There is about a month left on my 401K challenge and things are heating up. In a recent post I explained how I would be moving to Republic Wireless from AT&T and paying an early termination fee as well as buying a new phone. I’m currently unable to sell my iPhone unlocked because the jailbreaking community is waiting for Apple to release its latest iOS update (8.4). I paid about $300 for my new Android phone and will pay about $250 for the early termination fee while sitting on about $600 worth of iPhone potential. These unexpected expenses are making things a little tight.

There is about a month left on my 401K challenge and things are heating up. In a recent post I explained how I would be moving to Republic Wireless from AT&T and paying an early termination fee as well as buying a new phone. I’m currently unable to sell my iPhone unlocked because the jailbreaking community is waiting for Apple to release its latest iOS update (8.4). I paid about $300 for my new Android phone and will pay about $250 for the early termination fee while sitting on about $600 worth of iPhone potential. These unexpected expenses are making things a little tight.

And I did not help myself by increasing my 401K contribution from 55% of my salary to 60% – my paycheck this week was hilariously small. I should have enough money to pay rent on the day rent is due. Hopefully I will not have to dip into my funemployment money before then. I’m confident this will work out fine though. I’m leaving on vacation today and two days after I return my next paycheck comes in. Getting paid to vacation is the best. Let’s feel that burn and finish strong!

I finally took the plunge. After 8 years I’m walking away from the iPhone and as a result breaking the shackles that tied me to AT&T. I was planning to wait until my contract with AT&T is complete in October 2016 before breaking my contract with them to avoid any early termination fee, but as I mentioned my phone bill recently doubled from $45 a month to $90 a month without even having unlimited data. And that is a straight up ridiculous amount to pay for a phone service I barely use (I’m mostly on WiFi). So I started thinking about breaking the contract early when something wonderful happened. I received the impetus I needed.

I finally took the plunge. After 8 years I’m walking away from the iPhone and as a result breaking the shackles that tied me to AT&T. I was planning to wait until my contract with AT&T is complete in October 2016 before breaking my contract with them to avoid any early termination fee, but as I mentioned my phone bill recently doubled from $45 a month to $90 a month without even having unlimited data. And that is a straight up ridiculous amount to pay for a phone service I barely use (I’m mostly on WiFi). So I started thinking about breaking the contract early when something wonderful happened. I received the impetus I needed.  My cell phone plan increased to $90. Through many sneaky tricks of AT&T my phone bill somehow doubled as a result of me upgrading to the latest iPhone (mistake – I know). As a result I was looking for alternatives. I knew I wanted to switch to

My cell phone plan increased to $90. Through many sneaky tricks of AT&T my phone bill somehow doubled as a result of me upgrading to the latest iPhone (mistake – I know). As a result I was looking for alternatives. I knew I wanted to switch to  I’m half way through my “Maxing 401K in 6 Months” Challenge and I must admit I haven’t felt a difference. Despite my paychecks being half what they used to be I haven’t felt stressed or stretched. Saving in the current month for the next month’s rent has become routine. And the thrill I get seeing my 401K amount increase $1,500 every 2 weeks is something I can’t even describe. I’ve already saved $10,000 in my 401K and $11,000 overall this year and it’s the beginning of April. That’s 27.5% of my $40,000 savings a year goal which would double how much I saved last year.

I’m half way through my “Maxing 401K in 6 Months” Challenge and I must admit I haven’t felt a difference. Despite my paychecks being half what they used to be I haven’t felt stressed or stretched. Saving in the current month for the next month’s rent has become routine. And the thrill I get seeing my 401K amount increase $1,500 every 2 weeks is something I can’t even describe. I’ve already saved $10,000 in my 401K and $11,000 overall this year and it’s the beginning of April. That’s 27.5% of my $40,000 savings a year goal which would double how much I saved last year. So far in my four years of work experience I have noticed a pattern in the four jobs I have received: they are all through networking. So I was surprised when after applying online for a position at a Seattle agency I received a note from the recruiter asking to set up time to talk. Speaking to an agency recruiter isn’t a complete rarity, but this woman’s response time was impressive. So far in my search for Seattle jobs while still in New York the few people that have reached out to me of their own volition have fallen off the face of the Earth after I mention where I’m located. But she didn’t. Despite having to reschedule several times we made it work. And I’m so glad I didn’t give up on her because this conversation gave me very valuable information that will allow me to cut my 10 years to financial independence to a slim 5 years.

So far in my four years of work experience I have noticed a pattern in the four jobs I have received: they are all through networking. So I was surprised when after applying online for a position at a Seattle agency I received a note from the recruiter asking to set up time to talk. Speaking to an agency recruiter isn’t a complete rarity, but this woman’s response time was impressive. So far in my search for Seattle jobs while still in New York the few people that have reached out to me of their own volition have fallen off the face of the Earth after I mention where I’m located. But she didn’t. Despite having to reschedule several times we made it work. And I’m so glad I didn’t give up on her because this conversation gave me very valuable information that will allow me to cut my 10 years to financial independence to a slim 5 years. I’ve always been addicted to Sims. Since Sims 1 came out when I was in middle school it’s been my favorite game. That was 15 years ago. There is just something so fascinating about building (and at times ruining) virtual lives. It was the ultimate sandbox game before Minecraft, and in my opinion is still a worthy competitor despite its focus being different.

I’ve always been addicted to Sims. Since Sims 1 came out when I was in middle school it’s been my favorite game. That was 15 years ago. There is just something so fascinating about building (and at times ruining) virtual lives. It was the ultimate sandbox game before Minecraft, and in my opinion is still a worthy competitor despite its focus being different. Overall the tax code in this country, or more specifically the ways FI bloggers have presented the tax code of the US, seems pretty lovely. It understandably targets workers since that is a vast majority of the population and includes several complex ways that you can shelter money from taxes legally and then access it before standard retirement age. I’m still trying to make sure I understand how the tax code in this country works and how I can use it to my advantage. My favorite bloggers make it seem so simple, specifically the Mad Fientist, but when I go to IRS website my eyes still glaze over. It seems that everything has an exception and then an exception to that exception.

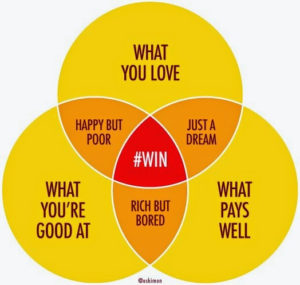

Overall the tax code in this country, or more specifically the ways FI bloggers have presented the tax code of the US, seems pretty lovely. It understandably targets workers since that is a vast majority of the population and includes several complex ways that you can shelter money from taxes legally and then access it before standard retirement age. I’m still trying to make sure I understand how the tax code in this country works and how I can use it to my advantage. My favorite bloggers make it seem so simple, specifically the Mad Fientist, but when I go to IRS website my eyes still glaze over. It seems that everything has an exception and then an exception to that exception.  Since I joined the workforce I’ve kept lists of what I enjoy and don’t enjoy in each job I’ve had. From these lists I’ve created the profile of what I thought would be my ideal job in advertising: flexible, constantly challenging with a boss I love and limited human interaction. I now have that job. I have had it for almost a year. And I am still not satisfied. I don’t know what it is about work that makes me analyze my satisfaction with it at every turn. Maybe because the general public seem to think ‘work’ is what you do for 40-50 years of your life. Other parts of life do not last that long: high school, college – all previous steps were 4 years long. Now that 4 has turned into 40.

Since I joined the workforce I’ve kept lists of what I enjoy and don’t enjoy in each job I’ve had. From these lists I’ve created the profile of what I thought would be my ideal job in advertising: flexible, constantly challenging with a boss I love and limited human interaction. I now have that job. I have had it for almost a year. And I am still not satisfied. I don’t know what it is about work that makes me analyze my satisfaction with it at every turn. Maybe because the general public seem to think ‘work’ is what you do for 40-50 years of your life. Other parts of life do not last that long: high school, college – all previous steps were 4 years long. Now that 4 has turned into 40.