I posted on Instagram about my latest travel hacking wins and several people in the comments asked if I could write a post about specifically HOW I travel hack. I thought the topic was overdone with the abundance of articles out there that all basically say the same thing, but I guess not 🙂 .

So I’m here by popular request to lay out how exactly I travel hack these points to pay for my luxury international flights. There’s nothing new here – it’s the same formula you’ll see on any major travel hacking blog, but I understand that different approaches and styles resonate with different people so I’m going to give you my spin on it 🙂 .

I will also be including a new factor to all of this: figuring out travel hacking in this new pandemic frontier! It is no joke. I’m still trying to figure that out myself and will determine if this is even something that will work going forward so we can work through that together below. So let’s get into it!

What Is Travel Hacking?

Travel hacking is the process of signing up for credit cards, collecting the bonuses that go towards airline miles or hotel points, and cashing them in for free flights, hotel stays and other travel expenses.

I’ve talked about travel hacking for years on this blog and here are examples of those posts with specific trips I enjoyed and how much money I saved booking them:

- How I Saved $44,667 With Travel Hacking In 2022

- How I Saved $24,227 With Travel Hacking In 2019

- How I Saved $1,348.74 With Travel Hacking In 2018

- How I Saved $1,912 With Travel Hacking In 2017

- How I Saved $27,007.38 With Travel Hacking In 2016

I also wrote the below post about the joy of first discovering travel hacking:

And I talked about the unfortunate experience of having to cancel years of travel when the pandemic hit:

How Does Travel Hacking Work?

Basically, I apply for credit cards with no annual fee the first year and high sign up bonuses based on what points I’m trying to acquire for specific flights. I do this when I know that I can hit their minimum spend requirements (usually $1-4K in 3 months).

I then hit that requirement, pay off the credit card in full, and close it 11 months after I apply, a month before I have to pay an annual fee. Simple 🙂 . However, I love step-by-step instructions so let’s go through each one of those items in detail.

STEP 1: Figure out where you want to go

First, I decide the route I want to fly, how many points it will cost and the kind of points the airline accepts. I’ve done this in a few ways. For example, I knew I wanted to go to Argentina to see my ex-roommate this past fall, and being a nomad means I can leave from anywhere.

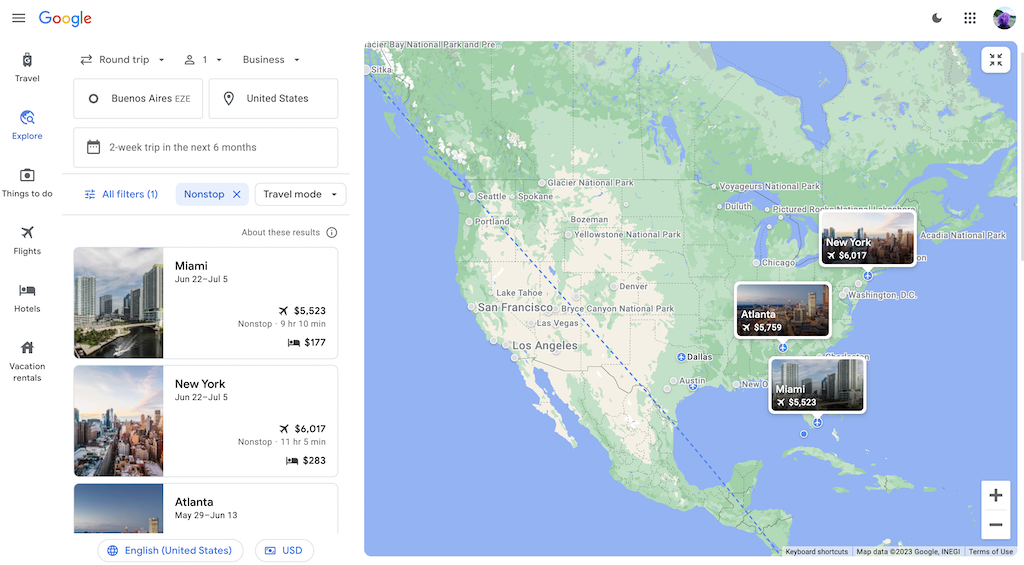

I also knew I wanted to fly Business Class and that I wanted a non-stop flight. So I used Google Flights to see what airlines fly from the US to Argentina non-stop. They have a handy Explore option so you don’t have to enter just one location. I put in “Buenos Aires” and “USA” and saw the airlines that fly non-stop between the two.

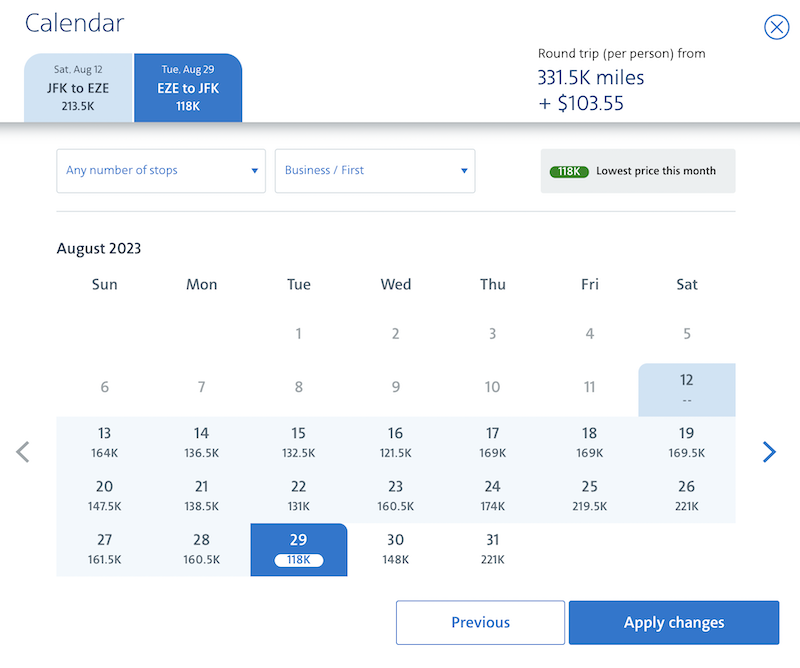

I saw that American Airlines had daily flights from JFK that would be easy to hop on, so I went to their website (in Incognito Mode so they don’t track me and hike up the prices accordingly 😉 ), and entered the route I wanted, JFK to EZE, and that I wanted to pay with points.

I chose general dates I wanted and when I clicked enter, their website provided a larger view of entire months and how many points were required to book those flights. So now I knew how many points I needed for a roundtrip, Business Class flight (198,500 points) as well as what kind of points (American AAdvantage 😉 ).

The other way I have done this might seem a little ridiculous 🙂 . However, I’ve mentioned how my Mom and I fell in love with luxury international flights. As a result, we have planned trips around just flying those planes that have unique and fabulous first class cabins. That’s how our First Class Emirates Suite experience to the Maldives happened.

We wanted to fly in the Emirates First Class Suites, saw they had a massive deal (which they’ve never promoted again), and chose where we went based on that. We had never even heard of the Maldives before finding it on the options of where that plane flies. However, if you’re not ridiculous like us, I say stick to the plan above 🙂 .

STEP 2: Find & Apply For Credit Card(s)

Then I find out what card(s) I need to get to meet the points requirements.

Airline Cards, Co-Branded Cards & Bank Credit cards

There are two general types of credit cards I use:

- Airline or Co-Branded Credit Cards

- Bank Affiliated Credit Cards

Airline credit cards are provided by the airline (in my example, American Airlines) while bank affiliated cards are ones that can be used with multiple airlines and are provided by companies like Chase, Citi, Capital One and AmEx.

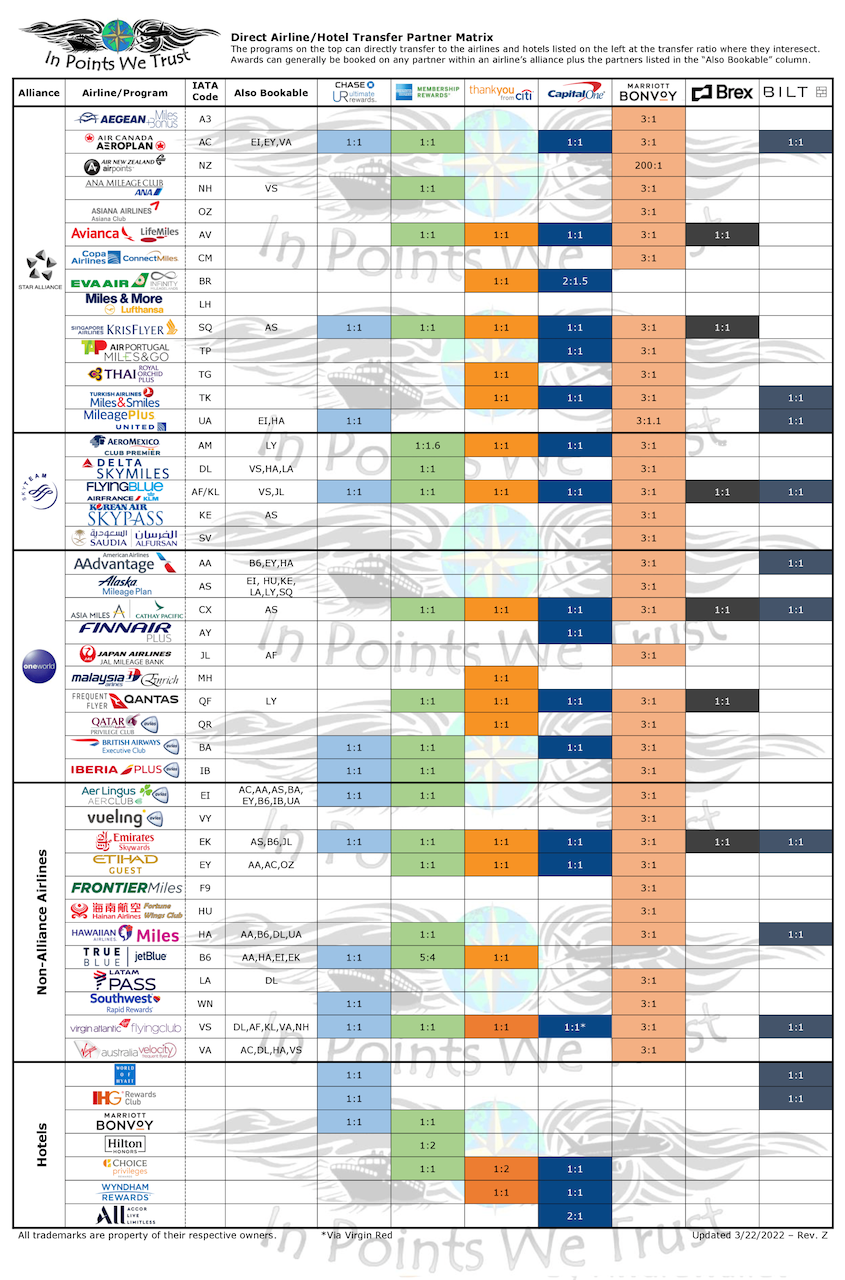

In addition to the straightforward approach of getting an American Airlines credit card to get American Airlines points to pay for an American Airlines flight, you can also gather points from one of American Airlines’ partner airlines. For example, British Airways is a partner of American Airlines and you can usually purchase American Airlines flights with British Airways points.

Another way to use British Airways points is to get a credit card from Chase or AmEx, which offers a 1:1 points transfer structure to certain airlines (e.g. 1 Chase point transfers into 1 British Airways point). Some transfers offer less ideal options, such as 3 points per 1 airline point you’re transferring into.

However, please note that you have to actively choose what airline you’re transferring the points to and do that online before buying a flight. But now we’re getting into the nitty gritty 🙂 . Here’s a helpful chart to simplify which airlines are transfer partners (so you can usually use points to transfer between them) and what credit cards get you those points:

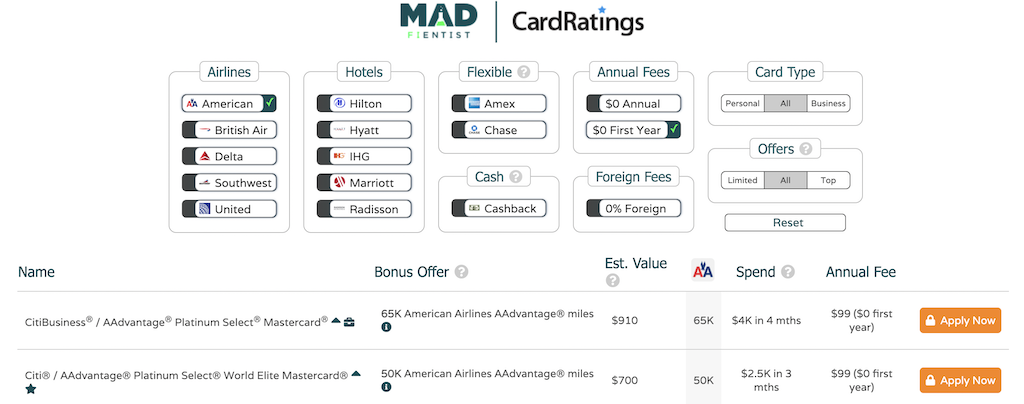

Finding A Credit Card

The Mad FIentist has a great credit card search tool that’s helpful. For example, I put in “American” points and that I want a $0 fee in the first year and it tells me what credit cards are offering how many points and provides links to them (which gives the MadFientist a little kickback – FIRE peeps supporting FIRE peeps 🙂 ). I look for credit cards with high initial bonus points because that’s where I’m going to make enough for these flights – the points per dollar you spend is not where the big money is.

In the same Mad FIentist calculator, it shows the minimum spend, which is how much you need to spend on this card in a certain amount of time to receive those bonus points. Before I apply for a card, I make sure that my planned spending aligns with that minimum and that I can hit it.

Applying for a Credit Card

Then I apply for the credit card I need first to purchase this trip. I do this at least a year before I want to travel somewhere. Heads up that if I need multiple cards to get the points I need for one trip, I usually stagger when I get them to make sure I can focus on one card and then another. This also helps me make sure I can hit the minimum spend since trying to hit multiple minimums at once with my low spending would be challenging.

STEP 3: Hit The Spending Minimum

I haven’t applied for any new cards yet in retirement, but doing so would actually be way easier now since my ‘rent’ is Airbnb fees that I can put on a credit card. That would hit the minimum spend no problem.

However, when I was working and sadly wasn’t able to put my rent on a credit card, (they either didn’t allow it or had a really high fee to do so – I don’t remember which) I would plan around large purchases, such as a flight I was going to buy in cash or a hotel stay or travel insurance. I would also change all my regular spending to go through that card until I hit the minimums if those large purchases weren’t enough.

STEP 4: Book The Trip

Once I hit the minimum spend requirement, my points are automatically deposited into my airline or credit card account. At that point, you can use them to book your trip! This usually involves logging into the airline’s website so they can see you have those points, clicking the pay with points option and purchasing a ticket normally. Heads up that there are usually small taxes you have to pay on these tickets, but those are minimal. For example, for my roundtrip flights to Argentina I paid $97.67 in taxes on my beloved Chase Sapphire Preferred credit card.

STEP 5: Cancel The Credit Card(s)

After I hit the minimum spend, I usually stop using my new credit card. There are ways to use certain cards to get additional points or cash back on certain items (for example, the Blue Cash Preferred Card from American Express provides 3% cash back on gas and transit), but to be honest, I’ve always been too lazy to do that stuff 🙂 . It’s great to save that money, but the minimal reward wasn’t worth the hassle to me.

Anyway, after I stop using the card, I just put it with my other finance documents and set a reminder on my calendar to cancel the card before the 1 year anniversary of the day I applied for it. This ensures that I don’t get hit with the annual fee that comes in year 2 on most cards. I usually cancel it about 10 months after I apply just to be safe.

STEP 6: Travel!

Now you sit back, relax and enjoy your heavily discounted travel! For examples of the experiences you can have, here are my latest flight reviews that I travel hacked:

- Review: The World’s Longest Flight: 19 Hours In Singapore Air Business Class

- Review: Singapore Air 737 MAX Business Class AKA “The Throne”

- Review: 21 Hours In Etihad Business Class (Part 1): Phuket To Abu Dhabi On A 787 Dreamliner

- Review: 21 Hours In Etihad Business Class (Part 2): Abu Dhabi To NYC On A 787 Dreamliner

- Review: American Airlines Business Class 777-200 – NYC to Buenos Aires

- Review: American Airlines Business Class 777-200 – Buenos Aires to NYC

Concerns

Credit Score

Usually when I’m talking about travel hacking, the first question I get is: But won’t that ruin your credit score?

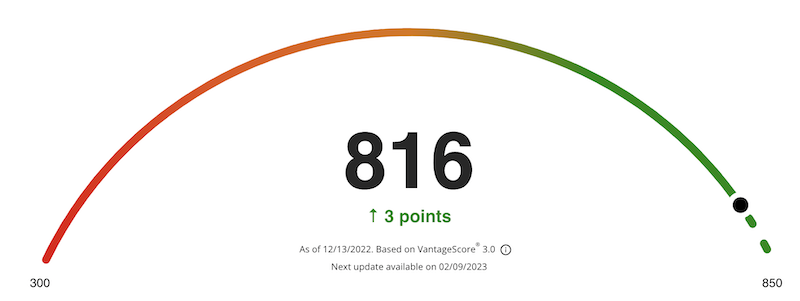

In essence, nope 🙂 :

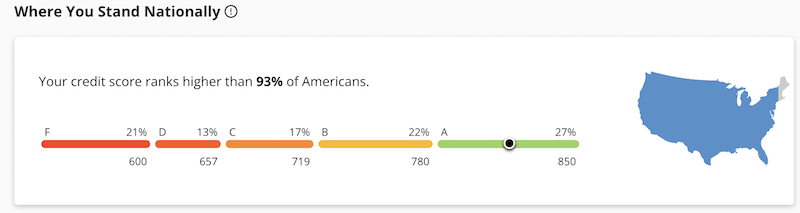

And I’m not one to play the comparison game, but this was also interesting to see:

Credit scores are made up of several factors that have different weights, specifically:

- Late Payment History (40% of score)

- Age of Credit (21% of score)

- Credit Usage of 30% or Below (20% of score)

- Total Accounts (11% of score)

- Hard Inquiries (5% of score)

- Available Credit (3% of score)

To check my credit, I use Credit Karma though now a lot of banks offer to show you your credit score for free whenever you’d like, so feel free to look into that if you’d like. So taking the above into account, I always pay my bill on time and never have a balance.

I also have always kept open my oldest credit card that didn’t have a fee so I have that history as well as my Chase Sapphire Preferred for the last 8 years, which is the only card I’ve ever paid an annual fee for. It’s completely worth it to me for the amazing delay reimbursement alone.

I have a large number of total (open and closed) accounts, which is actually a way travel hacking has improved my credit score. I also only use less than 30% of the large amount of credit that cards offer, and apply for credit cards in a spaced out fashion since each hard inquiry for a new card does make your credit score dip a few points (it usually makes mine dip about 5 points), but that bounces back in 3 months.

Overall, travel hacking hasn’t negatively impacted my credit score and in some ways it’s improved it by showing a larger number of past credit sources and that I always pay my bills on time and never carry a balance or pay interest.

Credit Card Rules

There are a few quirky rules that some credit cards have. They’re laid out in the card’s terms & conditions (which you should read 🙂 ), but here’s a summary:

- Chase: 5/24

- AmEx: 1 bonus per card per lifetime

- Citi: 24 & 48 month rule

- Capital One: Many rules 🙂

Let’s go through what these mean. Chase will only approve you for one of their cards if you haven’t opened five or more personal credit cards across all banks in the last 24 months. This applies to all cards – not just those through Chase.

AmEx will only let you receive the bonus from each of their credit cards once in your lifetime. This generally isn’t a huge deal since they routinely add new credit cards, but this is something to consider before getting one of their cards.

I also heard from a reader below that when they applied for the Amex Delta Platinum card recently the fine print notes that AmEx reserves the right to revoke their sign up bonus if they cancel the card within 12 months. I’ve never heard of that before so make sure to check the fine print before applying to a card.

Citi will only let you apply for a specific credit card for a second time if 24 months have passed. However, with Citi’s co-branded cards (like the Citi/American Airlines cards) you have to wait 48 months. In addition, they have rules about spacing of applications, specifically, you can only apply for 1 card (personal or business) every 8 days and no more than two cards in a 65 day window. Also, you can only apply for one business card every 90 days.

Capital One will only let you have 2 of their cards at a time and will only let you apply for one personal or business card every 6 months.

So, basically, it’s a little complicated, but luckily The Points Guy is here to help us out. Here is a list of all the rules for you to pursue before applying to a new card – heads up that they post a refreshed version monthly with the latest rules.

The New Pandemic Frontier

So during the first part of my travel hacking journey, my only concern was getting the most bang for my buck. Enter: The Pandemic and all the cancellations that came with it. Now I’m in a new situation. My Mom and I accumulated a shitton of points in anticipation of my retirement in 2020, and after canceling those plans, we still had all those points, but with the added challenge that several are now set to expire.

So my Mom and I had to figure out how to spend them before our years of work were wasted. This is the reason for my latest travel booking spree and the reason I took that American Airlines redemption to Argentina, which one commenter on Instagram mentioned seemed like a lot of points 🙂 .

I want to give that context because it seems like we might be entering into a new world of airline points after travel restrictions were lifted. This is now a world where points are FAR less valuable.

Airlines are (understandably) hurting after decreased travel and as a result, have increased their points requirements for flights. It’s becoming much harder to use points for flights. Overall, I’ve been finding that the (higher) amount of points required might not be worth it.

Travel hacking is now harder than it’s ever been for a few reasons:

- Airlines require more points for the same flights

- It’s harder to acquire those points through credit card bonuses

- Flights are constantly changing

- You can’t un-transfer credit card points

- A possible new law might get rid of airline points all together

In essence, this has become challenging on all sides and I’m honestly not sure if travel hacking will still be a huge thing in the future as a result. The amount of points needed for flights keeps increasing and the ways to get those points is becoming harder as well. After I’m done getting rid of these expiring points, I’m going to have a hard look at if this is a viable way forward in the future.

To further complicate things, flights are still constantly changing. I talked in my 2022 Travel Hacking post about all the drama my Mom and I went through with airlines discontinuing aircraft and changing routes. To use travel hacking going forward will require some flexibility and preparation for constant changes on top of the added challenges in this new landscape.

I prepare for this personally by being ready to get in contact with airlines through Twitter (the fastest way in my experience), or calling them through a number and method listed on GetHuman to actually get a human on the phone as soon as possible.

In the same vein, if you are using a bank affiliated credit card to get points and have transferred them to a specific airline, they cannot be put back onto that bank affiliated credit card. So if your flight is canceled and you got those points through Chase then transferred them to an airline, those points will always be with that specific airline until they expire. They can’t become Chase points again and be used for other airlines. This can obviously be a problem for flexibility.

And last but not least, the Credit Card Competition Act of 2022 was introduced to the Senate in September. This law would do several things, but one possible consequence could be card issuers decreasing or removing their loyalty programs, which is what travel hacking is based on.

Another Points Option

So those are the steps and concerns to finding a flight on one airline, getting points for that airline and using them. However, there is another option if you want to have more flexibility with your use of points that might work better in this new frontier. Another reason I keep my Chase Sapphire Preferred is because there are a multitude of ways I can use the points that card generates.

For example, I can book discounted travel through their online travel portal or I can transfer Chase Ultimate Reward Points 1:1 to 11 different international airlines as well as 3 hotel chains. I can also use the points to book rental cars, experiences and other travel related items.

The former of which I’m doing to avoid wild car rental prices in California for a wedding. There are a lot more possibilities for using these points and that’s the case for any transferrable points, such as:

- American Express Membership Rewards

- Capital One Miles

- Chase Ultimate Rewards

- Citi ThankYou Rewards

The Points Guy website has been a huge help in me learning how to travel hack and this page lists all the ways you can use the transferrable points above.

Conclusion

And that’s how I travel hack my way into ridiculous luxury flights 🙂 . I hope this was helpful to explain my process. Feel free to let me know in the comments below if you have any additional questions or things you want me to cover in a future post. Safe travels!

Have you ever travel hacked?

This was brilliant, thank you! I’ll be curious to see how this works on the future. Thanks for mentioning the credit score decrease and that you cancel them. I always wondered about those.

I’m so glad you enjoyed it! And I’m also curious how (or if) it works going forward 🙂 .

Very detailed. Thank you! Still burning through the Its Always Sunny podcast based on last month’s article.

I thought it would just be for entertainment purposes, but oddly enough I have found it motivating. They were three guys who kept failing and failing and refusing to change what they thought was funny, and eventually hit it big with the TV show.

Thank you for reading 🙂 . And ooh so glad you’re still enjoying the podcast! They are really profound on there – great life lessons in addition to laughs. They’re super motivational without trying to be 🙂 . The fact that they’re the longest running comedy ever and have never been nominated for a major award and keep doing it because they love it was a huge revelation for me and helped me let go of garbage metrics, which also helped with retirement 🙂 .

Purple: “This is just the normal information you can find on any travel hacking website.”

Also Purple: **drops the most helpful & concise guide on travel hacking any of us has ever seen in our lives**

Agreed! It was the post ive been wanting but didn’t know how to ask for!!

I scoured all your old annual travel hack posts recently and was just happy you listed the points and airlines. This supplements that very well!!!!!!!!!!

have you heard of the round-the-world ticket the alliances offer. Obvi, not free99 like travel hacking, but seemed pretty cool!

Now if i could just get approved for a travel card! Apparently not using credit cards for a decade has some downstream ramifications lol.

Yay! I’m so glad it fit together well. I have heard of that and actually considered it in my early “Retirement Victory Lap” travel plans. Good luck getting that card – the things credit card companies value is quite strange 🙂 .

LOL – fair point and that’s very kind of you 🙂 .

Heads up – a few weeks ago I got the Amex Delta Platinum card. The fine print in the card terms notes that American Express reserves the right to revoke my sign up bonus miles if I cancel the card within 12 months. I think that’s new.

Yeah I haven’t heard of that before – thank you for bringing it to my attention! Also awesome job reading the fine print. I’m going to edit the above to reflect this new rule.

True overall for American Express (cancel after the 12 months), and also of note a lot of card issuers will refund in the days following the Annual Fee hitting your transaction list, so it’s often not too late even once you’ve seen it to get it refunded! Some links that might be useful here:

https://thepointsguy.com/credit-cards/close-credit-card-one-year/

https://www.doctorofcredit.com/annual-fee-refund-rules-for-each-card-issuer/

Either way, happy to see you enjoying all your free(ish) travels. 🙂

Oh wow – thanks so much for that heads up! I knew about the refund, but not the AmEx rule. I’m curious when that was implemented and why we’ve never run into that issue.

Wow, this was helpful! Thanks for all the details.

Yay! I’m happy it was helpful 🙂 .

Excellent tips! I don’t travel as much as I used to, but we’ll ramp it up again when our child is a little older. I have definitely taken advantage of some credit card perks and bonuses for spending to help with the travel budget. You post reminded me that I just got a $100 Delta flight credit from one of my newer credit cards. It’s a great way to pay for more travel!

Thank you! And that’s an awesome credit. Safe travels!