Time continues to have no meaning 🙂 . Somehow, I have now been retired 2 years. HOW?! Time has been flying and life is going even better than forecast. So to commemorate the end of my second retired year and get pumped for the third, I wanted to go over where I’ve been, what I’ve spent, any revelations I’ve had, and what’s next in retirement 🙂 . Let’s get into it!

Year 2: Where In The World Is Purple?

Retirement Year 2 was the first time I ventured outside the US after the pandemic completely changed my retirement plans. Unlike the (very fun) US extravaganza of Year 1, in Year 2, I spent a little over 3 months total in Thailand and México!

4 weeks in Thailand was a lovely experiment to see how it would feel to go the other side of the world for a prolonged amount of time (Spoiler: It was awesome 🙂 ). Phuket, Thailand was gorgeous, the food was delicious and the prices were amazing 😉 .

9 weeks in México was also an experiment of sorts to see if I enjoyed living in México, since I had only been there for a week on vacations before, usually in touristy areas. It was also a jumpstart to my 2022 goal of going from speaking zero Spanish to being fluent by the end of the year. My Mom and I took intensive Spanish courses for a month and it was an amazing and challenging experiment.

After all that fun, I went back to the US and explored these states:

- Arizona

- New Mexico

- Texas

- Washington

- New York

- Connecticut

- Massachusetts

- New Hampshire

- Maine

The goal for the rest of the year was to see friends and family that we had only been able to contact via video chat while we were away. I also wanted to chill a bit before my next international adventure: Buenos Aires, Argentina for 5 weeks in November!

Overall, I think I explored quite a bit in Year 2 and even (finally!) dipped my toes into living abroad for at least a month in each location. I count it all as a great success 🙂 . After Argentina, I’m planning to be around the US for a bit before the big trip of 2023: Australia and New Zealand 🙂 .

Year 2 Spending

Before I get ahead of myself though, let’s see how much I spent living in 9 US states, Thailand and México in the second year of retirement. In typical fashion, I was curious how much y’all thought I spent:

My 2 year retirement anniversary is 2 weeks away🥳. To celebrate I'm tallying up every cent I spent during that time. Place your bets now🤣! How much money do you think I spent in Retirement Year 2💸? (In that time I visited 9 US states,🇺🇸, Thailand🇹🇭 & México🇲🇽)

— A Purple Life (@APurpleLifeBlog) September 12, 2022

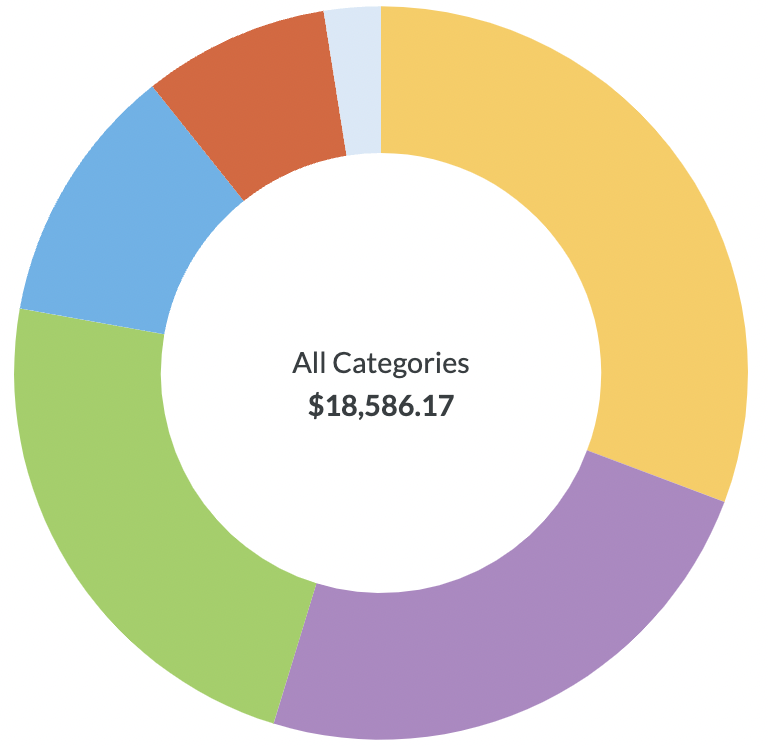

As usual, y’all are right on the money! Here’s the full picture:

Retirement Year 2 Spending Goal: $21,200

Actual Year 2 Spending: $18,586.17

I’m going to do a full breakdown of my spending in December like I have every year that I’ve written this blog if you want to know the details, but overall, I’m pleasantly surprised that all this travel hasn’t broken the bank 🙂 . In fact I was 12% under-budget despite all that’s happened in the last year. Wow 🙂 .

Year 2 Net Worth

So that’s how much I spent, but how has my money changed since I retired? Let’s see!

2020

Investments: $500,000

Cash: $40,000

TOTAL NET WORTH: $540,000

2022

Investments: $592,307

Cash: $33,871

TOTAL NET WORTH: $626,178

As you can see, when I retired I had a net worth of $540,000 including $40,000 of cash. As of this writing, I have a total net worth of $626,178, $33,871 of that in cash.

The slow draining of my cash cushion is a result of a few thousand dollars of my taxable account’s dividends being deposited into my Checking Account, and a small amount of Accidental Income I’ve made. I always break that down fully in my annual December income post, so look out for that. For example, here’s that post from 2021: How I Made $11,520 While Retired In 2021.

Originally the $40,000 I saved in cash when I decided to retire in 2020 was supposed to last until this very moment, but as you can see, I still have $33,871 left or about 1.5 years of expenses. Without any surprises, that means I won’t have to touch my portfolio until at least March 2024, almost 4 years after retiring. Very interesting.

In the meantime, my portfolio has just been growing and compounding on itself with my all-time high being hitting $755,790 in December 2021 before the market went down. Not bad at all 🙂 .

Revelations

It’s Easy To Lose Perspective

I’ve mentioned in previous posts that something I want to keep an eye on in retirement is losing perspective. Usually I mean this in the sense that living in a wonderful utopia where my needs are met, and I can focus on things I enjoy without worrying horribly about the outside world and its effect on others, can lead to losing perspective on the struggles in this world. And I never want to be like that. That’s why I have done my best to find a balance between being informed and constantly doom-scrolling.

Well I discovered another way this kind of life can be dangerous 🙂 . Since I spend a lot of time with my (retired) Mom and retired friends, I noticed that it was easy to lose perspective of what a real problem is. For example, the fact that a free first class flight is not available on the exact day we want it to be, is not a real problem 🙂 . Tiny inconveniences are not real problems.

Partner: Ugh I'm finally done with work! How was your day?

Me: Hard! I played too much Sims and watched too many shows in Spanish and now I have a headache🎮📺🇲🇽

Partner: 🤨

Me: You asked🤷🏾♀️ pic.twitter.com/RVKZsxDJHx— A Purple Life (@APurpleLifeBlog) August 4, 2022

So far in my retirement, seeing my partner still working very hard at his job while I galavant around has helped to keep that perspective, but I suspect that after he joins me in retirement, I’ll need to do more to make sure I keep the pulse on what’s a real problem so I don’t lose perspective in that way either. It’s good to remember what my life used to be like so when I hold up some small roadblock, it looks like a small bump in the road (as it should). Anyway, that’s something for me to think about and keep an eye on 😉 .

I Have Permission To Slow Down

Understandably, my first bit of retirement after we were vaccinated, was filled with wanting to go everywhere and never visit the same place twice. There is a big country out there to see and I was finally allowed to see it 🙂 . Then this year my possibilities expanded to encompass the actual world and there was even more I wanted to do.

Well after all that, I have decided to give myself permission to slow down. Overall, this was originally part of our plan – to live in a city or country for about 3 months at a time and then move on. I kind of forgot that in my excitement to see everything there is to see 🙂 . I also realized that having times of lower energy where I recoup from the last adventure, (be that babysitting or flying across the globe) are a wonderful and necessary thing.

So I also gave myself permission to revisit locations we’ve been before if we want to, such as cities with the sole purpose of seeing family and friends. Having this kind of balance between dropping myself in a new country and wanting to see everything and going somewhere I’ve been before where I don’t feel that compulsion and can just chill, has been really nice 🙂 .

Me Yesterday To @WeWantGuac: Don't let me set any big goals in 2023! I need to calm down. Becoming fluent in Spanish in 2022 and reading a non-fiction book a week in 2021 was too wild. Time to slow down😴!

Me Today: ….but what if I learned how to play piano in 2023🎹👀😜? pic.twitter.com/tOP3uw5aps— A Purple Life (@APurpleLifeBlog) August 19, 2022

(I Think) I Like Cooler Weather

Another revelation 🙂 . I love the sun – in fact, I suspect I thrive on it. As a result, I wanted to be in sunny places as much as possible in retirement. So I went to Thailand for a month in February where it was 100+F and 100% humidity. It was gorgeous, but I was immensely happy that our penthouse Airbnb had its own pool 😉 .

Then I went to Mérida, México during what I accidentally discovered were their hottest months (April and May). It got to a high of 105F and was once again 100% humidity – and I was eternally grateful for our personal pool 🙂 .

So it was great to visit those places, but I was not having an awesome time running in those temperatures and also preferred to not sweat my face off as soon as I stepped outside 🙂 . So I’ve decided to do an experiment. I’m going to try during this next year, to edit my weather requirements for my nomad locations with the goal being a 65F average.

However, as I said, this is an experiment and it’s very possible that I won’t enjoy the cloudy days that accompany cooler weather and could do a total 180. We shall see! I promise nothing 🙂 .

What’s Next?

So that’s where I am after Year 2 of retirement. Financially things are going swimmingly despite the market downturn. I still have a hefty cash cushion and most likely won’t need to touch my portfolio before my Year 3 Retirement Update. A whole 3 years post-quitting without having to sell from my portfolio? That sounds like an accidental and awesome win to me 🙂 .

Overall, I’m still the happiest, most mentally stable and physically fit I’ve ever been in my life and it’s only gotten better in Year 2 of retirement. As for my day-to-day life, I’m excited to continue exploring the US and the world in Year 3 including those trips I mentioned to Argentina, Australia and New Zealand. So that’s what I’m up to. Let’s see what Year 3 holds!

Do you have any questions for me about retirement year 2?

Also if you’re interested in a more in-depth look at what I’ve been up to in Year 2, here are my monthly retirement recaps from the past year:

- The Month Of The Southwest USA: October 2021 Recap

- The Month Of Santa Fe: November 2021 Recap

- The Month Of Family: December 2021 Recap

- The Month Of Freezing My Balls Off: January 2022 Recap

- The Month Of Thailand: February 2022 Recap

- The Month Of Spring(?): March 2022 Recap

- The Month Of México: April 2022 Recap

- The Month of Mérida: May 2022 Recap

- The Month of Seattle: June 2022 Recap

- The Month of Washington State: July 2022 Recap

- The Month Of New Hampshire: August 2022 Recap

You’re killing it! Nice work!

Thank you 🙂 !

Wow this is goals! What are you doing for healthcare in early retirement?

Haha thanks. And this is what I’m doing: https://apurplelife.com/2020/07/21/my-retirement-health-insurance-plan/

That’s awesome! I’m looking forward to the complete recap for the year.

I’m glad! Many recaps will be coming y’alls way: My spending, income, accomplishments etc. It’s gonna be a fun time 🙂 .

Go Purple! I won’t say I’m not still jealous, but I’m happy to see the updates of all the fun things you’re doing!

¡Sigue viviendo tu mejor vida!

Haha thank you! Y gracias. ¡Lo haré!

It’s amazing how much fun you have with the amount spent. Makes you wonder why everyone is still working. 🙂

I like it a bit warmer. 75-80 degrees is perfect for me. 100+ is way too hot.

Enjoy year 3!

Yeah it’s pretty wild – even I was surprised 🙂 . I seem to keep aiming for 80s and getting 100s – I might be doing it wrong haha. And thank you!

Fantastic that you’ve been able to avoid dipping into your portfolio, all the while having a great time seeing the world. Thats fantastic! Keep it up, look forward to hearing about Argentina and especially New Zealand. I’ve always wanted to go there!

Yeah I’ve been very lucky 🙂 . Will do! I’m excited too haha. I’ve never been to either country before.

Wow can’t believe it has been 2 years already! Congrats!

Haha yeah – neither can I 🙂 . I kept checking the calendar like “that can’t be right.” Time is weird. And thank you!

How do you keep up your mileage/points balance? With low spending it seems difficult to meet spend requirements for credit cards.

It also appears that you are depleting your miles quickly.

Please enlighten me.

Easy: I don’t try to keep it up 🙂 . I got these points over years (planning around big purchases) for a specific trip, which was cancelled for COVID and now the points are about to expire so I’m trying to use all of them.

Curious – will you continue to accumulate enough points to keep international travel as part of your retirement plans? Suspect likely with your AirBnb costs, etc.

Man, I love your posts – they’re so inspiring, even if I’m not retired. Your language, piano, health goals are so similar to mine. Love that you have the time and energy (the main things I seem to need), to enjoy trying it all! Cheers to another great year and I can’t wait to see your annual financial recap for more inspo!

Probably not for super luxury flights – no. However, I’m going to keep going international. Overall buying international flights doesn’t have to be expensive (in my experience in retirement) since I can buy them based on when they’re cheaper and plan my travels around that.

As for travel hacking, I’m not sure luxury travel hacking will be anywhere near as rewarding going forward unfortunately given the airline landscape post covid. Airlines are hurting and are (understandably) increasing the required points to buy flights to levels I’m personally not willing to strive for.

And I’m so glad you enjoy them!! And so true on time and energy – I didn’t used to have either 🙂 . Thank you so much! Lots of recap posts coming in December with all those money details 🙂 .

What a dream life. I’m happy for you. I wish I had someone to travel with and do all the retirement things you do. You are lucky to have your partner and your mom.

Thanks so much! And yeah I’m very lucky to have them.

I knew you were doing All The Things but added up all in one post, it’s extra fun to live through you a little bit. I do envy your command of Spanish in such a short time, what a great school/language immersion experience. Thanks for continuing to bring us on your adventures.

What happened with the free first class international flight? Was it just available for points but on the wrong date?

I’m so glad you enjoyed it!! And yeah I’m surprised with my Spanish progress, but immersion really is the way to go – even though it made my brain feel like it was exploding. And of course! Thank you for reading 🙂 .

As for the flight, I chatted with my Mom about it and we chose another date. Had to remind her that we have no restrictions and should take advantage of that 😉 . And yes it was still points, but on a different date. We booked it yesterday!

Congrats on another wonderful year in retirement!! 🥳 Time really is weird.

I’m so glad you experimented with your longer stays abroad! Also, you are fueling my desire to start planning out another lengthy stay abroad with the family. So that’s exciting haha.

Only disappointment is to see no short Canada stays in 2022! We’re going to have to coordinate something, perhaps if you are close to the border in my side of the country, I miss hanging out! Hopefully your new weather requirements may help me with that 😂.

But that selfish “I want to see you” point aside, I love how removing work can allow us to truly figure out the balance that works for us. Such as how you’ve come to see the necessity for you to recuperate from your big adventures. I personally didn’t realize how little I paid attention to what I really needed back when the 9 to 5 was eating up so much of my mental energy.

Anyhow, all of this to say, I’m so happy with you thriving in year 2 and continue to enjoy the heck out of this beautiful freedom you’ve built! So excited to see what lessons you take away from year 3. 💜

Thank you so much Mel!! And yaaas – travel it up! We do indeed need to coordinate something after our last plan didn’t work out. I’m still thinking about where to go next spring/summer – maybe a visit is in the cards if y’alls aren’t elsewhere. Let me know!

And so very true – down time for me is necessary to fully enjoy life 🙂 . I’m excited for Year 3 too 😉 . Thank you again!

Just found your blog after hearing you on Jamila’s podcast. Looking forward to reading it – and glad you are enjoying Maine (I live here too!) Also have a trip planned to the Phuket Elephant Sanctuary in 2024 so loving seeing these pictures!

I’m new to learning about FI and I was wondering if there is a tool you use to project how much your assets will be worth after a given time period? TIA!

Cool! And woohoo Maine – it’s beautiful here 🙂 . And that’s so exciting about the Elephant Sanctuary – it’s a lovely place. I was going to write a whole post about it, but didn’t get around to it before we left sadly.

Welcome to the FI community! I built my own spreadsheet to project that with basic equations, but if you google “compound interest calculator” there are lots of them. Good luck!

Thanks for continuing to post and I can ‘t wait to hear about your NZ and AUS travels. I spent about 2 weeks in NZ(mostly south island except for Wellington) on a travel study in 2016 and then since I was on sabbatical and I was already there, I independently went to Sydney for 2 weeks. It was so amazing.

Thank you for reading 🙂 ! And I’m happy to hear that – I’m excited to explore those new (to me) countries. I’m so glad you enjoyed them!!

Great article! I love the idea of early retirement, and it’s inspiring to see how far you have come. As someone who is still working towards that goal I find your story very motivating – here’s to many more years (2 or 20!) of thriving in financial freedom 💯

Thank you so much!