2021 is coming to an end – and it feels weird 🙂 . But I’m going to brush aside my weird feeling that my brain is still stuck in 2020, believe my calendar is correct, and soldier on.

So let’s talk about something fun, the surprising amount of money I made in retirement. It’s surprising because outside of dividends, I expected this amount to be $0 after I quit my job in October 2020 to retire at 30. But like a lot of things in life, I was wrong 🙂 . Let’s get into it!

Income

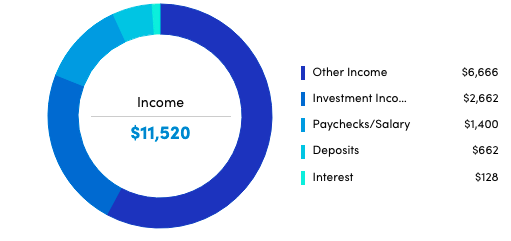

Here’s where my money came from in 2021:

Yes, yes – as I said, I was totally wrong. I assumed I would never make another dime after quitting my job (unless some serious unforeseen situation arose that required it) and instead, the universe threw that idea in my face. I made a little money from this blog and in opportunities that arose from it, such as someone asking me to write an article for their site.

However, so far, despite all my jokes about spreading birding knowledge because it’s somehow a pyramid scheme, my other hobbies have not accidentally created any income. Phew! Let’s try to keep it that way 😉 . Anyway, here’s all the money I’ve received this year:

Dividends

Income: $2,662

This is the only income I knew I would have in retirement (in addition to capital gains when I sold my stocks). The above amount are the dividends I received in my checking account from my taxable brokerage so far this year. The total amount of dividends I received (though the rest were automatically reinvested in my Traditional IRA and Roth IRA accounts) was $5,898.74.

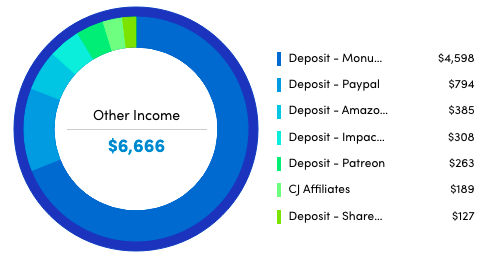

Blog

Income: $5,803

Estimated Taxes (15%): -$870.45

Expenses: -$855.40

Profit: $4,077.15

Hourly Wage: $7.18/hour

Shockingly, this blog made money this year. And because I didn’t have a lot of large expenses, such as conferences I attended in previous years (I guess FriendCon was also a money saving measure 😉 ), that profit was way larger than I expected.

However, before you think blogging is the path to riches, please check out these posts I’ve written on the subject (Spoiler: It is definitely not). Still, it’s nice that this site is now paying for itself and currently bringing in a little extra to boot. Maybe I’ll use it to (pandemic pending) go to more FIRE meet ups to see some of y’all in person 🙂 .

Speaking

Income: $500

PayPal Fees: -$22.44 (4.5%)

Estimated Taxes (15%): -$75

Profit: $402.56

I got paid to answer questions during a live webinar that about a thousand people RSVPed to. Over 300 showed up and the rest were able to re-watch my talk for all eternity 🙂 . It was nice to get paid for my time.

Writing

Income: $100

PayPal Fees: -$3.20

Estimated Taxes (15%): -$15

Profit: $81.80

I wrote a 1,000 word guest post for another site and got paid for the first time to do so 🙂 . I always find it fun to try new things and this was one of the most recent in a long line.

Patreon

Income: $333

Fees: -$70

Estimated Taxes (15%): -$49.95

Profit: $213.05

After a few threats from friends, I created a Patreon for the 18% of the recipients of my Accountability Beast tweets who want to pay for the service (the rest are on the free.99 plan 😉 ). Every Wednesday I take to Twitter and remind people of their goals…and bother them until they accomplish them 🙂 . Not bad for a weekly tweet thread that I happily did for free for many months!

Apps

Income: $25

I mentioned in this post that I began to dabble this summer with the wonders of apps that earn more with no effort like Pei (get $5 back on your first linked purchase with referral code aa7ynk). Understandably during the pandemic, some of the apps I used to use went out of business or made it more difficult to make money, but I’m still happy to see I could make enough for two delivered Chipotle bowls without trying 🙂 .

Interest

Income: $128

This is interest I received from my high-interest Ally savings account. They have understandably continued to chop interest rates from 2% when I started, to 0.5% currently, but still better than that 0.25% I get in my regular savings account so I’m continuing to use them to store most of my retirement cash cushion.

Tax Refund

Income: $662

Yep I overpaid the tax man and accidentally gave him a year long interest free loan. It was always a crap shoot trying to guess how much I would owe because of my previous employer’s intentionally confusing compensation structure 🙂 . I’ll add not having to deal with that shit to my never-ending list of things I’m grateful for in retirement 😉 .

Stimulus Payment

Income: $1400

I find this silly, but I qualified for the final stimulus payment and then I worked to put it into our local economy by helping to keep our favorite small restaurants alive and tipping even more than usual. I debated even including this in my income report, but it was an inflow so like the tax refund, I’m including it to give the whole picture.

Total Income

I received $2,662 of taxable dividends and I made $6,989.56 of profit for a total of $9,651.56 in 2021. That sounds like a legit chunk of change! Not bad for a lazy retired bum ;).

Spending

This year I spent about $20,000 and this amount is right on track with the $20,000 I budgeted for the first year of retirement and I was surprised to see it to be honest, since we’ve been traveling all over the US and eating everything in sight. I’ll be going into detail about all of this in my annual spending post next week so stay tuned 😉 .

Also, interestingly, if I were pulling from my investments instead of still living on my 2 year cash cushion my withdrawal rate this year would be 2% of my original investment portfolio when I quit…Sweeet!

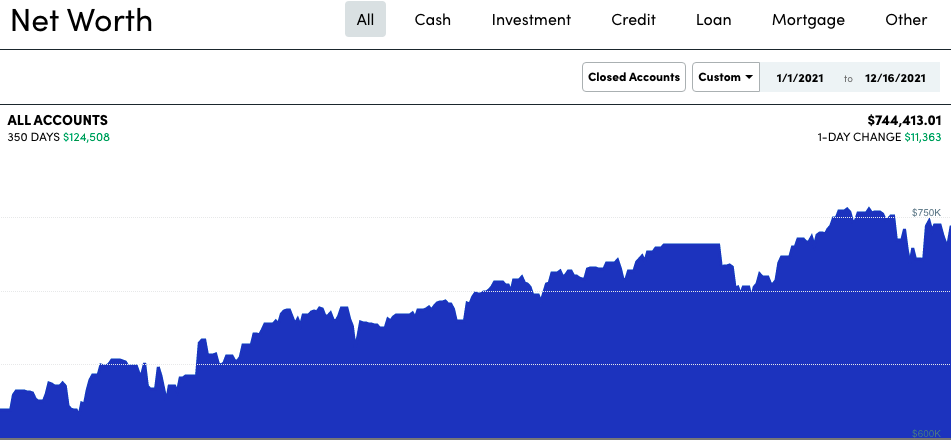

Net Worth

My 100% US stock portfolio is currently up 23% and as of this writing my net worth is $744,413. Since October 1, 2020 (the day I retired) my net worth rose $211,576 or 39%. I must admit that this was not the financial outcome I was expecting when retiring into a pandemic and possible recession, but here we are 🙂 . Another lesson that I cannot predict the future and should never try!

If you’re interested in monthly net worth updates throughout retirement, feel free to follow me on Instagram or check out my Numbers page.

Conclusion

And that’s it. My goals for next year are pretty straightforward:

- Increase my spending target to $21,200 to account for 2021’s 6% inflation

- Keep enjoying retirement 😉

So let’s see what 2022 brings!

How was your 2021? Did you hit your monetary goals?

Way to go! Can’t wait to see what the new year brings

I had a very similar experience I think people who retire early materially attract opportunity lol. You retired about a year after me, excited to see what after pandemic retirement looks like!!

Thank you!

Thank you! Me either 🙂 .

What a fascinating evolution. I love hearing about the things people say no to.

Haha thanks! And yeah it’s wild since I used to say yes to everything and anything 🙂 .

Nice year! I knew you’d make some money after early retirement.

We did pretty well with our goals too. Our net worth increased about 10%. That’s not bad, but it could have been better. We have a lot of drags – house, kid, bonds, etc…

Happy holidays!

Thanks Joe! I was skeptical myself, but it makes sense that you’d know what you’re talking about 🙂 . That’s awesome about your net worth! Happy Holidays 🙂 .

Great summary and an awesome cash flow for a retired bum.

Cash cushion – how much minimum do you keep in this bucket?

I’ve always thought that cash is only to be spent when the market is down so you don’t sell stocks. What is your strategy in refilling this?

Thank you 🙂 . As for the cash cushion: that wasn’t an overall financial strategy, but something I came up with to deal with the pandemic and possible recession we were going through, which usually lasts 2 years. I planned to save a 2 year cash cushion and use it in the allotted time, but since I retired over a year ago the cushion hasn’t shrunk so I’m going to use it until it runs out and a few months before (in 2024 at current estimates) start withdrawing from my portfolio. I’m not planning on refilling it.

Purple, don’t you find it a bit… ominous that in the first screenshot, your other income is $6,666?

JK, JK, I think it’s awesome you made money with very little effort. Is there any way to watch the recording for the live webinar? I must have missed that you were doing that because I did not sign up. 🙁

Haha no – my favorite number is 6 so I took it as a lucky number 🙂 . You can’t watch the webinar recording without signing up for the service of Female Invest, but I spoke about the same things I mention on the free podcasts I’ve been a part of – so if you want to listen to one of those you should be good 🙂 .

Haha nice! My favorite number is 7 (which I like so much that I ended up getting a phone number that had two 7’s in it, haha). I’ve listened to some of your podcasts so good to know I already have heard what you said. 🙂

Oh cool! And yeah there’s no special secrets I’ve been keeping just for random webinars so don’t worry 😉 .

Congratulations! That’s awesome. It’s mind blowing how things like increasing your net worth by almost a quarter million dollars without working a full time job is possible. We are living in one of the best times ever to live in.

So happy to have stumbled on personal finance blogs to think about the big picture personal finance strategies.

Thank you 🙂 ! And yeah the market has been ridiculous lately.

Ok I knew you’d make some money in retirement but just over half your spending budget is extra awesome 😉

Question about your cash cushion: how long will you draw from that instead of selling your stocks? Are you going to stop using it when you have X months or a year of cash left?

Well you knew better than me for sure 🙂 . I really didn’t think I would – and yeah that was super unexpected. I planned to use that cash cushion for 2 years, but we’re coming up on that number and it’s still full so I’m not planning to use it until it runs out, which looks like it will be in 2024. Then I’ll start withdrawing from my portfolio.

0.08% and 0.05% on your Ally savings accounts!? Gah I hope that’s a typo since we are getting 0.5%!! But otherwise a 2% SWR seems like you are killing it!

Whoops! That is a typo – it was supposed to say .8 and .5. Thank you for pointing that out!

Happy holidays, Purple 🙂

HAPPY HOLIDAYS!!!

Wow, looks like the blog + dividends were responsible for most of the income!

Always inspiring to see that people can make money post-retirement just by dividends and doing what they love (blogging in your case)!

Merry Christmas, and congrats on a great year!

True story 🙂 . And yeah – both were a bit of a surprise, but I’m not complaining. Happy Holidays and thank you so much!

“Not bad for a lazy retired bum”

But…laziness does not exist! https://www.npr.org/2021/09/24/1039676445/laziness-does-not-exist-devon-price

Or more to the point, you talked about it in this post, among others: https://apurplelife.com/2021/08/31/how-laziness-saved-me-from-bad-financial-decisions/

You’re right 🙂 . I was just having a bit of fun.

Nothing wrong with that 🙂 Happy New Year!

Congrats! More into blogging. What are your plans when it comes to monetizing the blog? Sponsored post, writing frequently for more views, focusing on affiliates?

Are you venturing to other blog topic like bird watching for creativity and possibly monetization?

I don’t have any plans besides keep writing until it’s not fun any more. I don’t currently accept sponsored posts and only change my schedule during PurpleMas, but I’m not sure I will continue that past this year.

I talk about anything and everything on this blog including birds so I’ll keep doing that, but no I don’t have plans to make any money from my other hobbies. Basically, I like not having anything resembling a job too much to do any of that stuff 🙂 .

It’s cool you made some extra income this year and I get what you’re saying that blogging isn’t the path to riches for YOU, but it definitely is for a lot of people. I spend maybe 20 hours a week working on my blog and earned $70,000 from it this year, my fourth full year of blogging. If you approach it like a business and go into it with the goal of making money, I think it’s very reasonable to assume it can be a huge money maker.

I remember you wrote an article about how blogs don’t make money but you are on your way to six figures I think.

Haha I very much doubt that, but I’m happy to eat my words if that happens 🙂 . And I still maintain, most blogs don’t make money and that’s why I’m surprised this one has.

Great post. I did actively seek income the first five years I was retired but this last year I stopped doing that. But I’ve found it doesn’t matter. Things like stimulus checks, my wife’s decades old teacher pension, dividends, friends begging me to do a paid project, even today that happened. So like you I make a meaningful amount I don’t really need but it still adds up! It is kind of fun that it happens.

Thanks! Good to know that even after you stop trying some opportunities still arise. It is indeed fun when that happens.

It’s great when things turn out better than expected. You’ve got some good cushion in the portfolio now should a recession hit.

Are there other money making opportunities that you were approached about that you turned down? Job offers, consulting, etc? I hear that’s a common thing for really early retirees.

It is indeed 🙂 . Outside of online stuff that I turned down (speaking engagements, brand partnerships etc) people from my old company keep trying to get me to come back in a FT or consulting capacity. I don’t think I’ve had recruiters reach out that I can remember (then again if they did I definitely deleted their email 😉 ), but that’s really rare to happen in my line of work in general.

Congratulations, and good job tracking it. My bet is that you’ll find additional sources of income in the years ahead, as you “get bored with sitting around retired.” The beauty of FI is that you can now do work that you enjoy, and earn some money on the side.

Thank you! And we’ll see 😉 . Based on my Mom being in year of retirement and still not bored of sitting around, I currently doubt that, but I try to never say never.

Why would you owe taxes if the 2021 federal standard deduction is $12,550?

Self employment taxes