In this time of stock market uncertainty, I thought it might be helpful to look at the upside and put a positive spin on things when the market seems to be dripping blood red 🙂 . The market has shown a bit of the downside of investing this year – or rather, one of the moments that dictate if someone will be a successful longterm investor. Freaking out and selling during a downturn will unfortunately not lead to longterm success.

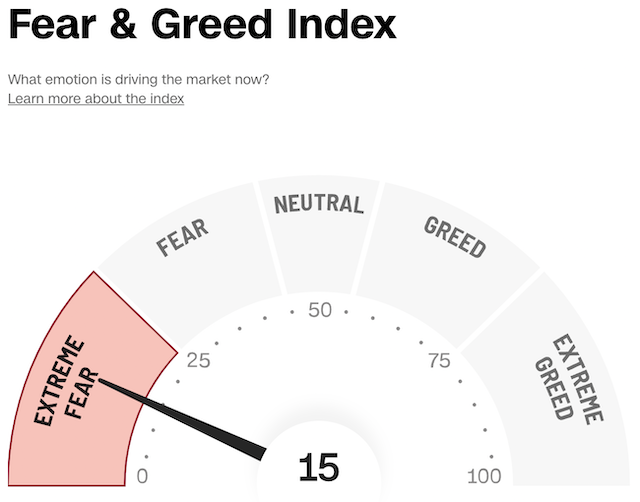

As Warren Buffett said, “be fearful when others are greedy and be greedy only when others are fearful” and according to CNN’s Fear and Greed Index, there’s a lot of fear right now.

This famous Buffett quote is from a 1986 Berkshire Hathaway shareholder letter, but it still applies to this day. When people are freaking out about the stock market is the exact moment that it matters most to keep your head. To use another Buffett quote (this dude has some real zingers 🙂 ):

“The Dow started the last century at 66 and ended at 11,400. How could you lose money during a period like that? A lot of people did because they tried to dance in and out.”

Too true. I’ve talked many times before about how I love the book The Simple Path To Wealth by J.L. Collins and his explanation of both Why The Stock Market Always Goes Up (in the long run 😉 ) and Why Most People Lose Money In The Market, are still the first down to Earth examples that finally helped me to understand investing. I’ve linked to his blog posts that inspired the chapters in The Simple Path To Wealth, in case blogs are more your thing than books 🙂 .

Those posts were written in 2012 and heavily influenced my own plans for how to emotionally weather what the stock market would throw at me. Interestingly, at the time they were published, I was about to quit my first job without a plan 🙂 . Soon after, I learned about financial independence from my partner, and promptly ignored it 🙂 . However, the path was finally illuminated before me and I started reading about finance for perhaps the first time in my life.

Exposure Therapy

Reading these posts made me realize that if I was going to jump into the stock market (especially with my 100% stock allocation) and use it as a foundation for my own early retirement, I had to plan how I would not be one of the many people who freak out, sell during a downturn, and lose money in the market. So I came up with my exposure therapy plan.

In direct opposition to my retired Mom’s plan to just not look at the market, (which is also an awesome plan that has been working for her), I decided to look at my investments – all the time. I saw small drops while my net worth was small and by the time my money was substantial, the roller coaster of the market didn’t evoke an emotional reaction in me.

I had internalized that what my shares are worth on any given day doesn’t actually matter. I’m not selling everything in one day so the cost is immaterial. I still own the same number of shares of companies that I did yesterday and what matters most to me is that over time, those companies are overall worth more. One number on one day does not dictate my financial future.

So I had a plan to avoid the main mistake people make when investing in index funds: Selling during a downturn, but what I wasn’t prepared for was how much weight the market would have in driving me towards my early retirement number. Humans seem to be very bad at understanding compound interest – myself included 🙂 . I’ve seen all the charts and graphs and was still shocked with this outcome. What might it be, you ask? Let’s see 😉 .

The Showdown: My Salary VS The Market

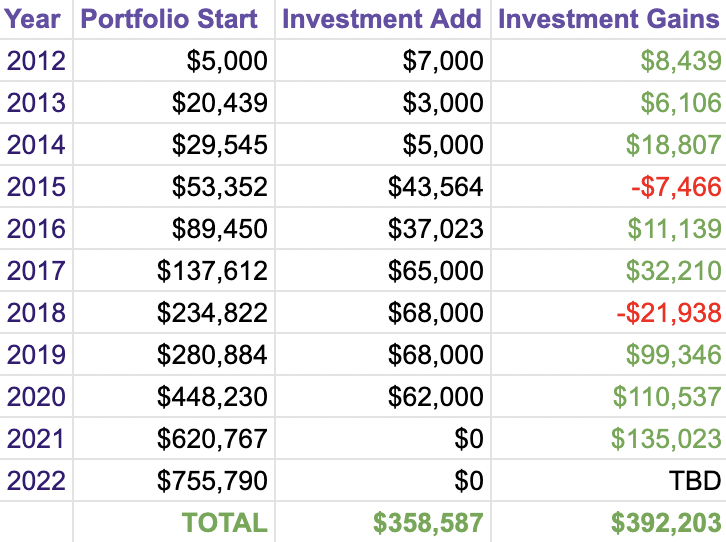

So let’s explore an example of why we put up with the gyrations of the market and what the upside looks like. Below is a chart listing out how much I put into my investments, my starting portfolio amount each year, and how much growth the stock market provided.

As you can see, the market fairly quickly outstripped the amount I was able to invest in a year even when I started making six figures in 2016. Overall, I’ve contributed $358,587 to my investment accounts and the market has contributed almost $400,000. Put another way, the market contributed to 53% and I contributed 47% to my latest annual net worth. The power of the market at work 🙂 .

The power of the market is even more apparent since I haven’t been adding to my investments for 2 years. We’ll see how everything settles at the end of this year, but even if my gains dip back below the amount I’ve contributed to my investment accounts this year, it will bounce back eventually and continue to grow my accounts overall. And I’ll also be paid dividends every quarter regardless of what the market is doing 🙂 .

Conclusion

I went into this post genuinely curious to see the result and I did not predict that the market would have done so much of the heavy lifting despite the downturns I’ve experienced, and how wild the world has been the last few years.

In case you’re feeling nervous about your index fund investments, take a deep breath and maybe listen to the below market meditation by J.L. Collins and his lovely voice (yes I’m fangirling a bit – just let me have this 😉 ).

Anyway – stay strong y’all. Deep breaths. You’ve got this!

How are you feeling about the stock market lately?

For myself, I feel fine about it. I look at the price for VTSAX every single day and look at it as my buy price, not to consider my net worth. I do so well at ignoring the price to NW relationship that I’m always surprised by the month end numbers. But that part is fine too because until I need to take money out, it’s all fake numbers anyway. And there’s my two part anti-anxiety strategy. It works well! I don’t know if it’ll work as well when the time comes to use the money but I’m making that tomorrow me’s problem.

Now you’ve got me wondering how much of our portfolio is contributions and how much are market gains. I’ll peek later.

Very smart 🙂 . And let me know what you find – I’m curious!

Thank you for putting things in perspective and keeping a cool head! Have I missed this, or do you talk about what funds and at which ratio you are invested? I’m looking to increase my dividend yield.

Anytime 🙂 . And yeah I talked about that in the post below, but in summary: I’m 100% VTSAX.

https://apurplelife.com/2019/10/29/why-i-own-100-us-stocks/

Yeah, I’m pretty much in the same boat after FIREing earlier this year. Just took a quick look; with the market drops my contributions make up a bigger part of my NW now but whatevs. I prefer to focus on thing I can kinda control. Like getting my hair to look phenomenal. 😊

Whatevs indeed 🙂 . And I like that new focus – the hair’s gotta be on point lol!

I keep looking at the price of the index fund that makes the bulk of my portfolio and raging lmao. I’m angry because it’s cheaper than it was six months ago and I should’ve saved my monthly contributions for the last six months for now. I seriously need to learn how to predict the future 😉 Like Revanche, I usually check it for buying purposes, not for overall portfolio valuation, though that’s dropped enough for me to be annoyed for that reason too hahaha.

For me, it’s less about “losing” the money, and more about not being FIRE yet. This downturn feels like it’s blocking progress. I want to be done already! Intellectually, I know it’s an important part of the process, so I try to make peace with it. Think of things as on sale, like in a previous comment discussion.

Another strategy to get past that feeling of being blocked is to remember what I want to do when FIREd and to do something on that list right now. It reminds me that life is about more than work and reaching FIRE, and that I can do the things I want to do now, even if in a limited capacity compared to if I didn’t have a job.

Hey there,

I’m also just as impatient as you and Purple’s posts are getting me through this. Also, gratitude for having my health, job, and benefits right now without worrying about navigating through insurance until later. We’ll get there, maybe not on this exact timeline but in our own way!

Totally agree with you. It’s helpful to read Purple’s posts and to remind myself of the positive things I have right now. We will definitely get there eventually! Life is a marathon, not a race.

I’m sorry. It’s definitely frustrating on the journey – I felt some of that during the ‘red’ years shown in that graph. I love trying to do some things you want to do in FIRE now. I did the same and it helped a lot. You’ve got this!

I’m just curious, how did your portfolio pull in $8k in investment gains when your entire portfolio was only worth $12k in 2012? That’s insane! $$$ Was the rate of return really over 50% that year?

I had the same question. Sadly I wasn’t able to find an explanation because I can’t get back into the portals I used for my job (and investments) back then, but I was in some weird fund that my first (and last) investment advisor recommended. I pulled that number from my spreadsheets and what I posted on this blog since I couldn’t find the details.

Is it possible this includes your employer match for the year? I have a line in my spreadsheet for how much of my net worth is employer match, makes the whole working thing a little more tolerable.

Great thinking! I just went back and according to my posts here my first employer match was at a job in the middle of my career and definitely not at my first job. It’s a mystery! That’s smart to have a separate line in the spreadsheet.

I’ve been utilizing the “don’t look” approach these days. I’m old enough to have been through this a few times and know that holding steady (or investing while stocks are on sale) is best for me.

I love it – do what works for you 🙂 .

Hi Purple,

I adore your blog.

Thanks so much for taking your time to share your life with us.

I just got into a heated argument about your table above (Portfolio Start – Investment Add – Gains).

I told someone I loved how you laid it out like that. I love the “simplicity” of the numbers and hope to be inspired to do a similar table.

The argument was whether your gains are realistic / true (which I think they are) or not (which they think is the case).

We’ve read your investment strategy, but maybe you can enlighten us a little bit more.

All the best

That’s wonderful to hear! Thank you for your kind words. I’m sorry you got into an argument about this though. Except for the first year (I mentioned in another comment that I can’t figure out why it’s so high compared to my investment because I can’t get back into the investment portal I was using in 2012 unfortunately), all the returns are the same as the S&P 500/VTSAX returns each year. So yeah they’re totally realistic. I’m still 100% VTSAX so my gains track with the overall market.

Hi Purple,

I appreciate your explanaition! Thank you!

I just want to say thank you for showing us what it’s like to retire and simply enjoy life. No side hustle, no inheritance, just enjoying the fruits of your labor 😁

Happy to help 🙂 !

Agree. 6 figures is awesome, but investment is what makes the day. I can imagine that most people will make 6 figures in 2 decades, but an investment portfolio will still make the “right” amount of money each year by then.

Yeah – the market is powerful 🙂 .

I hope this isn’t a stupid question, but how are you calculating your investment gains? Is it just portfolio start- finish- contributions. Or is there a place on the brokerage websites that tell you this. I want to make a similar table!

Not a stupid question 🙂 . It’s the former since I was in multiple accounts across the years before settling at vanguard, but they do show your gains in a table format under Performance on the Vanguard website. Good luck!

Very good question and insightful analysis! Thanks for sharing these results!

Plus…more $ from investment gains than from your own contributions?!?!?! Great reminder of the power of compound interest. 🙂

Thank you! And yeah it’s wild 🙂 .