What a year! It definitely wasn’t what I expected, but if I’m grasping for a silver lining: the amount I spent would be one of them. I barely left my house for most of the year, which obviously kept costs down 😉 . However, instead of clawing at the walls, I learned new ways to have fun and be social without stepping out of my front door (which I admit I enjoyed probably more than I should have…#HardcoreIntrovert)

Another effect of the pandemic was that the travel my Mom and I have spent three years saving up airline points for, was all cancelled. Obviously that’s not a big deal in the grand scheme of things, but it was a sad moment to see our hard work go down the drain. Anyway, a silver lining of that situation is that my other post-work goal of being around family was still possible and also a much cheaper way to kick off my first year of retirement. It’s also something that makes my heart warm 🙂 .

If nothing else, this pandemic has definitely helped reset my priorities. I thought I had a good grasp on them since being with my family while we’re well and able-bodied was my main reason for quitting early, but based on the plans I made, it doesn’t look like it 🙂 . My original plans look like they were made by a woman who was busting out of workplace prison after a decade and couldn’t wait to explore the world in longer than two week PTO stretches.

I say that because while I was going to spend more time with family, most of my first 6 months of retirement revolved around travel (with my Mom and partner, but still 😉 ). Now, instead of exploring new countries, I’m visiting a few new cities and spending a lot more time with family. It seems to be a blessing in disguise that I believe will also change how I plan to live in retirement as a whole.

Anyway, since I was in many different locations this year, I’m going to discuss the annual averages of my spending and then go into specific averages based on where I was: whether that was living in a Seattle apartment, a nearby Airbnb, or a shed turned tiny house in Georgia 🙂 . That way you can see how those costs differed based on location.

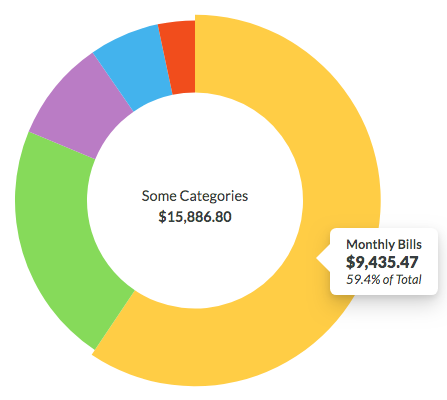

So let’s see how much I spent and get into it! Here’s every dollar I spent in 2020:

In 2020 I spent $15,886.80, which is $2,010.19 or 11.2% less than last year. Wowza. That sounds kind of ridiculous since I was living in Seattle for 75% of the year, but I guess Netflix Party movie nights and Jackbox group games are cheaper than the alternative – despite my newfound love of delivery food and my strong belief in tipping a shitton 🙂 .

For the money voyeurs, my spending broke down like this for the year:

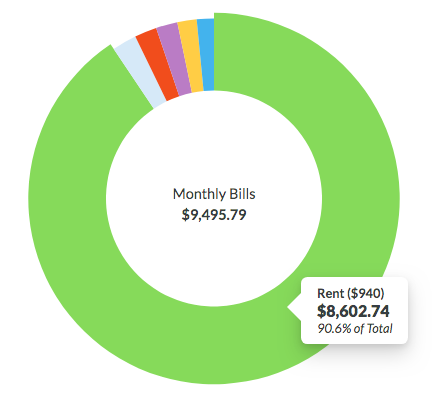

MONTHLY BILLS

59.4% Budget: $9,435.47 or $786.29/month

- Rent: $8,602.74 or $716.86/month – For the first 7 months of the year I shared a top floor, corner unit, 1 bedroom apartment with my partner, that was walking distance to downtown Seattle. Then we moved into Airbnbs that had more amenities than our apartment, such as a washer/dryer and a porch. After that, we moved to Georgia and decked out a shed turned tiny house.

- Phone: $145.97 or $12.16/month – I was originally planning to switch from Republic Wireless to GoogleFI so I could have cheap international data while traveling the world. When the world travel part of my retirement plans were scrapped, this phone plan was too. I celebrated 5 years with Republic Wireless this year and I’m still a happy customer 🙂

- Internet: $189.47 or $15.79/month – This includes paying for our own WiFi for 7 months of this year in our Seattle apartment, but then this gets dicey because WiFi is included in Airbnb prices, so it is a part of the “Rent” price when we’re staying in Airbnbs. However, once moving to Georgia, we split WiFi with my partner’s brother and his wife. All that to say – this category is about to get complicated 🙂 . Maybe I’ll collapse it into “Rent” for next year to be more clear.

- Electric: $209.13 or $17.43/month – Similar to the above, this is included in the Airbnb price and shows up under “Rent” for 2 months of this year. Otherwise electric in Seattle is surprisingly cheap because it’s mostly hydro from the waterways that surround Seattle. Once we moved to Georgia, the tiny house doesn’t take up much of the grid 😉

- Water/Sewer/Gas: $183.90 or $15.33/month – Once again, similar to the above, this is included in the Airbnb price and shows up under “Rent” for 2 months of this year

- Transit: $104.26 or $8.68/month – I haven’t gone anywhere so this isn’t a huge surprise 🙂 . I haven’t been on public transit since February. Basically, we’ve just taken a few Ubers around after they instituted their new COVID protocols.

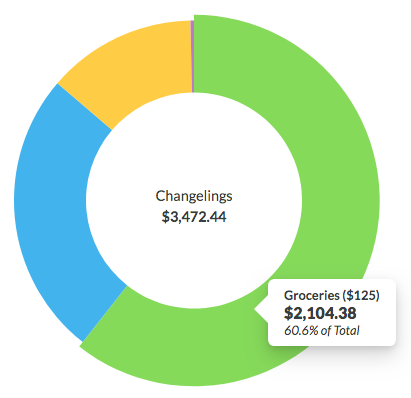

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month.

21.9% Budget: $3,472.44 or $289.37/month

- Groceries: $2,104.38 or $175.37/month – I’m not surprised that this is more than the $125/month I usually spend. The price of groceries increased during the pandemic and also, I was all about indulgences this year since my usual happy place of family, friends and travel were nonexistent for most of it. No regrets!

- Eating Out: $892.06 or $74.34/month – Similar to the above, my takeout and delivery spending went up. I actually expected it to be much more than this so #Winning! We had some delicious times and as I mentioned above, I was careful to always tip 20-30% and only buy from local businesses to support them.

- Alcohol: $465.19 or $38.77/month – I also expected this to be higher, so good job all around 🙂 . I guess I did do another 100 day alcohol free challenge as well as a dry month here or there, so it evened out with the amount of revelry I got up to 😉 .

- Parties: $10.81 or $0.90/month – Well…this is depressing 🙂 . This is one charge from going to karaoke in January before the world turned upside down.

VACATION

3.3% Budget: $528.77 or $44.06/month

- Travel: $519.28 or $43.27/month – These are just some expenses for my new, more pandemic-friendly transportation methods: driving and trains!

- Vacation Spending: $9.49 or $0.79/month – This was an Uber I took in January before the world exploded, while visiting Atlanta 🙂 . Since I’m a nomad now and travel is just how I live my life 😉 I’m going to be putting all expenses when I move to new locations, in regular categories (e.g. groceries, eating out etc) and get rid of this category.

- Friends Visiting: $0 or $0/month – Obviously necessary, but this is still me: 🙁 .

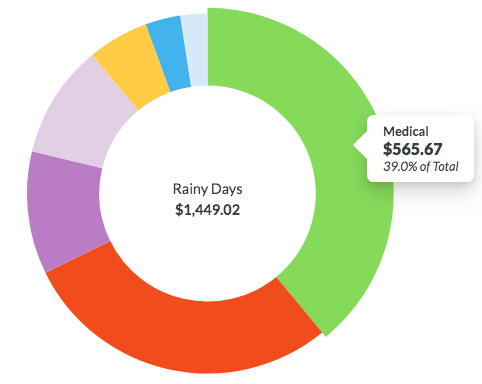

RAINY DAYS

This section is named based on a principal in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

9.1% Budget: $1,449.02 or $120.75/month

- Household Goods: $79.53 or $6.63/month – As always, this is the best part of the budget that covers things like toilet paper, sponges and items that keep a household running.

- Personal Products: $45.50 or $3.79/month – I gotta keep my purple locks luscious so this is mostly my favorite conditioner (Aussie 3 Minute Miracle) and a haircut.

- Clothing: $0 or $0/month – Oops! I guess I did another year-long clothing ban without realizing it…cheers to two years 😉 !

- Self-Care: $147.67 or $12.31/month – This was a category to keep track of that self-care cash gift I received. I spent this money on fancy Holo Taco nail polish, top coat and polish remover, nicer conditioner, La Croix seltzer, fancier face masks and eyeliner – all things that make me feel a little better 🙂 .

- Entertainment: $159.65 or $13.30/month – This includes our monthly Netflix subscription that we let a million people use for free, my fancy Spotify Premium subscription, a subscription to HBO GO for a month so I could watch the amazing Westworld Season 3, and a visit to a karaoke bar back when the world still did that 🙂 .

- Medical: $565.67 or $47.14/month – This is my 6 months of health insurance coverage from World Nomads along with some doctor’s visits. I talk about my retirement health insurance plan here if you’re curious.

- Dental: $416 or $34.67/month – I had some fun dental visits this year despite taking better care of my teeth than ever. I give up 🙂 .

- Grass: $35 or $2.92/month – Weed is legal in Washington State and as of the 2020 elections 1/3 of the US population live in places with legal weed so Wooohooooo!

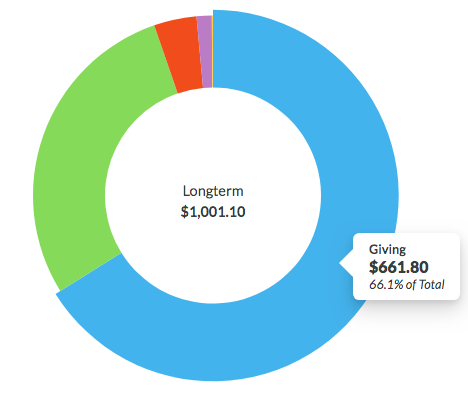

LONGTERM

6.3% Budget: $1,001.10 or $83.42/month

- Giving: $661.80 or $55.15/month – It’s a great year to give 🙂 . I need to keep it up.

- Credit Card Fees: $286.29 or $23.86/month – This is my annual fee for the amazing Chase Sapphire Preferred Card that saves my ass on a regular basis along with the fees to renew my driver’s license (I’m a Washington State resident for 6 more years!), buy my Traveling Mailbox so I can get my mail wherever I go, and the fee for my beloved budget software YNAB

- Blog: $38.35 or $3.20/month – Just the usual fees to keep up the blog minus hosting – I pre-paid for that for 3 years and it’s coming due in late 2021 when decisions need to be made 🙂 .

- Electronics: $13.61 or $1.13/month – I bought new earbuds because I thought my current ones might go soon. Pre-emptive purchase 🙂 .

- Moving: $1.05 or $0.09/month – This was the fee to file a USPS change of address request so they’ll forward my mail from my old Seattle apartment.

Breakdown By Location

Obviously costs vary wildly by location, even within the US, so I wanted to make it clear how these different locations affected my spending this year.

Part 1: Seattle (Jan – July Apartment)

Rent & Utilities Average: $924.93

From January through July, I lived in a Seattle apartment with my partner. Costs were relatively high, but stable.

Part 2: Seattle Nomad Life (Aug – Sept AirBnBs)

Rent & Utilities Average: $964.91

For the months of August and September, my partner and I lived in monthly Airbnbs around Seattle. For the first time in my life, a month seemed like a short amount of time. It felt like we had just settled in and then it was time to leave. We’re thinking about extending to a minimum of 6 weeks moving forward.

Part 3: Georgia Nomad Life (Oct – Dec Tiny House)

Rent & Utilities Average: $255.04

This has been an interesting one. Instead of jet setting around the globe in first class, my partner and I have moved into a shed turned tiny house in the backyard of my brother-in-law and sister-in-law’s property. We have been discussing (*cough* arguing *cough*) about how much rent to pay them the whole time we’ve been there. We want to pay them for their space and they are resistant to it since it was unused and we’re family, which I do understand, but this still feels like me sometimes:

The original agreement was that we can pay for things to improve the space, so we decked it out with new furniture (as mentioned in the tweet below) and recently helped buy a fancy stand-mixer that we’ve been using to make delicious breads from scratch. We then started brainstorming other improvements we can pay for and also some other ways we might be able to sneakily pay some more rent…which I can’t detail here because my sister-in-law reads this blog sometimes….is she gone👀?

Just dropped $700 at @IKEA. They don't currently have a pick up option so we had to walk the store, but I was pleasantly surprised that very few people were acting a fool🙌🏾! Would y'all be interested in a post about how we're furnishing our new tiny house🏡 for like $1,000? pic.twitter.com/5gUJ7WRMhv

— A Purple Life (@APurpleLifeBlog) October 4, 2020

Luckily though, after a few months, we lovingly beat them down enough that they agreed to accept cash rent starting in December 😉 . We are currently hunkering down until the spring to see how the pandemic shakes out, so until then, our rent for the shed/tiny house is going to be $200/month plus our share of utilities.

Given all that’s happened though, I must say living in a tiny house in rural Georgia is turning out to be a surprise cost saving measure – and we’ve been enjoying it immensely as well 🙂 . The amount of space is actually similar to the studio my partner and I shared for 2 years in Manhattan with the added bonus of having a large yard around it and our family very close by so we still get all the social time we want despite the pandemic. Life is good 🙂 .

Conclusion

And there you have it: every dollar I spent this year! I aimed to spend around $20,000 (aka my retirement budget) and ended up spending $15,886.80. Who knew not going anywhere or seeing anyone was so cheap 😉 . As I mentioned, given how this year is ending pandemic-wise, we’re planning to continue laying low for a little while longer, but then, if the world looks a little better in the spring, we’ll start up our nomad travels and take y’all along for the ride 😉 . Let’s see what happens!

How was your 2020 spending? Did you reach your goals?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Wow, nicely done! I did my 2020 financial recap just one day before yours. My largest spending is still in rent. I want to cut that down even more. The only way to do that is by moving to a cheaper place. My total spending is around $22,000 this year. That’s too much for me. I’m hoping 2021 will see less spending than 2020.

Thank you! And that’s super cool – great job with that spending 🙂 .

That’s pretty amazing. Your current COL is so low in GA!

I don’t think travel will open up in the spring. Lots of countries are still struggling with the pandemic. Travel might have to wait until next fall…

Unless you’re willing to jump through hoops and take some chances. I’m going to Thailand in 2 weeks. 🙂

Haha yeah it’s pretty ridiculous. I forgot that most of the country is way cheaper than everywhere I’ve lived in my adult life 🙂 . And to clarify: I meant domestic travel by car aka leaving the GA tiny house. I’m not assuming international travel is happening at all going forward. I’ve had enough of cancelling plans after this fall so I’m going to be patient (or try to 😉 ). So jealous about Thailand – have fun!

You inspired me to write it all out for myself too! This is my first full year of YNAB so it was so easy to get these numbers and I had similar pretty graphs. YNAB is also beloved to me <3 I've turned my brother & my intern onto it!

This year was such an outlier due to COVID. I moved back to my parents' place – more for social & emotional health than for financial health, but it had a huge boon on my finances since my bills & utilities dropped from about $675/month to $200/month for August-December while my income stayed the same. So it's hard to compare my numbers to anyone else's this year. I spent about $15,300 including donating over $4,200. That donation number includes the $1,200 stimulus check, but even without that, I more than doubled my giving from last year and it feels really, really good to see that my spending is aligning with my values in that way!

Doing this exercise also encouraged me to talk to my parents about letting me contribute more to the household. I pay rent & my share of groceries, but I want to cover more of our lifestyle expenses too (movie rentals, at least 1 of our monthly take-outs, the online yoga classes I occasionally join with my mom).

Thanks for inspiring a deep dive into my YNAB data! I love reading your numbers and seeing how similar & different we are, since you manage your finances as if you were single (like me) & you're only a few years older than I am. One last question – does your rent & utilities average for October-December include all the Ikea purchases?

Woohoo all around! That’s awesome you were able to be with your parents and that donation percentage is awesome 🙂 . I love the ideas for how to contribute more to your parents as well – that’s been an ongoing discussion at our commune 😉 . And yep those rent numbers include all our Ikea furniture.

That’s pretty incredible.

Your grocery numbers are crazy low. We’re in the $800 (CAD) a month range, but that’s two people and three cats. I’ll blame the cats!

Haha definitely blame the cats 😉 .

Being able to spend under $20k a year whilst being a nomad is so impressive. It’s hard to get to that total spend in SF Bay Area or NYC!

Living in the SF Bay Area, my rent per year is $21,780 for a small studio apartment that I live alone in. My total spend in 2020 is ~$65k total, not including the 2 rental properties I purchased in Ohio.

Totally difficult in those areas – and that’s one of the reasons I left NYC 😉 . Congratulations on your rental properties!

This is really impressive and inspiring! Thank you for sharing. From your health insurance post, it sounded like you were still clarifying the requirements for local coverage at the time. Did you end up having to get anything to supplement the World Nomads coverage? Otherwise I’m really surprised to see such “cheap” healthcare coverage in the US. Thanks again for keeping us posted on the adventure.

Thank you so much! And yes I clarified those requirements and mentioned them in a post…somewhere 🙂 . Thanks for reminding me – I need to add that as a note in the OG post. I did have to get state insurance in Washington (which obviously I can’t use in Georgia so it’s useless) in addition to the travel insurance.

I’m crossing my fingers that I can travel internationally in late 2021 and finally get on my original Expat Insurance plan instead of juggling two things. And yeah this is only cheap because it only covers catastrophes – I wouldn’t even really call it “healthcare coverage”. It’s still a ridiculously expensive healthcare wasteland over here unfortunately.

Wow that’s amazing! Can we see the before and after of what you did with the tiny house?

Thanks! I don’t actually think I took a before picture, but I’ll take an after…right after I get the urge to clean up a little 😉 .

I too have bad teeth despite a 4 step process 2-3x a day (including a water pick). I’ve been clean fasting for longer periods in the day to keep any sugar and food from snacking off my teeth – hoping this improves the situation. How you live on such a small grocery bill is amazing. Do you ever get tired of budgeting so diligently? I’m hope my clean fasting will lower my grocery and dental bill . . .

Ugh I’m sorry. I hope that helps you. I actually don’t budget – as in I don’t limit myself. I just buy whatever I want and see how much it amounts to at the end of the month. So since I don’t budget, no I don’t get tired of it 😉 . Good luck with the clean fasting!

I voted $25K on your Twitter poll but I should have had more faith that you’d spend even less than that 😀

I don’t have time for a whole detailed spending roundup but it looks like we spend approximately 54% of our income and that’s a better percentage than I expected.

Haha I was shocked at this number myself so no worries. And that’s an awesome percentage! Congratulations 🙂 .

Wow I will forever be amazed at how low your spending is! I just calculated mine and I thought I did well spending ~$24k this year which is already lower than last year’s thanks to Covid. Definitely didn’t think anything less than $20k was a possibility but there you go amazing us!

Yeah it was ridiculous this year – becoming a hermit is surprisingly cheap 😉 .

This is inspiring. Thanks for sharing the details.

Thanks so much for telling me that! And happy to share 🙂 .

Thanks for sharing and congratulations on a great year of savings. One of my new year resolutions is to track every single spending like you.

Of course and thank you! That sounds like an awesome goal – I look forward to reading your spending report 🙂 .

Thanks for sharing the details Purple! I chuckled at you spend with ‘grass’. AZ just legalized #yaay .

I just finished paying off my student loans and have one more loan left (car) so I am looking forward to tracking my spending this year and seeing where I am at. I have a feeling its in the 30ks.

Thanks!

Of course 😉 . And yay AZ! Congratulations on paying off your student loans – that’s awesome! You’ve got this – good luck 🙂 .

Hi a purple life,

I have a question. I make around 130k per year, and I think I’m on track to the same path as how you’ve been saving over the last few years. However, I’m worried about buying a house. Your numbers look great, but how will you buy a house? All the houses in my area is around a million dollars. A nice two story, two garage house is like 1.5 mil even further north in the suburbs. Or is the plan to rent for the rest of your life? What about rising rental prices? Will it make more sense for you to buy? Thanks for all your posts/numbers! They’re encouraging!

That’s an awesome salary – congratulations! I never want to own a home so that’s easy for me. I’ve always seen houses as a chain around my foot – the exact opposite of the nomad lifestyle I’m planning to live indefinitely. I also have no interest in all the extra and surprise costs a house has. So yeah if a home in that area is what you want that will extend your timeline a bit.

Yes I’m planning to rent indefinitely, though like all things I reserve the right to change my mind 🙂 . Rising rental prices don’t worry me since I’m a global nomad – if one place gets too expensive I’ll move somewhere else. There’s nothing keeping me anywhere. It doesn’t make sense for me to buy a house personally. I’m glad sharing my numbers has been helpful!

Holy moly! This is by far the most impressive annual expense report I’ve ever seen. I was most surprised at your grocery bill. Great job not trying to keep up with the Jones’ and doing your thing! What’s most impressive is that you still had a year filled with activities. I’m taking notes!!!

Thank you! And yeah surprisingly despite the world shutting down I did a lot – turns out with the internet I don’t need a lots of extra money for activities 😉 .

How did you get your internet so affordable? Is it because there are low income /student programs or did you get it through phone company or rural?

That’s how much our internet bill was in Seattle – I think it was through xfinity. I was making over $100K at that time so I wouldn’t have qualified for a low income program and I haven’t been a student since 2011. However, I did call xfinity every year to continue getting their intro rate so I’m sure that helped.