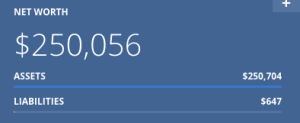

As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go!

As part of my many retirement charts I’ve created one that shows visually how much I’ve saved in $10,000 increments. The market is already going gangbusters in 2018 (though who knows how long it will last) and as a result without any paycheck I have more than $250,000. Originally I was just excited to fill in another bubble on my visual net worth sheet and enthralled by the fun of thinking about having “a quarter of a million,” but I just realized something: $250,000 is half of what I need to retire. I’m halfway there! That’s crazy! And based on the magic of compound interest my money will keep working for me and start earning money faster than I can. It looks like I’m halfway to retirement money-wise and less than halfway in regards to time: 2 years and 11 months to go!

Letting Motivation Come

It’s been a cloudy and rainy week in Seattle. Before I moved here I would have thought that’s a normal sentence, but it’s really not. Seattle is a wonderfully sunny place. Even when the day starts out crazy cloudy it’s sunny with a clear blue sky by the afternoon. This week has not been like that. We have been experiencing downpours this past week, which have kept the skies grey. It being January the fact that the sun rises at 8am and sets around 4pm has not been helping. Continue reading “Letting Motivation Come”

3 Years.

This month is an interesting milestone. 3 years ago my mother retired from 30+ years of full-time work. Work she hated. Work that kept her from spending time with me because of a long commute (that allowed my step-siblings to go to a school near their mother). Work that wasn’t very compatible with my own long commute to school downtown. Work that allowed her to retire early at 55. I can’t believe it’s been 3 years already. Continue reading “3 Years.”

This month is an interesting milestone. 3 years ago my mother retired from 30+ years of full-time work. Work she hated. Work that kept her from spending time with me because of a long commute (that allowed my step-siblings to go to a school near their mother). Work that wasn’t very compatible with my own long commute to school downtown. Work that allowed her to retire early at 55. I can’t believe it’s been 3 years already. Continue reading “3 Years.”

LinkedIn Picture Lies

I set up LinkedIn 6 months into my career in 2012 when I was starting to think of my first job hop. That also happened to be the time when I lost 30 lbs in 3 months by starving myself (coincidence?!…yeah I think it was…) As a result, the picture I used showed a skinny me smiling (also wine glasses…you have to show who you are, you know?) I’ve had that picture on LinkedIn since then: 6 years. Continue reading “LinkedIn Picture Lies”

I set up LinkedIn 6 months into my career in 2012 when I was starting to think of my first job hop. That also happened to be the time when I lost 30 lbs in 3 months by starving myself (coincidence?!…yeah I think it was…) As a result, the picture I used showed a skinny me smiling (also wine glasses…you have to show who you are, you know?) I’ve had that picture on LinkedIn since then: 6 years. Continue reading “LinkedIn Picture Lies”

Retiring “To” Something

I’ve heard it over and over again: on forums and countless blog posts that it’s important to not just retire “from” your job, but to retire “to” something: something productive that will fill the ‘hole’ working leaves. I’ve been thinking about this FIRE dogma a lot and I think we should decrease its “truth” status. I honestly don’t think this is the case for me or my Mom. Continue reading “Retiring “To” Something”

I’ve heard it over and over again: on forums and countless blog posts that it’s important to not just retire “from” your job, but to retire “to” something: something productive that will fill the ‘hole’ working leaves. I’ve been thinking about this FIRE dogma a lot and I think we should decrease its “truth” status. I honestly don’t think this is the case for me or my Mom. Continue reading “Retiring “To” Something”

An Accidental ATM Fee

It’s about 30 days before my trip to Singapore: my first time in the country. I’m visiting because I was invited by a Seattle friend of mine (and former colleague) who grew up there. We’ll be staying in her Mom’s apartment in its many empty rooms. Luckily I’ve met her mother and got along with her well. It should be a fairly frugal trip all things considered. Continue reading “An Accidental ATM Fee”

It’s about 30 days before my trip to Singapore: my first time in the country. I’m visiting because I was invited by a Seattle friend of mine (and former colleague) who grew up there. We’ll be staying in her Mom’s apartment in its many empty rooms. Luckily I’ve met her mother and got along with her well. It should be a fairly frugal trip all things considered. Continue reading “An Accidental ATM Fee”

2017 State of the Union

This year I had more than just monetary goals. They were:

This year I had more than just monetary goals. They were:

- Max my 401K ($18,000)

- Max a Roth IRA ($5,500)

- Overall invest $54,500 for a savings rate of 75%

- Have a net worth of $200,000

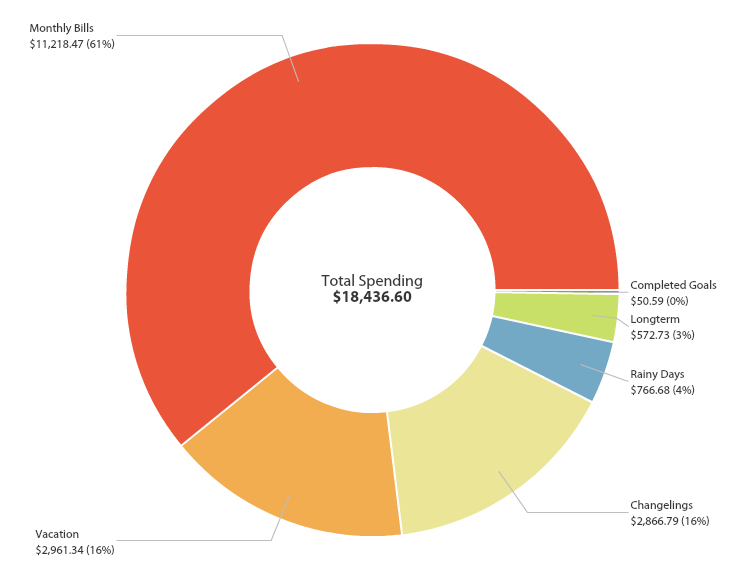

- Decrease my spending from $22,491.86 to $18,000

- Lose 28 lbs by eating low-carb/high-fat and have a normal BMI for the first time without starving myself

- Determine when I can retire based on my current salary and savings rate

2017 Spending