I’m still pretty baffled by tax code. In my most focused moments I can be found following links to read about tax opportunities that work best for the early retiree lifestyle. Luckily the authors and bloggers that direct me to these sites usually clearly explain the premise of the idea before I reach the IRS page so I am not overwhelmed by the jargon. But with my own W-2 soon to be posted I wanted to be prepared for my first tax season, which will be in some ways easier and in others more difficult than previous years. This year is easier in that it is the only one where I have paid taxes and held only one job at one company with no gaps or unemployment. It is more difficult because as a result of my Roth IRA mishap last spring I have a few hundred dollars of money in a taxable account. Since it is a Vanguard Target Retirement Fund it includes both stocks and bonds as well as domestic and international versions of both, which all create some added complexity. Continue reading “2014 Taxes: Surprise!”

I’m still pretty baffled by tax code. In my most focused moments I can be found following links to read about tax opportunities that work best for the early retiree lifestyle. Luckily the authors and bloggers that direct me to these sites usually clearly explain the premise of the idea before I reach the IRS page so I am not overwhelmed by the jargon. But with my own W-2 soon to be posted I wanted to be prepared for my first tax season, which will be in some ways easier and in others more difficult than previous years. This year is easier in that it is the only one where I have paid taxes and held only one job at one company with no gaps or unemployment. It is more difficult because as a result of my Roth IRA mishap last spring I have a few hundred dollars of money in a taxable account. Since it is a Vanguard Target Retirement Fund it includes both stocks and bonds as well as domestic and international versions of both, which all create some added complexity. Continue reading “2014 Taxes: Surprise!”

Dietary Musings

I went on a bit of an information binge the other way. We were stuck inside during what was supposed to be a previously unseen snowstorm that caused our Governor to order the transit system to close. I was working from home, but becoming a little starved for new information. So I started watching a few of the documentaries that I had in my Netflix queue. First I watched Food Inc, then Forks Over Knives and then Vegucated. I had unknowingly picked an almost perfect sequence of documentaries. Continue reading “Dietary Musings”

I went on a bit of an information binge the other way. We were stuck inside during what was supposed to be a previously unseen snowstorm that caused our Governor to order the transit system to close. I was working from home, but becoming a little starved for new information. So I started watching a few of the documentaries that I had in my Netflix queue. First I watched Food Inc, then Forks Over Knives and then Vegucated. I had unknowingly picked an almost perfect sequence of documentaries. Continue reading “Dietary Musings”

Worry: Past, Present and Future

I’ve noticed that this blog of mine is pretty dominated by worry and anxiety. That seems like a serious change from the other FIRE blogs I’ve read. This might be because I’m going through the initial phases of discovering this goal is possible. The other blogs are all written by people that have it all figured out and have already or are very close to financial independence. Another reason could be that I’m currently writing this just for myself instead of for an audience, which includes a large group of people that do not see FI as viable.

I’ve noticed that this blog of mine is pretty dominated by worry and anxiety. That seems like a serious change from the other FIRE blogs I’ve read. This might be because I’m going through the initial phases of discovering this goal is possible. The other blogs are all written by people that have it all figured out and have already or are very close to financial independence. Another reason could be that I’m currently writing this just for myself instead of for an audience, which includes a large group of people that do not see FI as viable.Our FIRE Celebration

The other day my partner and I sat down to do our regular FIRE (Financial Independence/Retire Early) calculations, but this time the results were different. Originally I calculated that given my current spending and saving level in NYC I could retire in 10 years. My partner calculated something similar, but wanted a larger nest egg to sit on so he was going to work about 5 years longer. This time when we did our calculations and accounted for moving to a much less expensive city (Seattle) he discovered that he too could retire in 10 years. It was time to celebrate!

The other day my partner and I sat down to do our regular FIRE (Financial Independence/Retire Early) calculations, but this time the results were different. Originally I calculated that given my current spending and saving level in NYC I could retire in 10 years. My partner calculated something similar, but wanted a larger nest egg to sit on so he was going to work about 5 years longer. This time when we did our calculations and accounted for moving to a much less expensive city (Seattle) he discovered that he too could retire in 10 years. It was time to celebrate!A Moral Dilemma: Anti-Consumerism and the Stock Market

I was reading Mr. Money Mustache the other day – about his anti-consumer ideals and alongside it, his promotion of the stock market as a wealth building tool when a strange thought hit me. How could this man critique our consumer lifestyle on one hand and consciously use that same system to make money through the stock market on the other? Continue reading “A Moral Dilemma: Anti-Consumerism and the Stock Market”

I was reading Mr. Money Mustache the other day – about his anti-consumer ideals and alongside it, his promotion of the stock market as a wealth building tool when a strange thought hit me. How could this man critique our consumer lifestyle on one hand and consciously use that same system to make money through the stock market on the other? Continue reading “A Moral Dilemma: Anti-Consumerism and the Stock Market”

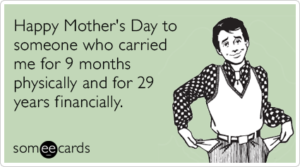

My Inspiration: My Mom

I started this blog by crediting Mr. Money Mustache with finally shaking me out of my default consumer habits and helping me realize that a different life was not only possible, but fairly easy to achieve. But this wasn’t the whole truth. After thinking about it more I realized that my actual inspiration for retiring early is my Mom. She retired herself last week at the age of 55. Her husband retired a year ago at 59. After a lot of hard work they were able to retire almost 10 years earlier than social security and medicare allow. Continue reading “My Inspiration: My Mom”

I started this blog by crediting Mr. Money Mustache with finally shaking me out of my default consumer habits and helping me realize that a different life was not only possible, but fairly easy to achieve. But this wasn’t the whole truth. After thinking about it more I realized that my actual inspiration for retiring early is my Mom. She retired herself last week at the age of 55. Her husband retired a year ago at 59. After a lot of hard work they were able to retire almost 10 years earlier than social security and medicare allow. Continue reading “My Inspiration: My Mom”

The Curious Case of My Heart During A Job Search

I found myself falling into a familiar trap last night. I had talked to a friend who mentioned a large company in Seattle that she has recruited for that pays very well, but is almost notoriously difficult to work for. It is said that your experience there completely depends on the team with which you’re placed, which is not that different from most companies. However, when reading reviews of the company by actual employees the overwhelming feeling is very negative. Continue reading “The Curious Case of My Heart During A Job Search”

I found myself falling into a familiar trap last night. I had talked to a friend who mentioned a large company in Seattle that she has recruited for that pays very well, but is almost notoriously difficult to work for. It is said that your experience there completely depends on the team with which you’re placed, which is not that different from most companies. However, when reading reviews of the company by actual employees the overwhelming feeling is very negative. Continue reading “The Curious Case of My Heart During A Job Search”

Unexpected Expenses and Releasing Worry

Today I arrived home after a full, but surprisingly stress free day at work to find a “not a bill” from my insurance company. This document which stated that it was “not a bill” on the front page said that I owed $361 and change for a procedure I had in November that the insurance company assured me was completely covered. This made me unreasonably angry and resulted in me calling the insurance company and emailing/texting several people for information. Apparently I can’t contest this document, its supposed charge and the multiple pieces of incorrect information it holds until I receive the “real” bill. In the grand scheme of things even if I was lied to and end up having to pay these charges this seemed to represent a larger problem that’s been in the back of my mind: unexpected costs. Continue reading “Unexpected Expenses and Releasing Worry”

Today I arrived home after a full, but surprisingly stress free day at work to find a “not a bill” from my insurance company. This document which stated that it was “not a bill” on the front page said that I owed $361 and change for a procedure I had in November that the insurance company assured me was completely covered. This made me unreasonably angry and resulted in me calling the insurance company and emailing/texting several people for information. Apparently I can’t contest this document, its supposed charge and the multiple pieces of incorrect information it holds until I receive the “real” bill. In the grand scheme of things even if I was lied to and end up having to pay these charges this seemed to represent a larger problem that’s been in the back of my mind: unexpected costs. Continue reading “Unexpected Expenses and Releasing Worry”