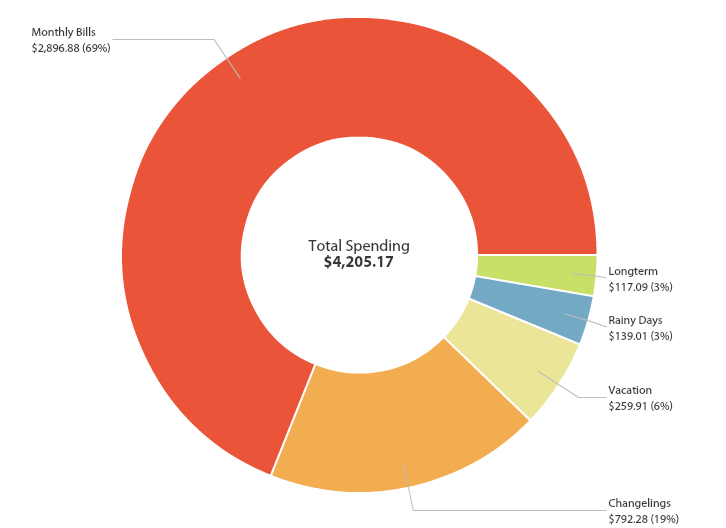

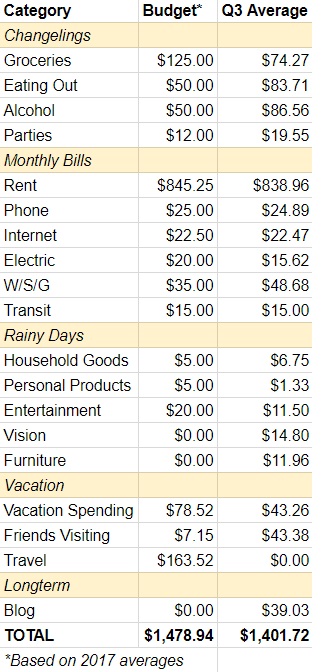

How is 2018 75% done?! I am both skeptical and surprised. Above is a snapshot of my Q3 spending from YNAB. Let’s get into the nitty-gritty:

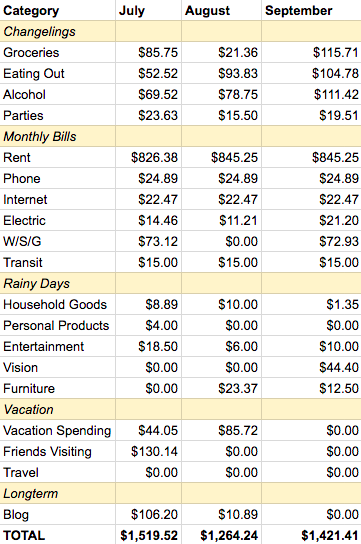

And for a month by month breakdown:

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month. So what happened this quarter? An explosion of spending is what! Despite spending less on groceries my increases in eating out, alcohol and parties (bringing wine and food to other people’s houses) more than overtook it. It was an awesome summer and with the lovely weather usually comes some fun times and an increase in going out. This is the result. I don’t regret spending the money, but I can work on suggesting more frugal activities going forward.

But in the meantime, let’s revel in what this cash did buy me: For eating out I went out a total of 5 times this month. I enjoyed 2 meals with far away friends, 1 lovely date night with my partner and 2 awesome FIRE meet ups. The previous two months followed a similar pattern.

As for alcohol, I bought some whiskey to share with family while I was home in Atlanta, got a Bloody Mary during a FIRE meet up and had some wine out with friends. I also enjoyed wine at a reading party that I shared on Instagram. It seems like the main culprit here was drinking out instead of at friend’s houses. Issue identified! Let’s remedy it.

MONTHLY BILLS

Pretty self-explanatory. This section doesn’t vary a lot month to month. The only changes included a slight rent increase for our apartment.

RAINY DAYS

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds. This quarter that included a $30 TV (stand included for free!), $25 to recycle our old TV at Best Buy and $44 for an eye exam and glasses from Zenni Optical. As for entertainment, I played Duffleboard for the first time, which was tons of fun, saw the Incredibles 2 in theaters (it was awesome) and paid for our Netflix subscription. Not bad at all!

VACATION

Not much happened in the vacation category since I bought all my flights near the beginning of the year. This quarter my friend from NYC visited and I have a category called “Friends Visiting” so I can see how much I spend per friend. It’s really nerdy and I love it. That way I can properly budget based on who’s coming to visit! With her we went on the ferry, wine tasted, went on a brewery cruise, had amazing sushi, sensational tex-mex and made sous vide steak! As for Vacation Spending this included visiting Portland to work from there for a week with my family, eating out a few times in Atlanta and a camping trip. I’m happy with this level of spending – let’s keep it up!

LONGTERM

This category is for you guessed it “longterm” items that come up rarely. The entire list includes the blog, my bike, electronics, taxes, credit card fees, and moving expenses. This quarter the only one of those that happened was launching my blog! These costs included 3 years of hosting and 1 year of protecting my information from the internet.

OVERALL

So far this year I’ve spent $15,268, 83% of my $18,360 goal, and that includes all the flights I’m buying this year for $1,303.08, $1,476 on taxes, $173.49 on furniture, $117.09 on the blog, $95 in annual credit card fees and $44.40 on my vision. If the rest of my spending stays the same and I remove those one-time expenses I’m projected to spend $19,287 in 2018. That’s $927 or 5% over my goal. Not ideal, but also not bad. Let’s see if I can inch that projection a little closer to my goal by the end of the year. To the rest of 2018!

What about you? How has your spending been lately? Are you on track to reach your annual goals?

Good job on keeping track of your spending 🙂

My September was a little high due to my son’s track & field activity and had to pay my lawyer $2,700 !! I am in the process of being laid off and hired a lawyer to get the best deal I can.

So far she is just costing me money:(

My monthly report won’t look as good as yours!

It’s an obsession of mine I must admit…Oh no! I’m sorry your September was higher than expected. And those lawyer fees YEESH! I hope she ends up saving you money – if not, I’m sure there are a lot of “rate your lawyer” type sites so you can save someone future heartache. Smart to get a lawyer while getting laid off though! I’ve been laid off 3 times and never did that. Might need to add it to my to do list just in case. Thank you for stopping by!

Oops, I’m definitely part of that uptick on restaurant spending! At least next time I’ll be feeding you at my house 😉

Hahaha – I wasn’t going to call you out, buuut…No I’m kidding. I had a wonderful time. Worth it! And yay future frugal hangouts!

I can’t believe it’s October already either!

My spending is always higher in the summer because we’re out doing things so much more. When it gets cold I go into hibernation mode and there are far fewer patio beers and random bike rides for ice cream. I tend to go over budget in the summer but then play catchup during the winter.

Yeah – time is really crazy. And I’m glad I’m not the only one! I’m hoping my spending levels out for the rest of the year, but we shall see! I also hibernate pretty hard these days…regardless of the weather though 🙂 . Thank you for stopping by!

I agree – you are completely nerdy and I love it 😀

Friend-based budgeting is just the best thing I have heard, it takes planning to a whole new level!

Aww thank you! And yeah friend-based budgeting has helped me a lot lol! There’s such a wind range of what I would spend extra with certain people that it’s helped me be a lot more accurate! Feel free to steal the idea 😉