I’m here to tell you the real truth. FIRE Blogging is a scam. It’s the only way to ‘retire early’ and I know the secret of how you can do it too!

All you have to do is be like me: Write a blog for free for 3.5 years. Then take it public and make -$117.09 writing it for another year. Then monetize it and make -$839 the next year. THEN in your 6th year of writing make $2,070.75 of profit and live on that. It’s super simple!

Just do daily work for 6 years and make a profit of $1,114.66 total: $185.78 a year or $0.26 an hour. It’s foolproof! It has almost as good of a return as an MLM 😉 !

Obviously, I’m completely joking. FIRE blogging generally would be a horrible plan to fund a retirement – or any lifestyle. I explained in this post about how blogging has turned out to be my dream job that it also pays basically no money. So then, why does it seem like the only way to retire early is to have a huge FIRE blog?

The Big Blogger ‘Camera Obscura’

As someone who was a lurker and reader in the FIRE community for years before peeking my head out and then raising my hand and then, years later, finally joining it, I think I can see this situation from both sides. Before I was a part of this community, I would see the same 5 bloggers or so, quoted in every mainstream article about FIRE. And those 5 bloggers had retired years ago, but also made a substantial amount from their blogs. And this is a weird tension.

More popular bloggers are by definition going to be making more money because of their larger audiences, so the bloggers I was more likely to hear about, are by definition bigger, money making bloggers. To put this into perspective, we actually hear from a relatively small percentage of actual early retirees because most (like my Mom) don’t have blogs. They’re just living their retired lives 🙂 .

Also, as I mentioned above, most people who have blogs, (retirees included) make basically no money from it. So FIRE bloggers that are big enough to be mentioned in mainstream media, are already usually a subset of two groups: retirees and bloggers who make money.

They are outliers, but because they are most of what we see, we can point to them and say “See! That’s the only way to retire early – to have a blog that shows people how to retire early!” It seems like the people who sell a book for a lot of money about how to sell a book for a lot of money. It’s a weird cyclical conversation that gives me pyramid scheme vibes. And this can appear to be the case, even if a FIRE blog in general (or the income from a blog) was not a part of the person’s original retirement plan.

Blogging Is Not A Great Income Plan

Putting aside the outliers for a second, the truth is that it’s actually quite rare to make any money from a blog and even more rare to make enough to live on. Income from a blog is also very unstable and is one of the first things to drop during a recession – marketing and advertising budgets get slashed, as we saw in March.

For example, the ad revenue from this site hasn’t yet recovered almost a year later. Some companies, understandably, started advertising less and other companies with affiliate programs I use cut the (already small) commissions or even lowered them to 0%. Also, unlike a salary, these changes can happen at any time. There is no guarantee you’ll make money from month to month.

Making Money From A FIRE Blog

So blogging in general is not a great plan if you’re looking to fund your lifestyle, but my situation in particular seems weirder because this is apparently a FIRE blog (or so it’s been called by others 😉 ). It’s basically a blog about me and I’m on FIRE, soooo I guess technically it’s a FIRE blog, though I’m sure that’s not apparent by the random topics I cover each week. I just write about whatever I feel like banging into this computer on a Wednesday morning, which often has little to do with money or financial independence in particular 🙂 .

But now I’m retired and I make a little money off of this blog. This is strange because I assume y’all are here reading this BECAUSE I was on the path to FIRE. If I was just some woman without a goal talking about random things every week, I imagine this would be far less interesting to you (let me know if I’m wrong in the comments 😉 ).

So it’s weirdly circular like the ouroboros below – the serpent that eats itself. This blog is fairly popular because I was on the path to retirement and now after 6 years, I’m making a little money off of this blog for that same reason.

I’m obviously not rolling in the dough from blogging, but after all these years, I am making a little money from this blog and that feels weird and meta to me since it’s a blog about my money journey…which is now paying me a little for my time.

The meta weirdness of it was one of the reasons I was completely against monetizing this site in any way for 4.5 years. That and because I wasn’t sure it could be done in a way that didn’t make me feel weird or sleazy (Spoiler: It can 🙂 )

So talking about the journey is now partially funding the journey. Super meta. It would have been so much simpler if random other things I like to do were what after years of effort turned a profit, but alas, I’m too lazy to have more than one big hobby at a time 🙂 .

A ‘Pure’ Retirement

If you’re looking for a ‘pure’ case study of people who have made money in retirement (as it seems most do), but are NOT using that money so they can test if their original plan would have worked, check out Millennial Revolution. They created a separate portfolio where they stash their blog, book and other retirement earnings in order to see if their original $1 million CAD portfolio would have sustained them without the extra. So far it has.

I am not a ‘pure’ case study for several reasons – one of which is that being open to and most likely accidentally making money, was always part of my plan – it’s one of the two levers (flexible spending and flexible earnings) that make me feel comfortable pulling the plug at 30 with an 100% stock portfolio.

I never claimed that my $500,000 would sustain me forever – this is an experiment with a lot of contingencies, but also an acknowledgement that – just like any retirement under the wrong set of circumstances – it could totally fail. However, failure has never really been my concern. And if failure is also defined by making money accidentally, I was almost 100% likely to fail.

So, in case you’re curious, I’m not trying to be a ‘pure’ case study and separate out my portfolios because:

- It would mess with my Roth IRA Conversion Ladder that I’m using to access my after-tax money before age 59.5

- It would make my taxes more expensive (for no good reason) and more complicated

- Most importantly: I’m lazy

The Internet Retirement Police

But what about the inevitable pushback? My partner has declared that he is a card carrying member of the IRP – the internet retirement police – and he says that the cultural perception or definition of a word is what it means, regardless of if that is true or accurate based on a dictionary. For example, the use of the word “literally,” which now means the exact opposite based on real world use.

While the FIRE space is trying to redefine ‘retirement’ as quitting your full-time job or doing whatever you want with your time, the stereotype and cultural definition of retirement is still being old and sitting on a beach and doing nothing that could possibly resemble work.

This is currently the case even though it’s not an accurate reflection of how older retirees spend their time. Most older retirees make money after quitting their full-time job either from necessity or desire. But how do we clarify the lack of facts behind these stereotypes and how does making money from a FIRE blog in retirement factor in?

Conclusion

So I’m retired and I make money from this blog. The small amount I’ve made is not what allowed me to retire early (as I try to make clear by sharing all my numbers) and any money I might make going forward, is not what will allow me to stay retired (the hundreds of thousands I saved before quitting are doing the heavy lifting 😉 ).

And now that I think about it, the fact that I’m deciding in October if I’ll reduce the frequency of posting here or even stop blogging all together, is just another example of how this income is not key to my plans before or during retirement. I don’t need it and I didn’t count on it or ever imagine that I’d even make it since, as I’ve said, a majority of blogs never make much money and I’m a realist 🙂 . However, even though I didn’t factor this accidental income into my plans, I did suspect from looking around at other early retirees, that I would possibly earn some money in retirement – I just didn’t know from what.

Because of my hopefully 70 year retirement timeline, I’ve always been open to making money in the future. I was never going to blindly pull 4% of my starting portfolio every year and see what happened. Flexibility is at the heart of why I feel comfortable quitting this young: flexibility to spend less and earn some money if needed.

Anyway, enough about me. I don’t have a solution or answer to this weird meta-problem we have in this community, but I did want to talk about it because the situation is just that: Weird. I hope my rambling thoughts can start a discussion about this strange reality and how we can all handle it going forward.

What do you think about FIRE blogs making money after retirement?

I think it’s absolutely legit to make money off your blog. No need to apologize. But if you don’t need the money, why don’t you turn off the ads at the bottom and just keep the revenue from affiliate links?

I personally find the ads to be quite intrusive on mobile.

Kind regards,

Jenni

Hi Jenni – I wasn’t trying to apologize, but good to know it might come off that way 🙂 . Thank you for the feedback on the ads! I have the ads at basically the lowest setting/frequency to a point where I don’t find them annoying when I’m editing posts, re-reading etc, but I’ll take that into consideration. Affiliate links alone wouldn’t usually cover the cost of running this site and it being in the black will most likely help me want to continue it (vs a money draining hobby). It also feels cool to get paid a little for doing something I love and have done for free for so long.

I’ve enjoyed being accused of not retired thanks to the $82 my blog has made in it’s lifetime. I even shut off one of the ad bars in despair of the insults!

Uh oh – better not tell them about your InstaCart earnings then 😉 !

It’s funny because I originally found your blog because I was interested in keto. Then I really liked the laid back style and fresh random content ha! Tv reviews, finance tips, kindness, laziness. It’s like the whole millennial experience in one fun weekly package. I also liked that you weren’t so technical or nervous about every worst case scenario like many other finance bloggers. It’s been fun to follow your journey for a few years!

Oh wow Nate – it’s been so long I forgot that keto brought you here originally 🙂 . And you need to be on my (nonexistent 😉 ) PR team – you make this sound like a cool place instead of a ball of randomness and I love it! And yeah the rest of the internet seems to have technical and nervous covered so I took a different path 😉 . Thank you so much for being here!

As a reader/long-time lurker of FIRE blogs, I don’t really care whether they make money for their writers or not. I read them for the content. If the content isn’t something I’m interested in, I don’t go back to the blog. I’ve visited certain blogs that haven’t updated in months, hoping for an update, more than I have other more popular ones.

As someone who hopes to achieve FIRE sooner rather than later, and whose mindset and approach is like yours, I can see how having even a little income stream from a blog would be nice. It’s a little extra security. For those bloggers who get big and popular, like, more power to them, you know? You rightly point out that FIREtirees tend to make money anyway, and I don’t really see the issue with blogging being one of those income sources.

I guess the difficulty is the suspicion in those who don’t think FIRE is possible at all. Maybe for those people, they don’t see the connection that FIRE allows for time to craft and build a blog, and instead see it the other way around, that this person only FIREd because they had the blog to support them. Maybe to them that makes more sense than saving and investing for years. idk.

Definitely not an issue for you, or anyone else, to fix! Who cares what other people think. If you want to keep up the blog, keep it up, and if you don’t, then don’t. It’s a cool way to capture a particular chapter of your life, and I for one am grateful you’ve shared it so far.

Thank you for sharing your experience! I think I heard about FIRE blogs mostly from mainstream media myself before finding them on my own and sticking around for great info. I like your outlook 🙂 . And I’ve never heard FIREtirees before – HOLY SHIT THAT’S AMAZING!!! And fair point that people pointing to income after retirement as some type of proof that the tenants we tout of how to retire are false. Thank you for your insightful words!

I love your blog!

I enjoy reading about people on the journey to FIRE (as I am) and about those who are already retired. I like how Millennial Revolution split their finances into Portfolio A & B and I would most likely do the same thing once I pull the trigger. My goal is to exit the corporate world in 2035 🤞🏿

Thanks!

Thank you Maisal! And that’s awesome you would split your portfolio like that – I tip my hat towards you as someone who is too lazy to 🙂 . And woohoo – come on 2035!

Everyone has to find their own path in life. I don’t really care what “early retirement” means to anyone except myself. If I care what other people think, I’d still be working. It’s perfectly okay to make money with your FIRE blog. The opportunity won’t always be there. The income can be very unstable.

Amazon just closed my affiliate account and stole $150 from me. Making money from any blog is tough. There are many easier ways to make money.

Great points as always Joe 🙂 . And oh no – I’m sorry to hear about your Amazon account. That’s ridiculous! I hope you can get that sorted out and 100% agree there are SO many easier ways to make money.

I honestly have no idea what’s the problem with making money from a FIRE blog or any other activity for that matter.

You have an audience that loves what you do. It’s perfectly fine making money from it. You aren’t a sleazy car salesman or something like that.

Yeah I have yet to find anyone that seems to have an actual problem with it…maybe they don’t read FIRE blogs, or at least this one? No idea. And thank you! I’m glad I haven’t accidentally ventured into sleazy car salesman territory 😉 .

I agree with your comments about the same five bloggers — though now you and I are both exposed to far more FIRE bloggers than that as part of the community.

I also really enjoy reading the financial independence subreddit since it’s a chance to read from a variety of people who don’t otherwise write about it.

I’ve been thinking of changing up my approach to the blog – instead of writing regularly once per week, just writing whenever I feel like it. I took a week off over New Year’s and it didn’t seem to make a difference in traffic, and even if it did, I doubt I will miss the $5 per month (before expenses!) that I typically make. Why not spend my time on things that actually produce, versus something I do almost because I “have to” (I do enjoy writing the blog but only do so on a once per week schedule because Google SEO or something, I don’t know why really). I’ve been toying with the substack idea more too – it’s going pretty well for my local news newsletter.

Yes indeed! I was shocked to learn how many FIRE bloggers there actually are – especially female and BIPOC ones since I basically never saw their names in lights back in the day. Love /r/FI 🙂 – they got me through the years before I took this blog public. As for schedule, you do you dude! A once a week set schedule for me just makes sure that I do it and keep that momentum because I know that if I didn’t that months (or years – oops) might pass before I deem a piece ‘worthy’ to post after my absence. Instead I have to push my baby out the door on Monday no matter what 🙂 . I imagine as a professional writer you would have less of my problem though.

ha. i just 3 months ago put ads on my blog. i have about $62 in revenue so far that should cover my cheap hosting plan. i really have considered making similar content in a bland and search optimized way that is devoid of personality just to see if i can make some money. after all, i have a certain command of finance concepts already.

the freddy smidlap blog will remain the half-assed bad personality show that it has been…but now with annoying ads! i can’t wait to drink that advertising money.

You’re making it rain over there Freddy! And I’m so happy to hear that your blog will continue to be (as you described) a “half-assed bad personality show” – that’s why I love it 🙂 .

I wouldn’t sweat this at all. My sense is that members of the IRP are either a) not retired and/or b) do not have a blog, so their opinions are with sweet FA.

For me it really boils down to intent. It’s not like you started a blog for the purpose of generating income as a specific mechanism to fund a retirement plan, it just sort of happened. And even if you or anyone else did, it really still doesn’t matter. That’s the beauty of FI – you can do whatever you like and however you like to do it.

Rock on and Happy 2021!

Those are all great points 🙂 . I hope you continue to rock on as well!

I think I like your blog because of the variety – stories about your move west from NYC, your hair, food, your family, just lots of random thoughts. It has been super interesting to know that these FIRE ‘rules’ are valid and that someone can retire at 30 and concentrate on life without worrying about a job. Making a few $ on the blog is just a way to show you’ve made progress. It’s not so much about the money – but that your efforts are appreciated. Have you ever asked your partner to write a post?

Well I am happy to hear it 🙂 . Variety keeps it interesting for me personally. And yep I’ve asked him and he’s so far declined 🙂 . If I can finally convince him after all these years, what would you like him to write about?

Interesting. I would like to hear his perspective on your FIRE journey. He eventually persuaded you of the merits of retiring as early as possible, but now you have reached your goal and he is still working. What’s it like to live with someone who seems to be a mix of high energy and being pretty chill? I liked listening to your mom’s story. I’m sure his is just as interesting.

Got it. So, that’s not really accurate – he never wanted me or him to retire as early as possible. He just wanted me to know that I didn’t have to wait until 55 to retire like my Mom. Also, he’s not high energy and neither am I 🙂 . We’ve both worked while the other was not working for long stretches of time (he took an almost year long sabbatical in 2019) so this situation and dynamic is pretty normal for us.

I’m also curious about his views towards FI and RE. Currently, I want the FI part as fast as possible, but not so sure about RE since I enjoy the career currently (may change by the time I reach FI). It would definitely open up a lot more options once reaching FI.

He’s all about full FIRE – neither of us would work if we don’t have to. That’s awesome you enjoy your career!!

Purple, congratulations for achieving these blogging milestones, and thank you for emphasizing how much time you invested to reach them! Helps those of us who are newer to blogging shape more realistic expectations not only in terms of revenue but also readership. I see no contradiction in earning an income from a FIRE blog. How often have we read advice to pursue free hobbies or develop interests that mature into side hustles? At this point, if blogging is a hobby that no longer costs you out of pocket, it’s commendable. More so, your willingness to pursue it while it cost you!

Of course – happy to share 🙂 . I don’t see the contradiction either, but was curious to explore it 🙂 . Thank you for stopping by!

“If I was just some woman without a goal talking about random things every week, I imagine this would be far less interesting to you (let me know if I’m wrong in the comments 😉 ).”

Haha you are definitely wrong? I first came for the FI talk but after a year or two everybody’s FI posts get a little repetitive. I come back for every post because you’re a great writer, fun to read, have taken several paths quite off the typical, and I am fascinated with trying to figure out how on earth you manage to live so cheaply. I love getting a little peek into a life different from mine lived with enthusiasm.

On another note, Do most people earn money after retiring? Not the ones I know. I think most of them could, but don’t want to…

Ooh proving me wrong in the comments – I love it! And thank you so much for those kind words 🙂 . As for earning money after retiring, anecdotally all the retirees I know do (including those not from this FIRE community) and I saw similar information backed with surveys, but those are obviously not comprehensive (those are the ones I linked in my post). Sounds like our anecdotes don’t align and that’s totally cool.

My jaw literally hit the floor when I saw your hourly rate from all this blogging!

I mean “figuratively,” actually. You know what I mean.

There’s nothing wrong with being paid for providing value to people. Monetize away.

Cheers!

-PoF

Hahaha – I see what you did there. And yeah my hourly rate is hilarious 🙂 . Thank you Leif!

You literally (proper use) described what I like about this blog: it covers a lot of interesting topics, it’s regularly updated but not in an overwhelming way, it’s well-written, it has a great little community of commenters, and to quote another commenter, it’s very Millennial, which I consider to be a compliment. I’m bracing myself for when you only pop in once a month; I’ve really loved the birding updates and star gazing info and general peek into a life that’s driven by interest and curiosity. Actually, scratch the “Millennial” descriptor, you write a blog from the point of view of someone who grew up learning in a Montessori style, and I think it’s amazing. I wish there was more content like this on the internet; I’d gladly pay for it.

Oh wow – that’s so kind! Thank you. I’m so glad you enjoy it!! Also I’m happy that my Montessori upbringing is shining through 🙂 .

The Internet Retirement police exist, but I’ve not seen very many comments or articles so far espousing those principles. I’ve only read a few FIRE blogs so far. I really don’t care if someone makes money after reaching financial independence. The value of reading the blogs is getting to see a variety of people achieving this challenging goal and the knowledge they share. This blog is especially fun for the plethora of entertaining topics 😀

Fair point – maybe they’re just active in the mainstream media article comment section. They don’t seem to usually have platforms of their own that I’ve seen. It’s cool to hear your perspective! And haha I’m glad you find the topics entertaining 🙂 .

If you can make a little money off your blog then all the power to you, you’re obviously not actively pushing product or trying to sell widgets. There is a cost associated with running a blog, however minor they might be, and making some money can offset those costs.

And if you feel guilty about it for some reason then donate your profits.

My thoughts exactly 🙂 and don’t worry – I don’t feel guilty 😉 . Just thought this would be an interesting discussion topic. As for donating the profits, that’s still my plan for all my money (side hustle income included) when I kick the bucket.

Great job on making enough to pay the bills. If anyone goes into FIRE blogging to make money, they should realize it’s a very long tail, hockey stick shaped graph. And for those that can’t stand ads anywhere, there’s always ad blockers like uBlock Origin. But I don’t have much problem with trying to pay the bills.

Where I don’t care for is blogs that write articles decrying/lambasting services like Betterment, then put up affiliate links pointing to the same service. Not because they’re making money, but because it’s internally inconsistent, making me trust that blogger less.

I have yet to add ads on my blog. I suspect I’ll do it at some point, but right now my blog is a labor of love.

Thanks! And yeah that’s a good way to describe it (hocket stick shaped). Seconded on the ad blockers. I haven’t seen that kind of two faced approach to companies personally (though I’m not on the internet very much now that I’m basically just a birdwatcher 😉 ). Flip flopping like that sounds shady. And woohoo to labors of love!

FrugalWheels, thanks for the subreddit suggestion! Agreed that blogs tend to self-select and aren’t going to show a representative slice of those who’ve retired.

Also, I think there’s a nugget of valid concern on FIRE bloggers making money, but not one that applies to you, Purple. I recall feeling a little queasy when I was reading a particularly smug/preachy blog post about OMY syndrome, and how you just have to pull the trigger… from a blogger that makes substantial money from their blog, and isn’t experiencing the reality of drawing down the hard-won stash. It felt a little… unsympathetic? Blinkered? Something icky. So that’s a very narrow slice of the community, but also a real one. No worries about that attitude here, obv 🙂

Thanks for opening the conversation and being so transparent, as always!

Enjoy that subreddit – it’s great 🙂 . And yeah that sounds like a weird place to be giving that kind of pull the trigger advice. And thank you 🙂 !

I’ve earned a lot of money in retirement, but only because I found being an overpaid consultant entertaining. My blog has no income sources and costs me a few hundred a year. You are wrong though, at least in my case it wasn’t the FIRE tie in, it was your unique voice and ideas that stretch my old boomer brain in ways that I hope keep me from becoming completely irrelevant.

Adding to my small anecdotal evidence that some retirees make money – nice 😉 . And good to know I’m wrong! Also hearing I stretch your “old boomer brain” is a high compliment!!

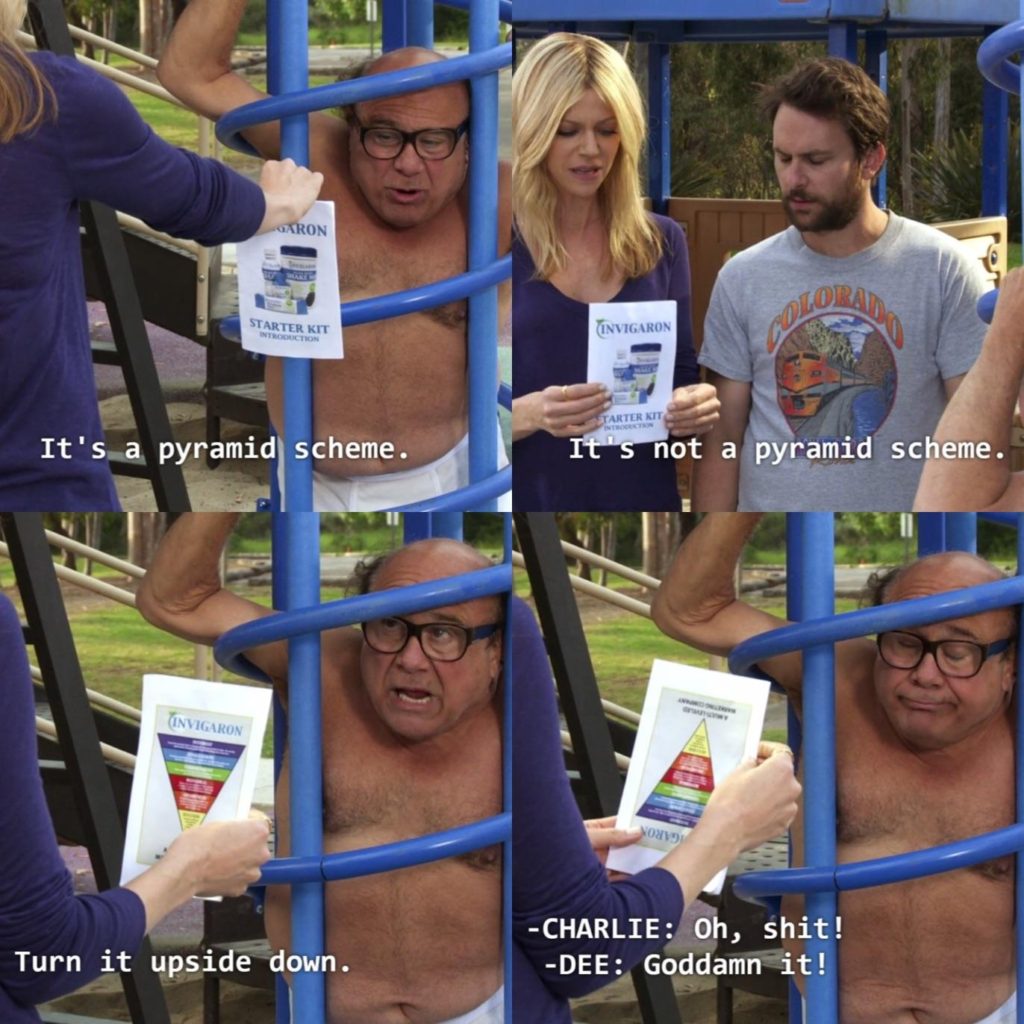

I grapple with some of these issues myself. I too just want to be pure like a greased Danny Devito in tighty whiteys. Since I have made zero money ever while blogging this makes it easy but there is of course nothing wrong with making cash. In fact most of us write about how great and useful it is to do so. For me I keep the blog a byproduct of living and this helps avoid becoming a tool of the tool as I see it. For me, part of financial freedom fun has been being able to choose what to work on independent of money. However, if I was looking to make cash it would be silly to blog for it when I could consult, do a business venture, or pick up another rental property and make infinitely more profit right? It is a great point Purple about the meta weirdness of being part of this community. Be well and keep it up…as long as the cost benefit works in your favor 🙂

All great points – I like your approach! And will do 😉 .

Since I’m pretty much only motivated by money, monetizing my site has helped motivate me to post more, knowing that with an influx of traffic I might make two cents on Adsense instead of simply one penny haha. I can’t imagine I take it any further than my limited Google Ads and affiliate links on books I read, and thus I unfortunately won’t make those big blogger dollars, but it’s been a fun hobby to learn about while increasing my personal finance knowledge every day. Loved this post!

Haha I love that you know your motivators 🙂 . And 2 cents is double 1 cent so that’s HUGE growth 😉 ! I’m so glad you enjoyed it.

So ppl throw the “meta” word out frequently, but this is a case where it actually makes sense to use it. This FIRE world is a little weird, huh? I’m so grateful for FIRE blogs because I went from thinking I was going to need between $5 – $10 million in assets to retire to a much more reasonable number. I spent my first 18 months reading all about the mechanics and trying to dial in a personal plan and then afterwards shifted to the stuff that makes me curious and/or entertains me. So thanks for filling that void for me! Until just recently (like literally 3 weeks ago), I hadn’t made a single $1 off anything besides passive investment income and my investment portfolio is still larger than when I retired (July 1, 2017) including me shifting a chunk to pay off my mortgage ($260,000). At any rate, I’ll be doing a little project this year to kill a bit of time during the pandemic and make a little coin doing so. And one of the other commenters hit it on the head – I think most of the RP folks are ppl who don’t believe it’s possible at all. Very insightful comment! Keep up the fun content as long as it feels fun to you and if and when it doesn’t I’m sure you’ll find another fun creative outlet. Cheers!

Haha happy to fill the void and I’m glad I used meta correctly 🙂 . And yeah that commenter seems to know what’s up. Will do – thank you!