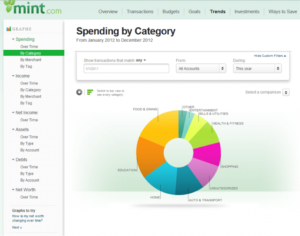

Mint.com has been indispensable in understanding my first years of adult life and what I spent money on. Mint.com was also the way I truly realized how much money I have spent living in one of the most expensive cities in the world. Looking at the overall cost, I could have bought a house in a different major city instead of living in various apartments with large numbers of roommates. Mint.com helped me see how much I had actually spent not only on housing, but also restaurants and bars out. And that has been amazing – in retrospect – but Mint.com is not very helpful in changing actual behavior in the moment. It tries to be through its various budgets, but unfortunately doesn’t seem to follow through. Their budgeting feature seems to be thrown in as an afterthought instead of part of their main purpose.

My other concern with Mint.com is their ridiculous number of ads. The largest spaces on their website and mobile app – even though they are both ‘newly designed’ are from advertisements. I understand that the ads for recommended banks, investments and credit cards is how they are able to provide this free service but it feels a bit obnoxious. Another concern is that once you delete an account (including an investment account) Mint.com doesn’t allow the history of that account to be added back into your Mint.com overview despite that information being available to it. It’s frustrating specifically when looking at investments and net worth. However, overall I appreciate Mint’s service and will be keeping them around to understand my spending while in New York and how it will change in the future.