At this point, I’ve almost completed 3 years of retirement and I finally sold my first share! I wasn’t out of my cash cushion yet so selling wasn’t an urgent need, but I felt the anniversary of saying “I QUIT!” was a good time as any and I will keep that schedule going forward so don’t try to time the market since that never works.

So today I’m talking about my experience selling shares to fund my retirement. As background, I first looked over my hundreds of pages of notes that I wrote when planning how I would approach FIRE 8 years ago. I knew what to do, but all these new questions kept popping up in my head:

- Am I forgetting something?

- Will this lead me to pay additional taxes unnecessarily?

- Which lot of stocks do I sell first? Does it matter?

Double Checking

I got a little in my mind about it so after coming up with a hypothesis, I asked a professional to confirm: my Mom’s fiduciary financial advisor at Vanguard. I helped my Mom move her investments to Vanguard a few years ago after I saw the ridiculous amount she was paying in fees at Edward Jones, and unlike my DIY ways, she decided to pay a little more to have an advisor manage her investments.

She’s had 2 advisors at Vanguard over the years and loved them both. So I ran my thoughts by him and got the confirmation that I wasn’t missing anything.

All this to say, even with all the research and confidence in the world, I got tripped up right before pulling this trigger for the first time. It’s ok to ask for help or a second opinion. If speaking to this advisor wasn’t an option, I was planning to talk to a fee-only fiduciary advisor before diving into this part of my retirement. Just in case 🙂 .

The Overall Plan

When I retired in I did 3 things:

- Rolled over my 401K into a Traditional IRA at Vanguard

- Changed my Taxable Brokerage Dividends to be deposited into my checking account instead of reinvested

- Started a Roth IRA Conversion Ladder

There was a 4th step on that plan that I haven’t executed until now: Selling my taxable investments with long-term capital gains to fund my retirement after my cash cushion ran out. As a reminder, I saved a cash cushion because I was retiring into the hellscape of 2020 and wanted that extra precaution as a result.

So to institute that 4th step, I first needed to look at all my investment buckets:

- Taxable Brokerage Account

- Traditional IRA Account

- Roth IRA Account

- HSA Account

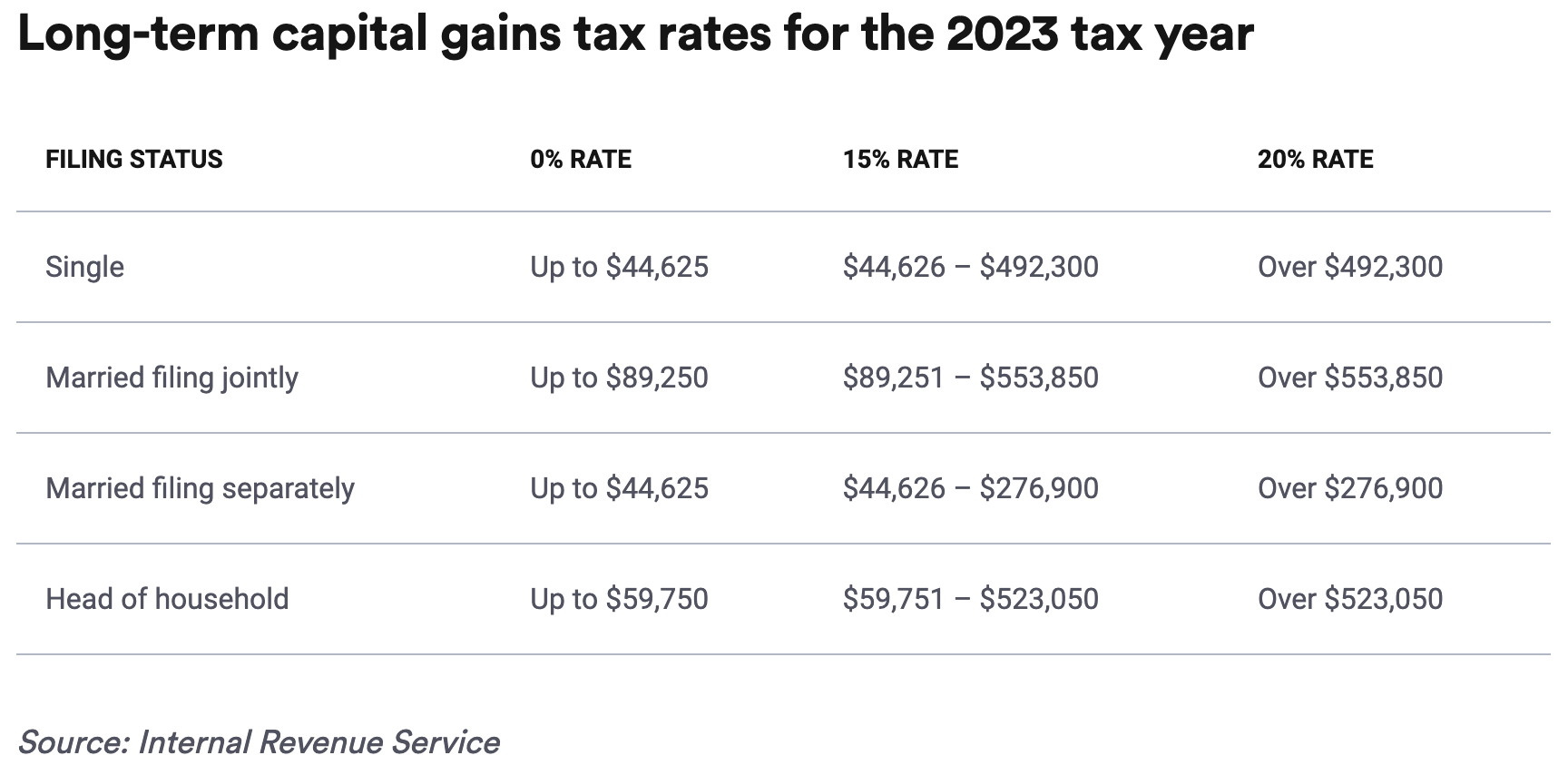

Long-Term Capital Gains Taxes

I am only taking money from my Taxable Brokerage Account because I have access to it now and will currently pay no additional taxes on long-term capital gains, which are shares held for over 1 year. My capital gains will be taxed at 0% if my taxable income is less than or equal to $44,625 for a single filer in 2023.

How To Sell Investments To Fund Retirement

So now I’m going to go step-by-step through exactly what I did to sell my investments and fund my retirement. Vanguard does have a video guide for how to sell investments, but it’s out of date and shows their previous website design and language so I thought it would be helpful to show what the process actually looks like now. So here’s how I did it!

First, I logged into Vanguard. Then I selected the Holdings tab.

From there I went to the type of account I wanted to sell (labeled “Brokerage Account” for me, not “Traditional IRA Brokerage Account” or “Roth IRA Brokerage Account” which seems like it’s intentionally confusing 🙂 ).

I went to the Transact dropdown menu on the right side and clicked the 3 dots to reveal several options and selected Sell Vanguard Funds.

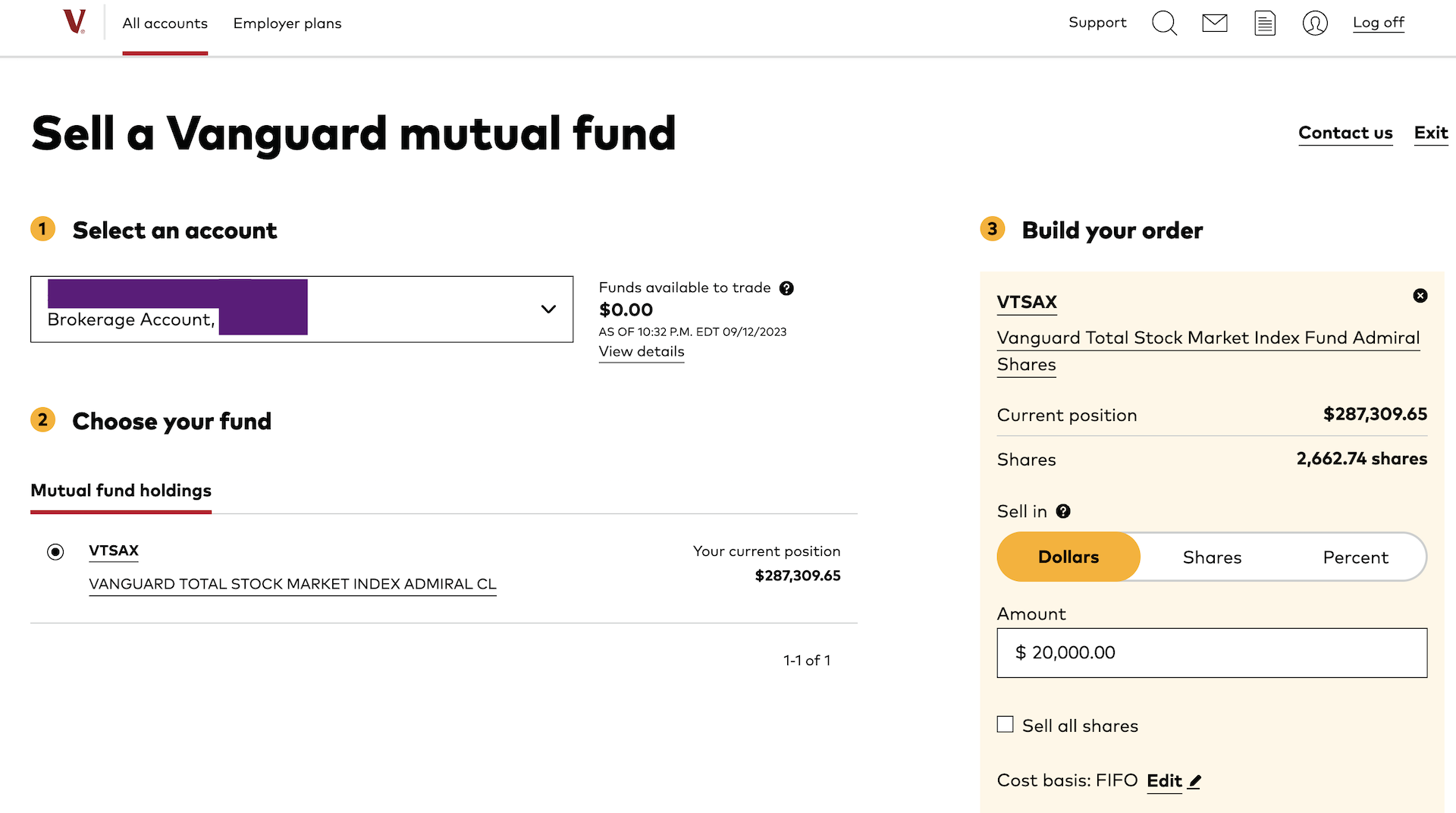

Step 1: Sell A Vanguard Mutual Fund

That brought me to this page:

Then I (1) Selected an account – my Brokerage Account, (2) Chose the fund I wanted to sell, which was easy for me since I only have one: VTSAX and (3) Built my order.

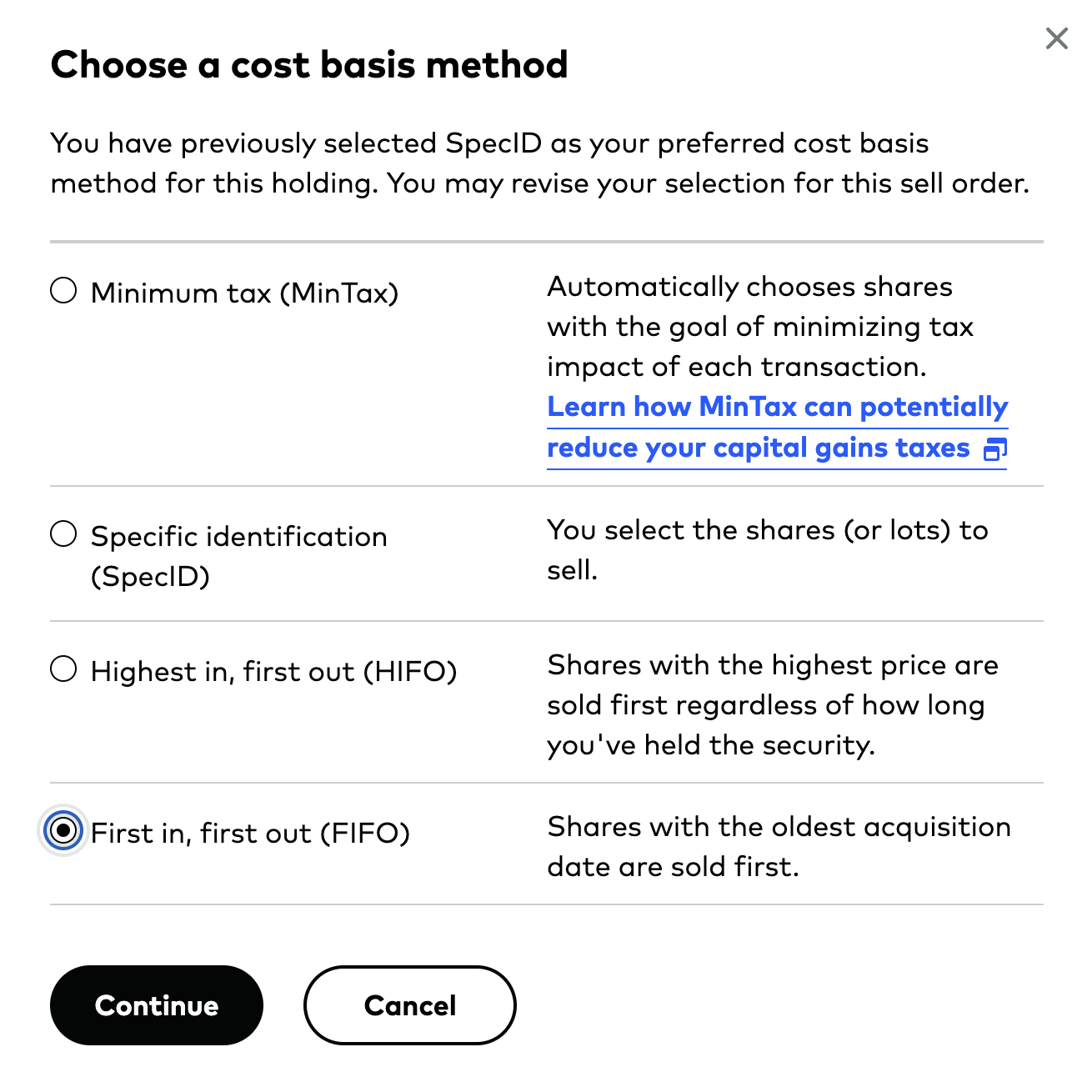

To build my order I needed to choose what kind of Cost Basis Method I wanted to use to choose which shares to sell. If you click Edit you can see all the options:

I chose FIFO (First in, First out) to ensure I’m only selling my oldest shares and creating long-term capital gains.

Then I had to select how I wanted to sell my shares (either through a dollar amount, number of shares or percentage of shares). I chose Dollars for ease.

Then I inputted the amount I wanted to sell. I put $20,000 as the example above, but the actual amount increases every year with inflation and my want or need to spend more because my retirement model doesn’t include a spending ceiling. For example, in 2023 I’m aiming to spend $22,700.

When all that’s sorted, I clicked Continue.

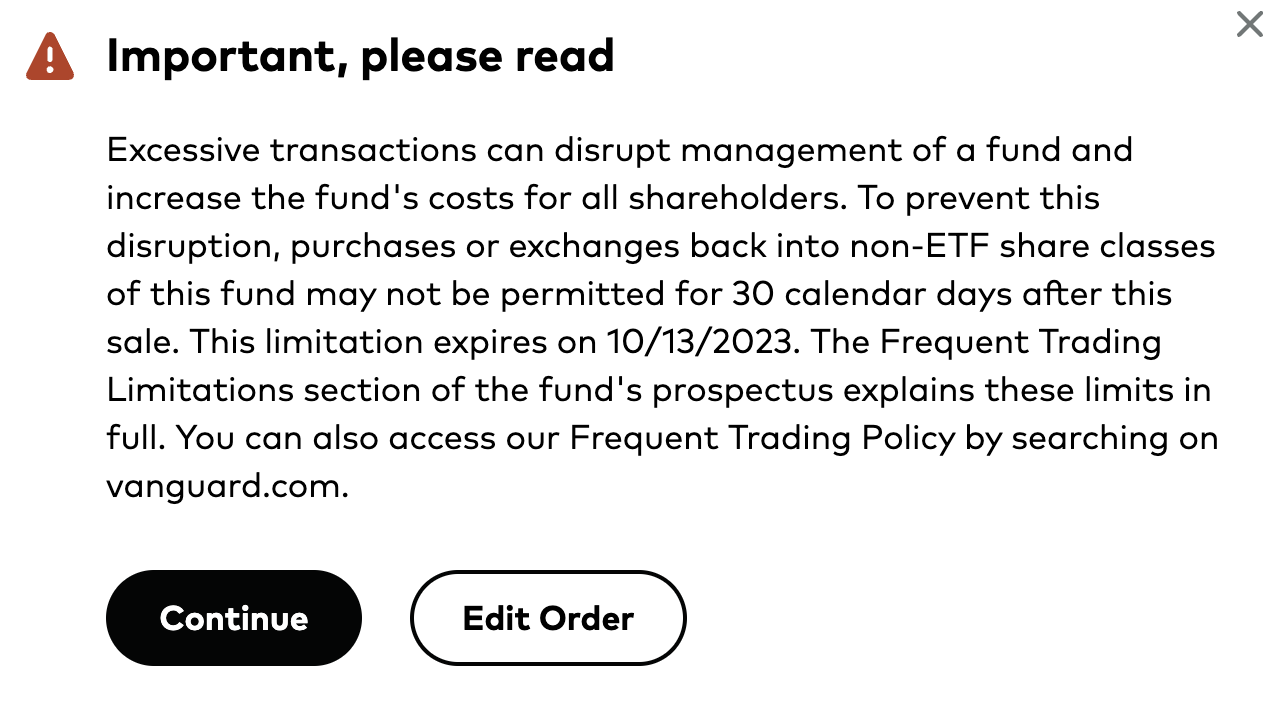

At this point this disclaimer popped up that is warning you not to create a wash sale, which is when you sell at a loss for a tax deduction and then buy back the same or similar fund in less than 30 days. I won’t be doing that so I clicked Continue.

Step 2: Transfer Proceeds

That brought me to this page:

I then (1) Told them where the money from selling my shares is going: a settlement fund with Vanguard or a bank transfer. I chose a Bank Transfer and then (2) Select a specific bank account.

Then I clicked Preview Order.

Step 3: Review Order

That brought me to this page:

So then I reviewed my order, triple checked that everything was correct and clicked Submit Order. It was done 🙂 .

How Did It Feel?

Weird 🙂 . Just like with my first foray into my Roth IRA Conversion Ladder – this seemed almost too simple 🙂 . I triple checked I was pressing the right buttons since it was my first time doing so and then took a deep breath and pressed “Submit Order.” A few days later a year of spending was dropped into my checking account like magic.

It really is a simple process that was only nerve-wracking because it was my first time doing something that I only knew about in theory, but all went well. I’m excited to see if this becomes old hat and feels as exciting as a standard bank transfer next year 🙂 .

Conclusion

And that’s how I sell my investments to fund my retirement! It is a simple process that was surprisingly nerve wracking the first time so I hope this guide helps if you’re in a similar position. Now I’m going to go stare at my Year 4 retirement spending money and start dreaming about all the places I can go to spend it 🙂 . Until next time!

Have you ever been nervous before taking new investment steps?

Love this guide, thank you! Such a scary endeavor until it’s actually done and you know it’s worked correctly.

I’m happy you liked it!

thank you for the step by step guide of this seemingly simple task. I always wondered how it is *actually* done and since I’m not at that point, wasn’t about to find out for myself anytime soon.

Yeah I was curious as well. Thank you!

thank you so much for posting this! I feel confident in the steps that have gotten us to be two years away from early retirement, but less so in the execution part once we take the leap, so thank you again for this! question – how did you decide on taking one lump sum for the year vs. monthly or quarterly? I know you are wisely partial to the path of least resistance, so was it as simple as that or another financial factor? thanks and have a wonderful time with your mom in Australia. my mom, sister, and I went to NZ together years ago and still talk about it to this day. making memories with your loved ones is so priceless!!!

Of course! I hope it helps. I decided to take an annual lump sum for ease and because I don’t spend a set amount every month. My expenses jump when I book our accommodations for the next 3-6 months in batches. Basically I didn’t want to have to manage my cash flow around that so I’m taking money annually. Thank you! We’re having a great time. That sounds like a wonderful trip to NZ 🙂 .

I’ve never seen an early retirement step by step guide to accessing your Roth IRA “contributions”. Yes, I’ve always read that if you’ve had your account open for five years, you could then access your contributions only (before 59 and 1/2). However, this guide you created explains the FIFO button/option. I was nervous thinking about how to differentiate between selling contributions vs earnings. Thank you Purple!

Was there an option to automatically sell your investments annually (on your retirement anniversary date)?

This is a guide to accessing your taxable brokerage in retirement. I haven’t touched my Roth yet, but when I do I’ll write a post about it. However, I suspect the Roth has a similar FIFO option. I think they make it easy to distinguish contributions vs earnings. I didn’t see an option to auto-sell, but it’s possible it exists.

When you withdraw from a Roth account you automatically (i.e. there is no alternative available to you) take out contributions first followed by gains.

Great to know! Thank you for sharing 🙂 .

The timing of this post is *perfect*! I just put my notice in at work, so I’ll be officially be FIREing this year. Knowing how to get money out (and things to keep in mind like capital gains taxes) is just what I needed. Will also be checking out that post on setting up a Roth conversion ladder.

Thank you so much for your content.

Congratulations on your notice! And you’re welcome – thank you for reading.

This was a great write-up! Thank you. It’s nice to see a drawdown in action.

Thanks!

Great detailed post: love it!

Thank you for sharing all your finances so openly. The screenshots really help.

I also wonder why you take out a whole year, as opposed to setting up a monthly automated plan so the remainder may make a little more money. Is this part of your overall strategy? Or a system constrain? I thought you could program monthly withdrawals, but now I don’t know for sure.

My other question is where to put this money… what is your preference? Thank you and happy travels!

I’m so glad you loved it! And yeah I love a good screenshot 🙂 . I’m planning to take out money annually because it’s easier. I could do it monthly, but I don’t spend a set amount each month and I pay in advance for housing in batches usually and need flexibility and cash for that. Basically I don’t want to have to think about it 🙂 .

I’m not sure if they have monthly automated withdrawals, but maybe. I put my cash in Ally, which is returning 4.25% right now. Thank you!

You are doing an amazing job living your best life and showing us that it is doable. Thanks for all the information. Looking forward to readIng more. All the best.

I’m so glad it was helpful! Thank you 🙂 .

I really enjoy your blog. I can’t travel like you so I enjoy reading about it!

Just curious about your comment of not timing the market when you sell. However, with sequence of returns risk you would want to avoid selling in a down market if possible. I don’t consider this market timing but just being prudent. This is the whole purpose of a cash cushion so you can time your withdrawals.

Thanks again for sharing your retirement journey!

Thank you! I hope you get to travel more soon if that’s something you want to do.

I don’t use a cash cushion for that purpose and don’t personally use that strategy (not selling in a down market). I only saved a cash cushion because I was retiring in 2020 when we thought the world would be closed and market would be down for 2 years.

After I deplete my 2 year cushion I’m not going to replenish it and always have a cash cushion. As for “market timing” I mean worrying or wondering about what the market will do day-to-day before selling for the year and deciding a specific day to sell based on that. Instead I just picked a day that I’ll sell every year so I don’t have to think about it. Thank you for reading!

It’s so nice seeing someone go through the steps! thank you!

I love a good step-by-step list so I thought others might as well 🙂 . Thank you!

Wow, thank you for taking time to give us the step by step process this is a lot of help, especially like me who is only a beginner when it comes to investments

Happy I could help 🙂 .

Congratulations on adding step 4! I was wondering, when do they tell you about your long term capital gains? Someone might want to only sell a number up to the long term capital gains number, rather than the total cash amount. Was that an option for you to see? either before or after.

Thanks! I didn’t see an option to only sell long-term capital gains by share number, but the “MinTax” option seems quite close: https://investor.vanguard.com/investor-resources-education/taxes/cost-basis-minimum-tax.

Hi Purple! Maybe this is a silly question, but when you were making more than the ~45k/year, did you already pay taxes on the capital gains (dividends, etc) of your taxable brokerage account? I’m trying to learn how taxable brokerage accounts work vs. retirement accounts – thanks in advance!

Hi! There are no silly questions – finance can be confusing 🙂 . Yes I paid taxes on my taxable brokerage dividends and gains while I was working.

I am not ready to withdraw from taxable accounts yet but as I am trying to simulate it for next year, I am having a tough time balancing the MAGI to be low enough for WA ACA. I think you are also enrolled in WA exchange so wondering if I can get your thoughts on this 🙂

For the premiums to be low and plans with low enough deductible, the MAGI needs be low enough around 200% FPL which is about 35k. With dividends, small extra income of 4 to 5k and even a withdrawal with long term cap gain of 5k is causing the number to jump above this. Are you facing this issue especially with the withdrawal since long term cap gain is counted as MAGI for ACA? If not, any thoughts on how to get around it?

I had high hopes for tax gain harvesting but it seems that to do that I will have to likely not qualify for ACA if I do that. Looks like only a small ROTH conversion of around 4 to 5k is feasible to keep the MAGI low for ACA purposes.

Hi! What calculator are you using? I plugged the inputs you mentioned into GCC’s below and got a low monthly cost. I currently have WA Apple Health/Medicaid because that’s what I qualify for based on income (not ACA) since it allows me to be eligible for the World Nomads global travel insurance I pay for.

https://www.gocurrycracker.com/aca-premium-calculator/

However, in the next few years, I will likely no longer qualify for WA Apple Health because of my income from selling stocks and I’ll need to either enter the ACA to qualify for my current travel insurance or come up with a new plan all together. I’m starting to research and evaluate my options now.

I’ve come to the same conclusion with tax gain harvesting and large Roth IRA conversions. It’s hard to juggle if I want to qualify for a low ACA payment as well. Anyway, I hope that helps. Good luck!

Thanks for the response!

Yes, I used GCC’s calculator too and a few others for sanity check.

The monthly premiums are still pretty low below 300% FPL but the deductibles and Out of pocket maximum increase dramatically from 150% to above 200% FPL. I will be keeping our income (my husbands and I so we file jointly) below 200% FPL for the meantime but not sure if it is a sustainable strategy for long term as we withdraw more from taxable. Curious to hear about your experience for next year and I am also happy to share my findings as I am on WA healthcare too.

Of course 🙂 ! It may take me a bit of time lol, but I try to respond to every comment I receive.

That totally makes sense. I’d love to hear more of your findings as you go forward. I’m only just starting my research, but will be sure to share what I learn here once I decide what to do.

Absolutely! Happy to share my findings. We are also out of the US for most of the year and also have Safety wing coverage. Curious to hear about your holistic strategy once you are ready 🙂

Nice! How do you like Safety Wing? Do they have the same requirement of having primary insurance like World Nomads? It sounds like it, but I wanted to check because I asked them that when they reached out to me about a partnership and I didn’t get a straight answer so I didn’t go forward with trying their insurance.

Even though we have had Safety wing for over a year, I don’t have any concrete feedback on them because we only had one incident, a surgery for a lipoma, which was was not covered in their coverage. Luckily, we were in Malaysia and used a hospital there which was an amazing facility for a very good price so it wasn’t an issue to pay out of pocket.

My understanding is that they don’t require primary insurance. We looked through the coverage in detail to find this but it is not as important to us because we will continue to have coverage with WA ACA since Safety wing doesnt cover cancer so I wouldnt consider it as a plan by itself.

https://safetywing.com/nomad-insurance/description-of-coverage.pdf

Ah – got it. Thank you so much for the information! I’m glad y’all were in Malaysia and could get great treatment for a good price.

I’ve been saving this post in my browser for months, I wanted to give it the attention it was due and my brain has just been a mess most of this year. lol and behold, it’s actually not terribly complicated 😄

thanks for taking the time to lay out the steps with the screenshots, that’s always appreciated.

Haha no worries – I procrastinated looking into this very subject for months 🙂 . I’m happy to hear it’s helpful. I’ll be referring to it myself when I sell investments again 😉 .

I have a question that perhaps you can help with. Will Vanguard send you a LT Capital Gains tax statement/estimate of some sort, or does one need to be prepared to do the math themselves when filing taxes?

This is a great post, thank you! 🙂

Yes they send those statements to you annually (I think in January) and the information is always available to look at in real time on their website. No need to do the math yourself.

Thank you for reading!