Also known as every dollar I didn’t spend in 2019! One year ago I declared the following monetary goals for 2019:

- Max my 401K ($19,000)

- Max a Roth IRA ($6,000)

- Overall invest $68,000

- Continue spending around $18,000

Let’s see how I did! (For progress on my non-monetary goals check out my annual goals and accomplishments post.)

Overall Goals

In 2019, I was able to max my 401K and Roth IRA and invested $68,000 across those and a taxable account. Overall, in 2019, I saved $68,000 and my after-tax savings rate was 77% based on my salaried income. Not bad at all!

Here’s how I did it:

Income

For the first time in my life, I had multiple streams of income this year. So much for not retiring to something…Y’all tricked me! (Gotta always point blame outside of yourself right 😉 ?) Here’s where my money came from in 2019:

Full-Time Job

My annual salary is always within a range because of performance bonuses, but I can now confirm that I made $110,034 in 2019. First time breaking into the $110s – Woot!

Blog

As I mentioned in this post, I decided to monetize my blog in July 2019 after writing for four and a half years. So let’s see how many millions of dollars I made to perpetuate the stereotype that publicly early retired people are only financially independent because they have blogs!

Income: $225.58

Estimated Taxes (30%): -$67.67

Expenses: -$996.91 (As documented under the “Blog” category in my annual expenses)

Profit: -$839.29

#KillingIt! I’m obviously only retiring at 30 because of my massive blog income 😉 .

Apps

I mentioned in this post that I began to dabble this summer with the wonders of apps like Job Spotter, Freebird and (after a few threats from friends) Patreon for my Accountability Beast tweets.

Income: $423.47

Freelance Writing

Income: $400

As I mentioned in my post about what I learned after writing on this blog for 5 years, I agreed to help out a friend and do some freelance writing for them. Based on my experience this was my first and last foray into freelance writing 🙂 . It was good to experiment and try something new, but I confirmed that even something I love, like writing, can feel like work if it’s not on my own terms. Still, it was interesting to see what kind of effort that type of work takes and the possible rates if I were to change my mind in the future.

Also just an update on how that project ended – my friend actually read a post I wrote during the experience and texted me saying she didn’t want me to have to keep working on that project if I wasn’t enjoying myself (what kind of boss says that?!) and that the project seemed to be taking more hours than we anticipated.

I don’t go back on my word so I wasn’t going to reach out and ask her to change our deal, but she offered and then she surprised me by doubling my rate for the work I did do. It was incredibly sweet and I can confidently say she’s the best employer I’ve ever had 🙂 .

Interest

Income: $73.31

This year I finally opened an Ally bank account and actually started accumulating some interest bigger than 1 cent a month so I decided to start documenting that! I had heard that Ally was the place to be because of their 2% interest rate for their savings account (which has since dropped to 1.6% 🙁 ), but my parents had a poor customer service experience with them so I was hesitant to join.

I haven’t had to interact with customer service (like my parents did) and everything has been smooth sailing so far. It also doesn’t hurt to see the equivalent of a free Chipotle burrito bowl drop into my account every month without me having to do anything. Nom nom.

Total Income

So between my main job and the random hobbies and dollars I’ve picked up along the way, I raked in a total of $111,156.36 this year. Not too shabby 🙂 .

Spending

I was curious how my 2019 spending would play out this year, but after all the dust settled I ended up spending $17,896 in 2019, which is barely more than I spent last year. Wowza! Not bad at all for all the fun I got up to this year.

Net Worth

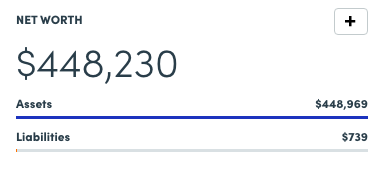

This year ended with my 100% US stock portfolio up 30.79%. On New Year’s Eve, my net worth was $448,230 – the highest I’ve ever seen and my first foray at ending the year above the 200Ks – way above 😉 . I could get used to this. Since 2018 my net worth rose $167,346 or 59%. Compound interest is a hell of a drug. Feel free to follow me on Instagram or check out my Numbers page to get monthly net worth updates even in retirement.

Retirement Date

As I detailed in this post, I am quitting my job in September 2020 before flying to Long Beach to attend FinCon 2020 after which I’m off to Australia and New Zealand for six weeks to explore the Great Barrier Reef, Hobbiton and Glow Worm Caves with my Mom. After that, I’m visiting my college roommate in Argentina for another month. That’ll bring me to mid-December 2020.

The next year has a lot of awesome plans built in and I’m excited to see what the future holds. With the current state of affairs above and even assuming no market growth, I’m on track to hit my $500,000 goal before I quit, but only time will tell if I’ll be able to declare I’m “retired” at FinCon, but I’ve never been one for labels 😉 .

My goals for next year are:

- Max my 401K ($19,500)

- Max a Roth IRA ($6,000)

- Set aside my Year 1 Retirement money in cash ($20,000)

- Overall save $51,000 before I quit in September

Let’s see what 2020 brings!

How was your 2019? Did you hit your monetary goals?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Whoah!!!! Super impressive saving numbers there Purple, congrats!

I knew reading your every dollar spent post that you’d done super well on keeping expenses low, but seeing the other side of the equation (how much you earned, and didn’t spend !) it‘S super impressive!

Also: I love Accountability Beast 😂😂😂 such a great idea

Thank you!! Both sides of the coin are important for the full picture so I try to provide that. And haha glad you like the Accountability Beast idea. It was a total accident – I just like bothering people, who knew you could get paid for it😂???

Woo hoo! Congrats on cracking $110K! You had an amazing 2019, and it looks like 2020 will be another amazing one for you.

I’m excited to follow along as you approach the BIG DAY. I’m totally jealous that you’ll get to visit Hobbiton.

All the best to you in 2020, Purple!

Thanks so much! 2019 wasn’t bad at all 😉 and I am curious to see what happens this year. The suspense! And no need to be jealous of Hobbiton – come with us 🙂 !

I’m only 5 feet tall, so I think I’ll feel right at home in Hobbiton. (Not to mention I love everything LOTR!) I think I’ll like it too much and never want to leave, LOL.

First time comment-er, long time reader. From one person who also saved $68,000 in 2019 to another…this is awesome! Hoping you have a wonderful 2020! 🙂

Hi Danny! Thanks so much for the comment – they’re my favorite part of blogging so I really appreciate you taking the time 🙂 . And WOW congratulations!!! So wild we saved the same amount. What are you putting your savings towards (just curious)? I hope you have a wonderful 2020 as well! Happy New Year!

Of course, and thanks so much for making my Tuesday’s a little more entertaining 🙂 My breakout was 401k = $22,400 (some matching from my company…yay!) and taxable account = $45,600. Like you I am also leaving my job in 2020, although it will be temporary. So just trying to buff up the taxable account while I contemplate the next move.

Anytime 😉 . That’s a nice match! Great idea to beef up your taxable account. And yay for quitting in 2020!!! That’s awesome – good luck!

Somebody had to…

https://imgflip.com/i/3lf2sk

Hahaha perfection!

well done. i don’t know if i could leave a job where i was making so much jack and saving so much. smart move on getting some cash savings for your first year out of the work force.

oh, you don’t have to worry about giving yourself any labels. the world will do that for you. i say “gimme all the labels.” is that all you got?

good luck truckin’ down the road.

Yeeeeah I might be ridiculous, but I think we already knew that 😉 . And that’s a great perspective on labels – I’m sure even when I declare I’m retired the IRP will come after me “but you spend an hour a week writing on your bloggggg – that’s not retired!” All good points as usual!

Your saving rate is incredible. Nice job. Good luck in 2020! There will be a lot of changes this year.

Thank you! It’s wild what low spending can do I guess. And thank you! This year is going to be something 🙂 .

And I thought my goals for saving $25k in 2020 were strong! Very motivating, especially to see how little you spend and how much you do.

I mean – that IS an awesome goal! This is obviously close to my highest savings rate ever. It took a long time to build up to that.

” … obviously only retiring at 30 because of my massive blog income …”

Nice one!

Great work, Purple. Keep killing it.

Haha yep – trying to tell it like it is. Blogs make so much less than the general public seem to think. Thank you!! Will do!

Congrats! Very happy for you!

Thanks so much!

Purple –

First of all, congratulations on your 2019 accomplishments! I know you will kill it in 2020 also.

I was just wondering about your one year’s worth of expenses cash savings. I’ve been trying to maintain a three year’s worth cash cushion as recommended by Firecracker and Wanderer over at

Millennial-Revolution.com.

Can you enlighten me regarding your thought process for deciding on a just having a one year cash pile? It might help me quit being disappointed in myself watching my three year cash pile losing time covered due to the unexpectedly lavish lifestyle inflation we’ve experienced over my six year long retirement, for which MMM would give me several punches in the face. I suppose the saving grace is that most of the lavishness is discretionary spending based on a severe case of the YOLOs and taking advantage of lower tax rates to do some generational gifting …

Thanks for your thoughts!

Thanks so much! So comparing my investment approach to Millennial Revolution’s I am wayyyy more aggressive overall with my 100% stock allocation vs their 60/40 and my 1 year of expenses saved vs their 3 years minus dividends…though now that I do the math I’ll only be $10K short of their 3 years – dividends approach.

I’m comfortable with this approach for myself because my lifestyle is completely flexible: I can move across the world on a dime and I have absolutely no recurring bills I need to pay (e.g. mortgage, car payment, childcare etc). The other reason I’m comfortable with this is that most downturns last about a year so I would have a runway to determine if the market might come back up or think of a new plan to avoid selling in a downturn, such as moving somewhere with a lower cost of living so I withdraw less or making some money if needed.

Definitely don’t beat yourself up for your cash pile decreasing. It sounds like you’ve made the financial decisions that will make you most happy and that’s all anyone could do. Let’s set aside the face punches for now 🙂 . Let me know how you decide to proceed with the cash cushion – I’m curious 🙂 .

My dearest Purple –

Thank you so much for giving me permission to take a pass on those face punches! LOL

Giving the matter much more thought and doing the relevant number crunching reveals my cash cushion covers just over 5 years (when including estimated dividend income) or just about 18 months (when not including any estimated dividend income). Since downturns typically (?) last 18 months (??), I think I can breathe a little bit easier. I also took a closer look at just what part of our spending is actually discretionary, which turned out to be a significant portion. I also feel comfortable including estimated dividend income, since our asset allocation is a very conservative 7% cash / 60% bonds / 33% equities, given we are in our early 60’s.

I realized I was not taking into account ALL income sources (i.e., hubby’s pension and Social Security benefits). It also (FINALLY!) dawned on me that monthly transfers from my “operations” checking account into multiple “parking lot” type savings accounts (used to save for future annual expenses similar to the “envelope” or “jar” physical budgeting method for known large bills coming due at various points throughout the year) were making my expenses artificially high. *sigh* Those mathematical logic errors can really mess you up.

So it looks like we are in good shape, and I was worrying over nothing – which is usually always the case. The things I worry about NEVER happen, while the things that do happen are things I’d never think to worry about in a gazillion years.

About the only thing off the table is geo arbitrage, but hey, never say never, right??? 😉

OOPS! Make that “estimated dividend and capital gain investment income”, which, yes, I know, is counting my chickens before they’re hatched …. LOL

No problem! Just curious: How are you estimating capital gain income? As a percentage of your portfolio that you intend to sell? Congratulations on realizing you had more stocked away than you thought! I’m so happy you can breathe easier now. I do believe downturns usually last around that amount of time.

Adding a pension and social security on top of your plan makes it sound really solid with that asset allocation. I’m also very happy you found that those checking account transfers were making your spending look inflated. My Mom uses the same system and it was quite a process when she tried out YNAB. In th end she gave up on YNAB and just kept up with her virtual envelope method. And yes – never say never 😉 !

The more I learn about your Mom, the more alike we are! 😉

I looked into YNAB, but decided that was too much work and just stayed with my Excel Workbooks and multiple Credit Union savings accounts. It is fun to change the name of our vacation savings account to our next travel destination. 🙂

My investment portfolio includes two actively managed Vanguard mutual funds that, in addition to paying dividends on a quarterly basis in March, June, September, and December, also typically pay capital gains on an annual basis in December. (Can you see how December can be a BIG passive investment income month???) These capital gains derive from the selling activity by the managers of the mutual funds’ holdings throughout the year, not from any action on my part. My goal is to not need to sell any of my shares of either mutual fund. Looking at the funds’ past dividend and capital gain distributions, I conservatively estimate what might be a reasonable per share distribution. The risk is that of course past performance does not guarantee future results. LOL.

I must admit it was a bit of a disappointment that this year’s capital gains were ~42% LESS than last year’s! Sort of like the year you figure you are getting that “usual” big year end bonus at work – the same large bonus you’ve received in previous years – so you make plans for that money you are expecting to receive (which you NEVER did in the past!), but then you barely squeak over the results sharing threshold to qualify for a minimal bonus. *sigh*

Hmmm …. maybe I do need a bit more in my cash cushion after all ….

Haha – do whatever makes you feel comfortable for the cash cushion and obviously how you manage your money. Seems like you’ve got it all figured out 🙂 . I’m sorry your cap gains were less than last year. I guess since they’re based on the mutual fund manager’s selling activity it can’t really be expected to stay steady (unlike dividends – usually). Let me know what you decide to do! I’m curious.

I just checked my IRA and agree with you: Compound interest IS one hell of a drug!!! (Thumbs up emoji.)

Thank you for all you do, Purple. You are an inspiration!

Woohoo that’s awesome! And thank you so much – that’s so wonderful to hear 🙂 !

Congrats on a great year! Almost there 🙂

Thank you!!

Congrats on a great year! Can’t wait to hear about your world travels later this year and then world conquests in future years! 😉

Thank you!! I’ll be sure to keep y’all updated on my travels – probably over on Instagram. As for world conquests that seems too much like work 😉 .

I think it’s awesome that your are pulling the plug! If and when the market crashes by 50%, what do you plan on doing? Can you cut your expenses by 50%?

Thanks! And haha – no I don’t need to cut my expenses 50%. I’m going to cut my expenses to $16,500 through geo-arbitrage. If I had done that and retired during any of the last 147 years I wouldn’t have run out of money. Otherwise I’m going to continue on with my life.

Awesome! Are you willing to share what you invest in for your taxable accounts?

Sure – 100% Vanguard Total Stock Market Index Fund

Great minds think alike! That’s EXACTLY how I told my 35 year old son to allocate his assets in his Vanguard Rollover IRA. 🙂

WOOT WOOT!

Hi purple

Are you planning to sell some of your holding to lock in the profit?

Hi – Not at this time nope.

Wow that is super impressive. You almost doubled your net worth from 2018 to 2019. Hope the dip due to the coronavirus didn’t delay your FIRE plans any :/. And I saw your post on living in Seattle on $1,600 a month. I know some people that live in Seattle proper and that’s how much they pay for rent haha.

Yeah last year was pretty wild in the market (+30%) and my savings wasn’t bad either 🙂 . The virus isn’t changing anything for me right now so no worries. Full steam ahead! Totally fair on Seattle rent – we aren’t in the heart of the city (where the rents were shockingly close to NYC when I checked), but instead walking distance from it in a more residential neighborhood.

This is amazing! Spending less than $1500 a month on average, I need to learn your secrets

Also, I love it when bloggers post actual numbers.

It helps that I don’t have a car, house, kids or pets I suspect 🙂 . Glad you enjoyed it! I love actual numbers too – that was the impetus for me sharing everything down to the decimal point on here.

This is quite impressive. I am on my own journey as well, and you have inspired me to keep on going. Rome wasn’t built in a day, but piece by piece it all came together. Thank you for your post and I love the 77% savings rate. My wife and I are hitting on 55% right now.

Thank you! You’ve got this 🙂 . 55% is really impressive!