keto on January 4, 2017. On February 13, 2018 I traveled to Singapore. Almost exactly a year before that I was on my way to Thailand – only 1.5 months into my keto journey and ready to give it all up for 2 weeks to experience this new country. Continue reading “2 Weeks Off Keto”

I originally started keto on January 4, 2017. On February 13, 2018 I traveled to Singapore. Almost exactly a year before that I was on my way to Thailand – only 1.5 months into my keto journey and ready to give it all up for 2 weeks to experience this new country. Continue reading “2 Weeks Off Keto”

Exposure Therapy

One of my favorite bloggers GoCurryCracker has a wonderful article on Exposure Therapy. He basically gives advice that is contrary to a lot of other finance bloggers who say ignore the stock market completely (which I would argue is a little impossible in our tech heavy, media heavy world). GoCurryCracker suggests that yes we should ignore it as in not change our plans based on it, but that we should also pay attention when it drops so we can see how we feel ‘losing’ money.

One of my favorite bloggers GoCurryCracker has a wonderful article on Exposure Therapy. He basically gives advice that is contrary to a lot of other finance bloggers who say ignore the stock market completely (which I would argue is a little impossible in our tech heavy, media heavy world). GoCurryCracker suggests that yes we should ignore it as in not change our plans based on it, but that we should also pay attention when it drops so we can see how we feel ‘losing’ money.