I got my paycheck last night. It included a bonus. A bigger bonus than I anticipated. All of my concern that I didn’t feel excitement when I heard people get their bonuses unless they’re on an improvement plan completely faded away because I am PUMPED! I know lots of job search disappointments and life disappointments have conditioned me to not believe something until I see it, until it’s in my hand. And I think that’s what happened here. I didn’t believe I would get a bonus. I didn’t necessarily believe that new HR person knew what she was talking about. I didn’t necessarily believe that bonus was a part of my compensation package. But it is. And updating my spreadsheets last night was glorious. Continue reading “Bonuses and Making Things Real”

I got my paycheck last night. It included a bonus. A bigger bonus than I anticipated. All of my concern that I didn’t feel excitement when I heard people get their bonuses unless they’re on an improvement plan completely faded away because I am PUMPED! I know lots of job search disappointments and life disappointments have conditioned me to not believe something until I see it, until it’s in my hand. And I think that’s what happened here. I didn’t believe I would get a bonus. I didn’t necessarily believe that new HR person knew what she was talking about. I didn’t necessarily believe that bonus was a part of my compensation package. But it is. And updating my spreadsheets last night was glorious. Continue reading “Bonuses and Making Things Real”

Category: Finance

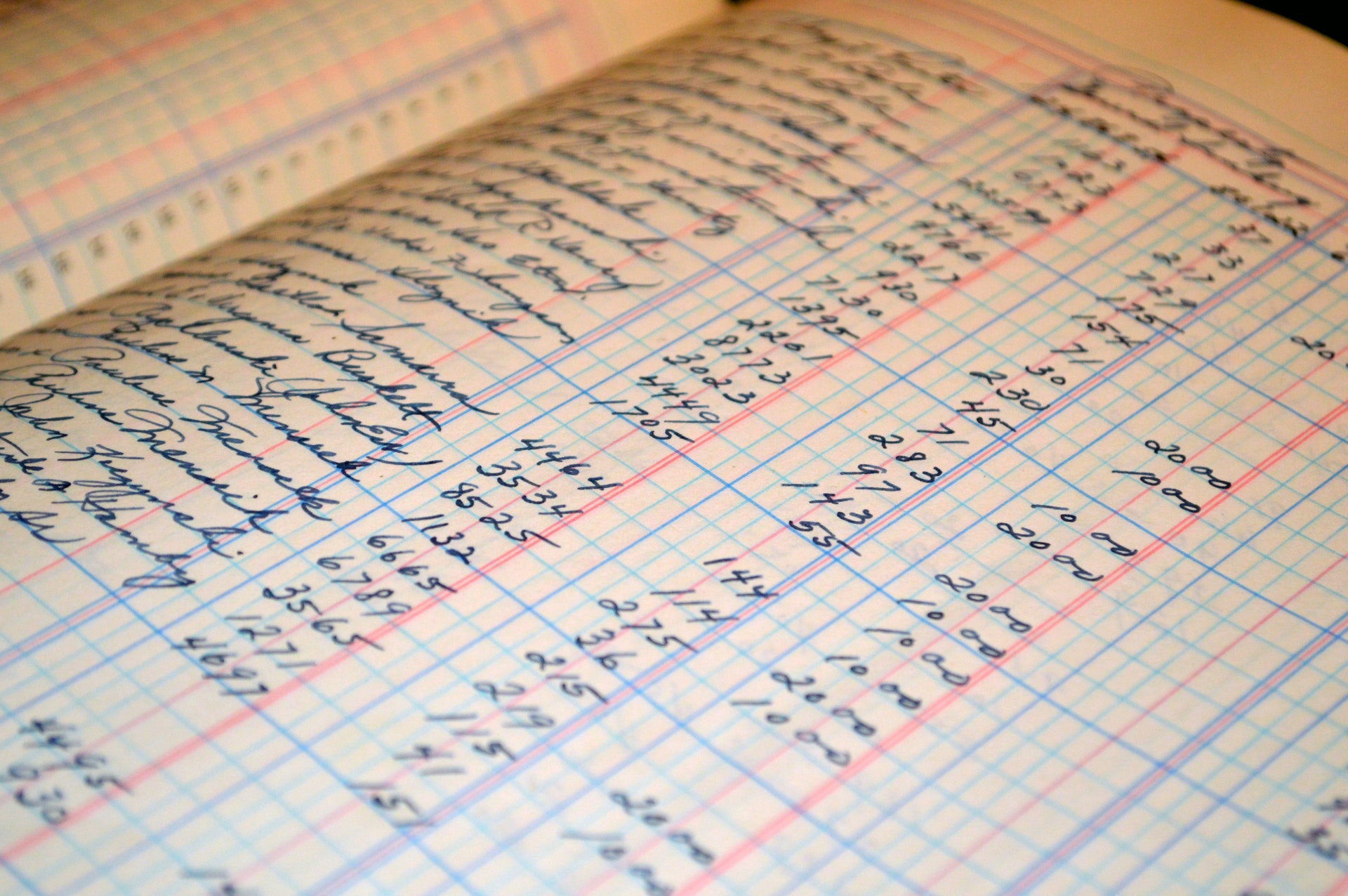

Q1 Budget Check-In 2017

Oooh maybe I should get another ledger like this.. And yes I’m that girl that always gets an itemized receipt 🙂

Shocker: I Don’t Love Going Out Anymore

I used to eat out several times a week. If someone suggested it I was always down (unless it was near the end of the month and I’d run out of budget…). In January I did the Frugalwoods Uber Frugal Challenge where I severely cut down on eating out. I ended up only eating outside food twice for a total of $12.34: A friend lunch date at Chipotle (my suggestion 🙂 ) and a take out burger on 1/2 priced Wednesdays. Luckily this was the same month I started eating low-carb and as a result discovered that butter and cheese make anything delicious 🙂 . Continue reading “Shocker: I Don’t Love Going Out Anymore”

I used to eat out several times a week. If someone suggested it I was always down (unless it was near the end of the month and I’d run out of budget…). In January I did the Frugalwoods Uber Frugal Challenge where I severely cut down on eating out. I ended up only eating outside food twice for a total of $12.34: A friend lunch date at Chipotle (my suggestion 🙂 ) and a take out burger on 1/2 priced Wednesdays. Luckily this was the same month I started eating low-carb and as a result discovered that butter and cheese make anything delicious 🙂 . Continue reading “Shocker: I Don’t Love Going Out Anymore”

Bonuses…and a Shocking Lack of Excitement

I had lunch with our new HR/recruiter person at work the other day. In addition to wanting to get to know her since she’s new to town I had a few questions for her of course 🙂 . What I learned about our job over the course of our lunch was extremely helpful. For example, I’m not sure I’ve mentioned this before, but my pay structure at this job is unlike any I’ve had before.

Previously I was given a set salary and that was it. In ad agencies they don’t really give you raises or bonuses so that wasn’t ever expected. I did receive $1,000 from one of my ad agencies because I planned the company holiday party (which I did the next year as well without payment 🙂 ).

They told me not to tell anyone about it. Since I am a strong believer in financial transparency I totally told people. You shouldn’t tell your employees not to tell others when they get a raise or a bonus. I understand why companies do it – to keep them in complete power – but how about we actually pay people fairly so they are not angry when they hear a colleague got a raise or bonus and are instead happy for them? I’m getting off topic. The lack of transparency in most aspects of the American jobs could take up multiple books. Continue reading “Bonuses…and a Shocking Lack of Excitement”

Autopilot

WARNING: Prepare yourself for a seriously “first world problem” piece of whininess.

WARNING: Prepare yourself for a seriously “first world problem” piece of whininess.

I’m bored 🙂 . The key to long term investing success is to set it and forget it: put your money in the market and let it ride. Since we are entering a new year I still had things to optimize: how much should I try to spend so I can save the maximum amount with my new salary? Would I get my bonus? If so, how would that increase my savings rate? How much of my budget should I allocate to vacations? Should I travel hack more of my flights? Sadly all of that has come to an end. I’ve solved them all and booked all my flights until March 2018. Now I seem to just be waiting for the end of each month so I can budget my money, move it into my investments and update my spreadsheets. This process sadly only takes a few minutes. Then I’m back to waiting. Continue reading “Autopilot”

10,000th Day and $150,000 Net Worth

While I was on vacation in Thailand I hit my 10,000th day of being alive. That went quickly! The market was also at an all time high and I hit $150,000 in net worth. WOAH. I expected that to happen when I got my next paycheck in March, but the rampaging market made it happen sooner. I started the year 2 months ago with $137,000 and we’re already at $150K with only 1 paycheck under my belt. I almost can’t believe it and I know it won’t last: the market will drop, maybe this month, maybe this year, maybe in a few years – I have no idea, but it will and I will see myself lose maybe half of my savings. Watching it grow in this current market and feeling that satisfaction will hopefully get me through that darker time. But in the meantime I will celebrate :). This was my first vacation where I had no job stress to think about. I even deleted my work email from my phone. I believe I am 1500 days (or less) from retirement and living life on my own terms. Bring it!

While I was on vacation in Thailand I hit my 10,000th day of being alive. That went quickly! The market was also at an all time high and I hit $150,000 in net worth. WOAH. I expected that to happen when I got my next paycheck in March, but the rampaging market made it happen sooner. I started the year 2 months ago with $137,000 and we’re already at $150K with only 1 paycheck under my belt. I almost can’t believe it and I know it won’t last: the market will drop, maybe this month, maybe this year, maybe in a few years – I have no idea, but it will and I will see myself lose maybe half of my savings. Watching it grow in this current market and feeling that satisfaction will hopefully get me through that darker time. But in the meantime I will celebrate :). This was my first vacation where I had no job stress to think about. I even deleted my work email from my phone. I believe I am 1500 days (or less) from retirement and living life on my own terms. Bring it!

Lessons Learned from My Mom

When I look around I can tell that I’m different from other people. Some have even told me so. I’m not sure if they meant it as an insult, but I didn’t take it that way. When I look around even a less consumer city (compared to NYC) like Seattle I see people in name brand coats with name brand bags wearing the same name brand boots. They like to talk about the other name brand things they are planning to buy while decked out daily in jewelry and make up. Continue reading “Lessons Learned from My Mom”

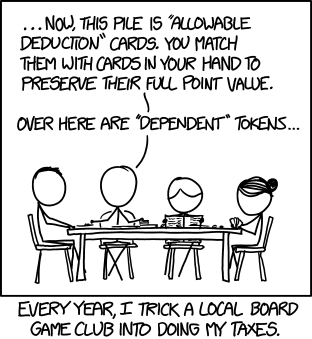

2016 Taxes Conquered!

“I AM A GOLDEN GOD!!!” That’s what I kept screaming after I did my taxes, unassisted, for the first time tonight. It also happened to be me and my partner’s anniversary – the perfect time to run some numbers :). Despite how annoying and seemingly redundant our tax forms are I was so excited that I was able to do it on my own! Continue reading “2016 Taxes Conquered!”