My Mom has been retired for 5 years and during those years, she discovered something fascinating: there is an entire industry of salespeople trying to sell ‘special investments’ (*cough* annuities *cough*) specifically to retirees. Instead of sending the usual junk mail, they invite people to an expensive meal, which they then hold hostage until you’ve heard their pitch. Continue reading “Annuity Scams, Investment Dinners And Preying On Fear”

Category: Investing

It’s Official: I’m Quitting My Job In 10 Months. Here’s The Plan!

This is a continuation of my monthly series that records what’s happening in my final stretch to early retirement. If you’re interested in previous posts, they’re here.

I’m not one to bury the lede so: We’re doing this people! Thank you so much for all of your comments on my last post about this decision. I really appreciate all of your encouragement, concerns and advice. After careful consideration it’s been decided: I’m leaving my job in September 2020. Continue reading “It’s Official: I’m Quitting My Job In 10 Months. Here’s The Plan!”

Why I Own 100% US Stocks

Let’s start with all the caveats! Just like everything I do in my life, this is not a recommendation. I’m just trying stuff out and seeing what works. I am not an expert or a guru, I’m just a 30 year old going through life. This is how I’ve set up my investment portfolio, but I’m not saying this is right for everyone. It’s called personal finance for a reason. Continue reading “Why I Own 100% US Stocks”

Should I Lock Myself Into Quitting My Job In 11 Months?

This is a continuation of my monthly series that records what’s happening in my final stretch to early retirement. If you’re interested in previous posts, they’re here.

The time has come: IT’S DECISION TIME. I need to decide if next month I will book my month long trip to New Zealand and Australia for October 2020. My Mom and I are working on her goal of experiencing palaces in the sky by using travel hacking to book the Etihad First Class Apartments for our flight from Down Under. Check it out: Continue reading “Should I Lock Myself Into Quitting My Job In 11 Months?”

My 2018 Financial Recap

Also known as every dollar I didn’t spend in 2018! One year ago I declared the following monetary goals for 2018:

- Max my 401K ($18,500)

- Max a Roth IRA ($5,500)

- Overall invest $65,000

- Decrease my spending officially to $18,360 ($18,000 + 2% inflation)

My First 401(k) Match, An Updated Salary and Inching Closer to Early Retirement

It finally happened – 7 years out of college and I am finally getting my first 401k match! I’ve dreamed of this moment for so long (yes, I have weird dreams – deal with it). While working at all of my previous jobs, I never qualified for the 401(k) match (if they even had one). If they did have one, you were not eligible for it until you had been there 4 or so years, which is basically unheard of in ad agencies. Well played HR. Well played. Continue reading “My First 401(k) Match, An Updated Salary and Inching Closer to Early Retirement”

That Time I Laughed In A Financial Advisor’s Face

Continue reading “That Time I Laughed In A Financial Advisor’s Face”

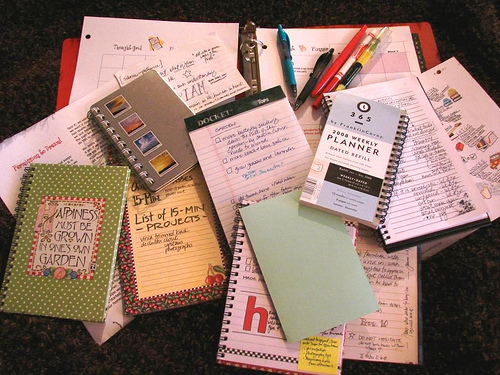

My Early Retirement Strategy

It’s time to bring out my planning materials! *rubs hands together maniacally*

It’s time to bring out my planning materials! *rubs hands together maniacally*

A reader requested that I post about my early retirement strategy. Thanks for the suggestion Palmetto Millennial!

My Situation

First I’m going to set the stage. Continue reading “My Early Retirement Strategy”