Category: Personal Finance Reviews

Finance Tracker Review: Personal Capital

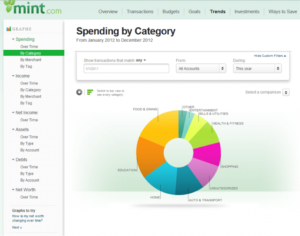

Finance Tracker Review: Mint.com

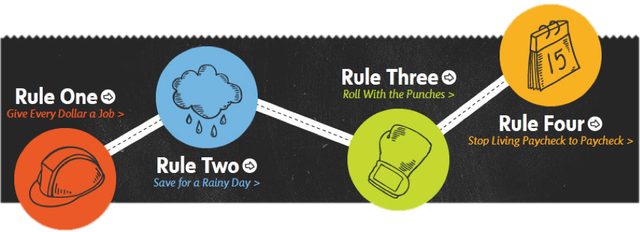

Finance Tracker Review: YNAB

I originally turned away from YNAB (You Need A Budget) during my time using Simple (before the dark days) for a few reasons when I compared it to Simple:

I originally turned away from YNAB (You Need A Budget) during my time using Simple (before the dark days) for a few reasons when I compared it to Simple:Continue reading “Finance Tracker Review: YNAB”

Bad Bank Review: Simple

Good Bank Review: TD Bank

I originally became a member of TD Bank because it was one of two banks in my college town and the only bank that also had locations in other parts of the country. So when leaving college I moved all my money to TD Bank and never looked back. And I believe I lucked out enormously. When compared to all the other banks in NYC TD Bank is consistently wonderful whether I’m visiting a location or calling customer service they are always there for me. In NYC at least they are also always building new stores – they seem to be taking over. And they even built one directly in front of my apartment in what seemed like weeks.

I originally became a member of TD Bank because it was one of two banks in my college town and the only bank that also had locations in other parts of the country. So when leaving college I moved all my money to TD Bank and never looked back. And I believe I lucked out enormously. When compared to all the other banks in NYC TD Bank is consistently wonderful whether I’m visiting a location or calling customer service they are always there for me. In NYC at least they are also always building new stores – they seem to be taking over. And they even built one directly in front of my apartment in what seemed like weeks.The only complaint would be the annual fee on their introductory credit cards. For that reason I did move my credit card use elsewhere. The only area that could use improvement is their online experience. It’s a little archaic, but still light-years ahead of a lot of banks that seem to be stuck in the past. Unfortunately I am planning to leave TD Bank simply because they do not have a presence on the West Coast.