My mom has never liked working. From an early age I would hear her express how pointless and silly office politics were. How the business world seemed to operate by rules that went against common sense. How arrogance and loudness were rewarded while simply completing your work was not. I knew early on that that was not the life I wanted for myself, which is one of the reasons I looked into advertising. It did not seem like the typical corporate environment that I had seen growing up.

It was my mom that instilled in me the basic values of financial strength: never have a balance on your credit cards and always pay them on time, having an emergency fund and (as her parents taught her) don’t succumb to lifestyle inflation: when you receive a raise or promotion immediately save that extra amount and financially act like nothing has changed. She was also the one that encouraged me to contribute to my 401K my first year of work. She didn’t start saving for retirement until her 40s, a typical tale. But by the time I stepped into the workforce she’d learned a lot about the benefits of starting much earlier and passed that on to me. So I called her financial advisor asking what the 401K options meant and took his advice for which one to pick (a poor choice unfortunately, but one I corrected fairly quickly).

My Mom first taught me what a side hustle is and said to never have only one income stream. While she was working 5 days a week in corporate america, at night she would teach classes with her MBA. Another year she started her own business. A different year, her own consultancy. My step dad was a salesman and for a long stretch had his own business. It was also my Mom who first explained how starting your own business is a great thing not only for entrepreneurship, but for tax purposes.

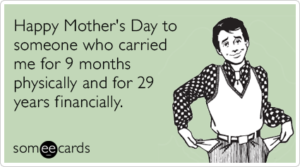

It was this foundation of saving and not spending money on frivolous things that shaped me into who I am today. Growing up my mother did not spend money on clothes, shoes or make up. Her only large expenses now are lavish vacations for her and I (but as I mentioned in an earlier post I’m trying to decrease that cost with travel hacking). My step dad is a fairly frugal man and often did a lot of price shopping and DIY research before making a purchase. Now that the kids are out of the house and I’m much further down my own F.I. journey I have seen some lifestyle creep happening in my parent’s household, but based on their calculations they can more than afford it. Their nest egg allows them to continue and even slightly increase their lifestyle. And if they can do that in 15 years with 3 kids that they helped through college, there is no question that I can in 10 years or less.

My obsession with efficiency, budgeting and investing has helped me dive deeper than even she has while relying on financial and tax advisers. Now my idea of fun is reviewing her investments, teaching her about index funds and seeing what kind of tax refund we’ll be receiving. I’m still trying to help her see this as fun, but I’m so glad we can share this together. My Mom is one of the main reasons I want to reach F.I. so quickly: to spend as much time with her as I can. I am incredibly grateful for my Mom and extremely inspired by what she has been able to do in a small amount of time. And I can’t wait to join her in Financial Independence.

This post warms my heart. Thanks for sharing.

I’m so happy to hear that! Thanks for reading 🙂 .