I’ve mentioned before that I have a complicated relationship with Amazon. I don’t agree with how they treat their warehouse workers, but I do buy things from them on occasion when I can’t find what I need locally (I’m obviously not perfect – just always trying to be better) .

So with that in mind, here’s something interesting that happened during a recent Amazon purchase of mine. I was checking out with an order of a little over $100 when a promo popped up. Usually I ignore everything extra Amazon tries to push on me, but this time I paused. They were offering $100 to open a no annual fee credit card…enough to almost pay for my entire purchase.

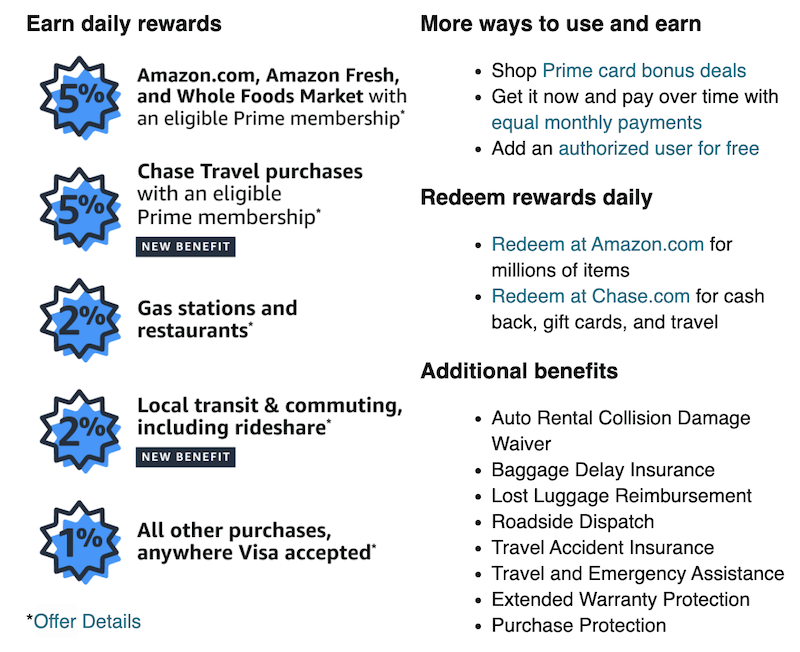

Now I’m suspicious by nature and don’t trust Amazon, so I looked into it more. I was surprised to discover that this Prime Visa Card appeared to be as advertised. Signing up for the card would give me a $100 Amazon credit as well as some common credit card perks, such as no foreign transaction fees and travel baggage insurance. It also claimed to offer 5% back on Amazon purchases.

However, I also discovered why I had never been offered this card before: You have to have Amazon Prime to get it. Hilariously I only had Prime for 1 month during a free trial because I wanted to watch a movie on their service. And this card offer aligned with that month. Having an Amazon Prime membership is required to get the card…but not to keep it 😉 .

Application

So given all of this info, I decided to apply for the card and see what happened. First they have a pre-qualification page to see if you’re eligible (I assume they basically just check you have Amazon Prime).

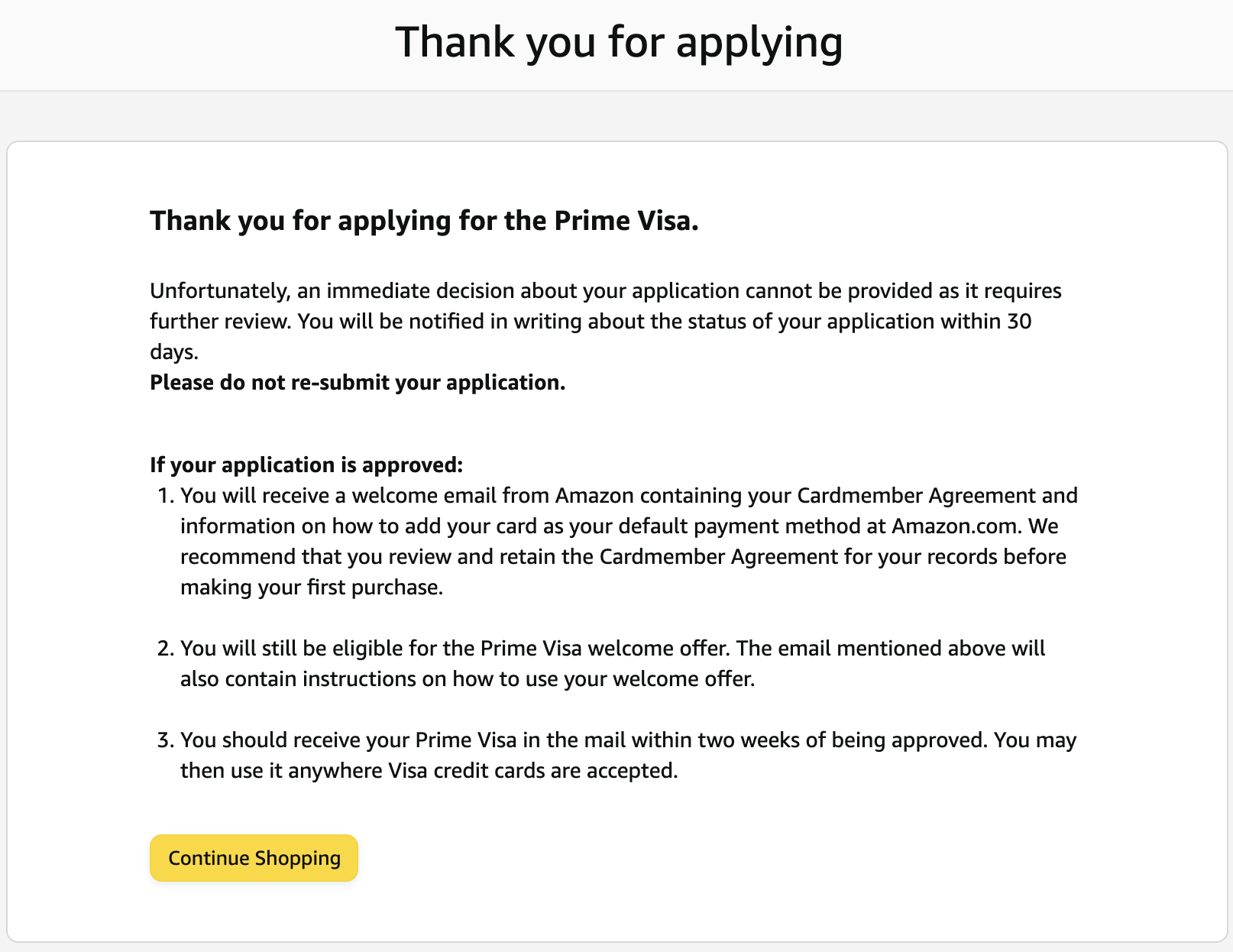

Then I completed the actual application. And this is where my suspicious nature was proven to be correct. The promotion had claimed that people get instant approval and an instant digital gift card (that I could use to buy the $100 of items in my cart). Nope!

After I applied, I was told that they needed to further review my application and that they’d get back to me in 30 days. Wow 🙂 . However, I’m not sure if this is outside of the norm and they flagged me because I’m retired and/or because I was on a Prime free trial. Hopefully that’s the case and they’re not straight up lying to everyone. So I quickly chalked this up to a bit of a failure, forgot about the card and moved on with my life 🙂 .

Approval

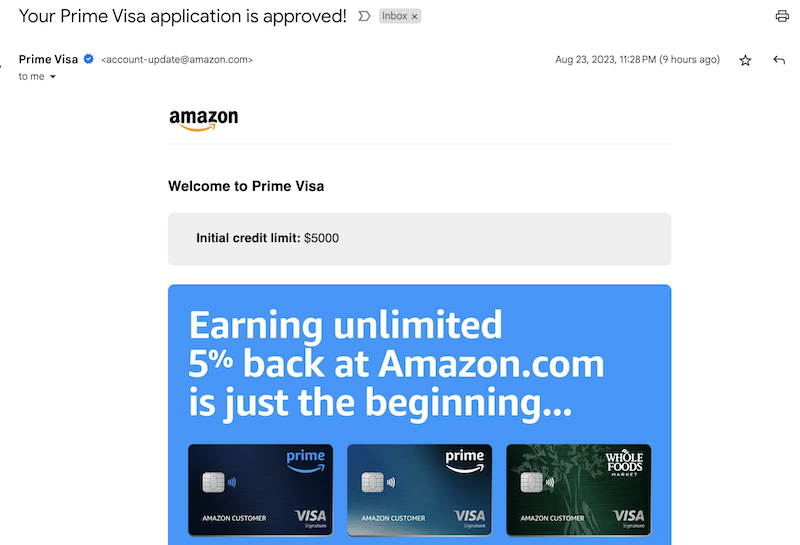

A week later I got an email that I had been approved for the card and luckily, I had put my Traveling Mailbox address on the application because my card arrived there two weeks after that. If I had put in the Airbnb address I had been living in while applying, it would have been useless since we had moved on already. So Traveling Mailbox for the win once again! Once it arrived, I paid about $3 for Traveling Mailbox to forward the card to my current location.

Once that was all set, I logged into my Chase portal (Prime Visa is a Chase card) out of curiosity. The email from Amazon (below) said that my credit limit was $5,000, but when I logged into Chase, it said that my limit was $34,500 for this card. Interesting 🙂 .

Next Steps

While I was logged in, I did what I always do with new credit cards: I set up auto-pay so the full amount of the card will be paid off every month without me having to do anything. This is a huge caveat I have around credit cards in general. My rule is to not get a new credit card unless I can easily pay off the entire balance every time. I don’t want to accumulate interest, which can easily overshadow the benefits of the card.

After that, I dug into more of the fine print of this card and found something interesting that I didn’t see easily when applying. If you don’t have Amazon Prime (like me), you only earn 3% back on Amazon purchases, not 5%. That would be good to say more prominently, but I would have actually expected them to make it 0% given how shady they can be – so I’ll take it 🙂 .

My final step was canceling my Amazon Prime free trial and when I did this, I discovered something else interesting. When trying to cancel, the website warned me that if I do, I will immediately lose my benefits of Amazon Prime…which turns out to be a huge lie 🙂 .

I went through with the cancellation process despite this warning and found it wasn’t true. I still had my Prime benefits until my trial ended, despite pre-cancelling my membership – and the cancellation email I received confirmed exactly that:

Now this is the shady behavior I expect from Amazon 🙂 . I assume they are lying to discourage people from pre-canceling so that they then forget and Amazon can charge them for another month. Classy.

Worth It?

So is the Prime Visa Card worth it? I think a few seconds of work is absolutely worth $100 for things I was going to buy anyway after having read all the fine print. I also suspect other people won’t even go through the days of waiting that I did after applying and actually get instant approval as promised, which is even better.

Personally, getting this card obviously got me that $100, but also 3% back whenever I have to use Amazon again. It’s also added $34,500 to my available credit, so my credit utilization will be even lower going forward, which will increase my credit score down the line (my credit score was 809 before applying and 812 after 😉 ). All positives over here.

What’s an interesting promo you’ve seen lately?

Discover more from A Purple Life

Subscribe to get the latest posts sent to your email.

Out of curiosity, how many credit cards do you think is worth getting? I’m always afraid to open up these types of credit cards when I already have 3. Thank you for reviewing!

Thanks for reading! I think that depends on your goals. I only have 1 credit card besides this one because I’m not chasing airline points right now. When I was I had like 10 cards, but now I just keep the ones that provide the most value to me like my Chase Sapphire does with its travel interruption and delay insurance.

As I understand it, the second offer your received was for a Prime Store credit card. This is different than the Amazon Prime Visa. The Prime Store card can only be used at Amazon. I only know this exists based on a recent conversation with a friend about rewards credit cards. She has both of these cards. I don’t know the benefit of having both other than she took advantage of the up front gift card offers.

That makes a lot of sense! Thank you for the clarification.

I was gonna warn you that this card took a spot out of your 5/20 lineup if playing the credit card bonus for miles game, and as such is not a good investment of that priced spot- but I think that you got this… right? If not head on over to 10xTravel, a Facebook group that has a free course that teaches me how to “play” the sign-up bonuses of credit cards for free travel. Love that course and all the advise I get from the group posts. Of course always pay your CC in full. Happy Travels!

Yeah I’m not playing the miles game anymore and am aware of that rule, but thanks for pointing it out for other people!

If you’re not chasing points right now, how are you paying for all your travel?? Old points or cash? Whats your future plans for award travel?

I’ve paid cash for like 95% of my travel since I retired – probably more. Using points is rare for me. I only use them for fancy international travel, which is max once a year. I’m not using points at all this year and I’m not planning to intentionally accumulate more points at the moment since post-pandemic restrictions haven’t made the ROI worth it to me.

I have this same card. I do pay for Amazon Prime, but I struggle with the ethics of it.

Like you, I dislike the way Amazon treats its workers (as well as some other things about the company). Also, Amazon’s quality has gone sharply downhill. It seems like the way they focus on price has driven out almost everyone except the lowest-quality sellers, mostly anonymous factories in China. I flat-out don’t trust Amazon anymore for anything expensive or complicated.

On the other hand, Amazon is sometimes the only place to get something I need. I buy from brick-and-mortar places if I can, but there aren’t as many of those as there used to be.

I’ve often thought about canceling Amazon Prime, but I was under the impression the card would stop working if I did. It’s good to know that isn’t the case!

All fair. And yeah I’ve been Prime free for many months and the card still works!

$100 sign-up bonus is pretty weak for a credit card, which tracks for Amazon!

Even if you aren’t going for travel hacking anymore, I’m kind of surprised you don’t still do a little bit of credit card churn for fun, since it’s free easy money. Ex: Chase Biz Ink Unlimited had a $900 SUB on $6k spend in 3 months, which would be super easy to hit at times you’re booking a bunch of month-long airbnbs for 2-3 people.

Is it the inconvenience of shipping cards and dealing with traveling mailbox? Or just not interested in playing the game anymore since you already have more money than you need?

FYI for any nomad churners: Amex tends to give you the credit card number after approval, so you can use the card digitally immediately, before the physical card arrives.

The latter 🙂 – I’m too lazy basically and free money doesn’t hold a large appeal. Thanks for sharing all that stuff though.

Nice post, I remember resisting signing up for this but then I’m like I can buy some semi useful/useless stuff for a $100. I think the thing I read was mainly it’ll be set up as your default card on Amazon so I was just intentional to delete/remove it lol. Keep up the great posts!

Thanks for reading! And that’s interesting – it wasn’t set up automatically as my default card on Amazon. I had to add it.

One thing to keep in mind for this card is that they will often offer/encourage you to use reward points to pay for Amazon purchases at checkout. Not terrible, but if you do that you lose out on earning more points on that Amazon purchase. It’s better to use the card to pay for purchases, then use the reward points to credit against the card balance or deposit to a bank account.

That’s good to know! Thank you.