Reality is setting in y’all. I feel similar to how I did right before we moved across the country without a house, job or knowing basically anyone on this side of the country. I had made the decision and I knew it was the right one, but it was still terrifying. I was leaving the best job I’d ever had behind, along with the best apartment I’d ever had and all the friends I’d made in my adult life. I was petrified. Continue reading “6 Months To Retirement: This Is Starting To Feel Real”

Category: Taxes

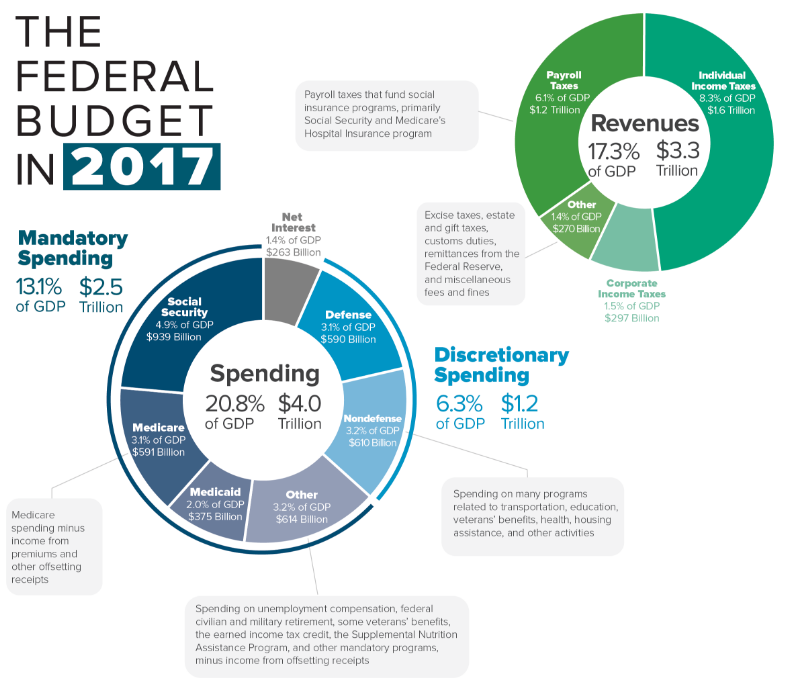

I Pay More In Taxes Than I Spend Annually

I love reframing how I view the world. A tax reform bill passed near the end of last year so taxes have been in the public eye for a bit now. Though I don’t agree with exactly how my tax dollars are spent I do not mind paying taxes. Every time I’m on a public road or see one of our public transit lines expand I think about how my money helped build that for myself and the community. This feeling is heightened when I learned that a 4 lane highway costs over $1 million PER MILE to build. Wowza. That’s a lot of cheddar. Continue reading “I Pay More In Taxes Than I Spend Annually”

2016 Taxes Conquered!

“I AM A GOLDEN GOD!!!” That’s what I kept screaming after I did my taxes, unassisted, for the first time tonight. It also happened to be me and my partner’s anniversary – the perfect time to run some numbers :). Despite how annoying and seemingly redundant our tax forms are I was so excited that I was able to do it on my own! Continue reading “2016 Taxes Conquered!”

401K vs. NYC Taxes

As you know, I have now maxed my 401K in six months of living in NYC to decrease my large state and city tax bill before we move. But I’ve been wondering how much money in state and city taxes I have saved by maxing this before I leave and how much of federal taxes have I saved by simply maxing this account. Continue reading “401K vs. NYC Taxes”

As you know, I have now maxed my 401K in six months of living in NYC to decrease my large state and city tax bill before we move. But I’ve been wondering how much money in state and city taxes I have saved by maxing this before I leave and how much of federal taxes have I saved by simply maxing this account. Continue reading “401K vs. NYC Taxes”

Taxes: Investment Accounts

Overall the tax code in this country, or more specifically the ways FI bloggers have presented the tax code of the US, seems pretty lovely. It understandably targets workers since that is a vast majority of the population and includes several complex ways that you can shelter money from taxes legally and then access it before standard retirement age. I’m still trying to make sure I understand how the tax code in this country works and how I can use it to my advantage. My favorite bloggers make it seem so simple, specifically the Mad Fientist, but when I go to IRS website my eyes still glaze over. It seems that everything has an exception and then an exception to that exception. Continue reading “Taxes: Investment Accounts”

Overall the tax code in this country, or more specifically the ways FI bloggers have presented the tax code of the US, seems pretty lovely. It understandably targets workers since that is a vast majority of the population and includes several complex ways that you can shelter money from taxes legally and then access it before standard retirement age. I’m still trying to make sure I understand how the tax code in this country works and how I can use it to my advantage. My favorite bloggers make it seem so simple, specifically the Mad Fientist, but when I go to IRS website my eyes still glaze over. It seems that everything has an exception and then an exception to that exception. Continue reading “Taxes: Investment Accounts”

2014 Taxes: Surprise!

I’m still pretty baffled by tax code. In my most focused moments I can be found following links to read about tax opportunities that work best for the early retiree lifestyle. Luckily the authors and bloggers that direct me to these sites usually clearly explain the premise of the idea before I reach the IRS page so I am not overwhelmed by the jargon. But with my own W-2 soon to be posted I wanted to be prepared for my first tax season, which will be in some ways easier and in others more difficult than previous years. This year is easier in that it is the only one where I have paid taxes and held only one job at one company with no gaps or unemployment. It is more difficult because as a result of my Roth IRA mishap last spring I have a few hundred dollars of money in a taxable account. Since it is a Vanguard Target Retirement Fund it includes both stocks and bonds as well as domestic and international versions of both, which all create some added complexity. Continue reading “2014 Taxes: Surprise!”

I’m still pretty baffled by tax code. In my most focused moments I can be found following links to read about tax opportunities that work best for the early retiree lifestyle. Luckily the authors and bloggers that direct me to these sites usually clearly explain the premise of the idea before I reach the IRS page so I am not overwhelmed by the jargon. But with my own W-2 soon to be posted I wanted to be prepared for my first tax season, which will be in some ways easier and in others more difficult than previous years. This year is easier in that it is the only one where I have paid taxes and held only one job at one company with no gaps or unemployment. It is more difficult because as a result of my Roth IRA mishap last spring I have a few hundred dollars of money in a taxable account. Since it is a Vanguard Target Retirement Fund it includes both stocks and bonds as well as domestic and international versions of both, which all create some added complexity. Continue reading “2014 Taxes: Surprise!”