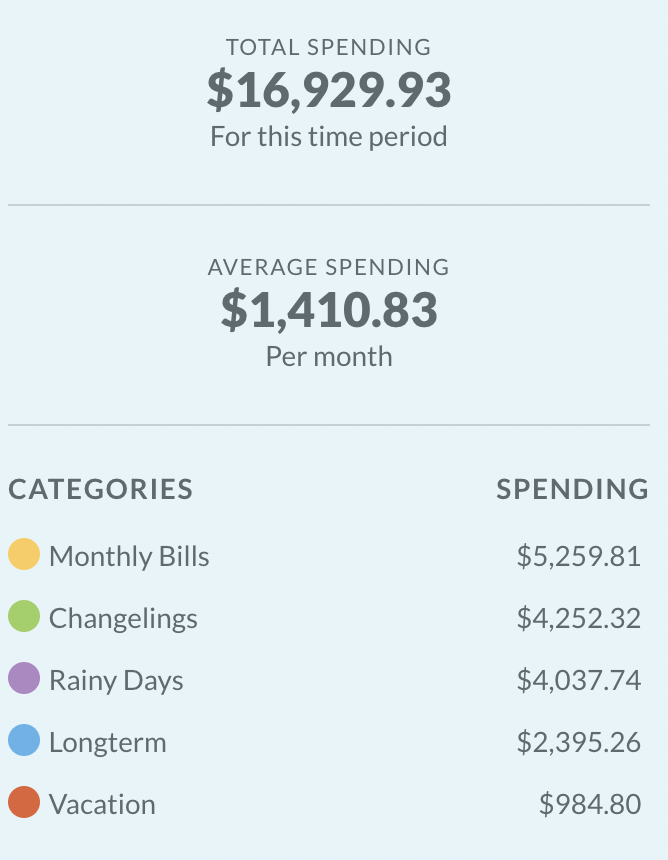

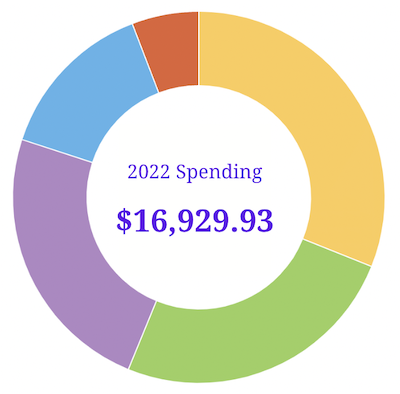

Now this is a surprise. My goal for 2022 was to spend $21,200 based on my inflationary increase from last year and instead I unintentionally spent $16,929.93, 20% below target or 4/5 of what I planned on spending.

I’ll get into all the nitty gritty details below, but I think two main things factored into this: the fact that I spent 1/3 of the year in low cost of living countries (Thailand, México and Argentina) and that people kept asking us to come visit them and stay in their space.

Apparently, even picking up the tab at dinner as often as we could (there was always a fight 🙂 ) couldn’t make up that difference. Fascinating. I thought galavanting around the world would be a lot more expensive, but the numbers are proving me wrong. Let’s dive into the exact numbers, where I spent my time (in Airbnbs, house sitting etc) and what that means for the future.

So let’s see how much I spent and get into it! Here’s every dollar I spent in 2022:

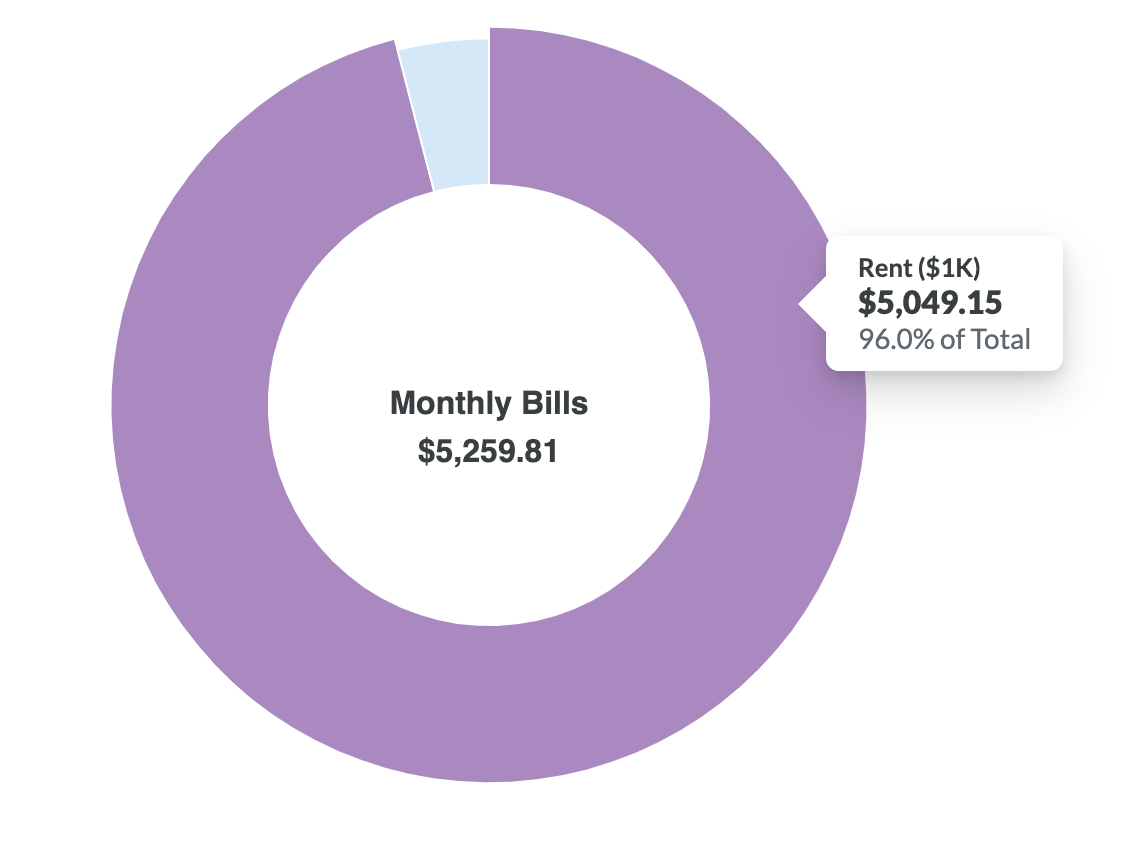

MONTHLY BILLS

31.1% Budget: $5,259.81 or $438.32/month

Rent & Utilities: $5,049.15 or $420.76/month – This includes all of my monthly living expenses, which were Airbnb payments that include utilities. The Airbnbs we choose are one bedrooms with a washer/dryer that’s walkable to downtown and ideally has outdoor space. I go into detail in the Type Of Lodging section below about why this portion is under budget this year.

Phone*: $210.66 or $17.55/month – This is for my Google Fi service that works globally. I switched from Republic Wireless in 2021 and wrote about why here. Also heads up, I received $140 total in credits for y’all signing up to Google Fi and getting $20 off yourselves. Hence the asterisk*. This is a simple referral link every Google Fi customer has, so if your friends want to sign up, feel free to share your link after signing up for the same perk. Anyway, feel free to mentally add $140 to my 2022 spending to account for this if you’d like. Overall I budget $30-40/month for my phone.

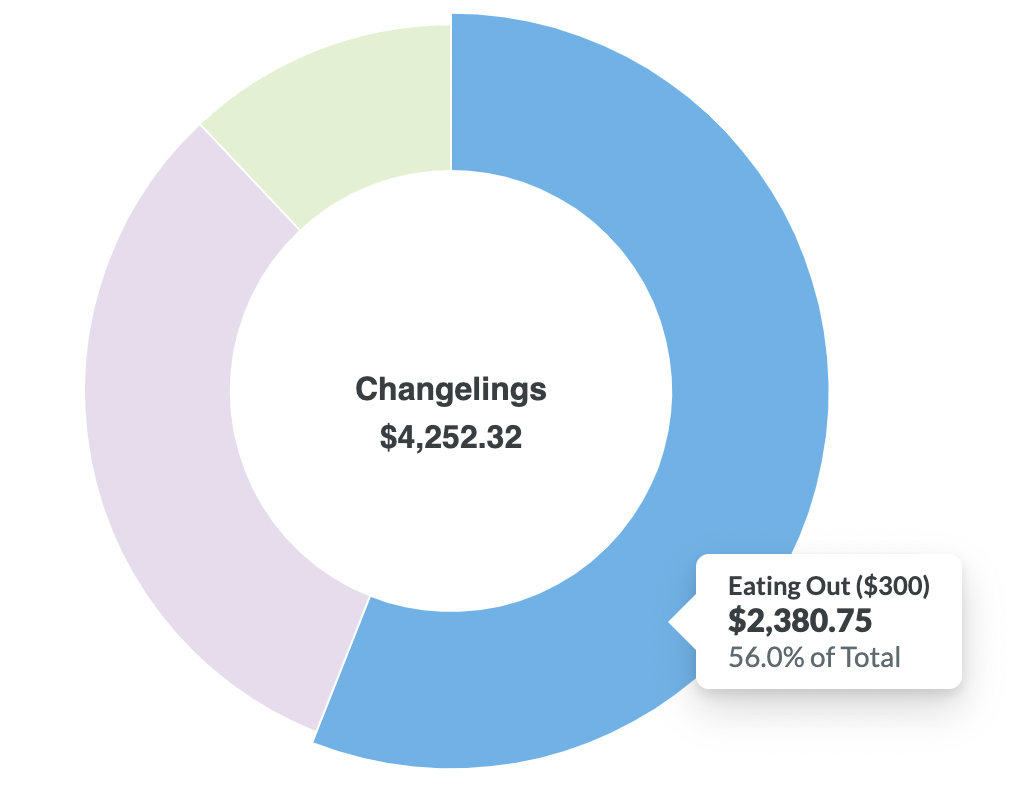

CHANGELINGS

I call this section “changelings” because they’re the items that change the most month to month.

25% Budget: $4,237.87 or $353.16/month

Eating Out: $2,380.75 or $198.40/month – This amount of spending makes sense to me given that I’ve intentionally increased the amount I dine out so that I can try the local cuisines in all the new places we’re living in! I suspected this cost would increase in retirement and I couldn’t be happier about it 🙂 .

Groceries: $1,360.98 or $113.41/month – My grocery cost surprisingly didn’t increase this year from the $125/month I usually spent in Seattle. This is surprising to me since grocery costs have been increasing and because with the monthly moving we do, that we’re not as efficient with our groceries as we used to be. However, that luckily hasn’t translated to more waste as I feared. If we have food left when leaving a location, we give it away to others or have found food pantries that will take our food and use it for good – win/win 🙂 . Overall though I think this is lower than expected because I’ve been eating out a lot more 🙂 .

How dare Thai grocery stores sell delicious, fresh croissants 6 for $1. It's basically criminal I say🤣! And don't even get me started on the donuts 🤤🥐🍩… pic.twitter.com/6eNG3ELKJJ

— A Purple Life (@APurpleLifeBlog) February 26, 2022

Alcohol: $496.14 or $41.34/month – Not bad at all! I thought this would be higher since I’m buying flights at breweries to try local brews instead of doing the more cost effective thing of buying some tipples at the grocery store, but this is a surprisingly low amount for all the new boozy experiences I’ve had this year 🙂 .

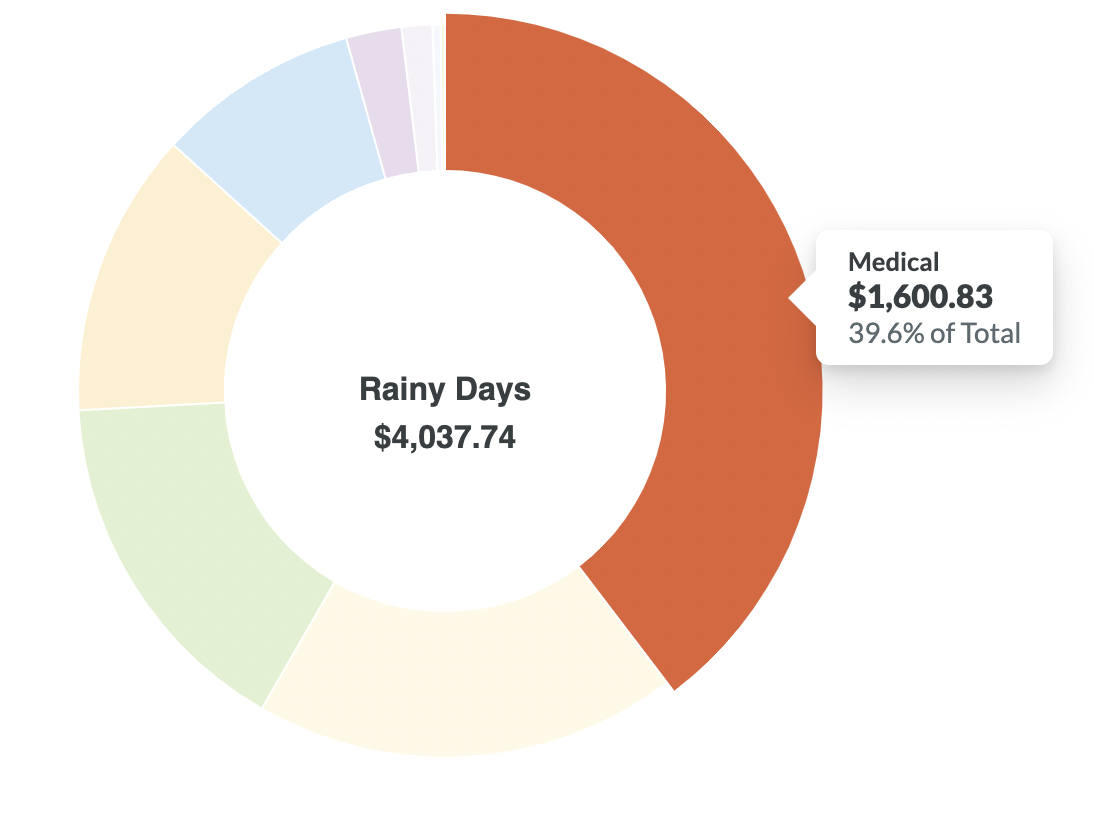

RAINY DAYS

This section is named based on a principle in YNAB: saving a little for inevitable things that don’t happen monthly so when a rainy day hits you have the funds.

23.9% Budget: $4,052.19 or $337.68/month

Transit: $507.11 or $42.26/month – This includes all the ride shares I’ve taken to make up for the fact that I don’t want to own a car as well as tickets for public transit around the world and filling up a gas tank if I borrowed a friend’s car while visiting them.

Education: $754.24 or $62.85/month – This is for my Spanish classes in México!

Household Goods: $14.24 or $1.87/month – As always, this is the best part of the budget that covers things like toilet paper, sponges and items that keep a household running. Most of this stuff is already stocked in the Airbnbs we stay in, so this number has plummeted from when I wasn’t a nomad.

Personal Products: $98.74 or $8.23/month – This is other fun stuff like toothpaste, fluoride rinse and hair ties. It’s wild over here!

Clothing: $360.55 or $30.05/month – This was mostly gear for my new running hobby 🙂 .

The bottom of these shoes are so pretty I don't want to mess them up. How do I get over this mental hurdle🤣👟🤷🏾♀️?! https://t.co/ltRDkRH0rq pic.twitter.com/WNYhISXZQ9

— A Purple Life (@APurpleLifeBlog) August 26, 2022

Entertainment: $639.52 or $53.29/month – This includes our monthly Netflix subscription that we let a million people use for free, my fancy Spotify Premium subscription, movie theater tickets, museum entrance fees and any random boat adventures we feel like taking 🙂 .

Grass: $22.18 or $1.85/month – Weed is legal in several of the states we lived in this year and as of the 2020 elections, 1/3 of the US population live in places with legal weed so woohoo!

Medical: $1,600.83 or $133.40/month – This is my 6 months of health insurance coverage from World Nomads along with some doctor’s visits and medication in the US, México and Argentina. I talk about my current retirement health insurance plan here if you’re curious.

Dental: $54.78 or $4.56/month – This included getting a dental check up and cleaning in México and Argentina!

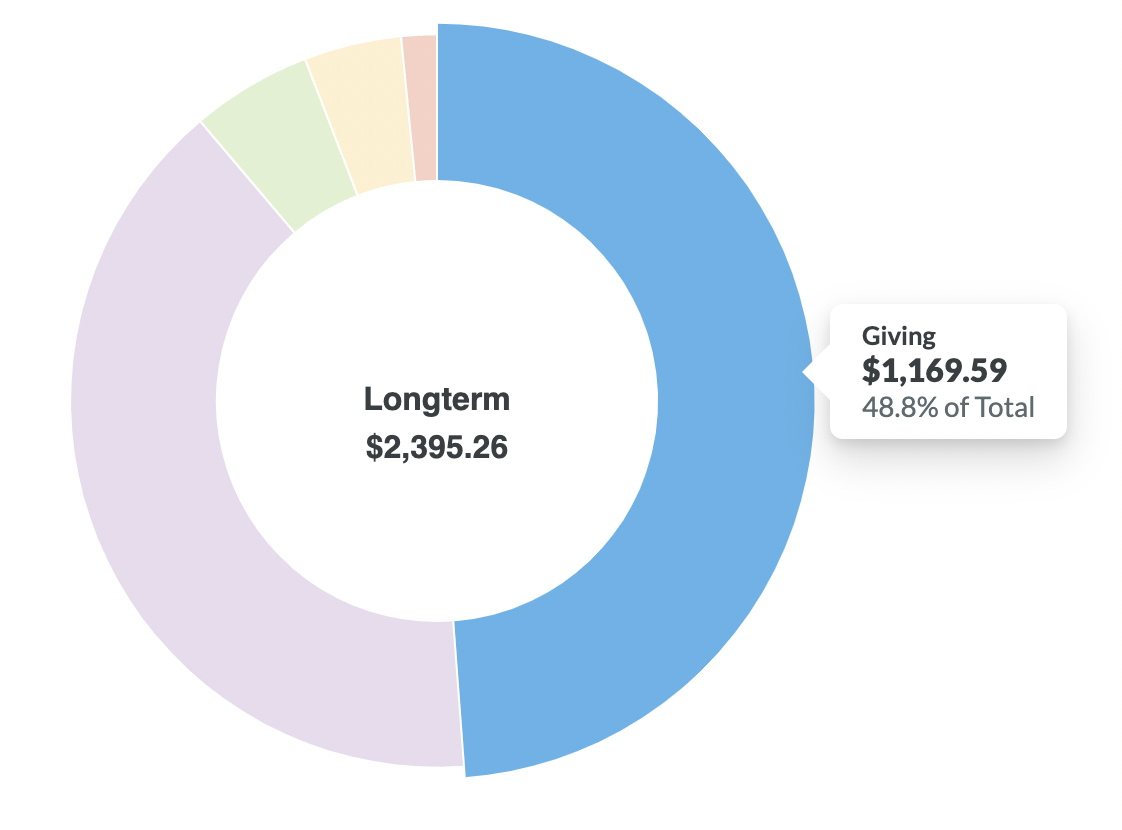

LONGTERM

14.1% Budget: $2,395.26 or $199.60/month

Giving: $1,169.59 or $97.47/month – Giving has become a bigger focus for me this year. This includes giving to charity (this year I gave to the National Network Of Abortion Funds, Planned Parenthood, the ACLU, AO3 and Wikipedia) as well as buying things for friends and family.

Subscriptions: $127.28 or $10.61/month – This includes my Patreon subscriptions, annual 1Password subscription so my shit is secure, the annual fee for my budget software YNAB and the annual fee for the amazing Chase Sapphire Preferred Card that saves my ass on a regular basis. It’s the only credit card I’ve ever paid an annual fee for and one that I’ve had for 7 years. It’s been completely worth it for the trip delay protection alone.

Blog: $37.47 or $3.12/month – This includes related expenses I’m filing so I can keep track of them, such as paying for this domain.

Mail: $102.89 or $8.57/month – This includes my annual Traveling Mailbox subscription so I can get my mail wherever I go and any additional costs for forwarding specific pieces of mail.

Electronics: $958.03 or $79.83/month – This includes my new (to me) MacBook Air, my travel adapter and some replacement headphones.

FURTHER UPDATE: Holy fucking shit Apple Migration Assistant has come a long way in the last 6 years😱💻. I let my two computers sync over Wifi for an hour, opened the new one and it's IDENTICAL to my old one. It even has the same tabs open on Chrome. MY MIND IS BLOWN🤯🤯🤯!!!! https://t.co/j667f9lDfa

— A Purple Life (@APurpleLifeBlog) August 3, 2022

VACATION

5.8% Budget

Travel: $984.80 or $82.07/month – I should probably re-name this budget section since every day is a vacation 😉 . This includes all the planes, trains and automobiles I took around the US this year! Booking in advance seemed to play a large part in this being low, along with the fact that I can travel whenever tickets are cheaper instead of trying to fit everything into the (more expensive) weekends. Travel hacking also helped to cover most of the cost of my longer luxury, international flights. For example, travel hacking saved me $44,667 on the flights I booked this year.

Days Per Type Of Lodging

When I was working, it was common to travel and visit my friends and family, but I would still be paying rent back home. However, now that we’re nomads without a home base, that’s not the case. So being a nomad unintentionally saves money in those times, despite our best efforts to pay for dinners out, groceries and even at times appliances for the people we stay with.

That usually still doesn’t add up to what we would spend on rent so I thought it would be helpful to break down how many days we spent in different types of living situations this year, including visiting others and house/baby/catsitting.

Airbnb

Number of Days: 162

Rent & Utilities Average: $935.03/month

This is the number of days we stayed in Airbnbs in 2022 and the average monthly price. At times we intentionally spent over our $2,000/month ($1,000 per person) target and at times we booked cheaper places – and it looks like it evened out! Not bad 🙂 . If you’re curious, our criteria for a monthly Airbnb is:

- Our own space (aka no shared houses)

- 1 bedroom

- $2,000/month total ($1,000 per person)

- Full kitchen with microwave (and previously a dishwasher, but we’ve changed our mind about that necessity)

- Washer/dryer

- Walkable to city center and grocery store

- AC/heat

- Fast Wifi

- Ideally a free standing house with outdoor space

House/Baby/CatSitting

Number of Days: 56

Rent & Utilities Average: $0**

I helped baby/housesit for a bit this year and I’ve never felt so tired 🙂 . Shout out to the parents out there – I don’t understand how you do it. I also house and cat-sat for my friend in Argentina when she had to work late and didn’t come home or went on quick trips.

It was a fun challenge to be there to let in her cleaning person, grocery delivery, exterminator etc (all in Spanish obviously 😉 ). I said previously that I would never petsit, but look at me now. I’m a cat feeding, feline snuggling, poop scooping pro. Such growth 🙂 .

Staying with Friends/Family

Number of Days: 147

Rent & Utilities Average: $0*

As I mentioned, when we stay with friends and family, we like to buy takeout, groceries and at times appliances to help pay them back for being in their space. I put that stuff in their respective categories in my budget (eating out, groceries and giving) so they won’t show up in rent*.

My partner and I have been debating if they should be (he puts them in rent), but I don’t really see it that way so they’re in separate categories. Separating it out helps me see how much we’re actually spending on Airbnb rent compared to other items.

2023 Housing Plan

The above breakdown of where we spent our time seems about right given that our goal as the world opened up, was to finally see more of our loved ones. We also underestimated the number of people that have extra room and asked us to just stay with them since we were specifically coming to the area to visit them.

Staying in their space also allowed us to hang out a lot more casually and more often than if we were in an Airbnb down the street (though we did get a few of those too). Next year we have way less visits on the docket and are planning to stay in the US more as well as higher cost of living places so I expect this ratio to shift. But then again, we also have two housesitting gigs set up so who knows how this will shake out in 2023 🙂 .

Conclusion

So there you have it, every dollar I spent this year! I aimed to spend $21,200 (aka my $20K retirement budget + inflation every year) and ended up spending $16,929.93! I was shocked when comparing this to the $20,415 I spent in 2021 especially with $1,170 of my 2022 spending going to Giving so a total of $15,760 or $1,313/month was spent on myself this year.

Instead of not leaving my house like I did in 2020 and saving money that way, I went to other countries this year and lived an extravagant life and accidentally spent less. I’m curious what will happen in 2023, which includes living it up in Australia and New Zealand and visiting lots of expensive US cities. Maybe I’ll actually hit my new spending target of $22,700 🙂 . We shall see!

How was your spending in 2022? Did you reach your goals?

and I cannot wait what great 2023 will come for you. Where will you travel?

Thank you 🙂 . These are my current plans:

January: Boston, Upstate NY, NH

February: New Hampshire

March: New Hampshire

April: Sacramento, CA

May: Seattle, WA

June: Chicago, IL

July: ???

August: ??? (Maybe Portland, ME)

September: Australia

October: New Zealand

November: ??? (Maybe Puerto Vallarta, México)

December: ??? (Maybe Puerto Vallarta, México)

Your love of NH winters cracks me up. I must learn more!

Chicago! My home base. I was considering doing airbnb and selling my place but found the pickings slim in decent neighborhoods. Be interested to know which hood you finally picked?

Yeah Airbnbing out your place sounds like a good way to decrease overall housing costs if that’s work you’re interested in doing. We chose a place a little south of Downtown – I don’t know the neighborhood names yet 🙂 .

I spent 3x what i did last year.

Gonna try for more award flights next year, albeit domestically.

With the chase card, does the travel protection work if you don’t use the card to book tickets? Since you use points for travel…

Oh wow – what contributed to that increase besides travel? I’m just curious. I use the card to pay for the taxes on award flights – it only works if you use the card to book some part of it.

Hi Purple,

I was wondering if this budget is based on a shared rent/food/groceries for 2 people, as you frequently travel with your mom or/and partner? This would mean to me that if solo traveling or planning, I should make an allowance for a full rental / groceries /outings payments and increase the projected budgeted amount accordingly. Thank you for your help! It is so very helpful . Safe travels always.

Hi! Yes for rent – this year I split all my Airbnbs with my partner or Mom (or both as was the case with Thailand and México). However, we all paid for our own food and groceries – my partner and I have basically opposite diets so that’s been how we operate for a while. So yes I would double the rent portion to be safe for estimates. I have found smaller places that are 50-75% of the cost that I would choose instead if I were traveling alone, but don’t think that’s an option in all locations. Safe travels!

Under $400 in clothes for the year?! If that isn’t goals, I don’t know what is! This post really inspired me to get my act together Purple, thank you! It’s clearly worth it to do so 😊

Haha that’s actually way more than I usually spend so I’ll take this as encouragement that I didn’t go too wild 🙂 . I’m so glad the post was helpful!

Is your food budget for yourself or does that include your partner?

All of the numbers on this site are just for me.

What are the odds — my yearly spending breakdown is coming out tomorrow and the title is almost the same (except the amount is different, LOL)! And you know, every time I write one of these, I wonder why people care, but then I go and read one somewhere else (like yours!) and it’s sooooo interesting! Some of our numbers match up (like the clothing spending this year, haha) but, for example, your blog is SOO cheap! Are you on a legacy WordPress plan or something else? And boy, you’ve totally nailed it on the car thing, it’s SO MUCH even when paid off. I’ve been chewing on that this year a lot. Anyway, thanks for being so transparent. Happy new year! 🙂

Haha cool! And yeah I often think the same thing, but then I read other people’s expense reports and enjoy them 🙂 . RE: the blog – it was only that cheap because I paid for a multi-year hosting package last year so that was a few hundred dollars upfront. Thanks for reading! Happy New Year 🙂 .

Gotcha! That makes more sense. And do you like your health plan, by the way? I had IMGlobal last year and I’m letting it expire — I thought it was more than I was willing to spend, especially because the silver plan (almost $2K a year) doesn’t cover women’s wellness (apparently they do cover specialist appointments, but don’t consider a gyno a specialist?! IDK). I had to pay additional out-of-pocket a few hundred dollars for that one, which I didn’t care for!

Yeah I’m using World Nomads right now, but was actually planning to switch to IMG Global. I’ll take another look at that – thanks for the heads up!

Awesome!

Curious how you track your international spending, since you probably use cash (in Argentina etc).

Thanks 🙂 . I track everything in YNAB – cash included.

Inspiring. As I read each section, I ask myself, “Can I do that?” But, for some reason, my mind seems trained to think of why I can’t do it. Living vicariously for now and hope one day I can be brave. You have travel partners and I need, ok want those! Thanks for sharing all the details.

Yeah – it’s easier for our brains to tell us why we can’t do something. I’m speaking from personal experience 🙂 . Good luck finding travel partners – I think there are a lot out there! Thanks for reading.

I’m confused on the annual subscription grand total of $127.28. This includes your YNAB subscription ? Isn’t that alone $99 for the year ? Maybe I’m interpreting the numbers in this section incorrectly. Thanks for the clarification !

That’s the YNAB cost per family account. I split it with my partner and I think we can add more people in the family to it to further lower the cost, but haven’t. Spotify lets you share a family plan with up to 6 people so we do that as well with 2 other people.

Wow, your total expenses is about the same as how much I paid in rent and rental insurance this year, living in Phoenix, AZ as a single person in a cheap-ish 1-bed apartment! And I got hit with a 20% increase in rent, so it’s only getting worse. I need to get a 100% remote job and do what you do! My other expenses are pretty much similar to yours. And I do still need a car here for work.

Haha yeah that sounds about right – I’m sorry your rent is increasing that much. That’s wild. Highly recommend the remote job – I loved having one my last 4 years in the workforce.

You mentioned $44k in travel hacking. Can you talk a bit about the value of that and how sustainable it is year to year? Obviously you wouldn’t pay cash for first class but might get that “value” but if you’re only spending $16k you won’t get that much in benefits year to year. Thanks for the info!

If you mean if I expect to be able to save that much with travel hacking every year – no, I don’t. This was a special case where I’m trying to get rid of all my points this year before they expire. The post I linked when talking about travel hacking has a full explanation of all those points if you want more details. I’m not sure what you mean by benefits related to my spending – I don’t build up points with my spending since they’re negligible points amounts. I do it with sign up bonuses. Let me know if you were talking about something else and I’d be happy to clarify.

Love that you donated to AO3. Keep that fanfiction going! 😀

Haha yeah – AO3 and the community I met there basically kept me sane through the pandemic. It’s so wonderful 🙂 .

Such a good write up! All the detail we know to expect from you, Purple 💜 it’s so useful having a partner to split certain costs with, though I imagine if you were solo travelling, costs might even out over time. When I travel by myself versus with friends or family, somehow it ends up cheaper for just me (thinking of how I spent less for two weeks in Greece solo than 4 days in Madrid with friends – but I do have some friends who enjoy fine living whereas I’m okay with budget options).

Seconding the comment about donating to AO3!

The travel hacking worked out nicely for this year! If you end up paying for economy flights to various places this coming year, it probably won’t move the needle that much. I did some expensive trips in 2022 and when I did my financial recap the other day, I was genuinely shocked to see how little the trips affected my general spending over the year compared to 2021. (I don’t travel hack as it’s not really an option where I live.) I guess it’s all about trade offs though – like you, I don’t buy clothing much, and don’t spend on certain other things.

Thank you! And I’m so glad you liked the detail 🙂 . It is helpful to split costs though I hear you – I also spend less when I’m alone. I think it’s because when I’m with others we want to go out and do things and that usually involves spending money meanwhile if I’m alone I’m happy to cook a meal and then go read in a park – all for free.

And woohoo AO3! It’s the best 🙂 .

Of the 11 Flights I took this year only 4 were travel hacked. The rest were domestic and I usually just buy those with cash. I also paid cash for my flights to/from México because they were relatively cheap as well. That’s awesome your trips didn’t move the needle that much!!

Another thorough and fascinating recap!

Your mention of trying beer flights in different places has me wondering, have you ever used Untappd? With your penchant and passion for tracking and reviewing it seems like a natural fit for ya! I would also love to get your reviews on gluten free beers!

Thank you! I actually have an Untappd profile, but I need to be better about updating it. It’s here if you’re curious: https://untappd.com/user/apurplelife. I really enjoyed the gluten free beers at Lucky Pigeon Brewing in Maine.

Your total expenses were less than what we paid in federal taxes! Our spending increased by 48% because we sold our rental property and took a hit in federal taxes. You inspire me to travel and spend some time in Thailand and Argentina. Your reviews are so helpful with my research!

Haha yeah – it’s less than I used to pay in federal taxes as well 🙂 . I’m so glad my reviews are helpful – thank you for telling me that! Safe travels.

Purple, I really love reading your annual spending summaries! My goal for 2023 is to keep my spending at $3k a month to see if I can start practicing for my “FIRE” annual spend now. This year was…incredibly expensive lol due to all my *choices* and my goal is for 2023 to be less so. Happy New Year!

Yay! Thank you for telling me that 🙂 . And that sounds like a great goal. You’ve got this! Happy New Year 🙂 .

Hmmm… looking my my similar hopes for retirement and figuring whether I could just double the airbnb budget as I’m single because I’m assuming that half your budget will not get me anywhere decent. Also have to figure in higher medical costs that yours because those travel plans will never take me.

Food for thought though as I think outloud! lol. Wonder if I could airbnb my place to make up for what it costs alone…

Depends on where you’re looking – $1000 a month can get you lovely places outside the US 🙂 , but yeah doubling to $2000/month would be the safer strategy just in case. And yep – great to plan for medical costs.