A reader requested that I post about my early retirement strategy. Thanks for the suggestion Palmetto Millennial!

My Situation

First I’m going to set the stage. I have read everything I can get my hands on about how to retire early and the different methods people have used. I understand the many risks: sequence of returns, an under-performing market, hyperinflation, chronic medical issues etc. But one thing makes me feel completely comfortable with my plan: I only have myself to take care of. I have no husband (my partner and I aren’t getting married and will always have separate finances), no kids (we’re childfree for life), no pets, no house, no car – basically no responsibilities (which is our motto actually. We’ve joked about having it made into a family crest). I have no obligations: no bills coming in that I can’t cancel immediately (such as my month-to-month Republic Wireless phone bill).

When I retire my partner and I are planning to sell all our stuff and be location independent for the near future. My luggage goal is to live out of a backpack like FIRECracker and Wanderer from Millennial Revolution. My partner is less ambitious (or crazy – depending on your perspective…) and will be bringing a rolly bag for the rest of his stuff. We’ll settle down in an AirBnB in different US and global cities every 3 months while my partner is still working. Then when he retires as well a few years later we can speed our travel up a little.

I say all this to explain that unlike a lot of bloggers I read, in the near future I will have no real fixed costs besides my annual healthcare premium. After a few years of slow travel we might settle down somewhere for longer, we might decide to move to Mexico for a year – that’s for Future Me to decide. I understand that things change and that’s why flexibility is at the core of my plan. I know that I’ll need to stay alert and adapt if the future deviates from historical trends or if my life situation drastically changes. However, I know I can do so because as Mr. Money Mustache wrote “It’s all about the safety margin” and my flexibility creates a large one that gives me comfort.

So even though I have planned my retirement based on the greats before me who have been successfully retired for many years, I have a slightly different situation that would allow me to drastically change my life and costs at the drop of a hat if needed. I lovingly refer to my strategy as a “balls to the wall” approach. [FUN FACT: For some reason most people (my younger self included) think that phrase is referring to male anatomy. Not the case! It’s actually a term used by pilots when they want to accelerate quickly. They have to push the throttle (the top of which is a ball shape) all the way to the panel (the wall). Learning new things is sweet!]

The Plan

So what IS the plan? It’s pretty standard. I’m using the 4% SWR from the Trinity Study as a baseline. Four Pillar Freedom recently shared an analysis of the updated Trinity Study data that includes retirement time frames up to 2017. Surprisingly it’s more optimistic than I imagined! So the 4% SWR gives me a goal of 25x my annual expenses, which are currently between $18-20K while living in the expensive metropolis of Seattle. So to be on the safe side, I’m aiming to have $500K invested in 100% stocks to retire (If you’re interested, this article by Go Curry Cracker explains the benefits of an all stock allocation).

When I retire I’m planning to let my taxable dividends be transferred to my savings account to live off of. Then I will cash in some taxable capital gains to cover my remaining living expenses. At the same time, while my income is non-existent, I will be using a Roth Ladder as described by the Mad Fientist and Root Of Good to slowly move the money I’ve accumulated in my Traditional IRA into a Roth IRA so I never pay tax on it and so I don’t get hit with huge RMDs later in life (for info on RMDs see this article by JL Collins). This will also allow me to access my tax-advantaged accounts before 59.5.

Combatting Risk

So those are the broad strokes. To combat sequence of returns risk in my first 10 years I am willing and able to cut my spending to $16,500. I’ve run the calculations in cFIRESim (FIRECalc doesn’t let you show this kind of variable spending) and I have 100% success rate based on the last 147 years of historical data (yes I know the past can’t predict the future 🙂 , but it’s what we have for planning purposes). In these calculations I never run out of money even though I don’t count on receiving a dime of Social Security (which I will), even after a 70 year retirement (though based on my family history I doubt I’ll live that long…moooorbid alert!) Anyway, with a little bit of geo-arbitrage and travel hacking I can easily bring my spending down to that level without changing my standard of living. Flexibility is a key ingredient that makes me feel comfortable with my plan.

I’ve also been playing around with the idea of a cash cushion going into retirement like Millennial Revolution uses. A cash cushion is a stash that would cover about 3 years of living expenses. In case there’s a market downturn in the first few years of my retirement I can pull from this stash instead of selling my stocks at lower prices. I’ve been vacillating back and forth on that. On one hand the simulations work just fine without it, even in the financial shitstorms of 1929 and 2008. Also I feel antsy about having several years of expenses sitting by the sidelines in cash. On the other hand it might be the safe and smart move…though that doesn’t sound very “balls to the wall” does it? 😉

UPDATE: For a more detailed and in depth explanation of my strategy and why I’m comfortable with it check out my post here.

So what do you think of my strategy? Too wild? Too conservative?

Your plan sounds great to me. Being flexible is a key aspect to any FIRE plan. Keep in mind that if the fit ever hits the shan, you can always go back to work and employ my favorite trick: the 100% savings rate! Best of luck as you go forward crushing your plan. Ed

So glad it sounds great! And yes I am definitely willing to go back to work if I end up in a ‘failed’ retirement scenario. If I ever get to a 100% savings rate I will be a happy camper. And thank you!

The 100% savings rate is legit the most comforting concept… Somehow that possibility had never occurred to me!

Me either – Millionaire Educator is laying down the knowledge 🙂

Cool that you shares this. A good plan. Although don’t be to sure on the non kids stuff. Once you hit thirty – 35 this could change. Also the plan to travel is awesome, but from experience (also watch expedition happiness, and into the wild) after a few years you probably find a good place and get settled. So you might have to make some investments there. Thanks for sharing your story!

Nice plan and explanation! It is good to see how others are planning their FIRE in advance. Maybe I will have a similar post in a few years!

Glad you like it! I look forward to reading your post in the future 🙂

You’ve obviously spent quite a bit of time thinking this through. Cheers to you on these last two years too you’re there!

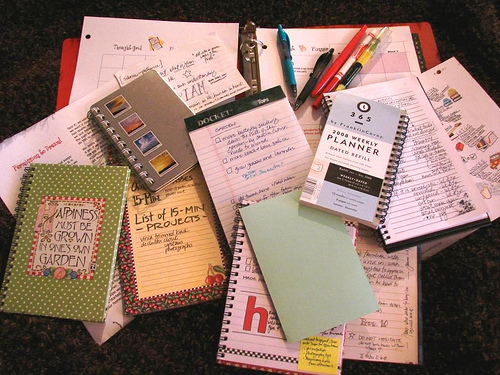

What gave me away 🙂 ? *attempts to hide a mountain of planning notebooks behind her back.* And thank you!

Seems legit. What’s your post-FIRE budget? $17500/yr = $1458/mo. And that’s a 3.5% withdrawal rate on a half million.

I figure we live on about 2x that pretty normally though we have a paid off house in a moderate COL area so it’s almost housing cost-free (pesky insurance, taxes, maintenance aren’t free).

Haha – you thinking it “seems legit” is a high compliment for me 🙂 . I’m giving myself a range for a post-FI budget since I know spending fluctuates. I spend about $18.5-$20K now and think with any additional expenses (more expensive health insurance etc) I’ll be solidly around $20K though I can trim that if necessary. I actually wrote about my assumptions in the post here if you want to check it out. Thank you for commenting!

Well I learned something new today – I was so wrong with my understanding of balls to the wall!

Seems like a good plan to me given your aspirations for your nomadic lifestyle. But will you have room in your backpack for all your notebooks & calculators…..? 😀

Right?! I was surprised to learn that and it made me like the phrase even more. The real meaning is a lot more badass.

Hahaha – I will not and that’s part of the point for me. I have WAY too many notebooks. I use all of them, which is good, but I’m going to have to cut back to one at a time.

Love your all out approach to achieve your goal! I’ll be rooting you on for the next two years!

Thank you – that means a lot!

Wow, retire at 30! I love that you want to be local independent in the near future to see more of the world. How exciting. I will be rooting for you and will be learning from you as well.

Yeah – we’ll see if it works out 🙂 ! Thank you so much! Thanks for stopping by.

I seriously love your strategy, Purple Life! I am taking a similar approach as the “no responsibilities” model. There’s not many people out there taking this approach so I always appreciate hearing someone else that understands my perspective. Regarding your strategy, I think the 25x strategy makes perfect sense. And you also factored in for change. I think it’s a good strategy because it’s based around your passion for travel. It’s sounds very specific and purposeful to me. Thanks for sharing.

Hello Fellow No Responsibilities Haver! You can share our crest when we make it. Thanks for weighing in on the strategy. I think it’s a good plan, but know better than to believe I can plan for everything 🙂 . It’s also great to know someone with a similar situation is out there. Thanks for stopping by!

Interesting. On the question of cash cushion I have to admit I have one – three years expenses by coincidence. Not only does it provide a certain security, but I like to have some extra cash on hand should buying opportunities arise – if the market takes a dump I already have a list of businesses I want to buy into. I keep one year in a high-interest savings account and two years in a tax protected savings account. Not the best returns but I sleep well at night.

I’d be interested to get your thoughts on side hustles – do you have any side businesses apart from selling items on Amazon? I do part-time tutoring which is quite lucrative and occasional freelance Python programming, which is even more lucrative.

That’s interesting – I wasn’t even thinking about using the cash for buying opportunities. I think that would be the same time (down markets) where I would want to use it for living expenses instead and so would hesitate to switch its purpose. Whatever makes you sleep well at night sounds awesome to me!

I think I’m the odd-one out with my side hustle thoughts 🙂 . In fact I wouldn’t call me selling old books on Amazon even a side hustle since I haven’t done it for year and when I did it was max 1 book/month and I didn’t do any promotion really – I just took it to the post office. Anyway, overall I require a lot of downtime to function (or some might call it lazy…) and find it hard enough to kick ass at my career, my relationship, maintain friend circles, travel and have this blog so that’s all I’m doing right now 🙂 . Part-time tutoring and Python programming sounds awesome!! So glad it’s lucrative and good on you for being able to juggle that with your other responsibilities! Thanks so much for stopping by.