Interestingly I have found that frugality and weight management seem to go hand in hand. My original motivation to decreasing my time spent at restaurants and bars in NYC was because I wanted to stop paying people to serve me: to pour my drinks, cook my food and literally wait on me hand and foot. Instead I’ve sought to do it myself to save money until I am rich enough to pay people to do my bidding as MMM implies. So my partner and I eat and drink at home and we buy and make food and drinks ourselves. Continue reading “Frugality and Weight Management”

Interestingly I have found that frugality and weight management seem to go hand in hand. My original motivation to decreasing my time spent at restaurants and bars in NYC was because I wanted to stop paying people to serve me: to pour my drinks, cook my food and literally wait on me hand and foot. Instead I’ve sought to do it myself to save money until I am rich enough to pay people to do my bidding as MMM implies. So my partner and I eat and drink at home and we buy and make food and drinks ourselves. Continue reading “Frugality and Weight Management”

My Surprising Consumer Mindset

New York City seems to be the consumer capital of the US – everything seems to be defined by outward symbols of wealth. This might be a result of the industry I’ve chosen to work in and the type of people that are usually attracted to it, but even outside of my profession I have seen this trend. The default here is always to do things that cost money to enjoy life: go to a bar for a drink despite having a bottle at home, go out to a diner to eat regardless if you have the same bacon and eggs sitting in your fridge, go to a movie for $15 instead of watching something slightly older on the huge TV in your living room. I wasn’t even aware that different behavior was possible until I visited my partner’s family and they seemed to have a much happier life without a lot of these outings that have become normal for me. Not only do they often have people over for home cooked meals instead of being served in a room full of strangers, but they also obviously value people over things — time over money maybe. Continue reading “My Surprising Consumer Mindset”

New York City seems to be the consumer capital of the US – everything seems to be defined by outward symbols of wealth. This might be a result of the industry I’ve chosen to work in and the type of people that are usually attracted to it, but even outside of my profession I have seen this trend. The default here is always to do things that cost money to enjoy life: go to a bar for a drink despite having a bottle at home, go out to a diner to eat regardless if you have the same bacon and eggs sitting in your fridge, go to a movie for $15 instead of watching something slightly older on the huge TV in your living room. I wasn’t even aware that different behavior was possible until I visited my partner’s family and they seemed to have a much happier life without a lot of these outings that have become normal for me. Not only do they often have people over for home cooked meals instead of being served in a room full of strangers, but they also obviously value people over things — time over money maybe. Continue reading “My Surprising Consumer Mindset”

Challenge: Maxing My 401K in 6 Months

I just received my first paycheck of 2015. I was so excited to see it that I accidentally awakened at 5am to view the paystub that’s sent at 4am. I wasn’t excited to see all the money I could spend, but how much that would be left with after trying to max my 401K in 6 months and the challenge of living on the remainder. After I opened it I was excited to see how much was going into my 401K. It was over $1,500 in one pay period, which is about how much I would input into my IRA every few months. A few months of work done in two weeks because of the miracle of tax-advantaged accounts. I was so excited. Continue reading “Challenge: Maxing My 401K in 6 Months”

I just received my first paycheck of 2015. I was so excited to see it that I accidentally awakened at 5am to view the paystub that’s sent at 4am. I wasn’t excited to see all the money I could spend, but how much that would be left with after trying to max my 401K in 6 months and the challenge of living on the remainder. After I opened it I was excited to see how much was going into my 401K. It was over $1,500 in one pay period, which is about how much I would input into my IRA every few months. A few months of work done in two weeks because of the miracle of tax-advantaged accounts. I was so excited. Continue reading “Challenge: Maxing My 401K in 6 Months”

Advertising: The Anti-Consumer Nightmare

I have a difficult relationship with advertising – and not just because I currently work in it. Originally I simply understood that advertising was a necessary and even welcome evil simply because it allows a lot of content to be provided free: websites, magazines and originally television shows. And I appreciated that ad agencies were the first major industry to embrace the idea of creativity being vital to their work and trying to encourage it in the office culture and environment. However, once the fact that happier employees are more productive employees spread the idea of working to attract employees has become almost mainstream. Even older institutions are taking this onboard. Continue reading “Advertising: The Anti-Consumer Nightmare”

Advertising: My Job History and FU Money

I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence.

I first decided I was interested in advertising in college, before Mad Men became a runaway success and brought the profession into the light of pop culture. Originally I was looking for a fun, less stuffy profession compared to my mother’s 30 years working for various Fortune 500 companies full of pants suits and colorless, cubicle filled offices. Through job fairs and speaking with the lovely Alums in my college’s alumni network I first became interested in advertising and thought it would be a wonderful way to explore the creativity I was looking for in an office environment while using my main set of skills: organization and persistence.NYC to Seattle: A Revelation

I had a bit of a revelation today. For months I’ve been running numbers and scenarios as a result of our New York City to Seattle moving plans. I’ve calculated how much less we will pay in rent each month after moving. And on an abstract level knew that we’d save money by not paying state or city income taxes since Washington doesn’t have state income tax while NYC has one of the highest in the country. But today I looked at this information in a different light. Continue reading “NYC to Seattle: A Revelation”

I had a bit of a revelation today. For months I’ve been running numbers and scenarios as a result of our New York City to Seattle moving plans. I’ve calculated how much less we will pay in rent each month after moving. And on an abstract level knew that we’d save money by not paying state or city income taxes since Washington doesn’t have state income tax while NYC has one of the highest in the country. But today I looked at this information in a different light. Continue reading “NYC to Seattle: A Revelation”

Finance Tracker Review: Personal Capital

Learning about Personal Capital was another result of reading the amazing Mr. Money Mustache blog. Personal Capital, which I’d never heard of, is basically Mint.com but for investments. It also includes features similar to Mint.com that allow you to review your spending and income, but it is actually more difficult to add accounts to Personal Capital than to Mint.com and for that reason I haven’t added all of mine. In fact originally I only tried Personal Capital for a grand total of five minutes before closing my account because it was so unnecessarily difficult to add my accounts. Continue reading “Finance Tracker Review: Personal Capital”

Learning about Personal Capital was another result of reading the amazing Mr. Money Mustache blog. Personal Capital, which I’d never heard of, is basically Mint.com but for investments. It also includes features similar to Mint.com that allow you to review your spending and income, but it is actually more difficult to add accounts to Personal Capital than to Mint.com and for that reason I haven’t added all of mine. In fact originally I only tried Personal Capital for a grand total of five minutes before closing my account because it was so unnecessarily difficult to add my accounts. Continue reading “Finance Tracker Review: Personal Capital”

Finance Tracker Review: Mint.com

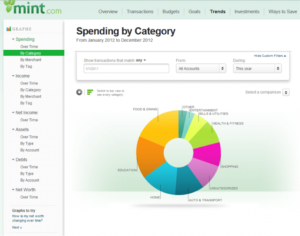

Mint.com has been a lifesaver. For what it is, I completely love it. However, it does not deliver on its product promise, which is to help you understand where your money is going and as a result save money. Mint.com is wonderful for learning where your money is going. It makes it very easy to track every digital dollar and provides a colorful and clear explanation of your spending month to month and year to year. It’s seamless in that it draws information directly from your accounts like Personal Capital instead of you inputting it like in YNAB. Continue reading “Finance Tracker Review: Mint.com”

Mint.com has been a lifesaver. For what it is, I completely love it. However, it does not deliver on its product promise, which is to help you understand where your money is going and as a result save money. Mint.com is wonderful for learning where your money is going. It makes it very easy to track every digital dollar and provides a colorful and clear explanation of your spending month to month and year to year. It’s seamless in that it draws information directly from your accounts like Personal Capital instead of you inputting it like in YNAB. Continue reading “Finance Tracker Review: Mint.com”