We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation).

We’re halfway done with 2018 and this year is both crawling and flying by. Let’s check in on my goal to decrease my spending to $18,360 this year ($18K + 2% inflation).Monthly Bills (including Rent, Utilities, Internet, Phone and Transit)

- January: $962.90 – We we forced to buy rental insurance for the first time. Streak broken 🙁

- February: $965.64

- March: $911.94

- April: $951.96

- May: $891.52

- June: $985.01

- Average: $944.83

CHANGELINGS

Groceries

- January: $158.53

- February: $93.93

- March: $134.14

- April: $146.14

- May: $78.97

- June: $71.67

- Average: $113.81 – This is $18/month or 14% less than last year!

Eating Out

- January: $42.06

- February: $64.57

- March: $130.46 – We went wild this month, taking advantage of a Wagyu beef special, going to brunch and while my partner was away I went out with lots of friends

- April: $12.50

- May: $20.31

- June: $53.05

- Average: $54 – Less than last year!

Alcohol

- January: $57.15

- February: $43.92

- March: $85.48 – My partner was gone for a week so I went out with friends more than usual

- April: $31.59

- May: $49.18

- June: $55.36

- Average: $57.26

Parties (Bringing food and drinks to people’s houses for parties)

- January: $6.50

- February: $0!

- March: $39.46

- April: $13.01

- May: $14

- June: $35.25

- Average: $17.71 – Less than last year!

LONGTERM

Giving

- January: $25

- February: $0

- March: $0

- April: $0

- May: $0

- June: $0

- Average: $4.16 – Much less than the $41.37 per month I spent last year!

Electronics

- January:$0

- February: $0

- March: $0

- April: $0

- May: $0

- June: $10.09 – The taxes on a free $120 Kindle Paperwhite

- Average: $1.68

Taxes

- January:$0

- February: $0

- March: $0

- April: $1,475 – I earned more money than anticipated last year so I owed the IRS some money. Woe is me 🙂

- May: $0

- June: $0

- Average: $246

Credit Card Fees

- January:$0

- February: $0

- March: $0

- April: $0

- May: $0

- June: $95 – The annual fee for my Chase Sapphire Preferred, which is my trip insurance and in all previous years has paid for itself when I’m stranded in a city overnight and need a last minute hotel

- Average: $15.83

RAINY DAYS

Household Goods

- January: $8.15

- February: $15.01- Including our first purchase of Drano! We’re such adults

- March: $16.19 – Batteries are expensive!

- April: $4.49

- May: $8.18

- June: $3.06

- Average: $9.18 – 29% less than last year!

Personal Products

- January: $0!

- February: $6.50

- March: $10.25

- April: $8.98

- May: $0!

- June: $0!

- Average: $4.29

Clothing

- January: $0!

- February:$0!

- March: $20.42 – I bought a new bikini for our Ecuador trip because my partner informed me that the last one was falling apart. 10 years for a Target bikini isn’t bad!

- April: $0!

- May: $0!

- June: $0!

- Average: $3.40 – This is higher than my $0 from the same period last year 🙂

Entertainment

- January: $11.50 – Bought a childhood favorite game: Age of Empires while it was 75% off

- February: $16.82 – Black Panther theater ticket and Blade Runner 2049 Redbox

- March: $30.48 – Sims 4 Cats & Dogs! Coco and Jumanji on Redbox

- April: $32.35 – I bought watercolor supplies to try a new hobby and tickets to Pacific Rim 2 (the abomination)

- May: $19.85 – I bought a full priced ticket to Deadpool 2. No regrets!

- June: $6

- Average: $19.50

Furniture

- January: $0

- February: $0

- March: $137.62 – We bought a portable air conditioner to make Seattle’s increasingly hot summers bearable. Look at us being so fancy!

- April: $0

- May: $0

- June: $0

- Average: $22.94

Grass

- January: $18

- February: $0

- March: $0

- April: $0

- May: $0

- June: $0

- Average: $3

Medical

- January: $13.75 – I was sick for 24 hours and loaded up on sugar free cough drops and drugs for the flight home

- February: $0

- March: $0

- April: $0

- May: $0

- June: $0

- Average: $2.29

VACATION

Vacation Spending

- January: $49.26

- February: $191.77 – Singapore

- March: $0

- April: $68 – This is for 3 campsite reservations of 2 nights each around Washington

- May: $75.81 – This was remaining camping expenses and our trip to Ecuador

- June: $200.41 – Ecuador and Camping

- Average: $97.52 – 15% less than last year!

Travel

- January: $446.40 – Roundtrip summer flight to ATL for 2 weeks

- February: $775.70 – Christmas flights: 2 weeks ATL, 1 week HF

- March: $0

- April: $80.98 – Taxes for my travel hacked flight to Costa Rica

- May: $0

- June: $0

- Average: $217.18 – This is $72.52/month less than the $289.70 average from last year!

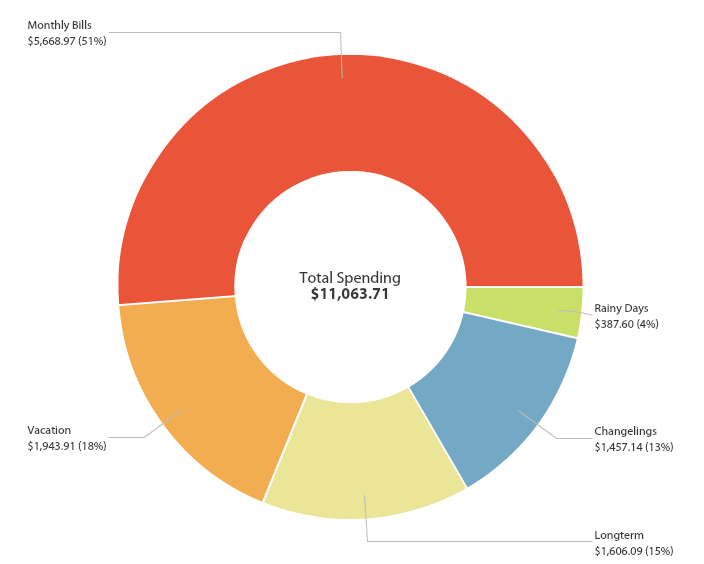

H1 AVERAGE MONTHLY SPENDING: $1,843.95

– Minus flights and one-time expenses: $1,342

So far this year I’ve spent $11,063.71, 60% of my $18,360 goal, and that includes all the flights I’m buying this year for $1,303.08, $1,475 on taxes and $95 in annual credit card fees. If the rest of my spending stays the same and I remove those one-time expenses I’m projected to spend $19,115.71 in 2018. I’m projected to be $755.71 or 4% over my goal. No big deal. I guess it’s a good thing I decided to chill out about this stuff huh 🙂 . To the rest of the year!