I always assumed that my thoughts on spending money would remain stagnant, like my thoughts on marriage or having kids. However, it turns out that my view of spending has evolved almost as much as my thoughts on time.

I’ve talked in a few posts about time dilation and how at times, hours seemed infinite while I was working and in retirement days, weeks and even months seem to fly by. My perception of time is also completely different. I used to know what hour, minute and often second it was (helpful knowledge to ensure I was always on time to work calls 😉 ).

Now I usually know the month, rarely know the date and might have an idea of the day of the week because of the activities of those around me who still work, but I tend to forget the hour. Sometimes I’m so wild that I gauge the time of day (morning, afternoon etc) by the position of the sun. I’m getting really hippie in my retirement 😉 .

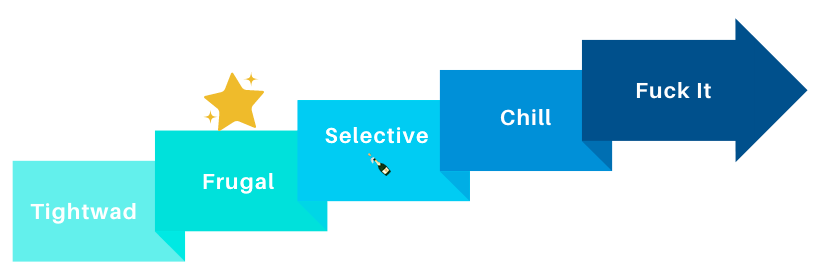

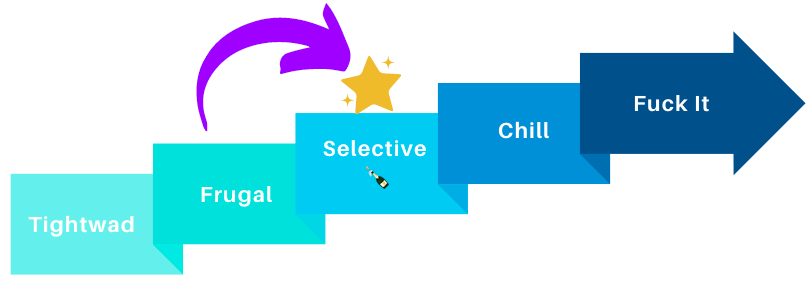

My thoughts on spending money have traveled down a similarly wide spectrum. So let’s see how those thoughts have evolved over time and what it means for the future:

Frugal

I grew up being raised by a single Mom until I was 7. I had everything I needed, but nothing extravagant and that was fine with me. We had a great life together and I never felt like anything was missing. I grew up seeing my Mom buying clothes based on necessity – quality clothes that would last, but nothing flashy for flashy sake. She didn’t buy make up, much jewelry or any shoes that weren’t practical. We were frugal by necessity.

Later my Mom remarried and money became less tight with two household incomes and economies of scale. Despite that, frugality was still how we lived our life. For example, when I would go to a friend’s house in high school, my Mom would give me $20 in case we wanted to see a movie or whatever (this was back in the day before a single movie ticket cost almost $20…wow I’m old 🙂 ). However, instead of spending this money on whatever we got up to (such as treats to eat while hanging out at the mall), I saved it.

Between these $20s and the money from my after school receptionist job, I accumulated a few hundred dollars, but instead of spending it on anything…I kept most of it. This compounded in college when my Mom gave me a small stipend in case I wanted to go out to eat. We had an agreement that I wouldn’t work during the school year so I could focus on my studies (though I did work during one summer, went to classes for a second and planned to work a third, but instead had to take care of a family member).

One time when my Mom came to visit, she asked if I needed more money and I responded that I still had most of what she had given me. She expressed concern that I wasn’t spending the money and assumed I wasn’t living as a result, but that’s not how I felt. That small amount of cash was all I had in the world and I did spend it on takeout once every few months, but overall it was there to make me feel secure. I didn’t see the point of spending it (in my mind) unnecessarily.

Selective Extravagance

This mentality continued, but also evolved after I graduated college. Instead of being frugal in general though, I followed a new example set by my Mom. While she continued her frugal ways after money became less tight, she started to choose maybe one thing a year that she would spend money on – and it was always travel 🙂 . I learned that if you save most of the year, you can buy a nice experience down the line.

So that’s what I did. This culminated in me spending over $700 on a flight to Beijing to visit my friend who was studying abroad there while I was also studying abroad in Italy at the time. I had to fly to London to get on this flight to Beijing and when I did, I discovered that I couldn’t get on my flight to China (the reasons behind that involve a ridiculous story that I detail below).

I was stranded in London with basically no money a week before my pre-booked flight back to Italy. I ended up frantically contacting the one person I knew in London, which was my former college roommate, and crashing with her for a week until my flight back to Italy. This was a serious bonding experience because her room was so small that the only floor space was just enough for me to curl up in. I am forever grateful to that friend for helping me in my time of need and am shocked that that bonding experience didn’t scare her away (she’s the friend I still video chat with weekly who lives in Argentina that I was supposed to visit for a month in November 😉 ).

Anyway, despite the debacle that was me trying to go to China, this idea that money was to be saved and then spent on a great experience continued into my adult years. My Mom instructed me to invest in my first company’s 401(k) and I did. After setting and forgetting that monthly amount, I figured everything else was spending money, right? I had a $5,000 emergency fund and was investing a little monthly so the rest must be gravy!

It was this thinking that resulted in me spending $7,000 for a First Class Emirates flight to the Maldives. I had a little more than that in my checking account and that’s what the remaining money was for right 😉 ? This is how I lived for a year or two – saving by living in a shitty apartment in NYC with too many roommates and then buying first class tickets around the US and the globe (I once went to London in Business Class for a weekend…). It was a wild time.

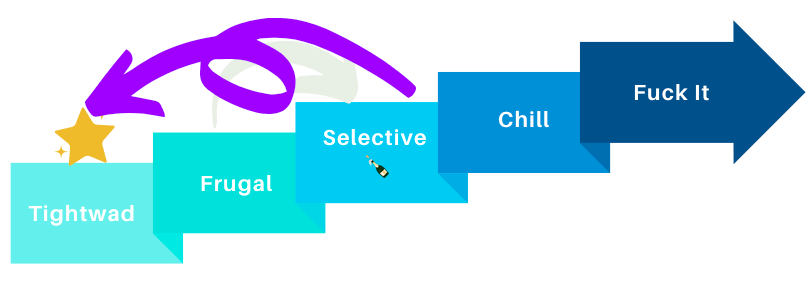

Tightwad

Then years later, I started my financial independence journey (after ignoring my partner trying to convince me for 2 years…). I did a few experiments to see if what I was spending money on actually made me happy and discovered that in some ways it did (such as travel) and in some ways it didn’t (such as paying $90/month for an iPhone data plan when a $15 plan from Republic Wireless worked just as well.)

In addition to these small changes, my partner and I were ready to make a big change: Leaving NYC. We had lived there for 4 years and I was over it 🙂 . So for mental, emotional and financial reasons, we moved from NYC to Seattle and in doing so, I cut my costs in half while actually increasing my standard of living. Simply the difference in rent prices and taxes between the two cities made all that difference. At the same time, I continued job hopping and increasing my salary in $20K jumps basically every year.

These two actions of tackling my biggest expenses and a few smaller expenses combined to shorten my journey to financial independence from my original calculation of 10 years to 5. However, after seeing how my journey was shortening and shortening, I started to feel impatient. I got greedy and wanted it to shorten even more. As a result, I started tightening my financial belt and seeing any waste as delaying the time to my final destination.

This was not a healthy stance to take. For example, I was in a friend’s wedding party and the bride wanted me to pay $100 to sleep in a bunk bed for 1 night in a house with the other girls that was a 15 minute uber from my home. She said it would be a bonding experience. It was not 🙂 . We got back from a bar and went right to sleep – they wouldn’t have known if I nipped home for the night.

So in my mind, that was $100 wasted and I was upset about it. Despite the fact that it was only 6% of my monthly budget, I saw it as going against my goals. In the end, that extra $100 really did not delay my time to financial independence and the joy it seemed to bring her was worth it, but in that moment, I got into a weird, unhelpful thought process. Luckily it did not last long.

Chill Bro

During my last two years or so before retirement something shifted. It might have been because compound interest was working its magic and making my net worth growth feel exponential (see below) or it might have been that I finally realized a few hundred dollars here or there wasn’t a big deal in the grand scheme of my net worth.

Regardless, whatever happened, I started being chill with money. And not just reverting to my previously “I’m fine” frugal ways. I started being a chill bro about it. Instead of checking my budget before making a decision I had a type of flippancy that would have shocked Young Purple. For example, my partner would ask me “Want to split this $200 wedding gift?” and I’d reply “Sure, whatever you want.”

Or when we were trying to get rid of all our belongings last year, we decided in the end to pay the city’s garbage collection service to pick up our mattress and couch instead of re-selling it or even giving it away for free. This is something I can’t imagine my old self doing. PAYING to get rid of something that cost us hundreds of dollars?! But I did it without batting an eye. I was a changed woman 🙂 .

Frugality By Necessity VS Frugality By Choice

I have a bit of an ‘out there’ theory about why my thoughts evolved in this fashion. At the beginning of my life and my career, I had to be frugal – that was the only way to pay my bills. Later in life I became a bit of a tightwad in order to get closer to my goals, but then relaxed the reigns once I realized that these decisions were really tiny drops in a massive lake.

These two states also felt completely different emotionally. I think it was because the latter was me pretending at having to be frugal. I didn’t actually have to be – I had the money to do all the things I needed and wanted to do, but at the time, didn’t see it as “worth it” compared to the freedom that awaited me. Instead of feeling anxiety that I wouldn’t have enough to get a hotel for the night or get home (like when I was stranded in London), I was doing a cost/benefit analysis and became annoyed if it didn’t come out the way I wanted.

Later in life I knew that when shit hit the fan I could, if needed, throw money at the problem. There was no underlying stress to it. This is why I was less stressed about getting rid of all my stuff in the most cost efficient way possible compared to how I approached moving across the country without a job or apartment awaiting me. I had to be much more careful in the latter scenario because money seemed finite.

This opposite side of the coin also makes me think of the latest surge in #VanLife while compared to “living in your car” and the love of Tiny Houses juxtaposed against the fascinating and at times depressing lives depicted in Nomadland. I watched a YouTube video recently about the ‘real’ experience of Van Life and one of the top comments was “I did this in the 80s and 90s when it was called ‘being homeless’.”

A critique of these ‘movements’ is that it’s (stereotypically) rich white people glorifying what others in poverty have to do, that they’re playing poor by living in a vehicle for example while also spending $100,000 to deck it out to look like a house inside. That they are glorifying this faux poverty by posting pictures of their parking spot by the ocean, but not the many nights they spend in a Walmart parking lot.

I could probably talk about this forever, but it felt similar to how frugality goes from a necessity to a choice as your net worth grows. And when it’s no longer a necessity, it seems to become a game that you can opt in or out of as needed.

Change A Comin’

So given all the above changes in my thoughts towards money, I was SO curious how my thoughts on spending would change in retirement because it would involve a huge shift. Instead of seeing almost $10,000 hit my bank account every month, there would be nothing. I would be living off my savings and investments. I imagined this would cause me to be more miserly with my money since it was finite – there was no more coming in.

Previously my spending had basically been on autopilot for big stuff, so small stuff ($100 here or there) didn’t have a big impact, but in retirement the faucet is shut off. I’m “on a fixed income” (as the older women at the The Incredibles cried). So I was curious if some of my previous stages would come back or if I would keep my current attitude of “I have so much money – WAY more than I ever dreamed was possible growing up. It’s fine.”

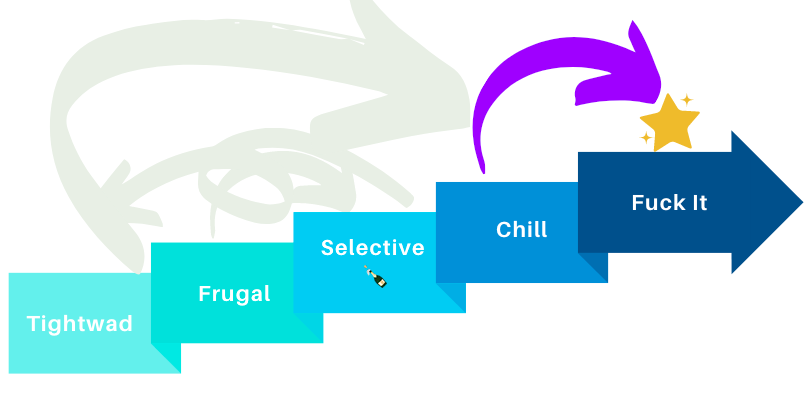

Fuck It

And now I have the answer:

Partner: So what's your budget for a 2 week beach vacation rental🏖️?

Me: Whatevs.

Partner: Whatevs?!…Who have I become😈?! pic.twitter.com/ubPAVYz2F8

— A Purple Life (@APurpleLifeBlog) December 30, 2020

After almost 6 months of retirement, I can now say that my current approach to money is “Fuck it” and that is SHOCKING to me 🙂 , but it seems to be true based on all of my experiences. For example, throughout these months, I have gotten takeout more than probably ever before in my life and obviously since it’s a pandemic, I have been getting a lot of delivery and tipping even more generously than usual.

Also, because of the pandemic, we’ve often been getting grocery delivery. I’ve had wine delivered and even Chipotle a few times while we were in our January vacation Airbnb. The money was flowing out of my pockets and I was happy to pay those delivery fees and extra tips. I didn’t even glance at my YNAB budget.

In addition, we’ve been living in a commune situation with my brother-un-law, sister-un-law and toddler nephew and we have wanted to be generous while doing so. We’ve been buying gifts and meals for the commune during these months and when my partner purchases something and later asks if I want to chip in, I always say “sure” and when he asks how much I say “whatever you want.” I’ve come so far from my miserly ways 🙂 .

For comparison, we used to go line by line down a grocery list to make sure it was split fairly between my partner and I. Now I don’t even glance at the receipt. I have been completely flippant with my money, but when I checked if this attitude messed with my bottom line…it hasn’t:

I had $500K invested when I retired in October…WTF is happening📈?!? #Stonks pic.twitter.com/WTqHUJjhDI

— A Purple Life (@APurpleLifeBlog) February 9, 2021

I started wondering if it was just these relatively small day-to-day expenses that didn’t phase me. But then I made a surprising decision about one of my most prized possessions: my laptop. It’s a refurbished MacBook Air from 2015 and its battery has been lagging lately.

I did research on how to fix it and priced out getting someone else to fix it. I also did research on a budget option like a Chromebook and discovered shockingly that it is not that much cheaper for a lot less functionality. But then I saw that Apple was reversing some of the silly changes they’d made to recent MacBook Airs that made them work less well.

And at that moment I decided that I would just buy a new (to me) refurbished version of the latest laptop they just released. I would still be saving a few hundred off the brand new price, but also getting one of the most expensive laptops on the market instead of fixing mine or going for a seriously frugal option. I’ve changed bro 🙂 .

But then I thought – maybe I’m only feeling this way because these are still smaller purchases in the grand scheme of things – it’s not like it’s my biggest expense: Rent. And then the universe decided to show me that that didn’t matter to me either 🙂 . We booked a monthly Airbnb in Maine for May and a few weeks later were told that the host needed to cancel.

I had found us a great deal in downtown Portland, ME for $2500 a month. Now that we were closer to the in-demand summer season on the beach, I couldn’t find us a similarly awesome place for that price. Instead, I found a different Airbnb that we loved that was $700 more than our original one. It was a nicer, top floor unit with 2 bedrooms instead of 1, but that’s still almost 30% more than we originally paid and 60% more than our standard $2,000 a month budget (which we were already going to push given the season and demand).

However, we booked this new place without a thought. It turns out even big amounts don’t scare me. At this point I truly don’t give a fuck. My thought process is accurately reflected in this t-shirt:

Just in case my allegiance was unclear🤣…#Fanguard @Vanguard_Group pic.twitter.com/nZYBdelDeT

— A Purple Life (@APurpleLifeBlog) October 19, 2019

Conclusion

I have watched other early retirees expand their lifestyle as retirement goes on and that makes sense to me – to be more cautious in early years when sequence of returns risk is highest and then allow yourself to loosen your belt if you want. Personally, my early retirement math always included no spending ceiling, so I can spend more in up market years and later in life if I choose or need to.

However, I expected this feeling of emotional freedom from spending worries to happen YEARS from now, not within the first 6 months of my retirement. I’m curious to see if I will revert back to an earlier part of this spectrum in the future as the world opens up and I can do and spend money on more things…or if this is just who I am now. I guess we’ll see 😉 .

How have your thoughts on spending money evolved?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Great post. I’m finding that I’m getting a bit more “f*ck it” in my money approach through this time of pandemic – especially since travel is off the cards for now (my favourite thing to spend money on). I’m getting looser with the ol’ purse strings now it seems more important to spend on local businesses to keep them running. Would you say any of your current stance is because of COVID and how it has changed your plans?

Woohoo the “fuck it” club grows! I don’t think my current stance is because of covid since we’re about to continue with our original nomad plan and do so in the US, which is more expensive than most of the places I was supposed to be visiting at this time 🙂 . We’ll see though! Once the world opens up maybe all those restaurants and bar tabs will add up 😉 .

Great post! I’m curious where you think your 2021 spending might be, especially compared to how low your 2020 spending was. I can’t say I’m at the “fuck it” stage or really anywhere close to that, but it must be an amazing feeling to be able to say yes to both big and small money decisions without any hesitation. Your story about spending $100 to split a place with friends and being upset about it sounds a lot like me!

I’m aiming for my 2021 spending to be around $20,000 instead of $16K like in 2020. It’s currently way below that despite us having already booked and paid for lodging until June. And yeah it’s a weird and amazing feeling 🙂 .

This feels like an unusual post, and I hope I can articulate why. The post-FIRE updates I’ve read always seem to have numbers and calculations and daily budgets, with an underlying stance of “we’re spending what we want, but I’m watching the numbers.” This is different, in that you’re on “fuck it!” mode. Which is excellent! It’s a breath of fresh air and honestly, #lifegoals for me to reach the same place mentally, but I guess I just can’t picture life without that nagging voice of “where’s your money, what’s it doing, do you have Enough.” You checked your numbers and did the math, so all is well. These updates from you on your mental state are awesome, thank you!

That being said – $100 for one night at a place 15 mins away from home and you weren’t even at the place for longer than to sleep!?!? Outrageous, I’d still be mad about something like that!

Yeah I’m a weirdo – you hit the nail on the head 🙂 . I couldn’t have ever imagined I’d get to this mental place either. It’s super strange. So glad you you’re enjoying the more ‘soft’ mental updates (vs just hard numbers 😉 ). I’ll keep it up! And haha yeah I was pretty mad at the time. I’ve let it go though.

Your thoughts on marriage and children might evolve just as your thoughts on spending money have. Especially as you approach end-stage fertility (not for a while yet) and then again late in life when you need to make POA-type decisions or someone needs to make them for you.

No. They won’t. She’s been very clear on this. Why do people keep pushing this bullshit narrative?

Why do you respond for her?

To save me time because I’ve talked about it before and I appreciate it 🙂 . Thank you Josh!

It’s nice when someone else has your back isn’t it? I can see this blog is intolerant of viewpoints that differ slightly from the prevailing narrative. Good luck in your retirement.

Actually this blog is intolerant of people imposing themselves on someone else’s life choices and not believing women when they present decisions that they’ve made about their own life and bodies. Thanks

You’re the intolerant one, imposing the “prevailing narrative” of marriage and child-bearing on the AWARD-WINNING, early-retired, author of this blog.

And at least I sign my real name to my comments “wallies” so I don’t come across as an internet troll.

As of recently I have been on the fuck-it train as well…

I think there are a few factors that have culminated in this for me.

1) Reaching FI–feeling the freedom makes you feel very powerful!

2) Work not being as bad, because I’m working from home

3) The markets have been very kind to us

Once you hit big #s in your investments and the market is relatively stable, its incredible how quickly your net worth can grow. This makes you realize that anything under a certain comfortable threshold of spending…doesn’t matter that much.

Also, if you don’t have the dragon of a bad work environment/workload breathing down your neck…money feels different. Instead of it feeling like the air you need to escape work it feels like water you can just enjoy swimming in.

Appreciated your perspective here!

Choo choo all aboard the “fuck it” train 🙂 ! I’m so glad to hear your situation has improved (such as working from home) and that you’re at this place as well. Money does indeed feel different!

Love it. I think we followed a similar path, where we were really (too?) tight with money in the early years, but it has paid off now. We don’t pinch pennies much any more, because most of the heavy lifting is already done. It feels good to relax and enjoy life a little more!

Haha glad I’m not the only one who got caught in the tightwad sand trap 😉 . And you’re totally right – the heavy lifting has been done. That might be another reason I should add to this 🙂 .

well, you have what i call a “big lead” on your 500k goal. granted we are in our 50’s in my house and only 4.5 years from out 1st social security if we want it. we’re using our same big lead to relax and enjoy most of our paychecks. the saving part is 95% done and we also have that big lead due to the markets being very good to us since ’16.

it’s a good feeling to buy what we want and i think we still do it within reason. the house is paid and the cars are older. we’re not upgrading that crap or putting in taupe granite countertops. it’s just a relaxing way to enjoy life.

That is very true. Love the approach and only 4.5 years woohoo! And haha no taupe for you 😉 .

I’m very much in the Chill stage and have been for a few years. I credit that to my Anti-Budget, which means I save “enough” and then whatever the rest gets spent on, it gets spent on! Much less stress than trying to stick to some self-imposed budget limitations.

That’s awesome!! And yeah I love an anti-budget myself. It’s the only way I could ever get a ‘budget’ to work for me…not having one LOL!

Interesting write-up!

I think our views in life change with experience especially when it comes to money and finance. When I was younger, I was a bit more materialistic than I am now. Personally, my spending habits have gone up and down. Though now, I’m a little more careful on what I spend my money on versus in the past. (I had my reckless moments!)

Right now, I think I’m in the “selective” category due to the pandemic and also because I just started a new business (apart from real estate investing). So, I’m having to spend money on education and tools for the new business to improve my skills which is a good thing. 🙂

Also, I’m having a better appreciation for the simple things in life due to the pandemic and this snow storm I just went through in TX (it was crazy!). Things like having power and running water is so important. Many in the snow storm had their power and water shut off. I was lucky to have power. Though, my pipes froze and I was without running water for a week (not fun!).

I enjoyed reading how your views on finance and spending habits have changed with time. I especially like how you categorize things! 🙂

Thank you! Also congratulations on your new business 🙂 . The pandemic does indeed help appreciate the simple things and OH NO! I’m so sorry – I’m glad to hear you had power and have water now. Scary stuff! And haha I’m glad you appreciated the categories 😉 .

Fascinating evolution. After 3 years retired, I think we’ve settled into the Chill stage. Maybe closer to Fuck It with Airbnbs though. We “stretch” the budget all the time to get what we want.

Oooh that’s interesting that different expenses are in different stages AND that your biggest expense is the one in the “fuck it” category. Super cool!

I think I reached that chill stage once my mortgage was paid off and I was completely debt-free. I felt a huge mind-shift then and it’s stayed. I did buy a couple of things on an online auction recently, so maybe I’ve reached a higher category as well.

That’s awesome you felt that way after the mortgage was paid off. You’re making me wonder if there are any other milestones that correspond with my changes…Hmm! And ooh an online auction sounds fun 🙂 .

It’s hard to enjoy life without the ability to apply the occasional fuck-it 🙂 But as your post shows, it’s still mindful. And that’s the key. I really liked this post. You’re crushing it, Purple!

Thank you so much!

The difference between your Fuck It mode and someone with your frugal background makes all the difference. You are probably still frugal in many ways without even realizing it, but when you are deliberately not (like paying for couch removal) it stands out so starkly. It helps that the market kept its tear up after retirement, which gave you a little more wiggle room in the sequence of returns risk. Either way, I applaud you–enjoy the fruits of your labor!

That’s a really interesting viewpoint. I guess it feels like I’m all “whatevs”, but I’m not out there buying Lambos or anything 😉 . Thank you!

The final stage F it mentality is definitely where people should want to be! I should be in the chill stage but to be honest, some days I feel chill and other days I don’t feel so chill. I can’t wait until I get to that F it stage where a $10 expense will be spent without thinking about my budget.

Congrats! Now you can enjoy life to how life was supposed to be enjoyed!

Fair point! I’m going to monitor if I feel like I move to other stages on different days. And thank you 🙂 .

Money should be spent, is exactly what they were earned for. To enjoy the money spending is the highest point of financial independence (as I see it).

The evolution of your relations with money is inspiring!

Love the perspective and thank you!

EXACTLY! Not obsessing over my finances anymore sent me for a loop. It’s totally cray-cray. I used to check my Vanguard account weekly, mortgage interest and debt snowball spread sheets updated manually online regularly. Net worth checks frequently have all gone by the waist side. Ha! I haven’t done any of these things on a regular basis probably since the month after I retired (insert surprise emoji here) and it’s been a little over a year now- still don’t do it. Now, my financial goals are set it – don’t look at it – and forget it. Yyyaaasss. Congrats on your Net Worth continuing to increase and reporting to all of us!

That’s a great point – my time spent checking accounts and spreadsheets is also ridiculously different. So glad you’re having an awesome time 🙂 and thank you!

When I retired last December I thought that I had one more renovation expense to go – to redo my ensuite.

Then the tiler discovered that there was water damage in the boys’ bathroom. So I’ve spent an extra 12K that I wasn’t expecting.

I would have expected that I’d be stressed out by it, but I ok’d the expense without a second’s thought. It was a little annoying, sure – I would’ve preferred to put that money towards a trip to Antarctica – but I haven’t lost a wink of sleep over it.

I’m sorry about the water damage. That’s awesome you approved it without a second thought though and woohoo to not losing sleep over it! Now I need to hear more about this Antarctica plan please 🙂 .

In a couple of years Latestarterfire and I are heading off to Antarctica. I blogged about it being my next big goal and she wanted to come along.

She’s coming over for lunch next week and no doubt we’ll start putting plans in place. 🙂

This sounds familiar in my fuzzy brain 🙂 and makes me so happy to hear! And lunch next week ahhhh I’m so jealous. ENJOY!

Thanks so much for this post. It gives me hope! As someone who’s *just* realized they can retire, I’m erratically hopping between tightwad, frugal and selective. And I’m still obsessively running my numbers through spreadsheets and FIRE calcs to make sure I haven’t made a colossal mistake. (I can’t wait for this stage to be over.) But it’s just a matter of building up more confidence that I can handle whatever may happen in the future, because no matter how hard you prep, life inevitably has its own ideas.

That makes me feel so happy!! Let’s spread some hope around. Life does indeed have its own ideas. I hope your current stage ends soon and you can join us over here in the sun 😉 .

We for sure are in the “fuck it” club these days for the same reasons you are. COVID and a market that is still finding a way up. Oh and “fuck it” = FI !!!!

OMG Fuck it = FI!!! How did i miss that lol?? Sensational. Happy to hear I’m not the only one feeling this way 😉 .

This is a unique and useful way to think about it!

I’m currently in the ‘impatient tightwad’ stage. But then, I’m naturally frugal, so I don’t expect to get too far beyond the ‘selective’ stage. Or maybe the ‘chill’ stage.

That’s cool! I’d be curious to hear if the stages go like you imagine. I never thought I’d be here personally 😉 .

Do you think this attitude is because of outrageous market gains?

I don’t think so because I don’t care what the market is doing right now since I’m not touching my portfolio until like 2024 at this point. As in, the current market movement has no effect on my day-to-day life and I know it will go down at some point.

I’m between selective and chill. I still don’t like spending money on luxury stuff. I’d rather spend more on things that I know make me happy. Not sure if I’ll ever reach the f* it stage.

Well, I was at that stage while I was in Thailand. Maybe you just feel like you’re on vacation. When you’re on vacation, you tend to spend more and don’t really care.

Cool! And that’s interesting – I don’t think I change my spending habits when I’m on vacation usually. I’ll pay more attention next time I’m a beach to see if my wallet flies out of my hand 😉 .

Oh how I love this post. I was definitely frugal in my college days then to fuck it, back to frugal, the pandemic pushed me back to fuck it and now I’m in chill mode.

Yay! So glad you enjoyed it and lol it sounds like you need your own chart 😉 . You’re hopping around more than I am haha!

Loved this.

As a fellow FIRE’d peep (is that what we’re called, no idea…?!) I pulled the trigger two years ago now. It’s funny, on some things I still love to make sure I get what I deem good value. Not the cheapest, just what I think is money well spent.

Not because I need to but because I enjoy doing it. And I think that’s the thing you nailed for me – it’s so different when you no longer NEED to be mindful. Totally different head space.

It’s great to hear how much you are loving your new life – I read of so many people who seem to struggle with it whereas totally agree, it’s even better than I ever expected.

Cheers!

Lol – sure let’s take that label 🙂 . Congratulations on 2 years! That’s interesting about getting value. I’m going to pay attention to see if I do the same once we start moving around and I have to book rental cars and things where I could spend more time to probably get a better deal…but will I 😉 ? And woohoo to happy post-FIRE lives!

Yeah, definitely between selective and chill as well. I think we could get to the f*ck it stage if sequence of return risk is eliminated by a continued bull run. But for now, I am a bit more nervous than I have been about money, which is largely due to the lack of having a solid decumulation plan. Still a work in progress…

That’s interesting – I’m curious to see if your thoughts change with that decumulation plan or if you’re going to keep feeling cautious (which is obviously a good thing to be 🙂 ). Either way, I’m sure it’ll be awesome. You’ve got this!

FRUGALITY BY NECESSITY VS FRUGALITY BY CHOICE

Yesss, this 100%!!!

I’ve always been frugal but there’s a HUGE difference between doing it because you have no other option, and because you want to.

Likewise, as a woman breadwinner – HUGE difference between going back to work out of necessity vs choice.

Exactly 🙂 – completely agree!

Your observations are so interesting to read! I am wondering how I am going to feel about money in the future.

I am about to finish my masters degree and live under the poverty line set for a single person in Germany (less than ca. 700 €/month – though I am married, don’t have to pay for health insurance or university). Just yesterday my husband and I had – yet again – a discussion about our standard of living: Quite frankly I feel like a princess already! We have a lovely place to live (a bit run down but whatever 😀 ), the money for mostly organic groceries, travel at least twice a year, eat take-out about once a week etc.

I can’t imagine a better life – even with more money 😀 But we’ll see about that lifestyle inflation – maybe the urge for a Porsche and yacht arises once I am earning some real money … 😀

I’m so glad you liked them 🙂 ! That’s awesome you already feel like a princess – it’s usually the little things that make me feel that way. And haha – let me know if those Porsche and Yacht needs come up – I’ve never had them personally.

Does it matter if one is frugal by choice or necessity. It still involves the same behavior, right?

Similar behavior, feels completely different

I would never have believed that I would belong to this club except that I’m experiencing it first hand. I don’t know WHY I bought a chest freezer but it’s a pain. Whatever you need is always at the bottom, and you can’t see what’s in it so food gets freezer burned. I told my husband I wanted an upright freezer. He started to argue that nothing is wrong with this one, etc. I told him that we are never going to spend all the money we have, and I WANT one. He laughed and asked when I wanted to go shopping. Who is this person I’ve turned into? Great post!

Me either!! It’s so weird right 🙂 ? And “we’re never going to spend all the money we have” is an awesome come back. I hope to be able to say that myself some day. Welcome to the club 😉 !

Where did you get that Vanguard t-shirt?!?! I am googling and can’t find it and I NEED IT!

They were running a promotion on twitter and giving them to anyone who asked. Sadly as of a few weeks ago they’re not available, but keep a look out if they start the promo again!

I love this post! And I’m looking forward to reading about your time in Maine. I’ve wanted to visit Portland in the summer but never have, so I’ll definitely be interested in your experiences. I’m FIREing from corporate life June 1st – I can’t wait!

Yay!! And I’ll definitely get into the Maine life then – I wasn’t sure people would be interested 🙂 . And WOOHOO June 1 is so soon!

This post resonates with me and my own transformation through my journey to financial independence. While frugality helps you be disciplined in the beginning and amass adequate FU money, it becomes not nearly as important as you venture along. Learning how to spend your money again on things you enjoy, such as travel for me, is such an eye opening experience and makes the prior years worth it. I now have the freedom to live the life I want, even if it costs more in certain areas then I had planned.

Yeah it’s awesome to spend things that actually bring joy 🙂 .