2019 has come to an end and despite feeling like I was splurging, I’ve once again spent around $18,000! Let’s see how I did it:

In 2019 I spent $17,896, which is $181 or 1% more than last year. Not bad at all! I hit my goal of staying around $18,000 and didn’t even increase 2% with inflation. Given everywhere I went and everything I did I thought I had spent a whole lot more. I’m happy I was able to spend relatively little while living a fun, luxurious life. For details about my spending per month, check out my more detailed quarterly reports here: Q1 spending, Q2 spending, Q3 spending.

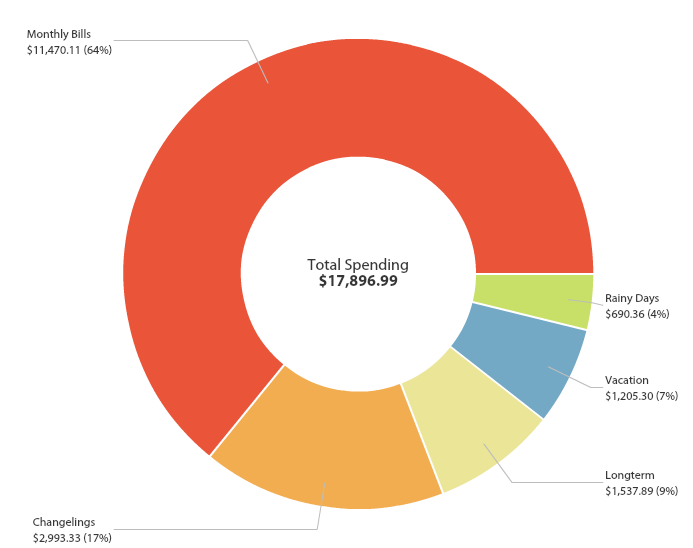

In 2019 I spent $17,896, which is $181 or 1% more than last year. Not bad at all! I hit my goal of staying around $18,000 and didn’t even increase 2% with inflation. Given everywhere I went and everything I did I thought I had spent a whole lot more. I’m happy I was able to spend relatively little while living a fun, luxurious life. For details about my spending per month, check out my more detailed quarterly reports here: Q1 spending, Q2 spending, Q3 spending.For the money voyeurs, my spending broke down like this for the year:

MONTHLY BILLS

64% Budget: $11,470.11 or $955.84/month

- Rent: $10,220.76 or $851.73/month – I share a top floor, corner unit 1 bedroom apartment with my partner that’s walking distance to downtown Seattle

- Phone: $377.46 or $31.45/month – I have a fancy phone plan with Republic Wireless with more data than I ever use. This year I changed to their annual plan so this amount is more than usual since I paid 1 year upfront and overall will pay $20/month instead of the usual $25/month. I also accepted an offer to test a new SIM card for them that will give me a $40 credit after the annual plan ends in June 2020

- Internet: $269.64 or $22.47/month – I negotiate every year to keep the intro internet rate. This is for 100 Mbps. I also negotiated a 2 year contract so I don’t have to go through my annual argument with them on our last year in Seattle

- Electric: $188.10 or $15.67/month – Electric is cheap in Seattle compared to NYC and we keep our house at 65 degrees in the winter, but use a fancy air conditioner we bought last year liberally in the summer because of how hot Seattle summers have become

- Water/Sewer/Gas: $317.22 or $26.43/month

- Transit: $96.93 or $8.07/month – I mostly walk everywhere since I want to be carfree for life, though this also includes topping up my bus card and the occasional Uber if I’m feeling tired or lazy.

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month.

17% Budget: $2,993.33 or $249.44/month

- Groceries $1580.90 or $131.74/month – Here are the tips I use to keep my food costs relatively low

- Eating Out $684.43 or $57.03/month – I used to spend $250/month eating out, but since going keto and discovering the magic of sous vide, I prefer to have dinner parties with more delicious food than I can get at a restaurant for a fraction of the cost

- Alcohol $575.79 or $47.98/month – After finishing Dry January and a 100 Day Alcohol Free Challenge I have been more discerning with the alcohol I do buy, which has led costs to be higher per month despite a smaller amount of alcohol. I’m not just buying the cheapest way to get tipsy so that’s something 😉

- Parties $152.21 or $12.68/month – This is food or drinks I bring over when we hang out a friends’ house or go to a party

VACATION

7% Budget: $1,205.30 or $100.44/month

- Travel: $135.75 or $11.31/month – This includes the few flights I didn’t travel hack this year

- Vacation Spending: $945.87 or $78.82/month – This includes what I spent on the ground in Portland, Atlanta, DC, Mexico, Costa Rica and over our 4 camping trips this year. In Portland we stayed in a convenient AirBnB downtown (If you haven’t used AirBnB before you can sign up here and get $55 off your first trip).

- Friends Visiting: $123.68 or $10.30/month – I like to separate out the spike in spending that comes from a friend visiting so I can budget for them going forward. So far it’s been really helpful!

RAINY DAYS

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

3% Budget: $690.36 or $57.53/month

- Household Goods: $105.20 or $8.76/month – Fun stuff like toilet paper, sponges and items that keep a household running

- Personal Products: $111.31 or $9.27/month – This was mostly money spent on my purple hair adventures including my signature dye: Manic Panic Ultraviolet

- Clothing: $0 – Huh. This was unintentional. Apparently I haven’t bought clothes since I got 1 bikini in March of 2018. Accidental 2 year clothing ban?

- Entertainment: $207.35 or $17.27/month – This includes our monthly Netflix subscription that we let a million people use for free as well as any movies we go to or karaoke lounges we rent

- Medical: $119.41 or $9.95/month

- Dental: $117.09 or $9.75/month – ACT fluoride rinse and paying for (hopefully) my last cavity ever

- Grass: $0 – What have I been doing with my life?!? Time to take advantage of this substance’s legality in the coming year!

- Laundry: $30 or $2.50/month

LONGTERM

9% Budget: $1,537.89 or $128.16/month

- Credit Card Fees: $95 or $7.91/month – My annual fee for the amazing Chase Sapphire Preferred Card that saves my ass on a regular basis

- Blog: $996.91 or $83.07/month – Oh mylanta. This is becoming an expensive hobby 🙂

- Giving: $423.87 or $35.32/month

- Electronics: $22.11 or $1.84/month – I bought extra storage for my Android phone, which turned out to be useless and a replacement part for my phone after almost just buying a new phone. Lesson Learned: Try some DIY instead of jumping to replacing an entire item

CONCLUSION

And there you have it: every dollar I spent this year. In 2020 I’m aiming to keep spending less than $20,000 (aka my retirement budget). I know costs will spike a bit when I prepare for my new nomadic life and want to accept that reality. Let’s see what happens!

How was your 2019 spending? Did you reach your goals?

i don’t even know what we spent this year. it might have been north of 60k, but with a big home project and a car purchase included. i think a comfortable life for us in a regular year would cost about 50ish.

good on you for living so inexpensively. how the hell do you get to the airport to fly around? doesn’t it cost something? car-free seems like a good deal if you don’t mind big city living.

Sounds like a nice level of spending! And haha – thanks. As for the airport, since we live in the middle of a major city it’s easy. I hop on the bus/train and I’m there in 45 minutes. If I’m tired I take an uber, but given how much I work I don’t actually go to the airport that often. And the Uber is $35 if I don’t split it with my partner. NBD 🙂

I just tallied up all my expenses too! $20,036 for 2019. I discovered FIRE sometime in late Jan/early Feb when I was still living at my parents’ house and only working as an intern. I started truly implementing it in my life once I moved out in March and started my first full time job. Although I’ve had some significant expenses this year due to moving and a learning curve on spending, I still managed to save 50.26% of all the money I earned/received this year. I am so amazed and so proud of myself! I’ve seen my net worth grow 10-fold this year from $2000 to $20,000+ and I paid off all $8000 in student debt. 2019 has been a great year and I am so excited for 2020! My financial goals for next year include maxing out my 401(k) and spending less than $20K. Bring it on 🙂

Thanks for your inspiration on this journey!!

That’s so awesome – congratulations!! Saving 50% out of the gate is amazing. Sounds like you’re totally poised to crush those goals in 2020. Woohoo!! And happy to help 🙂 .

I’m always so impressed by your budget. Dang it’s low!

I’ve realized that your budget is pretty much completely devoid of the “little things that add up” that my budget has. Ubers, chipotle, starbucks. It’s like death by a thousand cuts!

I spent about $66k last year and I’m thinking I can that down. I’m going to use this as part of my new years resolutions

Haha thank you! I hear you on the little things adding up. It looks like I spent $57.93 on Ubers, $32.49 at Chipotle and $19.87 at Coffee Shops this year. It might help that I don’t really like coffee though and basically just buy it to pay for my space when meeting someone. I do love some Chipotle though mmm…I even had some last night 🙂 . If you do want to decrease your spending I know you can do it. Love the new years resolution!

Wow, that’s very impressive. You live a good life without spending a lot. Actually, I think we’re almost tied, though. We spent about $46,000 for 3 people. That’s in the ballpark, right? 😉

Great job and good luck in 2020!

I’d love to see how much you need to spend with a more nomadic lifestyle. $20k/year is going to be tough for the long term, IMO. Well, it’s probably okay with no kid and splitting the expenses with a partner. Keep us updated.

$46K for 3 people is AMAZING!!! More than in the ballpark. My partner and I alone are close to $55K. Y’all are killing it. Thanks so much! We shall see about the nomadic lifestyle. I don’t delude myself to think it will be the same at all, but with sprinkling lower cost of living countries in there (as we were already planning to) I think we’ll be alright. I promise to keep you updated on here!

Wow those are definitely impressive numbers especially on food and based on your insta you are quite the chef! I love that you have a giving category.

Haha thank you! It’s amazing how little delicious food can cost when you make it yourself (or with your friends). I know I’m lucky that I prefer to do that (even though we do go out quite often). And of course on giving 🙂 I’m so fortunate I need to spread it around. I mostly do so with my time, but money can be important on that front as well.

You are a freaking BEAST lady!!

Haha thank you!

Smashing it! I just calculated my spending for 2019: USD$18,053. So close! It was helped in part by staying on the couch of a friend or two on my year in USA.

So you’re saying staying on my couch is the reason our numbers are so close? Haha kidding. That’s amazing lady!!

Way to go Purple! It’s official – I spent on a roof what you spent in an entire year!!!! I need to examine my life more closely (ha ha)! If this is a contest, I think I beat Freddy though. Bronze for me!

You seem like you live exactly how you want to even while being extremely frugal. Thanks for putting this example out into the world. Good for you.

Thank you! And woah that’s quite a roof! Haha it’s not a contest at all so no bronze for you 🙂 .

Can you tell more about how you keep personal products cost so low? I think I’m fairly low maintenance (don’t wear makeup, use mid-range drugstore products) but we spent more than twice this just this last shopping trip ($6 for shampoo, $2 for new mail clippers since our old ones were rusty, $12 for store brand toilet paper). How do you buy soap or chapstick or feminine products? Do these get rolled into groceries?

Sure – personal products for me are things like conditioner, eyeliner, razors, soap and pads. I separate out things like toilet paper and paper towels into “Household Goods.” Other than that I can’t really compare our costs without knowing more about yours. I buy everything I need when it runs out and that’s about it.

Super impressive numbers for the year!

I am loving your accidental two year clothes buying ban – that is great!

Also I agree, being car free in a city with multiple public transport options is brilliant (I used to live in London). It’s one of the few downsides of living somewhere greener / more countryside-y , which I am totally happy to absorb as I love it.

Thanks so much! And haha yeah that was pretty funny to see. I do love my public transit, but greenery is pretty nice too 🙂 . I’m still annoyed by cars given my upbringing in Atlanta, but if that ever wears off maybe I’ll check out the countryside.

Hello.

Out of curiosity, why were the costs with the blog so high? I understand that you may have a quite high traffic number nowadays, but that’s really high, in my experience. Would you be able to elaborate? 🙂

Sure – below are my 2019 costs for the blog including a conference I never would have attended without having this blog. This year costs will be higher because I need to move from Bluehost who I haven’t found to reliable to a better hosting option and that costs about an additional $40/month.

$32.87 – Domain registration and privacy renewal

$500 – FinCon Hotel

$205.23 – FinCon Food and Transit

$200 – FinCon2020 Ticket

$19 – Business cards for FinCon

$30.16 – (3) A Purple Life T-shirts for FinCon

Oh, wow. That’s really detailed. Nice one!

For the hosting costs, you’ve got a lot of other (cheaper and still reliable) options, actually. I know that, because that’s what I do.

For example, a virtual private server (VPS) with just your website, can cost around 5$/month. But that takes a lot of time configuring, and can easily be too technical, for someone that isn’t used to do it.

But, there are very good solutions specifically for WordPress out there. Take a look at this:

https://www.codeinwp.com/blog/best-wordpress-hosting/

I’m certain you can lower that, and keep the reliability and performance.

Shoot me an e-mail, if you want. Even though at this point, I’m just a stranger on the internet… and I totally understand if you’re a little bit skeptical ahah 🙂

Haha – yeah I’m all about those details. And good to know about hosting costs! I am looking for something fully managed and that comes highly recommended by other bloggers I trust. Based on how much hair pulling I did trying to get my site working the way I wanted in the first place getting my own VPS is not in the cards right now – maybe in retirement when I have time to learn this stuff 🙂 . I’ll check out that link and reach out if I have questions – strangers on the internet can be great sources of knowledge 🙂 .

Another amazing year of low spending! I’ll never stop being impressed that you spend a bit less in Seattle than I do in Wisconsin. I feel like I spent a fortune in December for Christmas and treating my coworkers on our last night of work, plus this bathroom remodeling project and some of my long-range purchases coming all due at the same time. Otherwise I was pretty frugal – like going with my friend to see Star Wars for $5, or going to my sister’s house to watch the Rose Bowl, or doing some writing at Whitewater Music Hall (also a beer and coffee place) using my gift card I got for Xmas. Oh yeah and treating my dad to a beer while watching the Packers game. Gotta spend some time with the old man while I can. But beer around here is pretty inexpensive too.

I was kind of surprised how little I spent in my mock-tirement. Take Christmas out of the equation and I think I spent about half of what I normally would while working, and I’m pretty frugal normally as you know. I’m curious if your spending will drop even further in FI (and now I’m curious if mine will drop when I hit FI too!). It’ll be interesting to see. Happy Holidays Purple!

Thank you! And yeah I’m a weirdo, but I think not having a house or car helps a lot. That sounds like an amazing December! And $5 to see Star Wars?? WOAH. The lowest I’ve seen in Seattle is $6 for the morning matinees.

Spending HALF of what you normally do (after subtracting one-off spending) in December is amazing!! I’m not sure my costs will drop similarly since I’ll be moving around more, but we shall see. Maybe with the geo-arbitrage in lower cost of living countries part…Happy Holidays to you too!

Amazingly low costs. Curious to see where it comes in when you become a nomad. Counting down with you. Best of Luck!

Thank you! I’m curious to see too 🙂 . We shall see!

Wow, well done. I spent 3x that amount just on my mortgage payments. Granted, very different lives and life stages but in 2019 I finally awoke to the error in my ways and am now committed to massive spending cuts in 2020. Cheers!

Thank you! Glad to hear you’re figuring out how to live the life you want – good luck!

Do you have a plan for health insurance in retirement?

Global expat insurance, which is mostly why I’m projecting spending 10% more than I do now in retirement: https://apurplelife.com/2018/05/07/projected-retirement-budget/

Perfect for overseas! Silly question- will you have a home base in the US in foreseeable future? What would you do for insurance then, or is the plan to stay oversees indefinitely? Looks like great coverage, unless you are at home in the US!

It’s true healthcare is cheaper outside the US. It’s also true many places ask for cash up front, regardless of insurance status. Remember these crazy stories: https://www.msn.com/en-us/news/us/american-couple-says-they-are-trapped-at-mexican-hospital-because-they-cant-pay-the-bill/vi-BBXeA97. Sadly, there are more.

My fear of health insurance and health issues is what’s standing between me and FIRE, so I am honestly curious as to others’ plans .

Yep! I don’t want to have a home base in the foreseeable future and if I change my mind it wouldn’t be in the US. So I’d be using the same solution. I’m not worried about other countries asking for cash upfront personally based on the estimates I’ve seen for care. Totally makes sense that healthcare in the US would make you cautious. I’m lucky that my preferences allow me to mostly avoid it.

That’s awesome. I’m impressed that the 30k ask upfront in Mexico doesn’t give you pause (it’s not an isolated incident, either, I’m afraid). It freaks me out, but I guess 30k is peanuts by American standards, right?

Enjoy your blog very much.

Haha exactly – the bill would be astronomically higher in the US and with the cost of living so low in Mexico I could swing it. I’m anticipating having to be very flexible in retirement and that’s why I’m comfortable pulling the cord so soon. So happy you’re enjoying it!

Post like these make me work harder to cut the budget! Very jealous! Great job!

Woohoo – happy to help! And thank you!

Thanks for the great breakdown of your spending! I’ve just started reading your blog and am bouncing all over trying to soak it all in, and this is definitely spending goals for me! as far as I can tell my spending is just under $40k per year, with $15k of that just being my housing costs… though I know there are plenty of other areas I can cut my spending back. as I saw another person mention, it’s like death by a thousand cuts, and those little spends become big dollars at the end of the month/year. Great to see that a full life can be had with less spending!

So happy you enjoyed it and Welcome! Spending can definitely be sneaky and add up – it’s happened in my life as well 🙂 . Good luck lowering your spending – let me know how it goes!

I love your website, and your funny write-ups. Brilliant life path, and you are brilliant for doing this so early. I love it that you are also realistic that things could change and that you could go back to work, even though I think you would be set given your lifestyle. I am going to retire at age 47 in four years, and if I had known at age 30 about what you are doing, I would have done the same. As you get older like me, you are less willing to take risks, so I could have retired at age 40 but I wanted to hoard money, which has been good, but then I’ve lost all those years of doing what you will do! So bravo! Also, if you have not been to Vietnam, check it out. It’s about 25% less than Thailand. I spend 5 months a year in Vietnam now; I am a professor at liberal arts college and I am going to use you as an example in my class on the sociology of money! Let’s try to see if we can meet at some point in Asia or elsewhere. I live in NYC now!

Hi – I’m so happy you’ve been enjoying it! And thank you – that’s so lovely to hear. Congratulations on your impending retirement! That’s so exciting. I have been to Vietnam and am planning to do back – the food was phenomenal. I didn’t notice the 25% less prices – that’s awesome and obviously another reason to go back. Spending 5 months a year there sounds like a dream! Looks like you’ve got a sweet set up for yourself. And oh wow using me as an example in a college class? That’s so cool – I’m telling my Mom haha. I hope you’re enjoying NYC! I’ll most likely be there sooner than Vietnam or Pomona and will let you know!